When you face workplace retaliation after reporting discrimination, harassment, or other illegal conduct, you’re entitled to various forms of compensation. Understanding these potential damages helps you evaluate your case strength and set realistic expectations for recovery.

In this guide, we’ll break down exactly what compensation you can seek in retaliation cases. Additionally, we’ll explain how courts calculate these damages and show you the documentation needed to maximize your recovery. Let’s explore the financial remedies that can help make you whole after experiencing illegal workplace retaliation.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

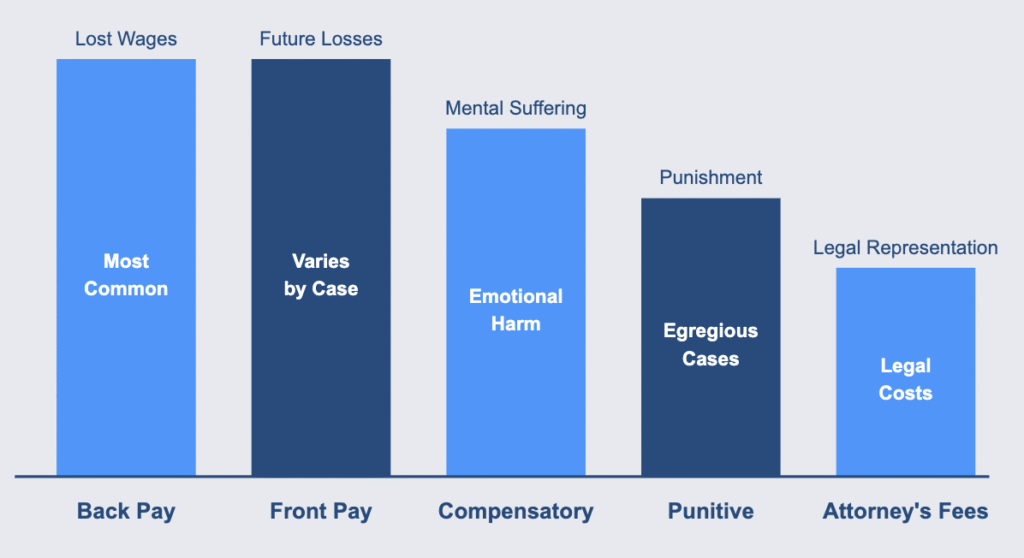

Types of Damages in Retaliation Cases

When you stand up against workplace wrongdoing and face backlash, the law provides multiple ways to get compensation. Furthermore, these damages fall into several distinct categories, each serving different purposes in making you whole after experiencing retaliation.

Back Pay: Recovering Lost Wages

Back pay represents the wages and benefits you would have earned without the retaliatory action. Typically, this covers the period from when the retaliation occurred until the judgment date (or settlement).

Back pay includes:

- Regular wages and salary

- Overtime you would have worked

- Bonuses you would have received

- Value of benefits (health insurance, retirement contributions)

- Paid time off you would have earned

For instance, suppose you were fired in retaliation for reporting sexual harassment. If you remained unemployed for six months before finding a lower-paying position, your back pay would include both the six months of lost wages and the ongoing difference between your new and old salary.

Moreover, courts calculate back pay using your pre-retaliation earnings history. Therefore, maintaining detailed records of your compensation package becomes crucial for accurate calculations.

Front Pay: Future Economic Losses

When returning to your former position isn’t possible, courts may award front pay to compensate for future lost earnings. Specifically, this addresses ongoing economic harm when you:

- Can’t find comparable employment

- Had to take a lower-paying position

- Lost career advancement opportunities

- Need time for additional training or education

Front Pay Calculation Process

| Factor | Consideration |

|---|---|

| Previous Salary | Your pre-retaliation earnings trajectory |

| Current Earnings | What you’re actually earning now |

| Career Prospects | Likely advancement opportunities lost |

| Time Period | Reasonable time to find comparable work |

Front pay calculations involve projecting what you would have earned without retaliation versus what you’re likely to earn now. Generally, courts limit front pay to a reasonable period necessary to obtain comparable employment.

Because front pay involves predictions about future earnings, expert testimony from economists or job specialists often strengthens these claims. Consequently, they provide data-driven projections of your career path and earning potential.

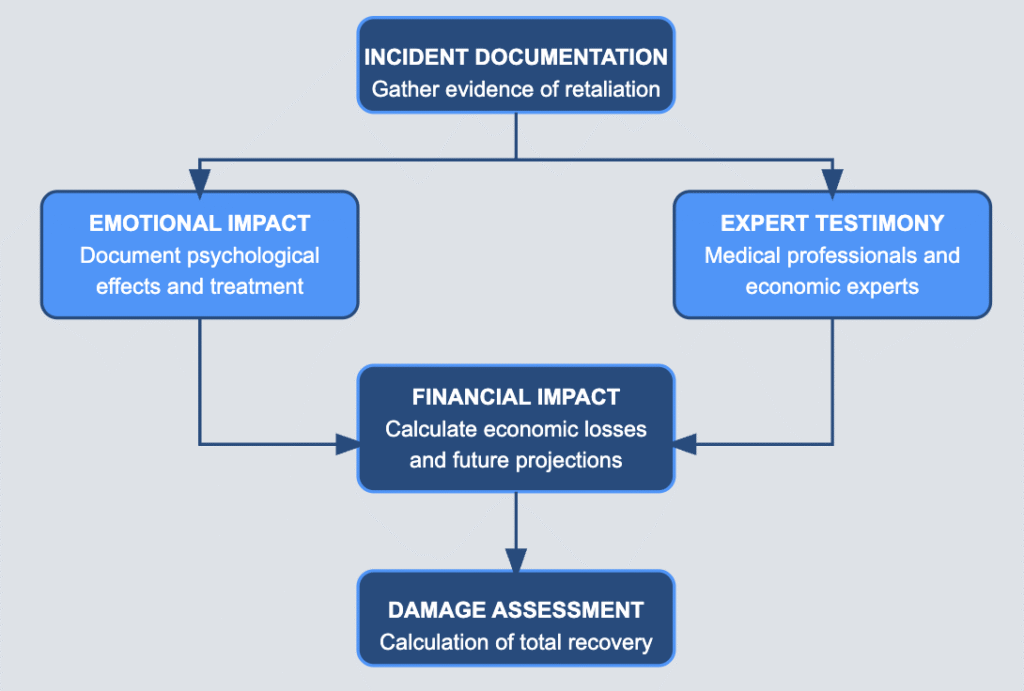

How Damages Are Calculated in Retaliation Cases

Understanding how courts and agencies determine damage amounts helps set realistic expectations. Also, it shows you how to properly document your losses.

Back Pay Calculation Methods

Courts use relatively straightforward methods to calculate back pay:

Back Pay = (Earnings you would have received) – (Earnings from new employment or unemployment benefits)

This formula accounts for your “duty to minimize damages” by seeking replacement employment. However, if you find a new job during the back pay period, your damages are reduced by those earnings.

Example Calculation:

- Pre-retaliation annual salary: $60,000 ($5,000/month)

- Unemployed for 3 months: $15,000 lost

- New job at $48,000/year ($4,000/month) for 9 months: $9,000 lost ($1,000/month difference × 9 months)

- Total back pay: $24,000

Nevertheless, courts may adjust this calculation if you didn’t make reasonable efforts to find comparable work. As a result, this could potentially reduce your award.

Emotional Distress Assessment

Unlike back pay, compensatory damages for emotional distress don’t have a simple formula. Instead, courts consider factors including:

- Severity and duration of emotional distress

- Whether you sought psychological treatment

- Impact on personal relationships

- Physical signs of distress (insomnia, anxiety, etc.)

- Pre-existing psychological conditions

Emotional Distress Damage Categories

| Distress Level | Typical Award Range | Evidence Required |

|---|---|---|

| Mild | $5,000-$25,000 | Testimony about emotional impact |

| Moderate | $25,000-$75,000 | Testimony plus some documentation (physician visits, medication) |

| Substantial | $75,000-$200,000 | Extensive documentation, possibly expert testimony |

| Severe | $200,000+ | Medical records, expert testimony, evidence of significant life disruption |

Remember that statutory caps may limit these amounts depending on your employer’s size and the laws under which you’re filing.

Statutory Caps and Limitations

Federal anti-discrimination laws impose caps on compensatory and punitive damages based on employer size:

Federal Damage Caps by Employer Size

| Number of Employees | Maximum Combined Compensatory and Punitive Damages |

|---|---|

| 15-100 | $50,000 |

| 101-200 | $100,000 |

| 201-500 | $200,000 |

| 501+ | $300,000 |

These caps apply to combined compensatory and punitive damages under Title VII, the ADA, and GINA. Importantly, they don’t limit back pay, front pay, or attorney’s fees.

However, some state laws provide more generous caps or no caps at all. For example, the New York State Human Rights Law and New York City Human Rights Law don’t cap compensatory or punitive damages. Therefore, this potentially allows for significantly higher recoveries for New York employees.

Punitive Damages: Punishing Serious Wrongdoing

When an employer’s retaliation involves malice or reckless disregard to your rights, punitive damages may be available. These damages serve to punish particularly bad conduct and prevent similar behavior.

Courts consider factors including:

- Whether management participated in or approved the retaliation

- Whether the employer tried to cover up the retaliation

- The employer’s history of similar violations

- The employer’s financial resources

Punitive damages typically require evidence beyond what’s needed for compensatory damages. Specifically, you’ll need to show the decision-makers knowingly violated the law or acted with reckless disregard for your legal rights.

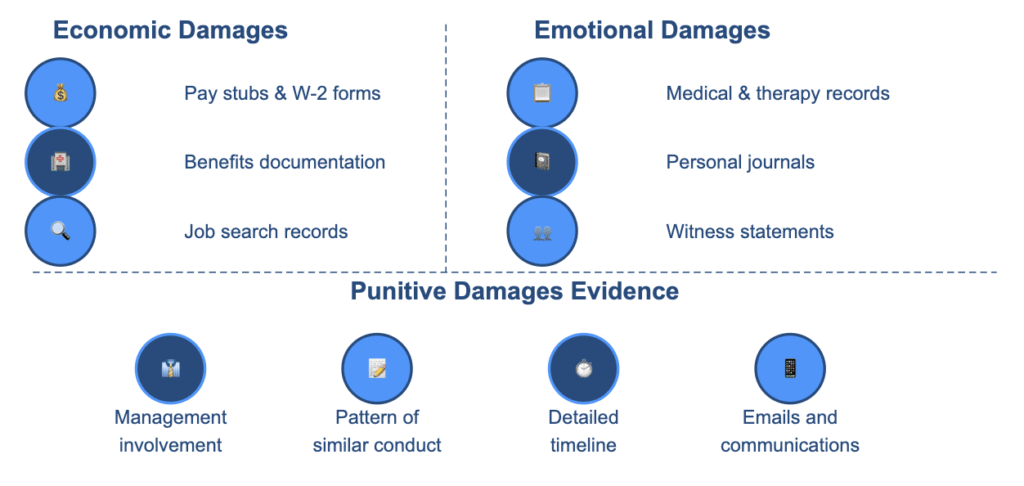

Documentation Needed to Maximize Your Recovery

The strength of your damages claim depends heavily on documentation. Here’s what you should gather to support each type of damages:

Back Pay and Benefits Documentation

- Pay stubs before and after retaliation

- W-2 forms and tax returns

- Documentation of benefits (health insurance, retirement, etc.)

- Records of bonuses, commissions, and overtime

- Performance evaluations and raises

- Job search efforts after termination

- Unemployment benefit statements

Emotional Distress Evidence

- Medical and therapy records

- Prescriptions for anxiety, depression, or sleep medications

- Journal entries documenting your emotional state

- Testimony from family, friends, or coworkers about changes in your behavior

- Before-and-after evidence of life activities and relationships

Punitive Damages Support Materials

- Evidence of management involvement in retaliation

- Documentation showing knowledge of protected activity

- Records of similar complaints against the employer

- Evidence of cover-up attempts

- Communications showing retaliatory intent

Important: Beginning documentation immediately after retaliation occurs preserves crucial evidence. Create a detailed timeline of events, save all relevant communications, and maintain records of how the retaliation has affected both your finances and well-being.

Beyond Monetary Damages: Equitable Remedies

Money isn’t the only remedy available in retaliation cases. Additionally, courts can also order other remedies that restore your position or prevent future harm.

Reinstatement

Courts may order your employer to restore you to your former position. However, this remedy works best when:

- Your former position still exists

- The relationship hasn’t become too hostile

- The retaliation wasn’t extremely public or humiliating

Many employees prefer not to return to a workplace where they experienced retaliation. In these cases, front pay often substitutes for reinstatement.

Court Orders for Change

Courts can prohibit specific employer behaviors through injunctions, such as:

- Removing negative performance evaluations

- Requiring anti-retaliation training

- Posting notices about employee rights

- Implementing new anti-retaliation policies

- Court monitoring of workplace practices

These remedies often benefit not just you but also your coworkers by creating system-wide change.

Attorney's Fees and Costs

Most anti-retaliation laws allow winning employees to recover reasonable attorney’s fees and litigation costs. These fee-shifting provision serves two purposes:

- Making legal representation accessible regardless of financial resources

- Enabling cases that might involve modest damages but important legal principles

Even if your economic damages are relatively small, you may still find legal representation through contingency arrangements. In these arrangements, the attorney’s payment comes from the fee award if you win.

Recoverable costs typically include:

- Court filing fees

- Deposition expenses

- Expert witness fees

- Document production costs

- Mediation expenses

Fee-shifting provisions significantly impact settlement negotiations. As a result, employers must consider both your damages and the potential attorney’s fee award when evaluating their exposure.

Recent Case Examples

Substantial Punitive Damages for Hostile Work Environment and Retaliation

In Holmes v. American HomePatient, Inc. (M.D. Pa. 2024), a Black customer service representative faced racial harassment and retaliation after reporting the hostile work environment. The jury awarded $500,000 in compensatory damages and initially $20 million in punitive damages, finding that the company had intentionally discriminated and failed to exercise reasonable care to prevent racial harassment.

Similarly, in a California federal case, an employee who raised concerns about meal and rest break violations was immediately placed on what the court called a “formulaic and virtually unattainable” performance improvement plan. After she was terminated for allegedly failing to meet the plan, a jury awarded $300,000 in economic damages, $850,000 in non-economic damages, and $3.5 million in punitive damages for retaliatory termination in violation of public policy.

HR Manager’s Retaliation Case Proceeds Despite Initial Dismissal

In Patterson v. Georgia Pacific, LLC, 38 F.4th 1336 (11th Cir. 2022), an HR manager was fired one week after her supervisor learned she had testified in favor of employees in a pregnancy discrimination case against her former employer. When she told him she had testified “for the ladies,” he responded that this “made things clear” to him.

Although the district court initially dismissed her case, the Eleventh Circuit reversed, finding that HR managers are protected from retaliation just like any other employee. The case illustrates how timing and suspicious statements can establish causation in retaliation claims, even when employers claim other reasons for termination.

Important Note on Mitigation: Courts consistently require employees to make reasonable efforts to find comparable employment to minimize their damages. As federal employment guidance explains, employees have a “duty to mitigate damages by making a reasonable good faith effort to find other employment.” However, this doesn’t mean accepting inferior positions or relocating to distant areas.

Tax Implications of Retaliation Damages

Different types of damages receive different tax treatment. Consequently, this can significantly impact your net recovery:

Tax Treatment by Damage Type

| Type of Damages | Tax Treatment |

|---|---|

| Back pay and front pay | Taxable as ordinary income |

| Emotional distress damages (physical symptoms) | Potentially non-taxable |

| Emotional distress damages (non-physical) | Taxable, but not subject to payroll taxes |

| Punitive damages | Taxable as ordinary income |

| Attorney’s fees | Complex; may be deductible depending on circumstances |

Important: Consulting with a tax professional about the tax implications of your settlement or judgment helps avoid surprises when filing your return.

Settlement vs. Going to Court

Most retaliation cases resolve through settlement rather than trial. When evaluating settlement offers, consider:

- The strength of your liability evidence

- The documentation supporting your damages

- The emotional and time costs of continued litigation

- The certainty of a settlement versus the uncertainty of trial

- Confidentiality requirements that may accompany settlement

- Tax implications of how the settlement is structured

A skilled employment attorney can help you weigh these factors to make an informed decision about resolving your case.

Damages Checklist: Are You Getting Full Compensation?

Use this checklist to ensure you’re seeking all available damages:

Back pay (all lost wages and benefits)

Front pay (future economic losses)

Compensatory damages (emotional distress)

Punitive damages (for malicious or reckless conduct)

Attorney’s fees and litigation costs

Other remedies (reinstatement, expungement of records)

Interest on back pay

Tax consequences consideration

Reviewing this list with your attorney helps ensure your demand includes all applicable damages components.

Next Steps If You've Experienced Retaliation

If you’ve faced workplace retaliation, taking prompt action maximizes your potential recovery:

- Document everything – Create a detailed timeline of events, save relevant communications, and maintain records of all financial and emotional impacts.

- File necessary administrative complaints – Many retaliation claims require filing with agencies like the EEOC before proceeding to court. Be aware of strict deadlines that can be as short as 180 days.

- Mitigate your damages – Actively search for comparable employment to fulfill your legal obligation to minimize losses.

- Preserve evidence of emotional distress – Keep records of medical treatment, medications, and personal impacts.

- Consult with an experienced employment attorney – An attorney can evaluate your specific situation, identify all potential claims, and develop a strategy to maximize your recovery.

At Nisar Law, we specialize in representing employees in retaliation cases. Our experienced attorneys understand the full range of damages available and how to document and present compelling evidence to maximize your recovery.

Contact us today for a confidential consultation to discuss your situation and explore your options for seeking justice and compensation.

Related Resources

- Protected Activities: What Actions Are Legally Safeguarded

- Forms of Retaliation: Beyond Termination

- Temporal Proximity: Linking Protected Activity to Adverse Action

- Documenting Retaliation: Creating a Paper Trail

- Whistleblower Retaliation: Special Protections

- Title IX Protections in Educational Institutions

- Faculty Rights and Academic Freedom

- Discrimination in Higher Education Settings

- Bullying and Harassment in Schools: Legal Remedies