If you’ve been wrongfully terminated, understanding exactly what compensation you can pursue is critical. New York law provides several categories of damages—from back pay and lost benefits to emotional distress and punitive awards—that can help restore what your employer’s illegal actions took from you. The amount you recover depends on the strength of your evidence, the type of violation, and which laws apply to your situation.

This guide breaks down each damage category, explains how courts calculate these awards, and provides practical steps to maximize your potential recovery.

Key Takeaways

- Back pay covers wages and benefits lost from termination to resolution, including salary, bonuses, commissions, and employer-paid benefits.

- Front pay compensates for future earnings when reinstatement isn’t practical, calculated based on your age, industry, and job market conditions.

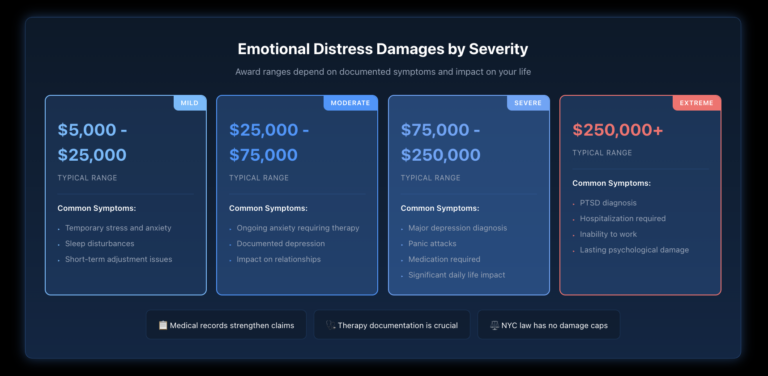

- Emotional distress damages can range from $5,000 to $250,000+, depending on severity and documentation.

- Punitive damages require showing malicious or reckless conduct, with federal caps ranging from $50,000 to $300,000 based on employer size.

- New York State and City Human Rights Laws impose no damage caps, often making state claims more valuable than federal ones.

- Attorney’s fees and costs are recoverable under most employment discrimination statutes.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Are Economic Damages in Wrongful Termination Cases?

Economic damages compensate you for the actual financial losses caused by your illegal termination. These are typically the most straightforward to calculate because they’re based on concrete numbers you can document.

How Is Back Pay Calculated?

Back pay covers what you would have earned from your termination date until your case resolves through settlement or trial. This includes your base salary plus any regular bonuses, commissions, or overtime you typically receive.

For example, if you earned $100,000 annually with a $15,000 yearly bonus and $1,200 monthly in employer-paid benefits, and your case takes 18 months to resolve, your back pay calculation would include approximately $150,000 in base salary, $22,500 in lost bonuses, and $21,600 in lost benefits—totaling over $194,000 before accounting for mitigation.

The key to maximizing your back pay recovery is thorough documentation. Gather your last several pay stubs, W-2 forms, benefit statements, and any records showing your typical earnings pattern, including commissions and bonuses.

What Is Your Duty to Mitigate Damages?

New York law requires you to make reasonable efforts to find comparable employment. This doesn’t mean you must accept just any position—the job should be similar in terms of salary and benefits, responsibilities and skill level, location and commute, and career advancement opportunities.

Any income you earn from new employment gets subtracted from your back pay award. However, if you take a lower-paying position after exhausting your job search options, you can still recover the difference between your old and new compensation.

Courts evaluate whether your job search efforts were reasonable based on your industry, skills, and local job market conditions. Document every application, interview, and networking effort to demonstrate you took this obligation seriously.

When Does Front Pay Apply?

When reinstatement isn’t practical—perhaps your supervisor was the harasser, the workplace became too hostile, or the position no longer exists—courts can award front pay to compensate for future lost wages until you can reasonably find comparable employment.

Front pay calculations consider your age and career stage, how specialized your skills are, current job market conditions in your field, and the typical time to find comparable positions. A 55-year-old executive in a niche industry might receive 3-5 years of front pay, while a younger professional in a growing field might get 6-12 months.

What Non-Economic Damages Are Available?

Beyond financial losses, wrongful termination often causes significant personal harm that courts recognize deserves compensation. These damages address the emotional and reputational toll of losing your job illegally.

How Are Emotional Distress Damages Determined?

Losing your job through discrimination or retaliation can cause severe emotional harm—anxiety, depression, loss of self-worth, difficulty sleeping, and family stress. Courts award damages based on the severity and duration of your symptoms, whether you sought counseling or treatment, the impact on your daily life and relationships, and particularly egregious employer conduct.

If you’re experiencing emotional distress symptoms, seeking professional help serves two purposes: it addresses your mental health needs and creates documentation that supports your claim. Keep records of all therapy appointments, prescribed medications, and how your symptoms affect your daily functioning.

Can You Recover Damages for Reputation Harm?

If your termination damaged your professional reputation—especially if false accusations were involved—you may recover compensation for this harm. This is particularly relevant when your termination became public knowledge within your industry, false reasons were given to prospective employers or colleagues, your industry is small or close-knit, making blacklisting effective, or you’ve lost specific job opportunities due to your former employer’s statements.

Post-termination employer conduct that damages your reputation can form the basis of additional claims. Document any negative references, false statements to third parties, or interference with your job search.

When Can You Recover Punitive Damages?

While not available in every case, punitive damages can significantly increase your recovery when your employer’s conduct was particularly malicious or showed reckless disregard for your rights.

What Conduct Justifies Punitive Damages?

Courts award punitive damages for wrongful termination when the employer acted with malice or conscious disregard for your rights, engaged in intentional discrimination or retaliation, showed a pattern of illegal behavior against multiple employees, or attempted to cover up or destroy evidence of wrongdoing.

The standard is high—mere negligence or poor management judgment isn’t enough. The employer must have acted knowing their conduct violated the law or with reckless indifference to whether it did.

How Do Federal Damage Caps Work?

Title VII and ADA cases cap combined compensatory and punitive damages based on employer size: $50,000 for employers with 15-100 employees, $100,000 for 101-200 employees, $200,000 for 201-500 employees, and $300,000 for employers with more than 500 employees.

However, these caps don’t apply to back pay, front pay, or attorney’s fees—which often represent the largest portion of a recovery. Age discrimination claims under the ADEA also have no caps on damages and allow for liquidated damages equal to back pay in cases of willful violations.

Why Do New York Laws Often Provide Better Remedies?

New York State and City Human Rights Laws don’t impose damage caps, often making state or city claims more valuable than federal ones. The NYC Human Rights Law is particularly employee-friendly, with uncapped compensatory and punitive damages plus a lower burden of proof than federal law.

This is why many wrongful termination claims in New York are filed under state and local laws rather than—or in addition to—federal statutes. An experienced employment attorney can evaluate which laws provide the strongest path to maximum recovery in your situation.

What Additional Costs Can You Recover?

Beyond the main damage categories, several additional costs may be recoverable depending on your circumstances.

What Benefits and Losses Are Compensable?

Your termination likely cost you more than just your salary. Recoverable benefit losses typically include health insurance premiums you’ve paid out of pocket since losing employer coverage, retirement contributions and employer matches you missed, stock options or equity that would have vested, tuition reimbursement programs you were enrolled in, and company car, phone, or housing allowances.

Calculate the value of each lost benefit and include it in your damages claim. These amounts can be substantial—health insurance alone might cost $15,000-$25,000 annually for family coverage.

Are Job Search Expenses Recoverable?

Reasonable expenses incurred while searching for new employment may be recoverable, including resume preparation and career coaching fees, travel costs for interviews, professional clothing purchased for interviews, networking event fees, and professional association dues, and relocation expenses if you had to move for a new position.

Keep receipts for all job search expenses. While not every court allows recovery for these costs, documenting them preserves your ability to claim them.

How Do Attorney’s Fee Awards Work?

Many employment statutes allow prevailing plaintiffs to recover reasonable attorney’s fees and court costs. This fee-shifting provision levels the playing field, allowing employees to pursue valid claims regardless of personal financial resources.

Recoverable legal costs typically include attorney’s fees at prevailing hourly rates, court filing fees, expert witness costs, deposition and transcript expenses, and document production costs.

The possibility of fee recovery often makes pursuing a valid claim financially viable even when individual damages might not justify the litigation expense alone.

How Do Taxes Affect Your Recovery?

Understanding the tax implications of settlement awards helps you evaluate offers and plan for the net amount you’ll actually receive.

Which Damages Are Tax-Free?

Generally, damages for physical injury or sickness are excludable from taxable income. Additionally, medical expense reimbursements related to physical injuries are tax-free. However, pure emotional distress damages without a physical injury component are typically taxable.

Which Damages Are Taxable?

Most wrongful termination awards are taxable as ordinary income, including back pay and front pay (taxed as wages), interest on awards, most emotional distress damages, and punitive damages.

Consider how settlement structure affects your tax burden. Spreading payments across multiple tax years or allocating amounts to tax-advantaged categories where appropriate can reduce your overall tax liability. Discuss these implications with both your attorney and a tax professional before accepting any settlement.

What Are Realistic Recovery Expectations?

While every case differs, understanding typical recovery ranges helps set realistic expectations for your claim.

What Do Typical Settlements Look Like?

Wrongful termination settlements and verdicts in New York typically range from $25,000-$75,000 for simpler cases with quick reemployment, $75,000-$250,000 for moderate cases with clear violations, $250,000-$1,000,000 for severe cases with egregious conduct, and $1,000,000+ for exceptional cases with substantial punitive damages.

Your specific circumstances—including the strength of evidence, employer size, type of violation, and applicable laws—significantly impact potential recovery. Cases involving pregnancy discrimination, religious discrimination, or whistleblower retaliation often command higher settlements due to strong statutory protections.

How Can You Maximize Your Potential Recovery?

Taking the right steps from the beginning strengthens your claim and increases potential damages.

What Documentation Should You Preserve?

Start gathering evidence immediately. Critical documents include all termination-related communications, including emails, letters, and text messages, pay stubs showing your regular earnings pattern, benefit statements documenting what you’ve lost, performance reviews contradicting any claimed performance issues, and any evidence of the employer’s discriminatory or retaliatory motive.

Effective documentation of both your damages and the employer’s wrongdoing creates the foundation for a strong claim.

Why Does Timing Matter?

Time limits for wrongful termination claims can be surprisingly short. EEOC charges generally must be filed within 180-300 days, depending on your state; New York State DHR complaints within one year (three years for sexual harassment), and NYC Commission on Human Rights complaints within one year (three years for gender-based harassment).

Missing these deadlines can eliminate your ability to pursue certain claims entirely, even with strong evidence. Consulting with an attorney early preserves all your options.

Ready to Take Action?

Wrongful termination claims involve complex calculations and strategic decisions about which laws to pursue, what evidence to present, and how to maximize your total recovery. An experienced employment attorney can evaluate your specific situation, calculate your potential damages, and develop a strategy to pursue full compensation.

At Nisar Law Group, we help wrongfully terminated employees throughout New York understand their rights and pursue the damages they deserve. We’ll analyze your case, explain your options, and fight for maximum recovery while you focus on moving forward with your career.

Contact us today for a consultation to discuss your wrongful termination claim and learn what compensation you might be entitled to under federal, state, and local law.

Frequently Asked Questions About Wrongful Termination Damages

Calculating wrongful termination damages involves adding together several categories of losses. Start with economic damages: multiply your regular pay rate by the time you’ve been unemployed, then add lost bonuses, commissions, overtime, and the value of lost benefits like health insurance and retirement contributions. Next, evaluate non-economic damages for emotional distress, which courts determine based on symptom severity and duration. Finally, if the employer acted maliciously, punitive damages may apply. The total is reduced by any wages you’ve earned from new employment and adjusted for applicable statutory caps.

There’s no single maximum—it depends on which laws apply to your claim. Federal claims under Title VII and the ADA cap compensatory and punitive damages between $50,000 and $300,000 based on employer size, but these caps don’t apply to back pay or front pay. New York State and City Human Rights Laws impose no damage caps whatsoever, making state and local claims potentially more valuable. Cases involving high earners with extended unemployment periods, severe emotional distress, and egregious employer conduct have resulted in multi-million dollar verdicts.

Whether it’s worth pursuing depends on several factors: the strength of your evidence, the amount of your provable damages, the employer’s resources to pay a judgment, and your tolerance for litigation. Many employment statutes allow you to recover attorney’s fees if you prevail, reducing financial risk. Even moderate claims can yield substantial settlements because employers often prefer to resolve matters before trial. An initial consultation with an employment attorney can help you evaluate whether your specific situation justifies pursuing a claim.

Strong wrongful termination cases typically include direct evidence of discrimination or retaliation, such as discriminatory statements, emails, or recorded comments, circumstantial evidence showing disparate treatment compared to similarly situated employees, documentation of your strong job performance contradicting any claimed performance issues, timing evidence connecting protected activity to your termination, and witness statements from coworkers who observed discriminatory behavior. The more documentation you preserve, the stronger your negotiating position.

Your net recovery from a $50,000 settlement depends on several factors. Attorney’s fees typically range from 25-40% of the recovery on a contingency basis, which would be $12,500-$20,000. Back pay portions are taxed as ordinary income and subject to employment tax withholding, while emotional distress damages are taxed as ordinary income but not subject to payroll taxes. After fees and taxes, you might net $25,000-$35,000 from a $50,000 settlement, though the exact amount depends on how the settlement is allocated among different damage categories.

A reasonable settlement offer should cover your economic losses, including back pay, front pay, and lost benefits, plus compensation for non-economic harm like emotional distress. It should also account for the strength of your evidence, litigation risks for both parties, and the costs of continuing through trial. Many attorneys evaluate offers against what might be recovered at trial minus litigation costs and risks. An offer covering 50-70% of your best-case trial outcome is often considered reasonable, though this varies significantly based on case-specific factors.

Wrongful termination cases can be challenging because employers rarely admit discriminatory or retaliatory motives. However, employees win or settle favorably in many cases by building strong circumstantial evidence, documenting inconsistencies in the employer’s stated reasons, and demonstrating patterns of disparate treatment. Cases under the New York City Human Rights Law have a lower burden of proof than federal claims, making them somewhat easier to win. The key is thorough documentation, preserved evidence, and legal guidance in presenting your case strategically.