Thinking about reporting illegal activity at your workplace? You’re protected by a complex web of federal laws designed to shield whistleblowers from retaliation. But here’s the catch – different laws apply to different situations, and knowing which one covers you can mean the difference between a protected disclosure and a career-ending mistake.

This guide breaks down the major federal whistleblower protection laws, shows you exactly when each applies, and gives you a practical roadmap for reporting wrongdoing while protecting your job.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

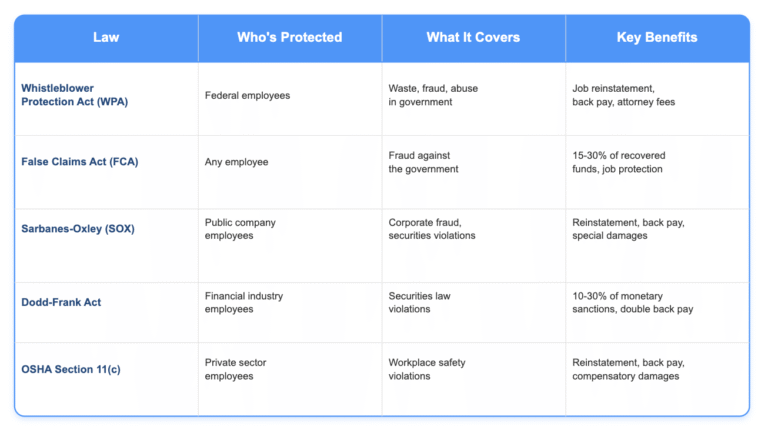

The Major Federal Whistleblower Protection Laws at a Glance

Not all whistleblower situations are created equal. The law that protects you depends on who you work for, what you’re reporting, and which agency oversees your industry.

Let’s start with a clear overview of the major federal protections:

Understanding the Whistleblower Protection Act (WPA)

If you’re a federal employee, the WPA is your primary shield against retaliation. Congress strengthened this law significantly through the Whistleblower Protection Enhancement Act of 2012, closing loopholes that agencies previously used to sidestep protections.

What Disclosures Are Protected?

The WPA protects you when reporting:

- Violations of laws, rules, or regulations

- Gross mismanagement or waste of funds

- Abuse of authority

- Substantial dangers to public health or safety

But timing and method matter. You must report to the right people – typically an Inspector General, the Office of Special Counsel, or Congress.

Critical WPA Protections

The law prohibits agencies from taking “personnel actions” against you for protected disclosures. This includes:

- Firing or demotion

- Pay cuts or benefit reductions

- Transfers to less desirable positions

- Poor performance reviews without merit

The False Claims Act: When Fraud Involves Government Money

The False Claims Act stands apart from other whistleblower laws because it allows you to sue on behalf of the government – and potentially collect a significant reward.

How Qui Tam Actions Work

Under the FCA’s “qui tam” provisions, you can file a sealed lawsuit against your employer for defrauding the government. The government then decides whether to join your case.

Key points about FCA cases:

- Your complaint remains sealed for at least 60 days while the government investigates

- If the government intervenes, you receive 15-25% of any recovery

- If they decline, you can proceed alone and receive 25-30% if successful

Anti-Retaliation Provisions

Beyond financial rewards, the FCA protects your job. If your employer retaliates for FCA activities, you can seek:

- Reinstatement with appropriate seniority

- Double back pay with interest

- Compensation for special damages

- Attorney’s fees and costs

Sarbanes-Oxley: Protection for Corporate Whistleblowers

Following major corporate scandals, Congress enacted SOX to protect employees who report financial fraud at publicly traded companies.

What SOX Covers

You’re protected when reporting:

- Mail, wire, bank, or securities fraud

- Violations of SEC rules or regulations

- Any federal law relating to shareholder fraud

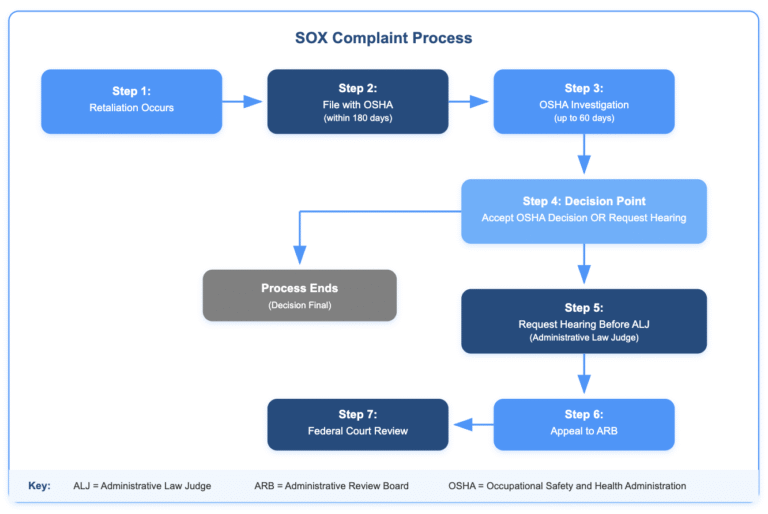

The 180-Day Clock Starts Ticking

Here’s where many employees stumble – SOX requires filing a complaint with OSHA within 180 days of the retaliatory action. Miss this deadline, and you lose your administrative remedy.

Dodd-Frank: Enhanced Protections for Financial Industry Whistleblowers

The 2010 Dodd-Frank Act created robust protections and incentives for reporting securities law violations.

Two Paths to Protection

Dodd-Frank offers two distinct types of protection:

- SEC Whistleblower Program: Report directly to the SEC for potential monetary awards

- Anti-Retaliation Provisions: Protection for internal reporting at your company

The Supreme Court’s Digital Realty Decision

In 2018, the Supreme Court ruled that Dodd-Frank’s anti-retaliation provisions only protect employees who report to the SEC. Internal reporting alone doesn’t trigger Dodd-Frank protection – though you might still have protection under SOX.

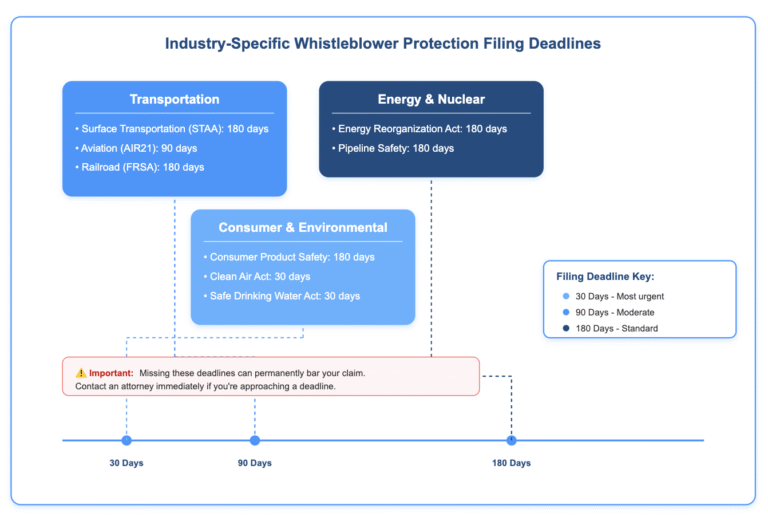

Industry-Specific Whistleblower Protections

Beyond these major laws, numerous industry-specific statutes protect whistleblowers:

Navigating the Reporting Process

Successfully blowing the whistle requires strategic planning. Here’s your roadmap:

Step 1: Document Everything

Before making any disclosure:

- Gather relevant documents (legally)

- Create a timeline of events

- Keep copies of all evidence off-site

- Note witnesses to key events

Step 2: Identify the Right Law

Review your situation against each law’s requirements:

- Who is your employer?

- What type of wrongdoing are you reporting?

- Which agency oversees your industry?

Step 3: Choose Your Reporting Channel

Depending on the applicable law, you might report to:

- Your company’s compliance department

- An agency’s Inspector General

- The SEC, OSHA, or other regulatory body

- Congress (for federal employees)

- Through a qui tam lawsuit

Step 4: Meet All Deadlines

Missing a filing deadline can be fatal to your case. Most laws require action within 30-180 days of retaliation.

Common Pitfalls to Avoid

Understanding what can go wrong helps you protect yourself:

Going Public Too Soon

Many laws don’t protect disclosures to the media. The WPA, for instance, generally doesn’t cover press disclosures unless you’ve exhausted other channels.

Disclosing Attorney-Client Privileged Information

Even valid whistleblowing doesn’t protect you from liability for disclosing privileged information. SEC rules provide limited exceptions, but tread carefully.

Failing to Follow Internal Procedures

Some laws require attempting internal reporting first. Document your efforts, even if you believe they’ll be futile.

When Retaliation Happens

If you face retaliation after whistleblowing, act quickly:

Immediate Steps

- Document the retaliation thoroughly

- Check filing deadlines for your applicable law

- File administrative complaints as required

- Preserve all relevant communications

Building Your Retaliation Case

To prove retaliation, you’ll need to show:

- You engaged in protected activity

- Your employer knew about it

- You suffered an adverse employment action

- A connection exists between your disclosure and the retaliation

The Intersection of Multiple Laws

Many situations trigger multiple whistleblower protections. For example, reporting Medicare fraud by a healthcare company might invoke:

- False Claims Act (government fraud)

- Dodd-Frank (if it’s a public company)

- OSHA retaliation protections

Understanding which laws apply helps you maximize both protection and potential recovery.

State Law Considerations

While federal laws provide substantial protection, many states offer additional whistleblower safeguards. These might include:

- Longer filing deadlines

- Coverage for smaller employers

- Protection for different types of disclosures

- Additional remedies

Always check both federal and state protections before proceeding.

Taking Action: Your Next Steps

Navigating federal whistleblower protections requires careful planning and often legal guidance. Here’s what you should do:

- Assess Your Situation: Identify which laws might protect your specific disclosure

- Document Everything: Start building your evidence file immediately

- Understand Deadlines: Know your filing requirements before taking action

Consider Legal Counsel: An experienced attorney can help you maximize protections and avoid pitfalls

Protecting Your Career While Protecting the Public

Whistleblowing serves a vital public function, but it shouldn’t cost you your career. Federal laws provide robust protections – if you know how to use them.

The key is understanding which law applies to your situation and following its specific requirements carefully. Missing a deadline or reporting to the wrong agency can eliminate your protections entirely.

If you’re considering blowing the whistle on workplace wrongdoing, or if you’ve already made a disclosure and face retaliation, professional legal guidance can make the difference between protected whistleblowing and career suicide.

Contact Nisar Law Group today for a confidential consultation about your whistleblower rights. We’ll help you understand which federal protections apply to your situation and develop a strategic approach to reporting wrongdoing while protecting your career.

Remember: the law protects whistleblowers, but only if you follow the right procedures. Don’t wait until retaliation occurs – understanding your rights beforehand is your best protection.