If you’ve experienced race discrimination at work, you may be entitled to significant compensation, including back pay, front pay, emotional distress damages, punitive damages, and attorney’s fees. The exact amount you can recover depends on which laws apply to your situation, the severity of the discrimination, and whether you file under federal or New York state law. Unlike many other employment claims, race discrimination cases under certain federal statutes have no damage caps—meaning your potential recovery could be substantial.

Key Takeaways

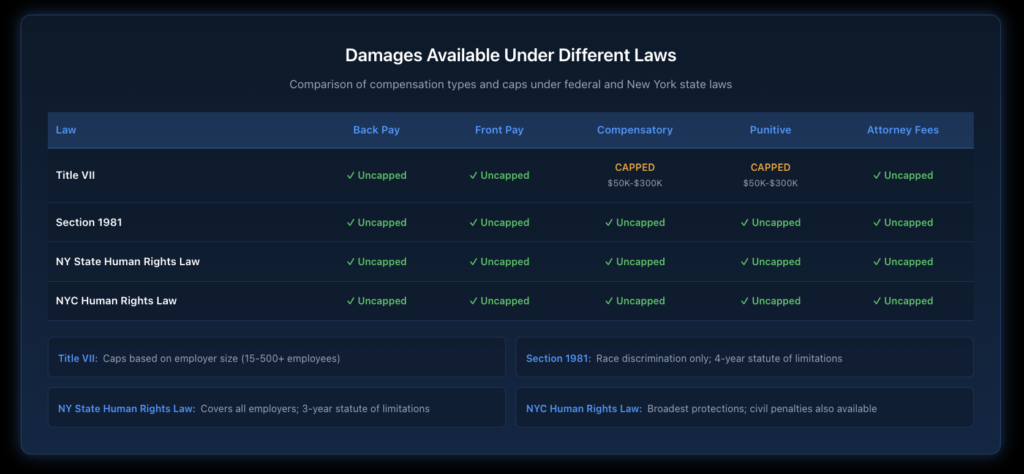

- Back pay and front pay are available under all race discrimination laws and have no caps.

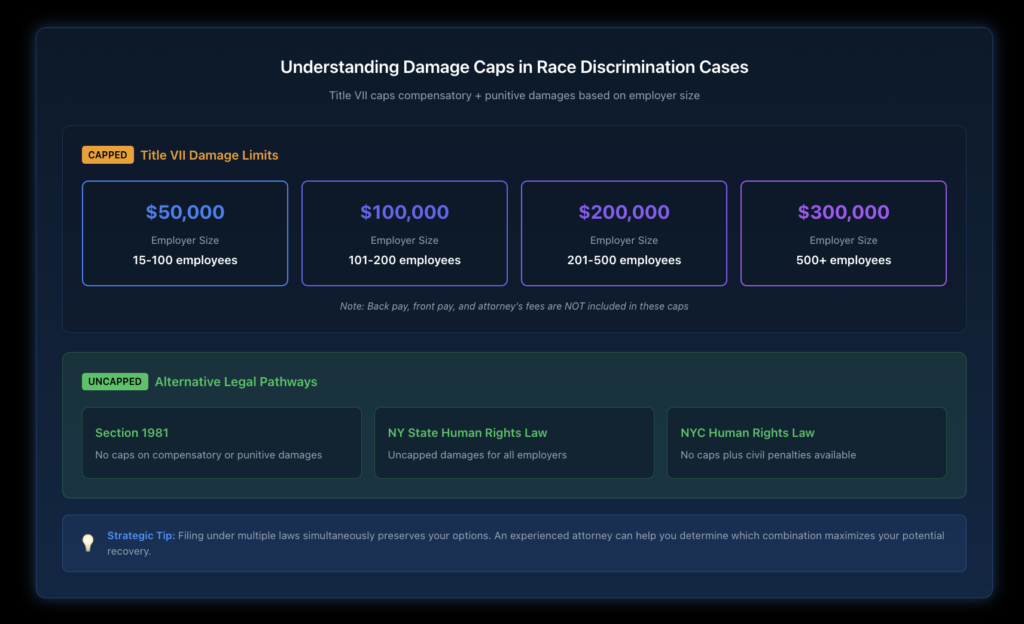

- Title VII damages are capped at $50,000 to $300,000 depending on employer size.

- Section 1981 claims have no damage caps for compensatory or punitive damages.

- New York State Human Rights Law provides uncapped compensatory and punitive damages.

- NYC Human Rights Law offers the broadest protections and potential remedies.

- Emotional distress damages compensate for mental anguish, anxiety, and suffering.

- Punitive damages punish employers who act with malice or reckless indifference.

- Attorney’s fees are recoverable in successful discrimination cases.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Types of Damages Are Available in Race Discrimination Cases?

Race discrimination victims can pursue several categories of compensation. Each serves a different purpose in making you whole after experiencing workplace discrimination based on race.

What Is Back Pay and How Is It Calculated?

Back pay compensates you for wages and benefits lost from the time of discrimination until your case resolves. This includes your regular salary, bonuses you would have received, health insurance premiums your employer would have paid, retirement contributions, and any other benefits tied to your employment.

Courts calculate back pay by examining what you would have earned had the discrimination never occurred. If you were wrongfully terminated, this means your full compensation package from termination until judgment. If you were denied a promotion, it’s the difference between what you earned and what you would have earned in the higher position.

Importantly, back pay has no caps under any federal or state discrimination law. The EEOC confirms that back pay falls outside the statutory limitations on damages, meaning you can recover the full amount of your lost earnings regardless of your employer’s size.

What Is Front Pay and When Is It Awarded?

Front pay compensates for future lost earnings when reinstatement to your job isn’t practical or possible. Courts award front pay when returning to work would be uncomfortable due to damaged relationships, when the position no longer exists, or when the employer’s conduct was so severe that continued employment isn’t feasible.

The duration of front pay awards varies. Courts consider how long it will reasonably take you to find comparable employment, your age and career trajectory, and economic conditions in your industry. Some awards cover several months; others extend for years in cases involving specialized positions or significant career disruption.

Like back pay, front pay has no statutory caps. The U.S. Supreme Court confirmed in Pollard v. E.I. du Pont de Nemours that front pay is equitable relief excluded from damage limitations.

What Are Compensatory Damages for Emotional Distress?

Compensatory damages address the non-economic harm discrimination causes—the mental anguish, humiliation, anxiety, depression, and loss of enjoyment of life that often accompany racial harassment and hostile work environments.

To recover emotional distress damages, you’ll typically need to demonstrate the psychological impact through your own testimony, testimony from family members who observed changes in your demeanor, or medical records and mental health treatment documentation. The more severe and documented your emotional suffering, the higher the potential award.

Emotional distress damages can be substantial, particularly in cases involving egregious discrimination or prolonged harassment. However, under Title VII, these damages face caps based on employer size—a critical limitation that makes understanding your legal options essential.

When Are Punitive Damages Available?

Punitive damages punish employers who discriminate with malice or reckless indifference to your rights. These aren’t compensation for your losses but rather a penalty designed to deter future misconduct.

To recover punitive damages, you must show your employer knew its actions violated federal law but did it anyway, or showed callous disregard for whether its conduct was lawful. Evidence of repeated discrimination despite complaints, failure to act on documented discriminatory behavior, or direct evidence of discriminatory intent strengthens punitive damage claims.

Punitive damages face the same Title VII caps as compensatory damages. However, they’re uncapped under Section 1981 and New York state law, creating significant recovery potential when those statutes apply.

How Do Title VII Damage Caps Work?

Title VII’s damage caps combine compensatory and punitive damages into a single limitation based on employer size. These caps established by the Civil Rights Act of 1991 haven’t been adjusted for inflation in over three decades.

What Are the Current Title VII Damage Caps?

The caps function as follows:

- Employers with 15-100 employees: $50,000 maximum combined compensatory and punitive damages

- Employers with 101-200 employees: $100,000 maximum

- Employers with 201-500 employees: $200,000 maximum

- Employers with more than 500 employees: $300,000 maximum

These limitations apply per plaintiff, not per claim. If three employees sue the same employer, each can potentially recover up to the applicable cap. Juries aren’t told about these caps when deciding damages, so they may award higher amounts that courts later reduce.

What Damages Fall Outside the Caps?

Several important categories of damages aren’t subject to Title VII caps. Back pay and front pay remain fully recoverable regardless of employer size. Past out-of-pocket expenses—medical bills, job search costs, and similar expenditures—also fall outside the caps. Attorney’s fees and court costs, which can be substantial in lengthy litigation, have no limitations.

This means even with the caps, total recovery in a Title VII case against a large employer could potentially exceed $1 million when combining back pay, front pay, uncapped expenses, the $300,000 compensatory/punitive limit, and attorneys’ fees.

Why Does Section 1981 Offer Greater Recovery Potential?

42 U.S.C. Section 1981, one of the nation’s oldest civil rights laws, prohibits race discrimination in the making and enforcement of contracts—including employment contracts. Its most significant advantage for plaintiffs is the absence of any damage caps on compensatory or punitive damages.

How Is Section 1981 Different from Title VII?

Section 1981 differs from Title VII in several important ways. First, there’s no administrative exhaustion requirement—you can file directly in court without first going through the EEOC. Second, the statute of limitations is four years rather than Title VII’s 180 to 300 days for filing an EEOC charge. Third, and most importantly, neither compensatory nor punitive damages face any caps.

These differences make Section 1981 particularly attractive for employees with substantial claims. A jury award of millions of dollars in a Section 1981 case remains intact rather than being reduced to statutory caps.

What Are Section 1981’s Limitations?

Section 1981 only covers discrimination based on race, ethnicity, or ancestry—not religion, sex, or other protected characteristics covered by Title VII. Courts also require plaintiffs to prove race was the “but for” cause of the adverse employment action, a higher standard than Title VII’s “motivating factor” test.

Additionally, Section 1981 requires proof of intentional discrimination. Unlike Title VII, you can’t bring disparate impact claims under Section 1981. This means policies that disproportionately affect employees of certain races, even without discriminatory intent, wouldn’t support a Section 1981 claim.

What Additional Protections Does New York Law Provide?

Employees in New York enjoy some of the strongest anti-discrimination protections in the country. Both the New York State Human Rights Law (NYSHRL) and the New York City Human Rights Law (NYCHRL) provide significant advantages over federal law.

What Makes New York State Human Rights Law Valuable?

The NYSHRL covers all employers regardless of size—even those with just one employee. This dramatically expands coverage compared to Title VII’s 15-employee minimum. More importantly for compensation purposes, the NYSHRL doesn’t cap compensatory or punitive damages.

Since the 2019 amendments, the NYSHRL also allows recovery of attorney’s fees in discrimination cases against private employers. The law uses a lower standard for proving harassment—conduct only needs to subject someone to inferior terms and conditions of employment rather than being “severe or pervasive” as federal law requires.

The statute of limitations for filing with the New York State Division of Human Rights is three years for most claims, providing more time to pursue your case than federal law allows.

How Does NYC Human Rights Law Expand Recovery?

For employees working in New York City, the NYCHRL provides even broader protections. It’s consistently interpreted as the most protective anti-discrimination law in the country, covering additional protected characteristics and defining discrimination more broadly.

The NYCHRL allows for uncapped compensatory damages, punitive damages, and civil penalties. Courts regularly award substantial damages under the NYCHRL that would be impossible under federal law. The three-year statute of limitations applies to court filings, giving employees more time to evaluate their options and build strong cases.

Why Should You Consider State Law Claims?

Filing under New York law instead of, or in addition to, federal law often makes strategic sense. The uncapped damages, broader coverage, lower proof standards for harassment, and longer limitations periods all favor employees. An experienced employment attorney can evaluate which combination of claims maximizes your potential recovery.

Many race discrimination cases are filed under both federal and state law, preserving all options until the case develops and the best path forward becomes clear.

What Factors Affect Settlement Amounts in Race Discrimination Cases?

Most race discrimination cases settle before trial. Understanding what influences settlement values helps set realistic expectations and evaluate offers.

What Evidence Strengthens Your Case Value?

Strong evidence of discrimination directly correlates with higher settlement potential. Direct evidence—discriminatory statements, emails referencing race, or testimony about overtly biased decisions—commands premium value because it reduces the employer’s ability to defend the case.

Circumstantial evidence can also build strong cases. Patterns of discrimination against employees of your race, statistical disparities in hiring or promotions, inconsistent application of policies, or implausible explanations for adverse actions all strengthen your position.

Documentation matters significantly. Employees who kept contemporaneous records, saved emails, or filed internal complaints create paper trails that support their claims and increase case value.

How Does Your Salary Affect Recovery?

Your compensation level directly impacts back pay and front pay calculations. Higher earners have more at stake economically, which translates to larger potential awards. A marketing director earning $150,000 annually who’s wrongfully terminated will have greater back pay claims than an entry-level employee earning $45,000.

This doesn’t mean lower-wage workers can’t recover substantial compensation. Emotional distress damages, punitive damages, and the deterrent effect on employers all factor into settlements regardless of salary level.

What Role Does Employer Size Play?

Large employers typically have more financial resources and greater motivation to avoid public trials. They may be willing to pay more to settle claims quietly. They also face higher potential exposure under laws like Title VII that scale damages to employer size.

Conversely, small employers have lower damage caps under Title VII but may face greater financial strain from litigation, potentially motivating earlier settlement. The key is understanding how your specific employer’s circumstances affect their settlement calculus.

What Is the Process for Seeking Compensation?

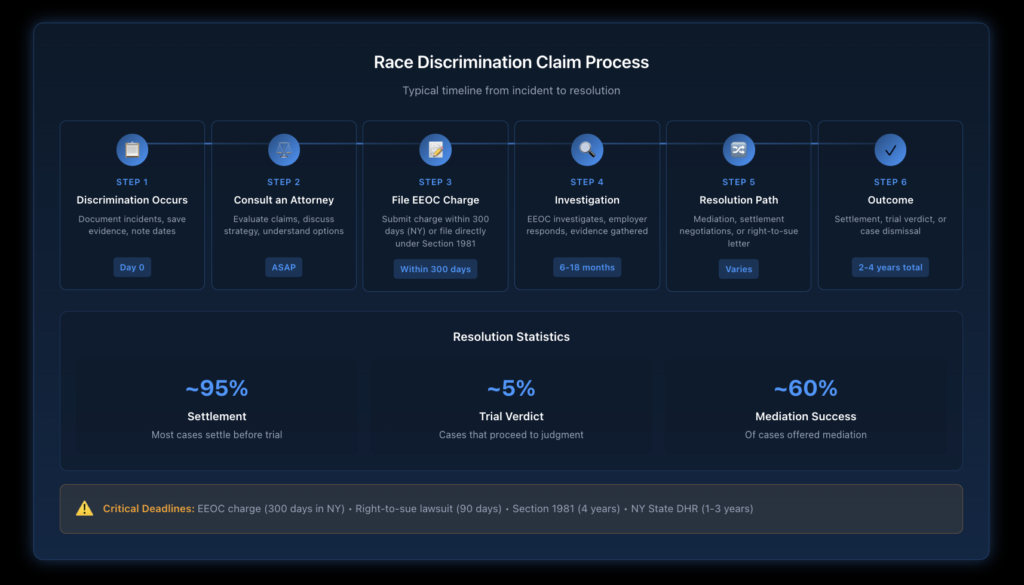

Recovering compensation requires navigating specific procedural requirements. Missing deadlines or failing to follow proper procedures can eliminate your claims entirely.

What Are the Filing Deadlines?

For Title VII claims, you must file a charge with the EEOC within 180 days of the discriminatory act, or 300 days if a state or local agency enforces a law prohibiting the same type of discrimination. New York has such agencies, so the 300-day deadline typically applies here.

Section 1981 claims have a four-year statute of limitations for filing a federal lawsuit. NYSHRL claims must be filed with the state Division of Human Rights within one year (three years for sexual harassment) or in court within three years. NYCHRL claims have a three-year limitations period for court filings.

What Happens After Filing an EEOC Charge?

After filing, the EEOC investigates your charge. This may involve requesting documents from your employer, interviewing witnesses, and analyzing evidence. The process typically takes several months to over a year.

The EEOC may offer mediation as a voluntary alternative to investigation. If the investigation proceeds, the agency issues either a finding of reasonable cause (supporting discrimination occurred) or a dismissal. Either way, you’ll receive a “right to sue” letter allowing you to file a federal lawsuit within 90 days.

You can also request a right to sue letter after 180 days, even if the investigation hasn’t concluded, allowing you to control the timeline of your case.

Should You Accept a Settlement Offer?

Settlement offers must be evaluated carefully against the strength of your evidence, the potential damages at trial, litigation risks, and your personal circumstances. Early offers are often lower than what might be achieved through litigation, but litigation is expensive, time-consuming, and uncertain.

An experienced employment discrimination attorney can evaluate settlement offers against comparable cases, your specific evidence, and likely outcomes. They understand what employers in similar situations have paid and can advise whether an offer is reasonable.

What Non-Monetary Remedies Can You Obtain?

Compensation isn’t limited to money. Courts can order various forms of equitable relief designed to correct discriminatory practices and prevent future harm.

What Is Reinstatement?

Reinstatement returns you to your job with full seniority, benefits, and privileges as if the discrimination never occurred. This remedy is particularly valuable when you want to continue your career with the employer, and the working relationship can be rehabilitated.

Courts recognize that reinstatement isn’t always practical. Where relationships have deteriorated significantly, continued employment would be hostile, or the position no longer exists, front pay typically substitutes for reinstatement.

What Injunctive Relief Is Available?

Courts can order employers to change discriminatory policies, implement training programs, establish new complaint procedures, or take other steps to prevent future discrimination. These orders benefit not just the individual plaintiff but all current and future employees.

In cases involving systemic discrimination patterns, injunctive relief may require comprehensive remedial measures, including hiring goals, reporting requirements, or appointment of monitors to oversee compliance.

Can You Recover Attorney’s Fees?

Yes. Federal civil rights laws, including Title VII and Section 1981, allow prevailing plaintiffs to recover reasonable attorney’s fees. The New York State and City Human Rights Laws also provide for fee recovery.

This fee-shifting provision makes it economically feasible to pursue discrimination cases even when potential damages might not otherwise justify the cost of litigation. Employers understand they may face significant fee liability if they lose, which influences settlement negotiations.

Ready to Explore Your Legal Options?

If you’ve experienced race discrimination at work, understanding your potential compensation is the first step toward holding your employer accountable. Every case is different, and the combination of applicable laws, available evidence, and specific circumstances determines what you might recover.

Nisar Law Group represents employees facing discrimination throughout New York and New Jersey. Our employment attorneys can evaluate your situation, explain which laws apply to your case, and help you understand the compensation you may be entitled to receive. Contact us today for a consultation to discuss your options.

Frequently Asked Questions About Race Discrimination Remedies

Race discrimination settlements vary widely based on case strength, evidence quality, employer size, and the employee’s salary. Settlements can range from $10,000 for minor incidents to millions of dollars for egregious discrimination with strong evidence. Most settlements fall somewhere between $50,000 and $300,000, though cases filed under uncapped statutes like Section 1981 or New York law can achieve significantly higher amounts. The strength of your evidence and whether you can prove intentional discrimination are the most important factors determining value.

After attorney’s fees (typically one-third of the recovery in contingency arrangements) and any case costs are deducted, you’ll receive the remaining amount. Some portions of settlements may be taxable—back pay is generally taxed as ordinary income, while compensatory damages for physical injury or illness are typically tax-free. Emotional distress damages without physical manifestation are usually taxable. Consulting with a tax professional about your specific settlement structure is advisable.

From filing an EEOC charge through trial verdict, discrimination cases typically take two to four years. However, many cases settle earlier—sometimes within months of filing if both parties are motivated to resolve the matter. The EEOC investigation phase alone can take six months to over a year. Once in court, discovery, depositions, and motion practice extend timelines significantly. Cases that go to trial rather than settling generally take longer than those resolved through negotiation or mediation.

You can prove discrimination through direct evidence (discriminatory statements, emails referencing race, or explicit policies targeting certain races) or circumstantial evidence showing disparate treatment. Useful circumstantial evidence includes showing you were treated differently from similarly situated employees of other races, statistical patterns of discrimination in hiring or promotion, timing of adverse actions after complaints, inconsistent enforcement of policies, or implausible reasons given for employment decisions. Documentation, including emails, performance reviews, witness statements, and records of complaints, significantly strengthens cases.

Neither option is inherently better—the right choice depends on your specific circumstances. Settlement provides certainty, speed, privacy, and guaranteed compensation. Trial offers the possibility of higher awards but carries risks including complete loss, lengthy proceedings, emotional stress, and public exposure. Most employment discrimination cases settle because trial outcomes are unpredictable and litigation is expensive. However, when employers make unreasonably low offers or when principal matters significantly, a trial may be appropriate. An experienced attorney can help you weigh these factors based on your case’s strengths and weaknesses.

The 80% rule, also called the four-fifths rule, is a guideline used to identify potential disparate impact discrimination in employment selection procedures. If the selection rate for a protected group is less than 80% of the rate for the group with the highest selection rate, it may indicate discrimination requiring further investigation. For example, if 60% of white applicants are hired but only 40% of Black applicants, the selection ratio is 40/60 or 67%—below 80%, suggesting possible disparate impact. This rule comes from EEOC enforcement guidelines and helps identify systemic discrimination patterns in hiring, promotion, or termination decisions.