No, in most cases, your employer cannot force you to retire based solely on your age—it’s been illegal since 1986 under the Age Discrimination in Employment Act (ADEA). If you’re 40 or older and working for a company with 20+ employees, federal law protects you from mandatory retirement, though narrow exceptions exist for certain executives earning substantial retirement benefits and safety-sensitive positions like airline pilots. When employers pressure you to retire through hostile work environments, sudden negative reviews after years of positive feedback, or “voluntary” buyout offers with underlying threats, you’re likely experiencing illegal age discrimination or constructive dismissal that violates your workplace rights.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Are the Key Takeaways About Forced Retirement?

- Mandatory retirement is illegal for most private-sector and government jobs under the ADEA since 1986.

- Only four narrow exceptions allow forced retirement: high-level executives with $44,000+ annual benefits, positions requiring age as a bona fide occupational qualification (BFOQ), certain public safety officers, and formerly tenured faculty (expired 1994).

- Constructive discharge occurs when employers make working conditions so intolerable that you feel compelled to retire.

- Document everything, including retirement comments, changed treatment, exclusion from opportunities, and performance review changes.

- You have 180-300 days to file an EEOC complaint, depending on your state’s laws.

- New York employees have additional protections under state and city laws covering smaller employers (4+ employees).

- Voluntary retirement programs must provide 21-45 days of consideration time and a 7-day revocation period.

- Legal remedies include reinstatement, back pay, liquidated damages, and attorneys’ fees.

When Is Forced Retirement Actually Legal Under Federal Law?

The Age Discrimination in Employment Act prohibits employers with 20 or more employees from discriminating against workers aged 40 and older in all employment aspects, including forcing retirement based solely on age. Since the 1986 amendments to the ADEA, mandatory retirement policies have been largely prohibited in most private-sector and government jobs. The law recognizes that age alone doesn’t indicate ability or performance—workers should be evaluated on individual merits rather than arbitrary age thresholds.

This means your employer cannot implement blanket policies requiring retirement at a certain age, force you to retire because they believe “it’s time,” pressure you to accept early retirement simply due to age, or make employment decisions based on assumptions about age-related abilities. In the financial services industry, companies often suggest retirement planning sessions exclusively to employees over a certain age, followed by reduced responsibilities and exclusion from long-term projects—this targeted approach based on age rather than performance or business necessity raises significant legal concerns under the ADEA.

Which Executives Can Face Mandatory Retirement at Age 65?

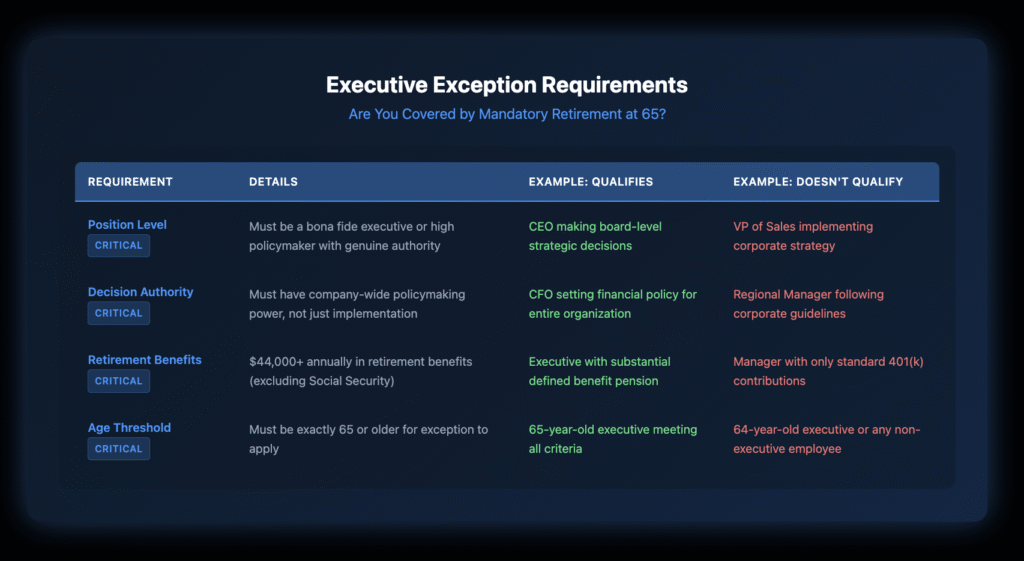

Companies may enforce mandatory retirement at age 65 only for employees qualifying as “bona fide executives” or “high policymakers” who will receive retirement benefits of at least $44,000 annually (not including Social Security). This extremely narrow exception typically applies only to the highest echelon of corporate leadership—executives with significant ownership interests or those with genuine company-wide policymaking authority.

The exception doesn’t apply to mid-level managers, department heads, professionals with specialized expertise but limited policymaking authority, or executives who don’t meet the minimum retirement benefit threshold. Courts interpret this exception strictly, looking beyond job titles to examine actual duties and authority. Many professionals with vice president titles discover they aren’t covered by this exception because their roles involve implementing rather than creating company-wide policy.

What Jobs Allow Age-Based Retirement for Safety Reasons?

Employers may establish mandatory retirement ages when age is a “bona fide occupational qualification reasonably necessary to the normal operation of the particular business.” This BFOQ exception is extremely narrow and generally limited to positions where safety concerns are paramount, age-related decline could pose significant public safety risks, and no individual testing can adequately address these safety concerns.

Classic examples include commercial airline pilots (FAA regulations previously set mandatory retirement at 60, now raised to 65), air traffic controllers, and certain public safety positions, including police and firefighters in some jurisdictions. Courts apply this exception very narrowly, requiring employers to prove the age limit is reasonably necessary for operational safety or effectiveness, all or substantially all individuals over that age would be unable to perform the job safely and efficiently, and individual testing for fitness isn’t possible or practical.

How Do State and Local Public Safety Officers Face Different Rules?

Special provisions in the ADEA allow state and local governments to set maximum hiring ages and mandatory retirement ages for public safety positions like police officers and firefighters. These exceptions recognize the unique physical demands and public safety considerations of these roles.

However, these provisions don’t apply to federal law enforcement officers (who have their own federal regulations), private security personnel, emergency medical technicians or paramedics (unless they’re also firefighters), or support staff within police or fire departments. Even within this exception, some jurisdictions have moved away from strict age limits in favor of more individualized fitness-for-duty assessments.

What Happened to Mandatory Retirement for Tenured Faculty?

Until 1994, colleges and universities could enforce mandatory retirement for tenured faculty at age 70. This exception has expired, and educational institutions are now generally prohibited from forcing retirement based solely on age, even for tenured professors.

However, institutions may establish voluntary early retirement incentive programs, phased retirement options, and post-tenure review processes that are age-neutral. These approaches must avoid targeting faculty based on age and should focus on performance, institutional needs, and voluntary choice.

How Can You Identify Legal vs. Illegal Voluntary Retirement Programs?

Many employers offer early retirement incentives or buyout packages to encourage voluntary retirement. These programs are legal when properly structured, but they must be truly voluntary, provide accurate information about benefits offered, allow sufficient time for consideration (at least 21 days, extended to 45 days for group programs), recommend consultation with an attorney, provide a 7-day revocation period after signing, and not target employees based on protected characteristics.

When early retirement programs appear voluntary but involve targeted pressure, reduced responsibilities, or negative consequences for non-participation, they may cross into illegal age discrimination. Many “voluntary” programs come with clear messaging that those who decline would likely face layoffs with less favorable terms—this coercive approach undermines the voluntary nature and raises serious legal concerns.

What Constitutes Constructive Discharge Related to Forced Retirement?

Some employers attempt to circumvent age discrimination laws by making working conditions so intolerable that older employees feel compelled to retire. This practice, known as constructive discharge, may violate the ADEA when working conditions become objectively intolerable, these conditions would compel a reasonable person to resign, and the intolerable conditions were created because of the employee’s age.

Signs of potential constructive discharge include sudden negative performance reviews after years of positive feedback, unreasonable performance expectations not applied to younger employees, reassignment to undesirable shifts, locations, or duties, exclusion from meetings, projects, or communications, repeated age-related comments or jokes, and encouragement to retire coupled with declining work conditions.

Sales professionals often face reassignment to territories requiring extensive travel after voicing concerns about retirement pressure. The timing and nature of such changes, following decades of exemplary performance in their original territories, often suggest an attempt to push them toward retirement through difficult working conditions.

How Should You Document Everything When Facing Retirement Pressure?

Documentation serves as the foundation for addressing retirement pressure effectively. When you experience subtle retirement pressure, meticulous records prove invaluable. Maintain a detailed journal noting every retirement-related comment, including who said what, when, and in what context.

Comments about retirement may seem innocent initially—casual mentions during team meetings or one-on-one conversations. However, when documented over time, patterns often emerge showing these inquiries happen disproportionately to employees of certain ages. Beyond verbal comments, preserve emails, memos, performance reviews, and any communication suggesting age-based assumptions or retirement expectations. Forward work emails to a personal account or take screenshots to ensure access if your employment ends.

Pay particular attention to documenting how treatment changed after declining retirement discussions, different standards applied to you versus younger colleagues, exclusion from opportunities following retirement discussions, and statements suggesting age-based assumptions about your abilities or plans.

Why Must You Understand Your Complete Benefits Picture?

Making informed decisions about retirement pressure requires a clear understanding of your financial picture. Having precise knowledge of your retirement benefits gives you confidence when responding to retirement suggestions. When facing subtle pressure to retire, reviewing your complete financial situation allows you to respond with facts rather than emotions. You might learn you need several more years to meet retirement goals, providing a concrete reason for continuing employment.

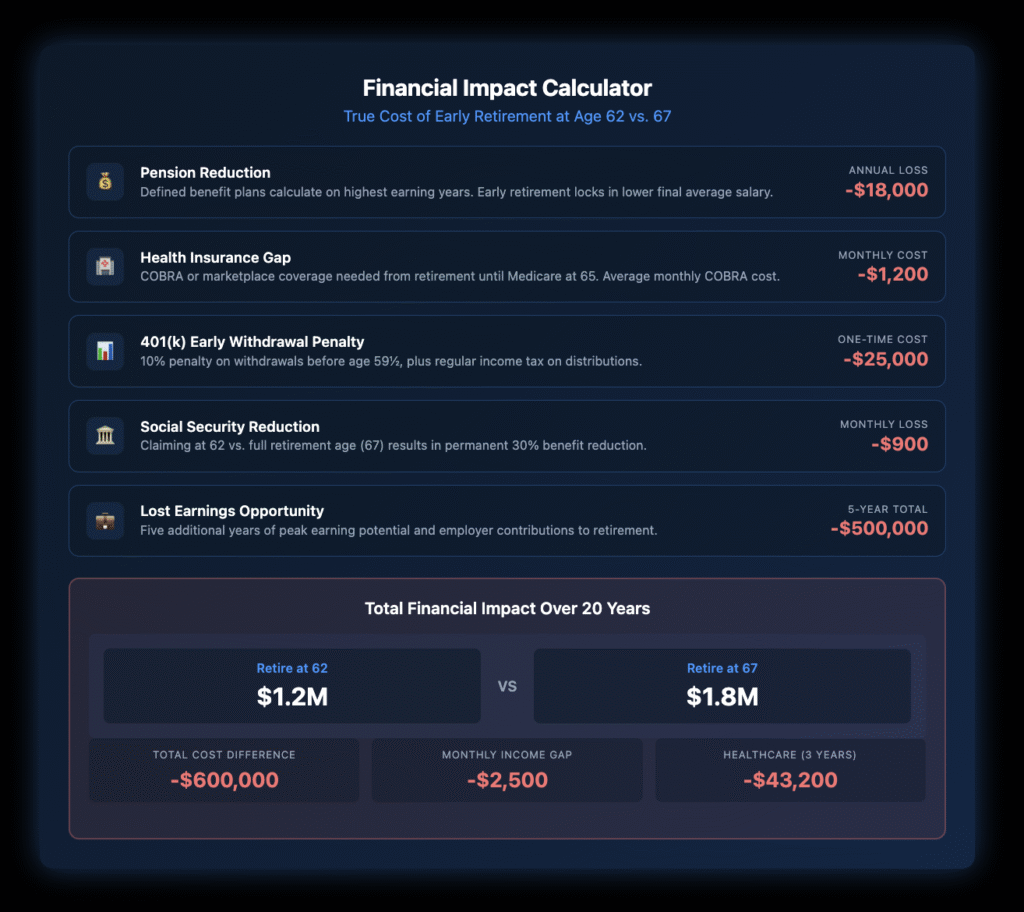

Your pension benefits and vesting status might mean the difference between a comfortable retirement and financial strain. Many defined benefit plans calculate benefits based on the highest earning years, so forced early retirement can permanently reduce your pension amount.

Health insurance concerns often loom large in retirement decisions. Understand whether you’ll have retiree health benefits, what COBRA continuation might cost, and how early retirement affects Medicare eligibility. Many workers face a coverage gap if forced to retire before Medicare eligibility at 65.

Early retirement often triggers penalties in retirement accounts and reduced benefits if you claim Social Security early. Calculate these long-term financial impacts before making decisions about retirement offers. This financial clarity helps you evaluate whether retirement offers are fair and provides concrete support for continuing work if that’s your preference.

How Should You Professionally Respond to Retirement Discussions?

How you respond to initial retirement inquiries can significantly impact your options. A measured, professional response helps preserve both your position and potential legal claims. When faced with questions about your “retirement timeline,” consider calmly explaining that you have no immediate retirement plans and remain committed to your position and the organization’s long-term success. Then, professionally ask whether there are concerns about your performance that prompted the question.

This approach accomplishes several things: it clearly communicates your intention to continue working, refocuses the conversation on performance rather than age, and potentially reveals discriminatory motivations behind the inquiry.

If retirement discussions arise, respond with clear statements about your intention to continue working (if that’s your preference), questions about what prompted the retirement inquiry, reminders of your recent contributions and ongoing projects, requests for specific feedback if performance concerns are cited, and documented follow-up emails summarizing the conversation. Maintaining professionalism during these challenging conversations helps preserve workplace relationships while protecting your rights.

When Should You Consult with an Employment Attorney?

The legal landscape surrounding retirement and age discrimination contains numerous procedural requirements and deadlines that are challenging to navigate without expert guidance. Many professionals initially hesitate to consult an attorney when facing retirement pressure, concerned that it might seem too adversarial. However, early legal consultation often prevents unintentional mistakes that can complicate your options later.

An employment attorney provides crucial guidance on whether the retirement pressure you’re experiencing potentially violates the law, how to document and address the situation while preserving legal claims, the adequacy and negotiability of any retirement or severance offers, strategic options for internal complaints or external legal action, and critical deadlines affecting your rights.

Many employment attorneys offer initial consultations at minimal or no cost, providing a valuable perspective before you make significant decisions. This guidance becomes particularly important before signing any retirement or severance agreements, which often contain waivers of your legal rights.

How Do Internal Complaints Help Protect Your Rights?

Internal complaints can sometimes relieve retirement pressure while preserving your legal rights, though the approach must be carefully considered. When you notice patterns like younger colleagues receiving challenging projects while you’re being sidelined with less meaningful work, addressing the issue through your company’s formal complaint process may be effective. Some organizations aren’t aware of these patterns until they’re specifically documented.

If your company has an established discrimination complaint process, follow the procedure outlined in your employee handbook, frame your complaint in terms of age discrimination and retirement pressure (not general unfairness), reference specific company policies or legal protections being violated, focus on factual information rather than emotions or assumptions, keep copies of your complaint and all related communications, and consider involving your attorney in drafting or reviewing the complaint.

While internal complaints don’t always resolve the issue, they create an official record of your concerns and may satisfy administrative requirements for later legal action. They also provide the company with an opportunity to address the situation before it escalates to external proceedings.

What Legal Remedies Can You Pursue Through the EEOC?

When retirement pressure crosses into potential age discrimination, several legal remedies may be available. The process typically begins with administrative complaints through the Equal Employment Opportunity Commission (EEOC) or your state’s fair employment agency. These agencies investigate discrimination claims and attempt resolution before litigation becomes necessary.

The administrative complaint process involves several key stages. First, you must file within strict time limitations—generally 180 days from the discriminatory act, extended to 300 days in states with their own age discrimination laws. Missing these deadlines can permanently forfeit your right to pursue legal action.

Once filed, the EEOC notifies your employer and begins investigating, which may include requesting position statements, interviewing witnesses, and reviewing documents. The agency may offer mediation as a voluntary alternative to investigation.

After investigation, the EEOC determines whether there’s “reasonable cause” to believe discrimination occurred. If reasonable cause is found, the agency attempts conciliation between the parties. If conciliation fails, the EEOC may litigate the case itself or issue a “right to sue” letter allowing you to proceed to court.

Even without a finding of reasonable cause, you’ll typically receive a right-to-sue letter allowing you to pursue litigation. You must file suit within 90 days of receiving this notice—another crucial deadline.

What Damages and Remedies Are Available for Forced Retirement?

If your case proceeds to litigation, potential remedies may include various forms of relief. Reinstatement can restore you to your position with appropriate seniority and benefits. While not always practical due to workplace relationships, it preserves your career path and future earnings.

Back pay compensates for lost wages and benefits from the time of discrimination until judgment or settlement. Front pay provides future compensation when reinstatement isn’t feasible. In cases of willful violations, liquidated damages equal to your back pay amount may be available. These effectively double the back pay award and serve both compensatory and punitive functions.

The ADEA also provides for recovery of attorneys’ fees and legal costs, making it more feasible to pursue valid claims regardless of financial resources. Beyond individual remedies, courts may order injunctive relief requiring policy changes to prevent future discrimination. These changes can benefit not just you but all older workers at your organization.

Why Do Many Age Discrimination Cases Settle Before Trial?

Many age discrimination cases resolve through negotiated settlements before trial. Settlement offers several potential advantages, including financial compensation without trial uncertainty, extended benefits coverage during transition periods, control over reference information provided to future employers, faster resolution than often lengthy litigation processes, and privacy protections that litigation may not provide.

Settlements provide value beyond financial aspects. They can validate concerns and allow professionals to move forward positively, sometimes including agreements for enhanced age discrimination training that helps prevent similar situations for others. Each legal option has advantages and limitations that should be evaluated based on your specific circumstances, preferences, and goals.

What Additional Protections Do New York Employees Have?

New York State Human Rights Law provides broader protection than federal law, covering employers with just 4+ employees compared to ADEA’s 20-employee threshold. New York City’s Administrative Code offers even stronger protections with longer filing deadlines and additional remedies.

New York employees can file complaints with the State Division of Human Rights within three years of discrimination—significantly longer than federal deadlines. The state law also covers more subtle forms of age bias and doesn’t require proving age was the sole factor in adverse employment decisions.

Manhattan, Brooklyn, Queens, and all NYC employees benefit from city-specific protections that make it easier to prove discrimination and provide broader remedies, including punitive damages in certain cases.

How Can Employers Avoid Discriminatory Retirement Policies?

Progressive organizations increasingly recognize that age diversity strengthens their workforce, bringing valuable experience and perspective alongside younger workers’ energy. Forward-thinking employers implement practices focusing on performance and capability rather than age-based assumptions.

Effective approaches include developing age-neutral performance evaluation systems that assess actual results rather than subjective factors that may incorporate bias. The best systems clearly define performance expectations, apply them consistently across age groups, and focus on measurable outcomes rather than subjective assessments like “energy” or “cultural fit.”

Many organizations now offer retirement planning resources to employees of all ages, recognizing that financial planning is valuable throughout careers, not just as retirement approaches. This approach normalizes retirement planning as ongoing financial management rather than signaling it’s “time to leave” for older workers.

When implementing voluntary retirement programs, legally compliant employers ensure these offers genuinely present choice rather than disguised termination. This includes providing accurate program information, adequate consideration time, and no negative consequences for those who decline.

Effective management training addresses both obvious and subtle forms of age bias. This includes eliminating age-related comments or jokes, avoiding assumptions about career plans based on age, and recognizing experience value. Some organizations incorporate age bias scenarios in regular discrimination prevention training to increase awareness.

Rather than pushing retirement, innovative employers often develop flexible work arrangements, retaining valuable institutional knowledge while accommodating changing life priorities. Options may include phased retirement, part-time schedules, job sharing, or consulting arrangements.

When employment decisions affect older workers, prudent employers document legitimate, non-age-related reasons for these decisions. This documentation focuses on specific performance metrics, business requirements, or organizational changes rather than generalized statements about “fit” or “energy” that may mask age bias.

Regular review of workforce demographics helps identify potential patterns of age discrimination before they become problematic. This includes examining the age distribution of promotions, layoffs, performance ratings, and development opportunities to ensure older workers have equitable treatment and opportunities.

What Are Your Next Steps to Protect Your Right to Work?

The decision to retire should be yours—based on personal circumstances, financial readiness, and career goals—not imposed based on age-related assumptions or stereotypes. While narrow exceptions exist, most workers have strong legal protections against forced retirement.

Understanding these protections helps you recognize potential age discrimination and take appropriate steps to protect your rights. If you’re experiencing retirement pressure that may be age-related, consulting with an experienced employment attorney helps you evaluate options and determine the best path forward.

At Nisar Law Group, we’re committed to helping workers of all ages secure the fair treatment they deserve in all employment aspects, including retirement decisions. If you have questions about retirement pressure or age discrimination, contact us for a confidential consultation to discuss your situation.

Related Resources

- Understanding the Age Discrimination in Employment Act (ADEA)

- Proving Age Discrimination: Evidence You Need

- Age Discrimination During the Hiring Process

- Age-Related Comments: What Constitutes Evidence

- Age Discrimination in the Workplace: Complete Guide

- Filing an Age Discrimination Claim: Step-by-Step Process

Frequently Asked Questions About Forced Retirement

Forced retirement occurs when an employer pressures, coerces, or requires an employee to retire based on their age rather than performance or legitimate business needs. This can happen directly through explicit demands or indirectly through hostile work environments, sudden negative reviews, reassignments to undesirable positions, or “voluntary” retirement offers with underlying threats. Since 1986, forced retirement has been illegal under the Age Discrimination in Employment Act (ADEA) for most employees aged 40 and older working for companies with 20+ employees. The only legal exceptions are for certain high-level executives with substantial retirement benefits and specific safety-sensitive positions.

No, it’s illegal to force most employees to retire based on age. The ADEA prohibits mandatory retirement for the vast majority of workers. Only four narrow exceptions exist: (1) Bona fide executives or high policymakers aged 65+ who receive annual retirement benefits of at least $44,000 (excluding Social Security), (2) Positions where age is a bona fide occupational qualification for safety reasons, like commercial airline pilots, (3) Certain state and local public safety officers, and (4) Formerly tenured faculty (this exception expired in 1994). Any retirement pressure outside these specific exceptions likely violates federal law, and New York State provides even stronger protections covering employers with just 4+ employees.

Start documenting everything immediately—keep detailed records of all retirement-related comments, changes in treatment, and exclusion from opportunities. Review your complete financial picture, including pension vesting, health insurance gaps before Medicare, and potential penalties for early withdrawals. Respond professionally to retirement discussions by stating you have no plans to retire and asking if performance concerns prompted the inquiry. Don’t sign any agreements without understanding them fully. File an EEOC complaint within 180-300 days (depending on your state) to preserve your legal rights. Most importantly, consult with an employment attorney before making irreversible decisions—many offer initial consultations at minimal cost to evaluate whether you’re experiencing illegal age discrimination.

While forced retirement and termination both end your employment, they differ legally and financially. Forced retirement often involves pressure tactics or hostile conditions designed to make you “voluntarily” leave, while termination is a direct employment action. The key difference: if you’re forced to retire due to age-related pressure, you may have stronger discrimination claims under the ADEA. Forced retirement through constructive discharge (making conditions so intolerable you feel compelled to quit) is legally treated similarly to wrongful termination if it’s based on age. Additionally, retirement packages typically include different benefits than severance packages, and accepting retirement may waive certain legal rights unless specific protections are included.

The primary rule is simple: mandatory retirement based on age is illegal for most workers. Legal retirement programs must be genuinely voluntary, provide at least 21 days to consider (45 for group programs), include a 7-day revocation period after signing, and advise you to consult an attorney. Employers cannot reduce your responsibilities, exclude you from projects, or create hostile conditions if you decline retirement offers. Any retirement pressure must be based on legitimate business needs, not age. The few exceptions allowing mandatory retirement have strict requirements—executives must receive $44,000+ in annual retirement benefits, safety-sensitive positions must prove age is essential for job performance, and public safety positions are limited to specific roles under state law.

If you don’t want to retire, clearly communicate your intention to continue working. When asked about retirement plans, state firmly that you have no immediate retirement plans and remain committed to your position. Document this conversation in writing via follow-up email. Focus discussions on your performance and contributions rather than age. If pressure continues, file an internal complaint through your company’s discrimination process, framing it specifically as age discrimination. Continue performing your job duties at a high level and maintain professionalism. Know your rights under the ADEA and your state’s laws. Consider consulting an employment attorney early to understand your options and protect your position. Remember, the decision to retire should be yours based on your personal and financial readiness, not your employer’s age-based assumptions.

No, your boss cannot legally force you to retire based on your age if you’re 40 or older and work for a company with 20+ employees. This protection applies whether pressure comes from your immediate supervisor, HR, or upper management. Your boss cannot implement policies requiring retirement at a certain age, pressure you with comments about being “ready to retire,” create intolerable working conditions to push you out, or threaten worse terms if you don’t accept “voluntary” retirement. If your boss is pressuring you to retire, document every interaction, respond professionally that you plan to continue working, and consider filing an age discrimination complaint. The only legal basis for mandatory retirement involves the narrow exceptions for certain executives and safety-sensitive positions, which don’t apply to most workers.