LGBT employees have the legal right to receive the same workplace benefits as their heterosexual and cisgender coworkers. Under federal law, following Bostock v. Clayton County and Obergefell v. Hodges, employers cannot legally deny health insurance coverage to same-sex spouses, refuse family leave for LGBT employees caring for loved ones, or exclude partners from retirement benefits. New York provides even stronger protections, ensuring LGBT workers access equal benefits in health coverage, leave policies, and all other employment-related programs.

Key Takeaways

- Title VII protections after Bostock v. Clayton County prohibit discrimination in employee benefits based on sexual orientation or gender identity.

- Same-sex spouses must receive identical health insurance, retirement benefits, and COBRA coverage as opposite-sex spouses.

- The Family and Medical Leave Act covers LGBT employees caring for same-sex spouses and recognizes marriages based on where they were performed.

- New York State and New York City human rights laws provide broader benefits and protections than federal law.

- Employers cannot offer inferior benefits packages or restrict coverage based on an employee’s LGBT status.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Federal Laws Protect LGBT Employee Benefits?

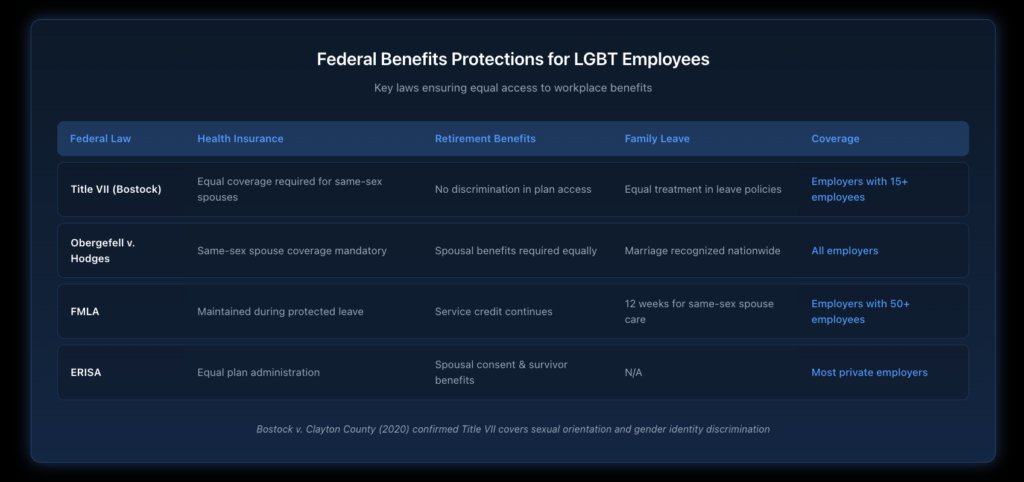

Several federal laws work together to ensure LGBT employees receive equal access to workplace benefits. Understanding these protections helps you recognize when an employer may be violating your rights.

How Does Title VII Apply to Employee Benefits?

Title VII of the Civil Rights Act of 1964 prohibits sex discrimination in employment, which the Supreme Court confirmed in Bostock v. Clayton County, includes discrimination based on sexual orientation and gender identity. This protection extends beyond hiring and firing to encompass all terms and conditions of employment—including benefits.

The EEOC has released guidance confirming that employers cannot provide different benefits to employees based on their sexual orientation or gender identity. If your employer offers health insurance to opposite-sex spouses but denies coverage to same-sex spouses, this constitutes illegal discrimination.

Title VII applies to private employers with 15 or more employees, government agencies, and labor organizations. Even in the current federal policy climate, Bostock remains the law of the land and provides binding protection for LGBT workers nationwide.

What Did Obergefell v. Hodges Change for Employee Benefits?

The 2015 Supreme Court decision in Obergefell v. Hodges established that same-sex marriage is a fundamental right protected by the Constitution. This ruling transformed employee benefits administration by requiring equal treatment of same-sex spouses across all federal benefit programs.

After Obergefell, employers must provide the same benefits to same-sex spouses that they offer to opposite-sex spouses. This includes health insurance coverage under group plans, COBRA continuation coverage, special enrollment rights when employees marry, and all spousal protections under qualified retirement plans.

The decision also eliminated the complex “state of residence” rules that previously created different benefit rights depending on where employees lived. Now, a marriage valid where it was performed must be recognized for benefits purposes regardless of where the employee currently resides.

How Does FMLA Protect LGBT Family Leave?

The Family and Medical Leave Act provides job-protected leave for eligible employees to care for family members with serious health conditions. Following regulatory updates, the Department of Labor confirmed that FMLA protections extend fully to same-sex spouses.

Under current rules, eligible employees can take FMLA leave to care for their same-sex spouse with a serious health condition. The law uses a “place of celebration” rule—meaning your marriage is recognized based on where it was performed, not where you currently live.

FMLA also protects leave for bonding with a new child. LGBT employees who become parents through birth, adoption, or foster placement have the same leave rights as heterosexual employees. This includes same-sex couples who jointly adopt and employees whose partners give birth.

What Specific Benefits Must Employers Provide Equally?

Employers must ensure LGBT-inclusive policies cover all major benefit categories. Discrimination in any of these areas may give rise to a legal claim.

What Health Insurance Rights Do LGBT Employees Have?

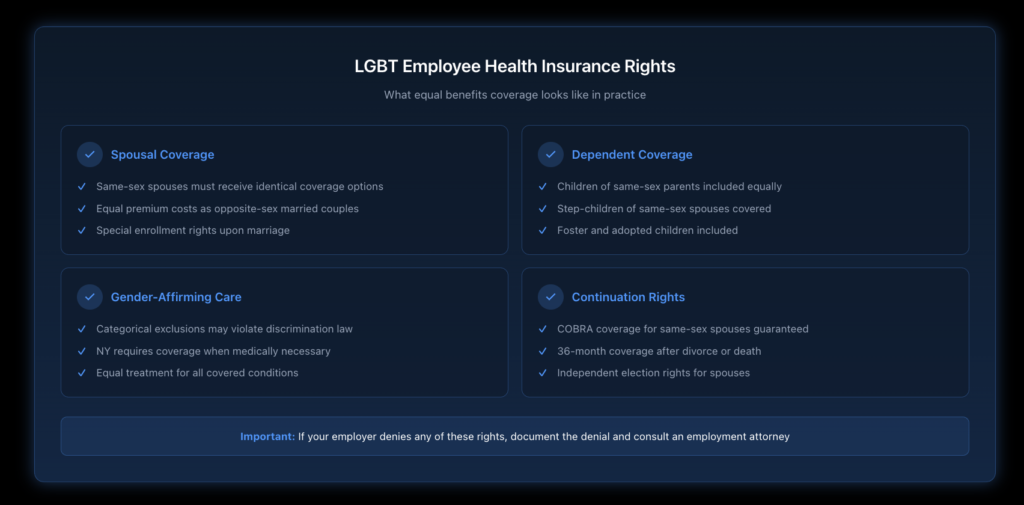

Health insurance represents one of the most significant employee benefits, and LGBT workers have clear rights to equal coverage. Employers offering group health plans must extend the same coverage options to same-sex spouses and families that they provide to opposite-sex married couples.

Specifically, employers cannot charge higher premiums based on sexual orientation or gender identity, refuse to cover same-sex spouses or domestic partners (if domestic partner coverage is offered to opposite-sex partners), exclude coverage for gender-affirming care that would otherwise be medically necessary, or deny dependent coverage to children of same-sex parents.

In New York, the protections extend even further. The New York State Human Rights Law and New York City Human Rights Law prohibit health insurance discrimination, and state insurance regulations require coverage of gender-affirming treatments when medically appropriate.

What Retirement and Pension Protections Exist?

Federal law requires that qualified retirement plans—including 401(k) plans and defined benefit pensions—provide equal benefits to same-sex spouses. After the Supreme Court struck down the Defense of Marriage Act in United States v. Windsor, the IRS issued guidance requiring retirement plans to recognize same-sex marriages.

These protections include qualified joint and survivor annuity requirements that protect surviving spouses, spousal consent rights for distributions and loans, beneficiary designations that must recognize same-sex spouses, and hardship withdrawal provisions that consider a spouse’s medical expenses.

ERISA-governed retirement plans must comply with these requirements nationwide. If your employer’s retirement plan administrator refuses to recognize your same-sex spouse or denies benefits available to opposite-sex spouses, this likely violates federal law.

How Does COBRA Coverage Work for LGBT Families?

The Consolidated Omnibus Budget Reconciliation Act requires certain employers to offer continuation health coverage to qualified beneficiaries after qualifying events. Same-sex spouses are fully protected under COBRA.

When a qualifying event occurs—such as termination of employment, reduction in hours, or death of the covered employee—same-sex spouses have the same independent election rights as opposite-sex spouses. This means your spouse can elect COBRA coverage for themselves even if you choose not to continue coverage.

The maximum coverage period is 18 months for termination or reduction in hours, and 36 months for divorce, legal separation, or death of the employee. Same-sex couples receive identical coverage terms and timelines as opposite-sex couples.

What Additional Protections Does New York Provide?

New York offers some of the strongest LGBT employment protections in the nation, going significantly beyond federal requirements.

How Does the New York State Human Rights Law Protect Benefits?

The New York State Human Rights Law explicitly prohibits discrimination based on sexual orientation, gender identity, and gender expression in employment. This protection applies to employers of all sizes—unlike Title VII’s 15-employee threshold.

Under state law, employers must offer equal terms, conditions, and benefits regardless of sexual orientation or gender identity. The Sexual Orientation Non-Discrimination Act (SONDA) and Gender Expression Non-Discrimination Act (GENDA) strengthened these protections.

The New York Attorney General’s office actively enforces these protections, and employees can file complaints with the New York State Division of Human Rights within three years of discriminatory acts occurring after February 15, 2024.

What Makes New York City Protections Broader?

The New York City Human Rights Law provides even more expansive protections than state law. It covers employers with four or more employees and uses a more employee-friendly interpretation of what constitutes discrimination.

Under city law, LGBT employees have explicit protections for dress codes and gender expression, pronoun usage and name recognition, access to facilities consistent with gender identity, and all employee benefits without exception.

The NYC Commission on Human Rights can investigate complaints and seek significant remedies, including compensatory damages, civil penalties, and attorneys’ fees. Employees have three years to file claims for gender-based harassment or discrimination.

What Are Common Benefits Discrimination Scenarios?

Understanding how benefits discrimination appears in practice helps employees recognize when their rights may be violated.

When Does Denying Spousal Coverage Constitute Discrimination?

If your employer offers health insurance coverage to opposite-sex spouses but refuses to cover your same-sex spouse, this is discrimination—regardless of how the employer frames the denial. Some employers have attempted to argue that benefits policies are “neutral” because they apply equally to all employees, but courts have rejected this reasoning.

The same principle applies to employers who offer domestic partner benefits to opposite-sex unmarried couples but exclude same-sex domestic partners. Any distinction based on the sex or gender of a partner constitutes illegal sex discrimination under current law.

How Can Transgender Employees Face Benefits Discrimination?

Transgender employees may encounter specific benefits issues, including health plan exclusions for gender-affirming medical care, denial of coverage for treatments that would be covered for cisgender employees, and administrative refusals to update records to reflect correct names and genders.

Many health plans historically excluded coverage for transition-related care. While some categorical exclusions may violate discrimination laws, the legal landscape continues to evolve. In New York, state insurance regulations require coverage when gender-affirming treatment is medically necessary.

What Should You Do If Your Benefits Differ from Coworkers’?

If you notice that your benefits package differs from what opposite-sex married coworkers receive, document the differences carefully. Request written explanations from your HR department and keep copies of all plan documents and communications.

Compare specific coverage terms: premium costs, spousal and dependent coverage options, covered treatments and exclusions, and leave policies. Any differences based on your sexual orientation, gender identity, or the gender of your spouse may constitute actionable discrimination.

How Can You Protect Your Benefits Rights?

Taking proactive steps helps ensure you receive the benefits you’re entitled to and positions you to assert your rights if discrimination occurs.

What Documentation Should You Maintain?

Preserving evidence is crucial if you later need to prove benefits discrimination. Keep copies of all plan documents, summary plan descriptions, and enrollment materials. Document any conversations with HR representatives about your benefits.

Save emails, letters, and any written communications related to your benefits enrollment or claims. If you receive a denial of coverage or are told certain benefits don’t apply to you, request the explanation in writing.

What Internal Steps Should You Take First?

Before filing external complaints, follow your employer’s internal procedures. Request a meeting with HR to discuss your benefits concerns and provide specific examples of how your benefits differ from those of coworkers in opposite-sex marriages.

Put your concerns in writing and request written responses. Many employers have internal appeals processes for benefits disputes. Exhausting these procedures can sometimes resolve issues without litigation and may be required before pursuing external remedies.

When Should You Contact an Employment Attorney?

Consider consulting an employment attorney if your employer refuses to provide equal benefits after you’ve raised concerns internally, you’ve been retaliated against for questioning benefits practices, you’re facing immediate harm from denied coverage, or you’re unsure whether your employer’s policies violate the law.

An experienced attorney can evaluate your specific situation, explain your options, and help you determine the best course of action for your circumstances.

Ready to Take Action?

If you’re facing benefits discrimination because of your sexual orientation or gender identity, Nisar Law Group can help. Our employment law attorneys have extensive experience protecting LGBT employee rights across New York and New Jersey. Contact us today for a consultation to discuss your case and understand your legal options.

Frequently Asked Questions About Benefits Equality for LGBT Employees

No. After Obergefell v. Hodges and Bostock v. Clayton County, employers must provide identical health insurance options to same-sex and opposite-sex spouses. This includes the same premium costs, coverage levels, and dependent options. Any distinction based on the gender of your spouse constitutes illegal sex discrimination under Title VII.

Yes. The Department of Labor updated FMLA regulations to fully protect same-sex spouses. You can take job-protected leave to care for your spouse with a serious health condition, and the law recognizes your marriage based on where it was performed. The same bonding leave provisions apply when you and your same-sex spouse have a child through birth, adoption, or foster placement.

This argument fails under the current law. Courts have consistently held that facially neutral policies that result in unequal treatment based on sexual orientation or gender identity constitute discrimination. If the practical effect of a policy is to deny benefits to LGBT employees or their families that heterosexual employees receive, the policy likely violates Title VII.

Categorical exclusions of gender-affirming care may violate discrimination laws, particularly in New York, where state insurance regulations require coverage when such treatment is medically necessary. Denying coverage for a treatment that would be covered if sought by a cisgender employee can constitute sex discrimination under Title VII.

Federal EEOC complaints must generally be filed within 300 days of the discriminatory act. In New York State, complaints to the Division of Human Rights can be filed within three years for acts occurring after February 15, 2024. NYC Human Rights Law claims also have a three-year deadline for gender-based discrimination. Acting promptly preserves your options.

No. Retaliation against employees who oppose discrimination or file complaints is illegal under both federal and state law. This protection applies whether you raise concerns internally, file agency complaints, or participate in investigations. If you experience adverse treatment after questioning benefit practices, you may have both a discrimination claim and a retaliation claim.