You’ve signed a confidentiality agreement or NDA at work, and now you’ve witnessed serious misconduct—fraud, discrimination, wrongful termination, safety violations, or other illegal activities. That agreement might feel like a legal muzzle, preventing you from speaking up. Here’s what you need to know: federal law provides powerful protections that often override these agreements when you’re reporting violations to the government. Understanding these protections could mean the difference between staying silent and safely exposing wrongdoing.

The conflict between confidentiality agreements and whistleblower rights creates genuine confusion for employees. While your employer might have legitimate reasons for protecting trade secrets and proprietary information, they cannot use these agreements to hide illegal conduct or prevent you from exercising your legal rights to report violations.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

Understanding Confidentiality Agreements and NDAs

Let’s start with what these agreements actually cover. Non-disclosure agreements (NDAs) and confidentiality provisions typically appear in employment contracts, severance agreements, settlement agreements, or as standalone documents. They’re designed to protect legitimate business interests like trade secrets, client lists, proprietary processes, and competitive information.

However, there’s a crucial distinction between protecting legitimate business information and concealing illegal activity. No confidentiality agreement can legally prevent you from reporting criminal conduct, regulatory violations, or civil rights violations to appropriate government agencies.

The Defend Trade Secrets Act Protection

The Defend Trade Secrets Act (DTSA) of 2016 includes an important whistleblower immunity provision that many employees don’t know about. Under 18 U.S.C. § 1833(b), you cannot be held liable for disclosing trade secrets if you make that disclosure:

- In confidence to a federal, state, or local government official

- To an attorney

- Solely for the purpose of reporting or investigating a suspected violation of law

This protection applies whether you make the disclosure directly or in a court filing under seal. It’s a federal shield that protects you even if your state law might be less protective.

When Federal Law Overrides Your Confidentiality Agreement

Federal whistleblower statutes contain explicit provisions stating that no agreement can interfere with your right to report violations. These laws recognize that allowing employers to silence whistleblowers through contracts would defeat the entire purpose of whistleblower protection.

The Securities and Exchange Commission has been particularly aggressive in protecting whistleblower rights. In 2015, the SEC brought enforcement actions against companies that used confidentiality agreements to impede whistleblowing, making it clear that any agreement that discourages reporting to the SEC violates federal law.

Congressional Testimony Protection

Your right to communicate with Congress is constitutionally protected and cannot be waived by any agreement. The Lloyd-La Follette Act (5 U.S.C. § 7211) specifically protects federal employees’ right to furnish information to Congress. This protection extends to private sector employees as well through various whistleblower statutes.

Navigating Different Types of Confidentiality Provisions

Not all confidentiality agreements are created equal. Understanding the specific type of agreement you’ve signed helps determine your reporting options.

Employment Agreements

Standard employment confidentiality provisions typically focus on protecting proprietary information and trade secrets. While these are generally enforceable for legitimate business information, they cannot prevent you from:

- Reporting violations to government agencies

- Participating in government investigations

- Testifying in administrative or court proceedings

- Filing a charge with the EEOC or similar agencies

Severance and Settlement Agreements

Severance agreements often contain the broadest confidentiality provisions, sometimes attempting to prevent you from discussing anything about your employment. However, the EEOC has made clear that these agreements cannot prevent you from filing a charge or participating in an EEOC investigation.

Recent changes have further limited what severance agreements can restrict. The Speak Out Act, enacted in December 2022, renders pre-dispute NDAs unenforceable with respect to sexual assault or harassment claims. This means that even if you signed an NDA when you started work, it cannot prevent you from discussing sexual harassment or assault.

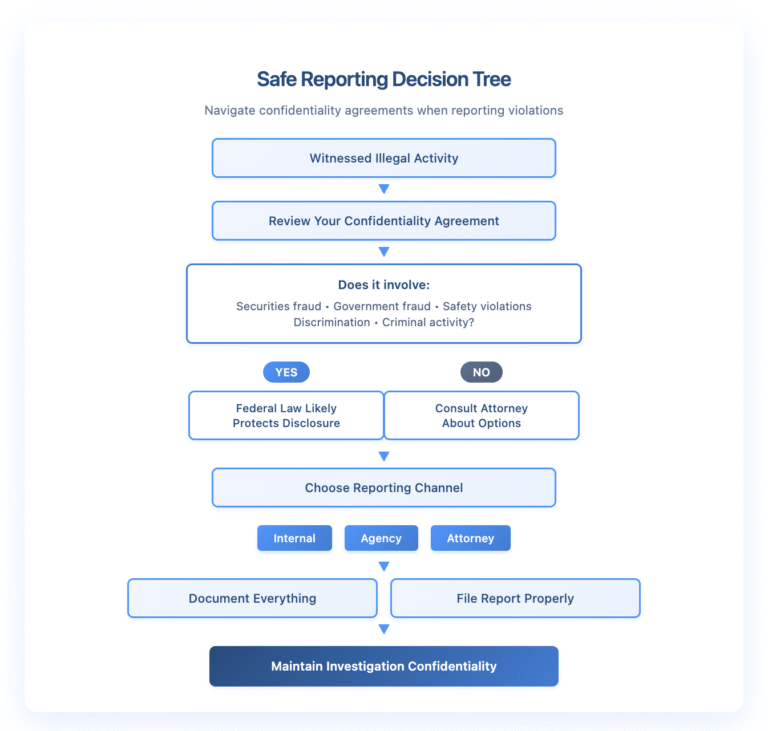

The Process: How to Report Safely Despite an NDA

When you’re ready to report violations despite having signed a confidentiality agreement, following the right process protects you legally and maximizes your whistleblower protections.

Step-by-Step Reporting Guide

First, identify which federal law protects your disclosure. Different violations fall under different whistleblower statutes, each with its own procedures and protections.

Second, consider consulting with a whistleblower attorney before making your report. Attorney-client privilege provides an additional layer of protection for your initial discussions about potential violations.

Third, gather your documentation carefully. You can use documents you have legal access to, but avoid taking documents you’re not authorized to access, as this could complicate your legal position.

Fourth, choose the appropriate reporting channel. Some laws require reporting to specific agencies to qualify for protection. Others allow more flexibility in where you report.

Fifth, maintain confidentiality about the investigation once you’ve reported. While you can report the underlying violations, discussing an ongoing investigation could compromise your protections.

Common Pitfalls When NDAs Meet Whistleblowing

Understanding what can go wrong helps you avoid costly mistakes when navigating the intersection of confidentiality obligations and whistleblower rights.

Pitfall 1: Disclosing to the Media First

While the First Amendment provides some protection for speech, whistleblower statutes typically protect disclosures to government agencies, not media outlets. If you go to the press before or instead of reporting to the appropriate agencies, you might lose statutory whistleblower protections.

Pitfall 2: Mixing Protected and Unprotected Information

Your report should focus on illegal activity, not general grievances or business disputes. Including unprotected information (like customer lists or pricing strategies unrelated to violations) could expose you to legitimate breach of contract claims.

Pitfall 3: Violating Attorney-Client Privilege

If you’re an in-house counsel or have access to privileged communications, special rules apply. While you can still report certain violations, you must navigate carefully around attorney-client privilege issues.

Employer Retaliation: When They Claim You Breached Confidentiality

Even with legal protections, some employers retaliate against whistleblowers by claiming breach of confidentiality agreements. Understanding how to respond protects your rights and strengthens your position.

Document the Retaliation

If your employer takes adverse action claiming you violated a confidentiality agreement after you’ve made a protected disclosure, document everything:

- The timing of the adverse action relative to your disclosure

- Any comments about your “breach” of confidentiality

- Changes in treatment after your report

- Disciplinary actions or termination paperwork citing confidentiality

Assert Your Legal Rights Immediately

Don’t wait to assert that your disclosure was legally protected. Inform your employer in writing that your disclosure was protected under applicable whistleblower law. Reference the specific statute that protects your disclosure.

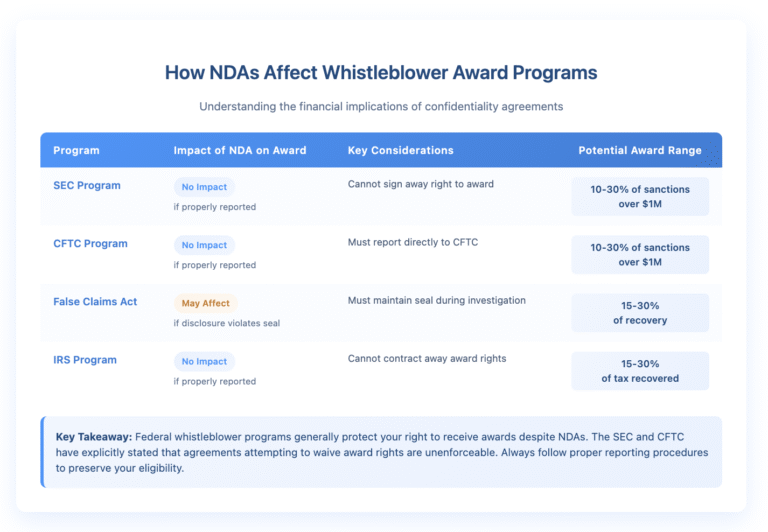

Financial Implications: NDAs and Whistleblower Awards

Confidentiality agreements can affect whistleblower awards in complex ways. Understanding these implications helps you make informed decisions.

Some severance agreements try to require you to waive any whistleblower awards. These provisions are generally unenforceable for reports made to the SEC or CFTC, as both agencies have stated that you cannot waive your right to a whistleblower award.

Balancing Settlement Offers Against Potential Awards

If your employer offers a settlement with a broad confidentiality provision after you’ve witnessed violations, consider the potential value of a whistleblower award. A modest settlement that prevents you from reporting could cost you a much larger whistleblower award down the line.

Recent Legal Developments Strengthening Whistleblower Rights

The legal landscape continues to evolve in favor of whistleblower protections over confidentiality agreements.

The SEC’s Rule 21F-17 prohibits any action to impede whistleblowing, including through confidentiality agreements. Companies have paid significant penalties for using agreements that could discourage reporting to the SEC, even when no actual whistleblower was silenced.

In 2022, Congress passed the Speak Out Act, which prevents the enforcement of pre-dispute NDAs for sexual assault and harassment claims. This represents a significant shift in recognizing that some matters of public concern cannot be silenced through private agreements.

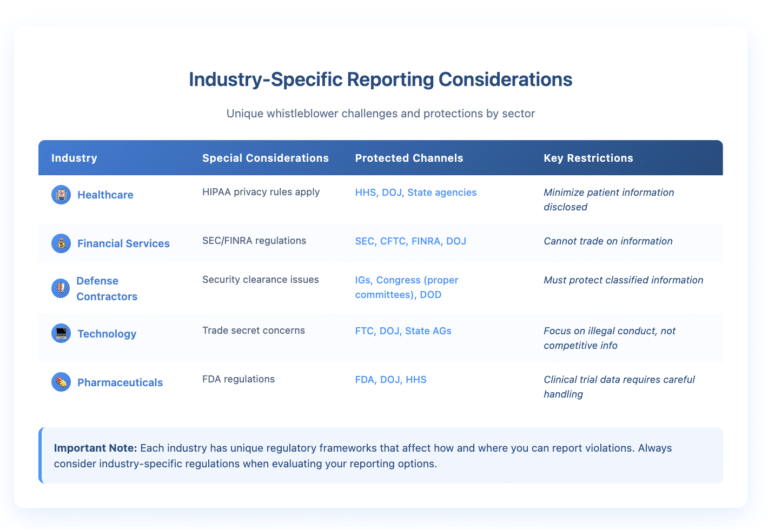

International Considerations for Multinational Employees

If you work for a multinational company or have signed agreements governed by foreign law, additional complexities arise. However, if the violations affect U.S. markets or involve U.S. government programs, U.S. whistleblower protections still apply.

The SEC and CFTC explicitly accept whistleblower reports from international whistleblowers. Your confidentiality agreement, even if governed by foreign law, cannot prevent you from reporting violations that affect U.S. markets.

Practical Strategies for Protecting Yourself

Taking proactive steps before and during the reporting process strengthens your legal position and protects your interests.

Before You Report

Review all agreements you’ve signed, not just obvious NDAs. Confidentiality provisions can appear in employee handbooks, bonus agreements, stock option grants, and other documents.

Keep copies of all your agreements in a safe place outside your workplace. If you’re terminated, you’ll need these documents to defend yourself.

During the Reporting Process

Use secure communication channels when reporting. Many agencies provide secure online portals or allow anonymous reporting through attorneys.

Don’t discuss your report with colleagues unless necessary for the investigation. This protects both the investigation’s integrity and your legal position.

After Reporting

Continue performing your job duties normally. Don’t give your employer additional reasons to take action against you.

Keep detailed records of any changes in how you’re treated after making your report. This documentation becomes crucial if you need to prove retaliation.

When to Seek Legal Counsel

While you can report many violations directly to agencies without an attorney, certain situations call for legal guidance:

- Your confidentiality agreement has unusual provisions or penalties

- You have access to attorney-client privileged information

- The violations involve classified information

- You’re considering a qui tam lawsuit under the False Claims Act

- Your employer has already threatened or initiated legal action

- You’re unsure which agency to report to or which law protects you

An experienced whistleblower attorney can help you navigate complex confidentiality provisions while maximizing your protections and potential recovery.

Taking Action: Your Roadmap Forward

If you’ve witnessed serious violations but are concerned about a confidentiality agreement, here’s your action plan:

First, don’t let fear of your NDA prevent you from reporting serious violations. Federal law provides strong protections for whistleblowers, and these protections often override confidentiality agreements.

Second, identify which federal law protects your disclosure. Different types of violations fall under different whistleblower statutes, each with specific procedures and protections.

Third, gather your documentation carefully and legally. Focus on the information you have rightful access to, and avoid taking documents you shouldn’t have.

Fourth, consider consulting with an attorney before reporting, especially if your situation involves complex confidentiality provisions or potential criminal conduct.

Finally, use the appropriate reporting channel for your type of violation. Following proper procedures maximizes both your legal protections and potential financial recovery.

Protecting Your Rights and Your Future

Confidentiality agreements serve legitimate business purposes, but they cannot silence whistleblowers who report illegal conduct through proper channels. Federal law recognizes that the public interest in exposing fraud, discrimination, safety violations, and other wrongdoing outweighs private confidentiality agreements.

Understanding your rights empowers you to make informed decisions about reporting violations. While the intersection of NDAs and whistleblower law can be complex, you don’t have to navigate it alone.

If you’re facing a situation where a confidentiality agreement seems to conflict with your obligation or desire to report wrongdoing, don’t let that agreement silence you. The experienced attorneys at Nisar Law Group can evaluate your specific situation, explain your protected reporting options, and help you navigate the reporting process while minimizing legal risks. Contact us today for a confidential consultation about your whistleblower matter and learn how we can protect your rights while you protect the public interest.