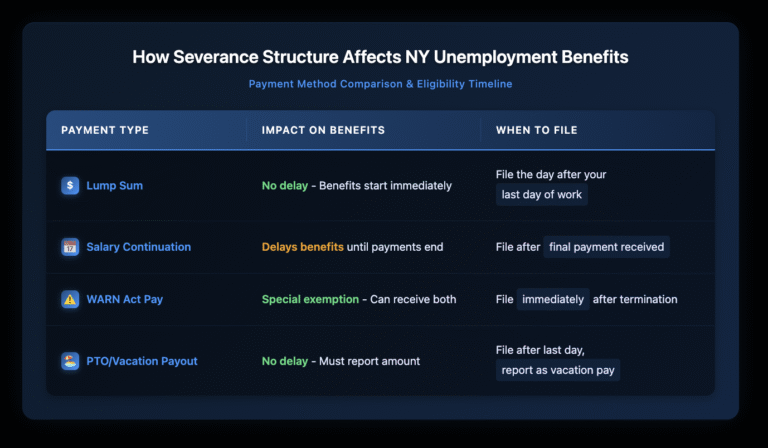

In New York, you can typically receive unemployment benefits after receiving severance pay, but the timing and eligibility depend entirely on how your severance is structured. If you receive a lump sum payment, you can usually file for unemployment immediately after your last day of work. However, if your severance continues as salary payments over time, New York’s Department of Labor considers you still employed during that period, which delays your unemployment eligibility until those payments end. Understanding these distinctions and strategically structuring your severance agreement can mean the difference between waiting weeks or months for unemployment benefits versus accessing them right away.

Key Takeaways

- Lump sum severance payments generally don’t delay unemployment benefits in New York.

- Salary continuation postpones unemployment eligibility until payments cease.

- Dismissal pay under specific circumstances doesn’t affect unemployment at all.

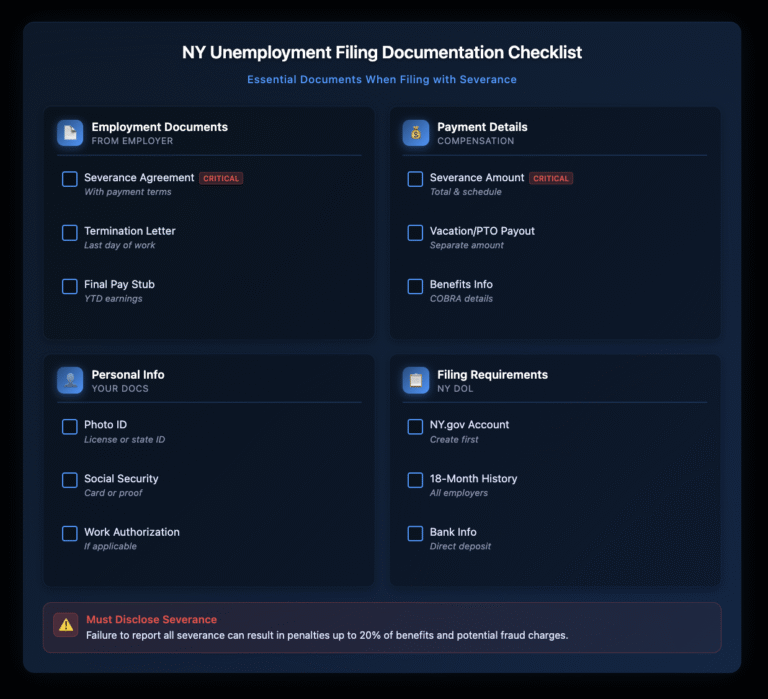

- You must disclose all severance when filing for unemployment or risk penalties.

- Strategic negotiation of payment structure can maximize your total benefits.

- WARN Act payments receive special treatment and don’t delay benefits.

- Vacation and PTO payouts are treated differently from severance.

- The maximum weekly benefit in New York is $504 as of 2025.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Types of Severance Payments Exist and How Do They Impact Unemployment?

How Does Lump Sum Severance Affect Your Unemployment Filing?

When you receive your entire severance package as a single payment, New York State typically treats this as a “dismissal payment” that doesn’t prevent you from filing for unemployment benefits immediately. You’ll need to report the lump sum amount when you file your initial claim, but it won’t create a waiting period before benefits begin.

The key advantage here is immediate eligibility. You can file your unemployment claim the day after your employment officially ends, even if you received a substantial severance payment that same day.

What Happens with Salary Continuation Arrangements?

Salary continuation presents a completely different scenario. When your employer continues paying your regular salary for a specified period after termination, New York’s Department of Labor views you as still employed. You cannot collect unemployment benefits during this continuation period.

For example, if you’re terminated on January 1st but receive salary continuation through March 31st, you cannot file for unemployment until April 1st. This three-month delay significantly impacts your financial planning.

How Are Periodic Severance Payments Treated?

Some employers structure severance as periodic payments that aren’t technically salary continuation. These might be bi-weekly or monthly payments labeled specifically as “severance” rather than wages. The treatment varies based on the specific structure and documentation.

If these payments maintain your regular salary schedule and amount, they’re likely to be treated as salary continuation. However, if they’re clearly designated as severance installments with different amounts or timing from your regular pay, they might not delay unemployment eligibility.

What Strategic Considerations Should Guide Your Severance Negotiation?

How Can You Structure Severance to Maximize Total Benefits?

The optimal severance structure depends on your specific financial situation and the amount being offered. Consider these scenarios:

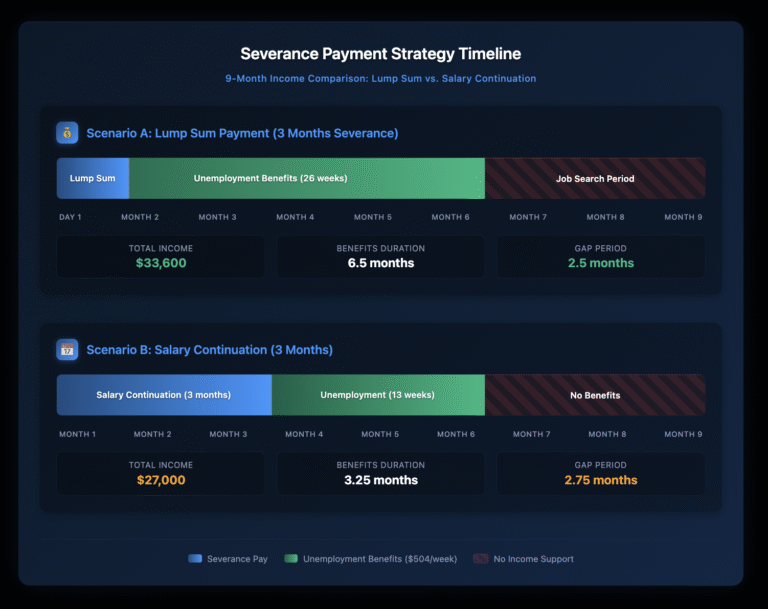

Scenario 1: Large Severance Package. If you’re receiving 6+ months of severance, salary continuation might actually benefit you. You’ll receive your full salary for the continuation period, then transition to unemployment benefits afterward. This extends your total benefit period.

Scenario 2: Modest Severance Package. For severance packages of 2-3 months or less, a lump sum payment typically maximizes your benefits. You can collect unemployment immediately while having the severance funds available for expenses.

What Payment Structures Should You Request During Negotiation?

When negotiating your severance agreement, consider requesting:

- Lump sum payment for immediate unemployment eligibility

- Clear designation of payments as “severance”, not “wages”

- Separate payment for accrued vacation and PTO

- WARN Act pay is classified correctly if applicable

- Written confirmation of your termination date

How Do Special Circumstances Affect Unemployment Eligibility?

What Happens with WARN Act Payments?

Under the Worker Adjustment and Retraining Notification (WARN) Act, employers must provide 60 days’ notice before mass layoffs or plant closures. If they fail to provide adequate notice, they must pay you for that notice period.

WARN Act payments receive special treatment in New York. These payments don’t disqualify you from unemployment benefits, even if paid as salary continuation. You can potentially receive both WARN Act pay and unemployment benefits simultaneously.

How Are Vacation and PTO Payouts Handled?

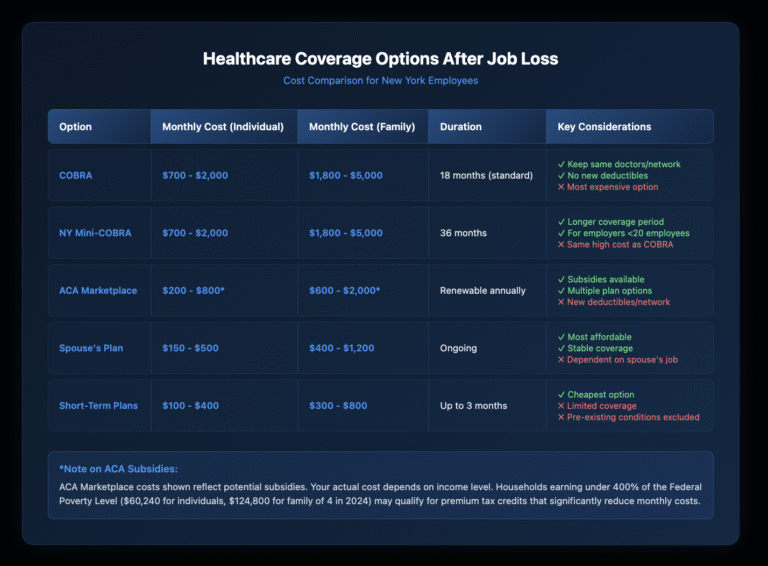

Payments for accrued but unused vacation time or paid time off (PTO) are treated separately from severance. In New York, these payments don’t affect your unemployment eligibility or create a waiting period.

However, you must report these payments when filing your claim. They’re considered “vacation pay” and are allocated to the period when you earned them, not when you received them.

What If You’re Terminated for Misconduct?

Severance negotiations become more complex if there’s any question about the reason for termination. If your employer alleges misconduct, this could affect both your severance package and unemployment eligibility.

New York requires “misconduct” to be more than poor performance – it must involve deliberate violation of company rules or standards. If you’re negotiating severance under these circumstances, ensuring the separation agreement characterizes your departure as a layoff or mutual separation protects your unemployment benefits.

What Are New York's Specific Unemployment Benefit Rules?

How Much Can You Receive in Unemployment Benefits?

As of 2025, New York’s maximum weekly unemployment benefit is $504. Your actual benefit amount depends on your earnings during the “base period” – typically the first four of the last five completed calendar quarters before you file.

The calculation uses your highest quarter earnings divided by 26, with the $504 weekly cap. For someone who earns $65,000 annually, this typically results in the maximum benefit.

How Long Do Unemployment Benefits Last?

New York provides up to 26 weeks of regular unemployment benefits. During economic downturns, federal extensions might provide additional weeks, but these aren’t always available.

This 26-week limit makes severance structuring crucial. If salary continuation delays your unemployment by three months, you’re potentially losing 13 weeks of benefits you could have received with a lump sum structure.

What Are the Work Search Requirements?

Even with severance, you must meet New York’s work search requirements to maintain unemployment eligibility. This includes:

- Conducting at least three job search activities weekly

- Maintaining a detailed work search record

- Being ready, willing, and able to work

- Not refusing suitable employment

What Documentation Do You Need When Filing for Unemployment?

What Information Must You Provide About Severance?

When filing your unemployment claim, you’ll need to provide:

- Severance agreement or separation agreement

- Final pay stub showing year-to-date earnings

- Breakdown of all payments received (severance, vacation, bonuses)

- Employment separation notice or termination letter

- Payment schedule for receiving periodic payments

Full disclosure is critical. Failing to report severance payments can result in overpayment determinations, penalties, and potential fraud charges.

How Do You Report Ongoing Severance Payments?

If you’re receiving periodic severance payments while collecting unemployment, you must report them during your weekly certification. This might reduce your weekly benefit amount depending on how the payments are structured.

New York uses a complex formula for partial unemployment benefits when you have other income. Generally, you can earn up to $504 per week (minus your benefit rate) before losing eligibility entirely.

What Common Mistakes Should You Avoid?

Why Is Timing Your Unemployment Application Critical?

Filing too early is a common mistake. If you file while still receiving salary continuation, your claim will be denied, requiring you to reapply later. This can delay benefits and complicate the process.

Conversely, waiting too long to file after eligibility begins costs you benefits. Unemployment benefits don’t retroactively cover periods before you filed, regardless of when you became eligible.

How Can Mischaracterizing Severance Create Problems?

Some employees try to characterize severance as something else to avoid reporting it. This is both unnecessary (if properly structured, severance doesn’t prevent benefits) and dangerous (misrepresentation can lead to fraud charges).

Similarly, employers sometimes mischaracterize payments to avoid unemployment insurance charges. If your employer incorrectly reports salary continuation as a lump sum, this could delay your benefits.

When Should You Seek Legal Advice About Severance and Unemployment?

What Red Flags Suggest You Need an Attorney?

Consider consulting an employment attorney if:

- Your severance agreement contains unusual payment structures

- There’s disagreement about the reason for termination

- Your employer is contesting unemployment benefits

- The severance amount exceeds six months of salary

- You’re unsure how to structure payments optimally

How Can Legal Counsel Maximize Your Total Benefits?

An experienced employment attorney can help structure your severance to maximize both immediate payments and long-term unemployment benefits. They understand the nuances of New York’s unemployment system and can negotiate terms that protect your eligibility while securing the best possible severance package.

What Are Your Next Steps?

Understanding how severance affects unemployment benefits is crucial for financial planning during job transitions. The difference between salary continuation and lump sum payments can mean thousands of dollars in benefits gained or lost. Before signing any severance agreement, carefully consider how the payment structure impacts your unemployment eligibility.

If you’re facing termination or negotiating a severance package, don’t navigate these complex waters alone. The employment attorneys at Nisar Law Group understand both severance negotiation strategies and New York’s unemployment system. We can help structure your agreement to maximize your total benefits while protecting your legal rights. Contact us today for a consultation to discuss your specific situation and develop a strategy that secures your financial future during this transition.

Frequently Asked Questions About Unemployment and Severance

Yes, but the impact depends entirely on how your severance is structured. If you receive a lump sum payment, you can typically file for unemployment immediately after your last day of work. However, if your employer continues paying your regular salary over time (salary continuation), New York considers you still employed during that period, which delays your unemployment eligibility. The key is understanding your payment structure and negotiating accordingly to minimize any delays in receiving benefits.

In most cases, you cannot receive both at the same time if your severance is paid as salary continuation. However, there are important exceptions. If you receive a lump sum severance payment, you can collect unemployment benefits right away since the lump sum doesn’t extend your employment period. Additionally, WARN Act payments have special status in New York – you can receive both WARN Act pay and unemployment benefits simultaneously, even if the WARN payment continues over time.

Yes, you must report all severance payments when filing for unemployment in New York. However, this doesn’t necessarily disqualify you from benefits. Lump sum severance is reported, but typically doesn’t delay eligibility. Salary continuation is treated as wages and will delay benefits. Failing to report severance payments can result in serious consequences, including overpayment penalties up to 20% of benefits received and potential fraud charges. Always be transparent about all payments received.

The “rule of 70” isn’t a legal requirement but rather a common benchmark some employers use for enhanced severance packages, particularly in age discrimination settlements or early retirement incentives. It typically means employees whose age plus years of service equal 70 or more receive enhanced benefits. However, this varies significantly by employer and isn’t guaranteed. If you’re over 40 and facing termination, you should know that the Older Workers Benefit Protection Act provides special protections, including 21 days to consider severance agreements and 7 days to revoke after signing.

There’s no legal requirement for severance in New York, but industry standards typically range from one to two weeks per year of service. Executives and long-term employees often negotiate higher amounts. Factors affecting severance include your industry, position level, years of service, reason for termination, and whether you have potential legal claims. If you believe you’ve faced discrimination or wrongful termination, you may have leverage to negotiate a more substantial package.

It depends on the payment structure. With salary continuation, you’re technically still on payroll and considered employed for unemployment purposes, even though you’re not working. With a lump sum payment, your employment ends on your termination date, regardless of the severance amount. This distinction is crucial for unemployment benefits, health insurance continuation, and even job search activities. Your separation agreement should clearly state your official termination date to avoid confusion.

If your employer challenges your unemployment eligibility, don’t panic. You have the right to appeal and present your case. Document everything related to your termination and severance agreement. Common employer challenges involve allegations of misconduct or voluntary resignation. In New York, misconduct must be more than poor performance – it requires deliberate violation of company rules. If your severance agreement states you were laid off or terminated without cause, this documentation becomes crucial evidence. Consider seeking legal counsel if your benefits are denied, as an experienced attorney can help navigate the appeal process and protect your rights.