Yes, severance payments are fully taxable as ordinary income and subject to federal income tax (typically 22% supplemental withholding rate), state and local taxes, plus FICA taxes (7.65% for Social Security and Medicare) – meaning you could lose 35-45% of your severance to taxes depending on your location and income level. However, strategic planning around payment timing, retirement contributions, and understanding specific tax rules can significantly reduce your tax burden and help you keep more of your severance package.

Key Takeaways

- Severance payments are taxed as supplemental wages at 22% federal withholding (37% for amounts over $1 million)

- New York residents face combined tax rates of 35-45% on severance payments

- Strategic payment timing across tax years can save thousands in taxes

- Contributing severance to retirement accounts provides immediate tax deductions

- Section 409A violations can trigger 20% additional penalties

- Certain legal settlement portions may qualify for tax exclusions

- Proper classification between wages and damages affects taxation

- Understanding withholding versus actual tax liability prevents surprises

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

How Is Your Severance Package Taxed?

What Makes Severance Payments Taxable Income?

The IRS treats severance payments as supplemental wages, identical to regular employment income for tax purposes. This classification means your severance faces the same tax obligations as your regular paycheck, including federal income tax, state income tax, local taxes, Social Security tax (6.2% up to the wage base limit of $168,600 for 2025), and Medicare tax (1.45%, plus 0.9% additional Medicare tax on amounts over $200,000).

Unlike some forms of compensation that receive preferential tax treatment, severance doesn’t qualify for capital gains rates or any special exclusions. The IRS considers it compensation for past services or payment in lieu of future wages, making it fully taxable regardless of how your employer labels it.

How Does the IRS Classify Different Severance Components?

Your employer must report severance payments on your W-2 form, not a 1099, reinforcing its treatment as wages rather than independent contractor income. This classification applies whether you receive a lump sum, periodic payments, or salary continuation.

Even enhanced severance for signing a release of claims remains fully taxable as wages. The consideration you receive for waiving legal rights doesn’t transform the payment’s tax character – it’s still supplemental wages subject to standard employment taxes.

What Are the Specific Tax Rates and Calculations?

What Federal Tax Rates Apply to Your Severance?

Federal taxation of severance follows specific supplemental wage withholding rules that differ from regular paycheck withholding. For severance payments up to $1 million in a calendar year, employers must withhold at a flat 22% rate for federal income tax. This rate applies regardless of your regular tax bracket or W-4 elections.

For high-income earners receiving severance payments exceeding $1 million in a single year, the withholding rate jumps to 37% on the excess amount. This heightened rate matches the top marginal tax bracket and ensures adequate tax collection on substantial payments.

What’s the Difference Between Withholding and Actual Tax Liability?

Remember that withholding isn’t your actual tax liability – it’s merely a prepayment. Your final tax obligation depends on your total annual income, deductions, and credits. If you’re in a lower tax bracket, you’ll receive a refund. If you’re in a higher bracket, you’ll owe additional taxes when filing your return.

For example, someone in the 12% tax bracket who has 22% withheld from their severance will receive a refund of the excess withholding. Conversely, high earners in the 35% bracket will owe additional taxes despite the 22% withholding.

How Do State and Local Taxes Impact Your Severance?

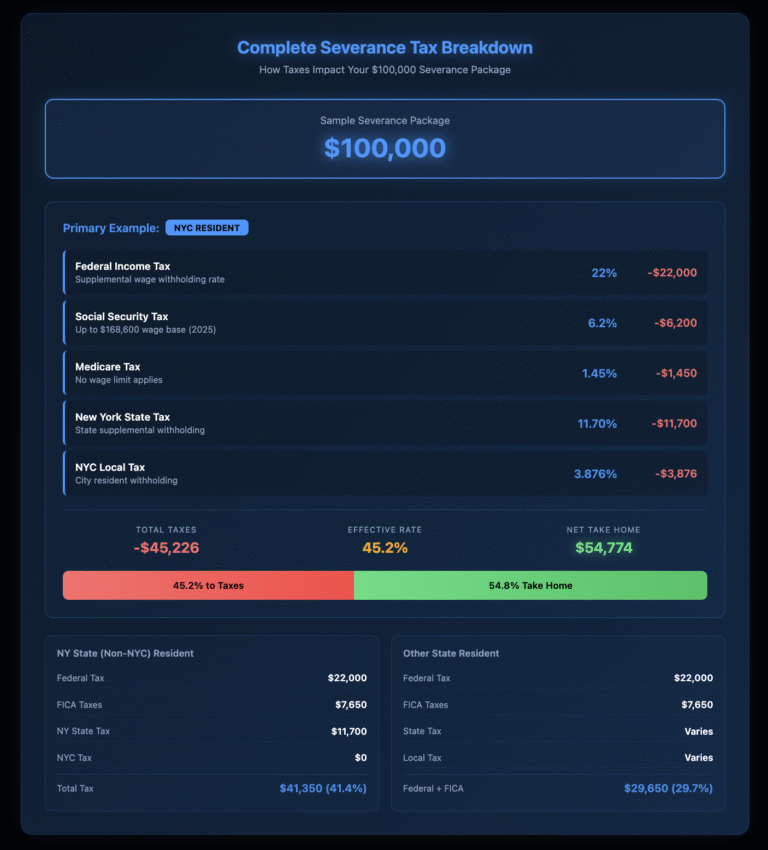

New York State imposes its own supplemental withholding rate of 11.70% on severance payments for 2025, while New York City residents face an additional 3.876% withholding. Combined with federal withholding, New York City residents see approximately 37.6% withheld from their severance before considering FICA taxes.

The actual New York State tax rate ranges from 4% to 10.9% based on your total income, with NYC rates adding 3.078% to 3.876%. High earners in Manhattan could face marginal rates approaching 50% when combining all tax obligations.

What FICA Taxes Apply to Severance?

FICA taxes add another 7.65% to your severance tax burden, consisting of 6.2% for Social Security (on amounts up to $168,600 for 2025) and 1.45% for Medicare (with no wage limit). High earners pay an additional 0.9% Medicare surtax on severance amounts that push their total wages over $200,000 for single filers or $250,000 for married filing jointly.

Unlike federal income tax withholding, you cannot adjust FICA withholding rates – they’re mandatory on all wage income. This means someone receiving a $100,000 severance package loses $7,650 to FICA taxes immediately, before considering any income tax obligations.

How Can Payment Structure Reduce Your Tax Burden?

Should You Take a Lump Sum or Installments?

Strategic structuring of severance payments can generate significant tax savings through careful timing and allocation. Receiving payments across multiple tax years often reduces your overall tax liability by preventing a spike into higher tax brackets.

What Are Section 409A Deferred Compensation Rules?

Deferred compensation arrangements under Section 409A allow spreading payments over several years, but require careful compliance with IRS regulations. Violations trigger immediate taxation plus a 20% penalty tax and interest charges, making professional guidance essential.

Key compliance requirements include specifying payment timing at the agreement’s inception, limiting the ability to accelerate or further defer payments, and observing the six-month delay for “specified employees” of public companies.

How Does Salary Continuation Affect Taxes?

Some employers offer the option to receive severance as salary continuation rather than a lump sum. While this doesn’t change the tax treatment, it spreads the tax impact and may preserve certain benefits like health insurance or 401(k) matching.

Salary continuation keeps you on payroll, potentially allowing continued retirement plan contributions and maintaining benefit eligibility. However, it might also restrict your ability to collect unemployment benefits or start new employment.

What Tax-Saving Strategies Should You Consider?

How Can Retirement Contributions Reduce Severance Taxes?

Maximizing pre-tax contributions offers immediate tax relief on severance payments. Contributing to a traditional 401(k) reduces your taxable income dollar-for-dollar, up to $23,500 for 2025 ($31,000 if you’re 50 or older). If your severance is paid while you’re still technically employed, you might be able to direct significant portions into your 401(k).

Traditional IRA contributions might provide deductions depending on your income level and retirement plan coverage. For 2025, you can contribute $7,000 ($8,000 if 50 or older), though deductibility phases out at higher incomes.

What Other Pre-Tax Deductions Help?

Health Savings Account contributions provide triple tax benefits: deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses. The 2025 limits are $4,150 for individual coverage and $8,300 for family coverage, plus $1,000 catch-up for those 55 and older.

Consider “bunching” deductions in the year you receive severance. Prepaying mortgage interest, making charitable contributions, or timing medical procedures can offset the income spike from severance.

Can Timing Strategies Reduce Your Tax Bill?

The timing of your severance receipt can significantly impact your tax liability. If you expect a lower income next year (perhaps due to unemployment or semi-retirement), deferring some severance to that year reduces your overall tax burden. Conversely, if you’re starting a higher-paying position, accelerating payment into the current year might be advantageous.

What Special Rules Apply to Legal Settlements?

Which Settlement Components Might Be Tax-Free?

Not all severance-related payments face identical tax treatment. Payments for emotional distress or discrimination might qualify for different tax treatment than standard severance. However, only payments for physical injury or physical sickness qualify for tax exclusion under IRC Section 104(a)(2).

The Supreme Court’s decision in Commissioner v. Schleier established that employment-related settlements, including age discrimination or wrongful termination, don’t qualify for the physical injury exclusion. Emotional distress alone, even with physical symptoms, doesn’t meet the exclusion threshold.

How Should Settlement Amounts Be Allocated?

Properly allocating settlement amounts between taxable wages and potentially excludable damages requires careful documentation. The allocation must reflect the genuine nature of the claims and cannot be artificially structured solely for tax benefits.

Attorney fees paid from your severance settlement aren’t deductible under current tax law due to the Tax Cuts and Jobs Act’s suspension of miscellaneous itemized deductions through 2025.

What Compliance Issues Should You Avoid?

When Does Constructive Receipt Trigger Taxes?

The IRS applies the “constructive receipt” doctrine to severance payments, meaning you’re taxed when funds become available to you without substantial limitations. If you have the option to receive payment but choose to delay, you’re still taxed as if you received it.

This principle affects negotiation strategies – you cannot simply refuse to cash a severance check to defer taxation. Once your employer makes payment unconditionally available, the tax obligation triggers regardless of when you actually deposit or use the funds.

What Documentation Protects You During Audits?

Proper documentation protects you during IRS audits and ensures accurate tax filing. Keep your complete severance agreement, including all amendments and side letters. Document any legal claims underlying the settlement, as these affect the tax treatment of various payment components.

Maintain records of all tax withholdings, which should appear on your W-2 form. If payments span multiple years, track each payment date and amount. Save correspondence discussing payment allocation between wages and other settlement components.

What Red Flags Might Trigger IRS Scrutiny?

The IRS examines severance arrangements that appear to circumvent tax rules. Excessive allocations to non-wage components, particularly claims of physical injury without supporting documentation, draw scrutiny. Attempting to recharacterize wages as capital gains or gifts violates tax law.

Structured payments that coincidentally avoid tax thresholds or brackets might suggest improper tax motivation. While tax planning is legitimate, arrangements must reflect genuine business purposes beyond tax avoidance.

What Special Considerations Apply to Executives?

How Are Golden Parachute Payments Taxed?

Executive severance packages face additional tax complexities, particularly regarding “excess parachute payments” under IRC Section 280G. If your severance exceeds three times your average annual compensation over the previous five years, you might face a 20% excise tax on the excess amount, in addition to regular income taxes.

Golden parachute payments triggered by changes in corporate control receive special scrutiny. The corporation loses tax deductions for excess parachute payments, often leading to “gross-up” provisions where the company covers your excise tax liability – though these gross-ups themselves are taxable.

What Rules Apply to Non-Qualified Deferred Compensation?

Non-qualified deferred compensation plans, common in executive packages, require careful Section 409A compliance. The six-month delay rule for public company executives can affect payment timing and cash flow planning.

These arrangements often include rabbi trusts or other funding mechanisms that don’t trigger immediate taxation but provide some payment security. Understanding the tax implications of various funding and vesting provisions helps executives maximize after-tax value.

Your Next Steps for Tax-Efficient Severance Planning

Understanding severance taxation empowers you to negotiate better terms and make informed decisions about payment structure. Before accepting any severance offer, calculate your actual after-tax proceeds, considering federal, state, and local tax obligations. Evaluate whether lump sum or installment payments better serve your financial situation.

Review opportunities to reduce taxable income through retirement contributions, HSA funding, or strategic timing of other income and deductions. Ensure any deferred payment arrangements comply with Section 409A to avoid devastating penalty taxes.

Most importantly, remember that tax considerations, while significant, shouldn’t override other important factors like ensuring adequate compensation for your claims and securing favorable non-monetary terms. Professional guidance can help balance these competing priorities while maximizing your after-tax severance value.

If you’re negotiating a severance agreement or need assistance structuring your package for tax efficiency while protecting your legal rights, contact Nisar Law Group for comprehensive guidance that addresses both the tax and legal implications of your severance arrangement.

Frequently Asked Questions About Severance Payment Taxes

Severance payments face multiple layers of taxation that typically total 35-45% of your payment, depending on your location and income level. At the federal level, employers withhold a flat 22% for supplemental wages (37% if your severance exceeds $1 million), plus 7.65% for FICA taxes (Social Security and Medicare). New York residents face an additional 11.70% state withholding, and NYC residents pay another 3.876% in city taxes. This means a NYC resident receiving a $100,000 severance package will see approximately $45,000 withheld for taxes. However, your actual tax liability depends on your total annual income and might be higher or lower than the withheld amount.

Your severance seems heavily taxed because it’s treated as supplemental wages subject to flat withholding rates that don’t account for your personal tax situation. The IRS requires employers to withhold at 22% federally, regardless of whether you’re actually in a lower tax bracket. Additionally, receiving a large lump sum can push you into a higher tax bracket for that year, increasing your overall tax rate. The combination of federal, state, local, and FICA taxes creates a substantial withholding that often surprises employees. While the withholding might seem excessive, remember it’s a prepayment – if you’re in a lower tax bracket, you’ll receive a refund when filing your return.

You cannot legally avoid all taxes on severance, but you can significantly reduce your tax burden through strategic planning. Contributing to pre-tax retirement accounts like a traditional 401(k) or IRA reduces your taxable income dollar-for-dollar, up to annual contribution limits ($23,500 for 401(k) in 2025). Spreading payments across multiple tax years can keep you in lower tax brackets. Maximizing deductions in your severance year – such as bunching charitable contributions or prepaying deductible expenses – offsets the income spike. Health Savings Account contributions offer triple tax benefits if you have a high-deductible health plan. While you can’t eliminate taxes entirely, these strategies can reduce your effective tax rate by 10-15% or more.

Whether lump sum or installments work better depends on your specific financial situation and future income expectations. Lump sum payments provide immediate access to funds and certainty, but can push you into a higher tax bracket for that year. Installment payments spread the tax impact across multiple years, potentially keeping you in lower brackets and saving thousands in taxes – our analysis shows splitting a $120,000 severance could save over $8,000 in taxes. However, installments carry risks: your former employer could face financial difficulties, and you might lose negotiating leverage once you’ve signed. Consider installments if you expect lower income in future years, but ensure any deferred payments comply with Section 409A to avoid 20% penalty taxes.

Yes, severance and bonuses receive identical tax treatment as “supplemental wages” under IRS rules. Both face the same 22% federal withholding rate (37% over $1 million), plus full FICA taxes and state/local withholding. Your employer reports both on your W-2 as wages, and both count toward your annual income for determining your tax bracket. The main difference isn’t in taxation but in timing and negotiability – you typically have more control over severance payment structure than bonus payments. Understanding this similarity helps in tax planning, as strategies that work for one (like retirement contributions or timing) apply equally to the other.

Minimizing taxes on a lump-sum severance requires coordinated strategies implemented before you receive payment. First, maximize all available pre-tax deductions: contribute the maximum to your 401(k), IRA, and HSA if eligible. Time the payment strategically – if possible, receive it in a year when you expect a lower income. Accelerate deductible expenses into your severance year: prepay mortgage interest, make charitable contributions, or complete planned medical procedures. Consider negotiating for non-cash benefits that aren’t immediately taxable, such as continued health insurance or outplacement services. If your severance includes payment for alleged discrimination or harassment, work with your attorney to properly allocate amounts, as some portions might qualify for different tax treatment.

Severance pay can significantly impact your tax refund because the flat 22% withholding rate often doesn’t match your actual tax liability. If your total income, including severance, keeps you in a tax bracket below 22%, you’ll receive a refund of the excess withholding. Conversely, if the severance pushes you into a higher bracket (24%, 32%, or above), you’ll owe additional taxes. For example, someone normally in the 12% bracket who receives a $50,000 severance will have $11,000 withheld federally but might only owe $6,000 in actual taxes, generating a $5,000 refund. Calculate your expected total income for the year to estimate whether you’ll owe or receive a refund, and consider making estimated tax payments if you’ll owe substantially more.

No state legally requires employers to provide severance pay – it’s entirely voluntary unless specified in an employment contract, collective bargaining agreement, or company policy. However, if an employer promises severance in writing or has an established practice of paying it, they must follow through. Some states, like New York, have stronger enforcement of severance promises made in employee handbooks or offer letters. The WARN Act requires 60 days’ notice or pay in lieu for certain mass layoffs, which functions similarly to severance. Understanding that severance isn’t mandatory emphasizes the importance of negotiation – employers offer it to obtain a release of claims, giving you leverage to negotiate better terms before signing anything.

Have questions about restrictive covenants in your severance agreement? These terms are negotiable, and understanding your leverage can mean the difference between career restrictions and career freedom. Contact Nisar Law Group for a confidential consultation about protecting your professional future while securing the best possible severance package.