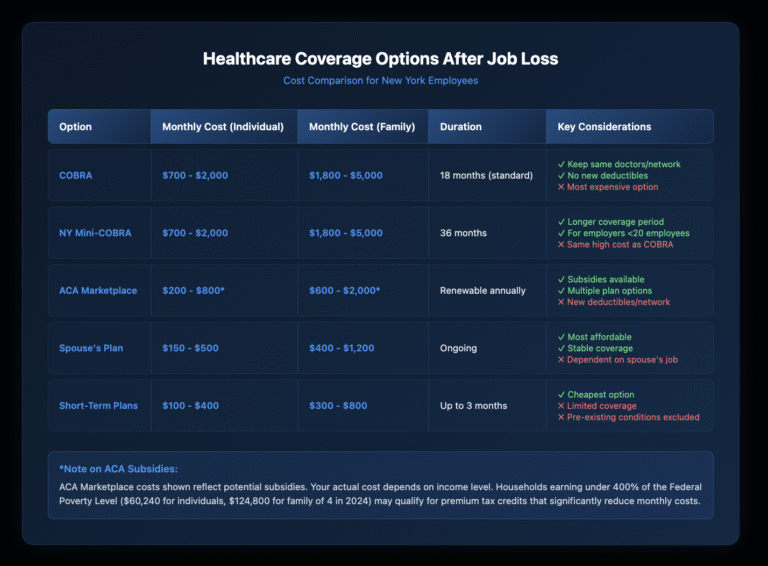

When you lose your job in New York, you typically have 60 days to elect COBRA healthcare coverage at 102% of your employer’s full premium cost – that’s your portion plus what your employer previously paid, plus a 2% administrative fee. For most employees, this means paying $700-$2,000 monthly for individual coverage or $1,800-$5,000 for family coverage. COBRA generally lasts 18 months, though certain qualifying events extend coverage to 36 months. You have alternatives, including ACA marketplace plans, New York State’s mini-COBRA for small employers, spouse’s coverage, or negotiating employer-paid COBRA subsidies in your severance package.

Key Takeaways

- COBRA coverage costs 102% of the full premium (employee + employer portions + 2% admin fee)

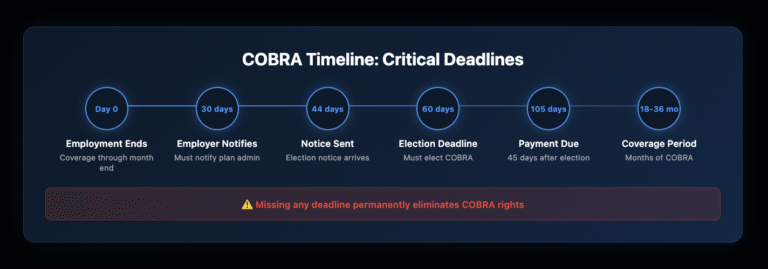

- You have exactly 60 days from notification to elect COBRA coverage

- Standard COBRA lasts 18 months, with extensions up to 36 months for certain qualifying events

- New York State offers mini-COBRA for employers with fewer than 20 employees

- COBRA subsidies are negotiable severance benefits – many employers offer 3-6 months

- Missing the 60-day election window means losing COBRA rights permanently

- ACA marketplace plans may cost less than COBRA, especially with subsidies

- Your coverage continues through the last day of the month you leave employment

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

How Long Do You Have to Decide About COBRA Coverage?

The COBRA election period creates strict deadlines you can’t afford to miss. From the date you receive your COBRA election notice, you have exactly 60 days to decide whether to continue coverage. Your employer must send this notice within 14 days after your plan administrator receives notification of the qualifying event, and the plan administrator then has 30 days to send you the election notice.

Don’t confuse the election period with the payment deadline. After electing COBRA, you have 45 days to make your first payment, which covers the period retroactive to when your employer coverage ended. Missing either deadline – the 60-day election or 45-day payment – permanently eliminates your COBRA rights.

What Exactly Does COBRA Cost and Why Is It So Expensive?

COBRA seems expensive because you’re seeing the true cost of health insurance for the first time. During employment, your employer typically paid 70-80% of premiums. Under COBRA, you pay the entire premium plus a 2% administrative fee.

How Are COBRA Premiums Calculated?

The calculation is straightforward: (Employee contribution + Employer contribution) × 1.02 = Your COBRA cost. If your employer paid $1,400 monthly and you contributed $350, your COBRA premium becomes $1,785 per month.

Premium amounts can change annually when your former employer’s plan renews. You’ll receive notice of any premium increases, but you can’t switch to a different plan level during COBRA continuation unless your former employer’s open enrollment allows it.

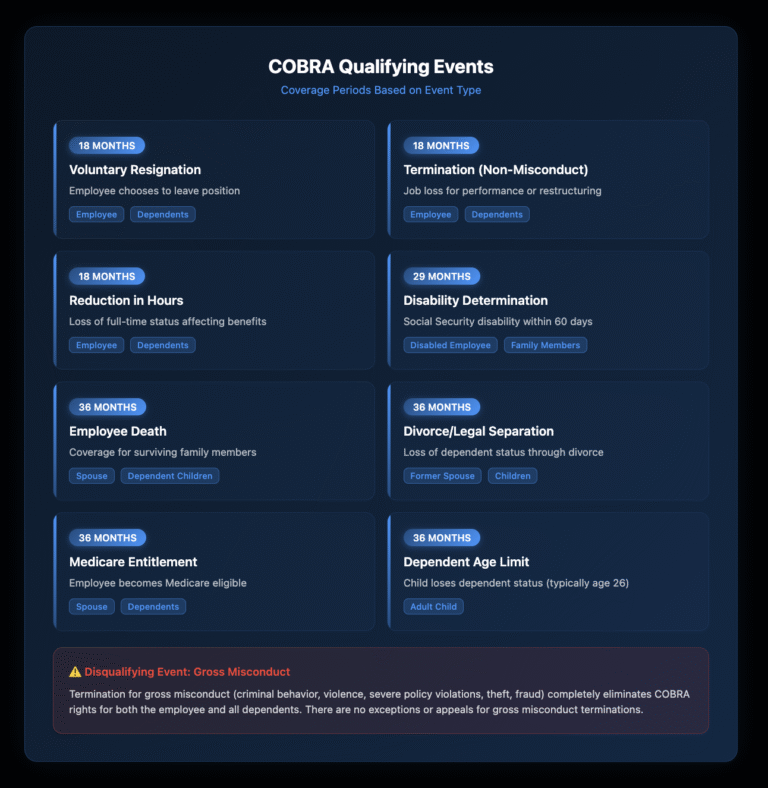

What Qualifying Events Trigger COBRA Rights?

Not every job separation triggers COBRA eligibility. Federal COBRA applies when specific qualifying events cause loss of coverage under an employer’s group health plan covering 20 or more employees.

Which Employment Changes Qualify for COBRA?

Voluntary resignation, termination for reasons other than gross misconduct, and reduction in hours that causes loss of benefits all qualify for 18 months of COBRA. Gross misconduct termination – typically involving criminal behavior, violence, or severe policy violations – disqualifies you from COBRA entirely.

Layoffs and workforce reductions always trigger COBRA rights, regardless of whether you receive severance. Even if your employer continues paying premiums during a severance period, you maintain the right to elect COBRA when that employer-paid period ends.

Do Family Members Get Different COBRA Periods?

Certain qualifying events provide 36 months of COBRA for family members: employee’s death, divorce or legal separation from the covered employee, employee’s Medicare entitlement, or dependent child losing dependent status. These longer periods protect family members when the primary insured’s status changes.

What Are Your Alternatives to COBRA Coverage?

COBRA isn’t your only option for health insurance after job loss. Understanding alternatives helps you make cost-effective decisions about healthcare continuation.

When Should You Choose the ACA Marketplace Instead?

ACA marketplace plans often cost less than COBRA, especially if you qualify for premium tax credits based on income. Losing job-based coverage triggers a 60-day special enrollment period for marketplace coverage. Unlike COBRA, marketplace plans let you choose different coverage levels and provider networks.

Compare total costs including premiums, deductibles, and out-of-pocket maximums. If you’ve already met your deductible under your employer’s plan, COBRA maintains that progress. Starting fresh with a marketplace plan means new deductibles and out-of-pocket costs.

How Does New York’s Mini-COBRA Law Expand Your Options?

New York State continuation coverage, often called mini-COBRA, applies to employers with fewer than 20 employees who aren’t covered by federal COBRA. This state law provides 36 months of continuation coverage – double the federal COBRA period for employment-related qualifying events.

Mini-COBRA premiums can’t exceed 102% of the group rate, matching federal COBRA pricing. The election period mirrors federal COBRA at 60 days. This longer coverage period particularly benefits employees of small businesses who need extended continuation options.

Can You Negotiate COBRA Subsidies in Your Severance Package?

COBRA subsidies represent valuable negotiable benefits in severance agreements. Many employers offer to pay COBRA premiums for a specific period as part of separation packages, typically 3-6 months for standard separations and longer for senior executives or discrimination settlements.

What COBRA Benefits Should You Request?

Start by requesting full COBRA premium payment for the length of your severance period. If the employer resists, negotiate for partial subsidies or a lump-sum payment equal to several months of COBRA premiums. Some employers prefer lump sums to avoid ongoing administrative obligations.

Request that subsidized COBRA be structured as employer-paid rather than taxable income to you. This distinction affects your tax liability and potentially your eligibility for unemployment benefits or ACA marketplace subsidies.

How Do Different Industries Handle COBRA in Severance?

Financial services and technology companies often provide 6-12 months of COBRA subsidies in standard severance packages. Healthcare and pharmaceutical companies sometimes extend coverage through the end of the calendar year. Government contractors and unionized employers may have specific COBRA subsidy requirements in collective bargaining agreements or federal contracts.

What Are the Critical COBRA Deadlines You Can't Miss?

COBRA involves multiple interconnected deadlines, and missing any one permanently affects your rights.

Your employer must notify the plan administrator within 30 days of your termination or reduction in hours. The plan administrator then has 14 days to send your COBRA election notice. You have 60 days from the later of the qualifying event or receipt of the election notice to elect COBRA.

What Happens If You Miss COBRA Deadlines?

Missing the 60-day election window permanently eliminates COBRA rights – no exceptions, appeals, or extensions exist. Courts consistently uphold these strict deadlines even in cases of employer error, mail delays, or personal hardships.

After electing COBRA, missing the 45-day initial payment deadline or any monthly payment deadline (typically with a 30-day grace period) results in permanent termination of COBRA coverage. Reinstatement isn’t available even if you pay all missed premiums.

How Do COBRA and Medicare Work Together?

Medicare eligibility significantly affects COBRA rights and strategy. If you’re Medicare-eligible when leaving employment, COBRA becomes secondary to Medicare, potentially reducing its value. However, COBRA may still cover services Medicare doesn’t, like prescription drugs, if you lack Part D.

Becoming Medicare-eligible during COBRA doesn’t terminate your COBRA rights, but it may affect your spouse’s or dependents’ coverage periods. If you become Medicare-eligible before electing COBRA, your family members may qualify for 36 months of coverage from your Medicare eligibility date.

What Special Rules Apply to COBRA During Disability?

Social Security disability determination extends COBRA coverage from 18 to 29 months if disability exists at termination or occurs within the first 60 days of COBRA. The premium increases to 150% of the plan cost during the disability extension period (months 19-29).

You must notify the plan administrator within 60 days of the Social Security disability determination and before the end of the initial 18-month COBRA period. This extension particularly benefits individuals awaiting Medicare eligibility through disability.

How Should You Document Your COBRA Election and Payments?

Protecting your COBRA rights requires meticulous documentation. Send your COBRA election by certified mail with return receipt requested, even if the administrator accepts email or fax. Keep copies of all notices, elections, and correspondence.

Document payment methods and dates carefully. Set up automatic payments if possible, but monitor them closely – bank errors or expired credit cards causing missed payments, terminate COBRA permanently. Keep payment confirmations for at least three years after coverage ends.

Screenshot or print online payment confirmations immediately. Email confirmations to yourself for backup. These records prove critical if disputes arise about payment timing or coverage lapses.

Take Action to Protect Your Healthcare Coverage

Understanding COBRA and healthcare continuation rights empowers you to make informed decisions during employment transitions. Whether negotiating severance packages, evaluating coverage options, or ensuring compliance with strict deadlines, knowledge of these rights protects your access to healthcare.

Don’t navigate these critical decisions alone. If you’re facing job loss, negotiating severance, or dealing with COBRA issues, contact Nisar Law Group for a consultation. Our employment attorneys help you maximize severance benefits, including COBRA subsidies, and ensure you understand all healthcare continuation options.

Visit nisarlaw.com or call 212-826-9900 to discuss your situation with an experienced employment law attorney who understands both the legal requirements and practical realities of healthcare continuation after job loss.

Frequently Asked Questions About COBRA and Healthcare Continuation Article

To continue your health insurance through COBRA, you must elect coverage within 60 days of receiving your election notice. Your employer notifies the plan administrator about your qualifying event, who then sends you an election packet with forms and cost information. Complete the election forms, return them within the 60-day window, and make your first payment within 45 days of electing coverage. This first payment covers the period from when your employer coverage ended, so it’s retroactive. Set up automatic monthly payments to avoid missing deadlines that would permanently terminate your coverage.

The primary downside of COBRA is cost – you’ll pay 102% of the full premium, often $700-$2,000 monthly for individual coverage. This includes what your employer previously paid plus a 2% administrative fee. Other downsides include strict deadlines with no flexibility (missing the 60-day election or any payment permanently ends coverage), no ability to change plan types unless during open enrollment, and a limited duration of 18-36 months. Additionally, COBRA doesn’t offer subsidies based on income like ACA marketplace plans might.

Yes, several alternatives typically cost less than COBRA. ACA marketplace plans often provide the best alternative, especially if your income qualifies for premium tax credits – potentially reducing costs by 50-75%. If you’re married, joining your spouse’s employer plan usually costs significantly less. New York State’s Essential Plan offers free or low-cost coverage for qualifying incomes. Short-term health plans provide temporary coverage at lower costs but exclude pre-existing conditions. Compare total costs including premiums, deductibles, and out-of-pocket maximums, not just monthly premiums.

Your employer-sponsored health insurance typically continues through the last day of the month in which your employment ends. If you quit on October 15th, coverage usually continues through October 31st. After that, you have 60 days to elect COBRA continuation coverage, which can extend your insurance for 18 months from the qualifying event. During the gap between coverage ending and COBRA election, you’re technically uninsured, but COBRA coverage is retroactive once elected and paid.

COBRA costs 102% of your employer’s full premium – that’s the employee portion plus what your employer paid, plus a 2% administrative fee. For individual coverage, expect $700-$2,000 monthly, depending on your plan’s comprehensiveness. Family coverage typically runs $1,800-$5,000 monthly. To estimate your COBRA cost, look at your last pay stub for your health insurance deduction, then contact HR to find out the employer’s contribution. Add these amounts and multiply by 1.02 for your COBRA premium.

You may deduct COBRA premiums as medical expenses if you itemize deductions and your total medical expenses exceed 7.5% of your adjusted gross income. Self-employed individuals can deduct COBRA premiums above the line without itemizing. If you receive COBRA subsidies through severance paid directly by your employer, those aren’t taxable income to you. However, if you receive a lump sum for COBRA costs, that’s typically taxable income. Consider using pre-tax COBRA premium payments through a severance arrangement when negotiating your exit package.

The answer depends on your specific situation. Choose COBRA if you’ve met your deductible for the year, need to keep your current doctors, or have ongoing treatment that shouldn’t be disrupted. Choose ACA marketplace coverage (Obamacare) if you qualify for premium subsidies based on income, want lower monthly costs, or need coverage beyond COBRA’s 18-month limit. Run the numbers: marketplace plans during open enrollment or within 60 days of job loss often cost 40-60% less than COBRA, especially if your income dropped due to job loss.

The “COBRA loophole” isn’t actually a loophole but rather the 60-day election period that provides retroactive coverage. You can wait up to 60 days after your employer coverage ends to elect COBRA, and if you need medical care during that window, you can then elect and pay for retroactive coverage. This strategy is risky – if you miss the deadline, you lose COBRA rights permanently. Some people use this “loophole” to see if they’ll need coverage while exploring other options, but one medical emergency after day 60 leaves you completely uncovered.