Evaluating an initial severance offer requires systematically analyzing each component against industry standards, your specific circumstances, and potential legal claims—most employees can increase their initial offer by 20-50% through informed evaluation and strategic negotiation. The key is understanding that first offers are rarely final offers. Companies typically build negotiation room into initial packages, expecting informed employees to identify gaps and request improvements. Your evaluation should focus on three critical areas: whether the financial compensation reflects your tenure and position, if the benefits continuation adequately bridges your transition period, and what legal rights you’re being asked to waive in exchange for the package.

Key Takeaways

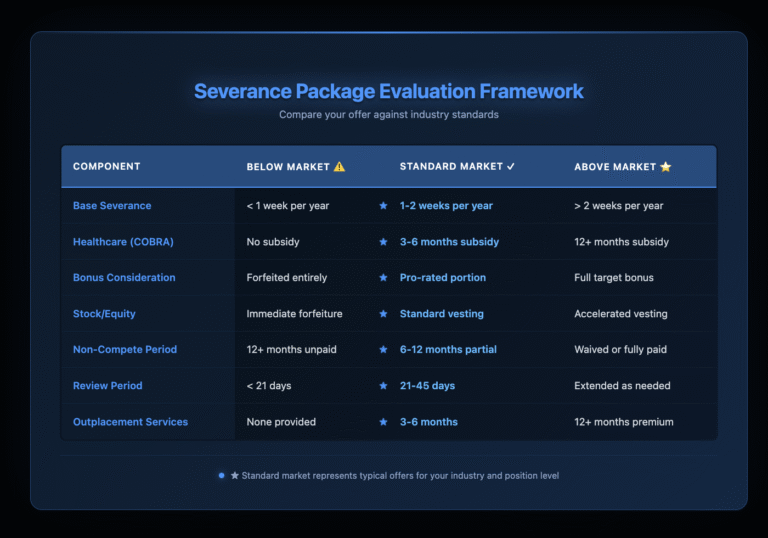

- Initial severance offers typically include 10-30% less than what employers are willing to pay—always evaluate before accepting.

- You have at least 21 days to review (45 days for group terminations) under federal law, with 7 days to revoke after signing.

- Compare your offer against the industry standard of 1-2 weeks of pay per year of service as a baseline.

- Healthcare continuation, bonus payments, and stock vesting are often negotiable, even when base severance seems fixed.

- Legal claims or discrimination concerns can significantly increase your leverage and package value.

- Document everything about your termination circumstances before signing—this evidence disappears once you accept.

- New York employees have additional protections that may enhance severance eligibility.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Makes a Severance Offer Fair or Unfair?

A fair severance offer compensates you appropriately for your tenure, position level, and the rights you’re surrendering. Start by calculating whether the base severance meets industry minimums—typically one to two weeks of salary per year of service. If you’ve worked somewhere for eight years, earning $100,000 annually, a fair starting point would be 8-16 weeks of severance pay, or roughly $15,000-$31,000.

But fairness extends beyond just the cash component. Consider whether the package accounts for unvested bonuses you’re losing, commissions in the pipeline, or stock options about to vest. A truly fair offer addresses these earned but unpaid elements rather than cutting them off at termination.

The circumstances of your departure also affect fairness. If you’re being terminated without cause during a profitable quarter or right before a major vesting date, the company should offer more generous terms. Similarly, if you’re being asked to train your replacement or assist with transition, additional compensation is appropriate.

How Do You Calculate Your Severance Baseline?

Calculating your severance baseline starts with documenting your complete compensation picture. Add up your base salary, average bonus over the past three years, and the value of benefits like health insurance premiums. This total compensation number, not just base salary, should form the foundation of your evaluation.

Next, research industry standards for your role and location. In New York City, professionals often receive more generous packages than national averages suggest—sometimes 2-3 weeks per year of service for senior positions. Technology and financial services companies typically offer higher multiples, while non-profits and smaller companies may offer less but provide longer benefits continuation.

Factor in your unique circumstances that might justify above-baseline severance. Long tenure, specialized knowledge, client relationships you’re leaving behind, or agreements with non-compete clauses all warrant additional compensation. If you’re over 40, companies may offer enhanced packages to avoid age discrimination claims, though they’ll require specific ADEA waivers.

What Red Flags Should You Watch For?

Several red flags in severance agreements can signal an unfair offer or problematic terms requiring attention. Watch for unusually broad release language that waives rights you cannot legally waive, like future workers’ compensation claims or rights to vested retirement benefits. These overreaching provisions suggest the employer is trying to take more than they’re entitled to.

Immediate signature demands represent another major warning sign. Any pressure to sign “today” or within 48 hours violates federal requirements for employees over 40 and suggests the employer doesn’t want you consulting an attorney. Legitimate employers understand you need time to review and will respect statutory review periods.

Non-mutual provisions should raise concerns, too. If you’re subject to non-disparagement but the company isn’t, or if you must maintain confidentiality while they don’t, the agreement is unbalanced. These one-sided terms often indicate room for negotiation and suggest the initial offer was intentionally skewed in the employer’s favor.

How Do Timeline Requirements Affect Your Evaluation?

Federal and state laws provide specific timeline protections that shape your evaluation process. Under the Older Workers Benefit Protection Act (OWBPA), employees over 40 must receive at least 21 days to consider an individual severance offer, or 45 days for group terminations. You also have 7 days after signing to revoke your acceptance—use this time wisely.

These timelines aren’t just procedural formalities; they’re opportunities to thoroughly evaluate your offer. During the consideration period, you can request additional information about the termination decision, comparable severance packages offered to others, and clarification on ambiguous terms. Companies cannot withdraw offers simply because you use your full review period.

New York State law may provide additional timeline protections depending on your employer’s size and the circumstances of your termination. The state’s WARN Act requires 90 days’ notice for certain mass layoffs, and failure to provide proper notice can result in additional compensation. Understanding these overlapping timeline requirements helps you maximize both your review period and potential compensation.

What Documentation Should You Gather Before Deciding?

Before evaluating any severance offer, compile comprehensive documentation about your employment and termination. Start with your employment contract, offer letter, and any subsequent amendments or promotion letters. These documents establish your baseline compensation and may include provisions about severance that the employer must honor.

Gather all performance reviews, especially recent positive evaluations that contradict any performance-based termination rationale. Save emails praising your work, documenting achievements, or showing you were meeting or exceeding expectations. If your termination seems suspicious—occurring after you complained about discrimination or requested medical leave—preserve all related correspondence.

Document your complete compensation, including salary history, bonus payments, commission structures, and benefits enrollment. Create a timeline of significant events: promotions, raises, any complaints you made, and the circumstances leading to termination. This documentation becomes crucial if you need to negotiate improvements or evaluate whether you have legal claims that increase your leverage.

How Do Benefits Continuation Impact Overall Value?

Benefits continuation often represents 20-30% of a severance package’s total value, yet many employees focus solely on the cash component. Calculate the true monthly cost of COBRA coverage (often $2,000+ for family coverage in New York) and determine whether your offer includes employer COBRA subsidies. Six months of employer-paid COBRA can be worth $12,000 or more.

Evaluate how the severance agreement handles other benefits like life insurance, disability coverage, and retirement contributions. Some employers continue these benefits during the severance period, while others terminate them immediately. The difference can be substantial, particularly if you have pre-existing conditions that make individual insurance expensive or unavailable.

Consider negotiating for extended benefits even if the cash severance seems non-negotiable. Employers often find it easier to extend benefits than increase lump sum payments, and the value to you may exceed the cost to them. This is particularly important if you’re between jobs during health challenges or have family members requiring ongoing medical care.

What About Stock Options and Deferred Compensation?

Equity compensation requires careful evaluation as severance agreements often accelerate forfeiture of unvested options or restricted stock. Review your equity agreements to understand default forfeiture provisions, then evaluate whether the severance offer modifies these terms. Even a three-month extension of your exercise period for vested options can provide significant value.

For unvested equity, calculate what you’re forfeiting and when it would have vested. If you’re losing options that would vest within 90 days, pushing for accelerated vesting or extended exercise periods becomes a priority. Companies may be more willing to provide equity extensions than cash increases, especially if they’re pre-IPO or experiencing cash constraints.

Deferred compensation plans add another layer of complexity. Understand whether your severance affects qualified or non-qualified deferred compensation, 401(k) vesting, or pension calculations. In New York, certain deferred compensation may be protected from forfeiture even if you’re terminated, but only if you understand and assert these rights during negotiations.

How Do Legal Claims Affect Severance Value?

The presence of potential legal claims fundamentally changes severance evaluation dynamics. If you’ve experienced discrimination, retaliation, or wrongful termination, your severance package transforms from a simple separation payment into potential settlement compensation. Companies often pay substantially more to resolve legal risks than they offer in standard severance.

Evaluate whether you have evidence of illegal treatment: discriminatory comments, suspicious timing after protected activity, or disparate treatment compared to younger, male, or non-minority colleagues. Document these issues thoroughly before signing anything, as severance agreements typically include broad releases that eliminate your ability to pursue these claims.

Consider the strength of potential claims realistically. Age discrimination claims for employees over 40, pregnancy discrimination, or retaliation after whistleblowing often command premium settlements. Even if you don’t intend to sue, understanding your leverage helps evaluate whether the offered severance adequately compensates you for waiving valuable legal rights.

When Should You Seek Legal Counsel?

Consulting an employment attorney makes sense whenever severance exceeds two months’ pay, includes complex provisions, or when you suspect discrimination. The cost of a consultation—typically $500-1,000 in New York—often pays for itself through improved terms or identification of issues you might miss. Attorneys can quickly spot unfair provisions and understand market rates for your situation.

Definitely seek counsel if you’re being asked to sign non-standard agreements like non-competes, lengthy non-solicitation provisions, or if the release language seems unusually broad. An attorney can explain what you’re actually giving up and whether the compensation is appropriate for these restrictions. They can also identify potentially unenforceable provisions that give you negotiation leverage.

Legal review becomes essential if you believe you have discrimination or retaliation claims. An attorney can evaluate claim strength, calculate potential damages, and determine whether the severance offer appropriately values your legal rights. They can also negotiate on your behalf while maintaining your professional relationship with the employer.

What Are Your Next Steps?

After thoroughly evaluating your severance offer, create a strategic response plan. If the offer is below market or missing key components, prepare a professional counter-proposal highlighting specific improvements needed. Focus on business rationale rather than personal hardship—explain how your contributions, institutional knowledge, or transition assistance justify enhanced terms.

Document your evaluation findings and prioritize your negotiation requests. Identify “must-haves” versus “nice-to-haves” and understand your walk-away point. Remember that negotiation is expected—employers rarely present their best offer first, and professional negotiation won’t jeopardize the base offer.

If your evaluation reveals potential legal issues or if you’re unsure about the offer’s fairness, now is the time to act. Contact Nisar Law Group for a comprehensive severance review. Our employment attorneys understand New York employment law and can help you secure the best possible terms while protecting your legal rights. Don’t accept less than you deserve.

Frequently Asked Questions About Severance Evaluation

No, negotiating severance is not risky when done professionally—in fact, employers expect it and rarely withdraw offers simply because you negotiate. The real risk lies in accepting an inadequate offer without attempting to improve it. Companies build negotiation room into initial offers, knowing informed employees will request improvements. As long as you maintain professionalism and avoid ultimatums, negotiation demonstrates you understand your value. The worst outcome is typically the employer saying no to specific requests while keeping the original offer intact. Document all negotiations in writing to protect yourself.

The “Rule of 70” suggests that if your age plus years of service equals 70 or more, you may qualify for enhanced severance benefits. For example, a 50-year-old with 20 years of service (50+20=70) might receive more generous terms than standard packages. While not a legal requirement, many companies use this formula to avoid age discrimination claims and recognize long-term employees. However, don’t assume this rule applies automatically—it varies by company and industry. Always verify whether your employer uses this calculation and negotiate for enhanced benefits if you meet the threshold.

Watch for these critical warning signs: immediate signature demands (violates your legal review rights), waivers of non-waivable rights like workers’ compensation or vested retirement benefits, one-sided non-disparagement clauses that only restrict you, unusually broad release language covering unknown future claims, missing revocation period language for employees over 40, below-market compensation (less than one week per year of service), no COBRA subsidy or benefits continuation, and overly restrictive non-compete clauses without additional compensation. Any of these red flags suggests the offer needs improvement and warrants legal review before signing.

A realistic severance package typically includes 1-2 weeks of pay per year of service, 3-6 months of COBRA premium subsidies, pro-rated bonus payments for the current year, outplacement services for 3-6 months, and mutual non-disparagement agreements. Senior employees or those with specialized skills often receive 2-3 weeks per year, while executives may get months or even years of compensation. In New York, packages tend to be more generous than national averages. Your specific circumstances—including potential legal claims, company size, industry standards, and economic conditions—all affect what’s realistic for your situation.

Professional severance negotiation rarely backfires—companies don’t rescind offers simply because you ask for improvements. The key is maintaining a business-focused approach rather than making emotional appeals or threats. Avoid ultimatums, unrealistic demands, or aggressive tactics that could damage relationships. Instead, present logical arguments based on your contributions, market standards, and the value of rights you’re waiving. The most common “backfire” is simply receiving “no” to certain requests, not losing the entire offer. If an employer withdraws an offer merely for negotiating, consider it a red flag about their practices.

Nearly every component of a severance package is negotiable: base severance amount, payment structure (lump sum vs. salary continuation), healthcare coverage duration and employer COBRA contributions, bonus and commission payments, stock option vesting and exercise periods, non-compete scope and duration, non-disparagement terms (push for mutual agreements), reference letters and statements, outplacement service length and quality, equipment retention (laptop, phone), professional development funds, and even title retention for resume purposes. Focus your negotiation on items most valuable to your situation—sometimes non-cash benefits like extended healthcare are easier to obtain than increased severance pay.

Unused PTO payout depends on your state’s law and company policy. In New York, employers must pay accrued vacation time upon termination if their written policy or established practice provides for it—review your employee handbook carefully. Many states treat earned PTO as wages that must be paid regardless of termination circumstances. However, “use-it-or-lose-it” policies may be enforceable if clearly communicated. Don’t assume PTO is automatically included in your severance; specifically request payout of all accrued vacation, sick time, and personal days. This payment should be separate from and in addition to your severance amount, not counted as part of it.

Employees with 10+ years of service typically receive enhanced severance packages recognizing their loyalty and institutional knowledge. Standard packages range from 10-20 weeks of pay (using the 1-2 weeks per year formula), but long-tenured employees often negotiate for more. Many companies offer additional considerations: extended healthcare coverage (6-12 months), full vesting of retirement contributions, accelerated stock option vesting, and substantial outplacement services. Your position level, industry, and location significantly impact these amounts. In New York, 10-year employees in professional roles often receive 3-6 months of full compensation. Always negotiate based on your specific contributions and circumstances rather than accepting standard formulas.