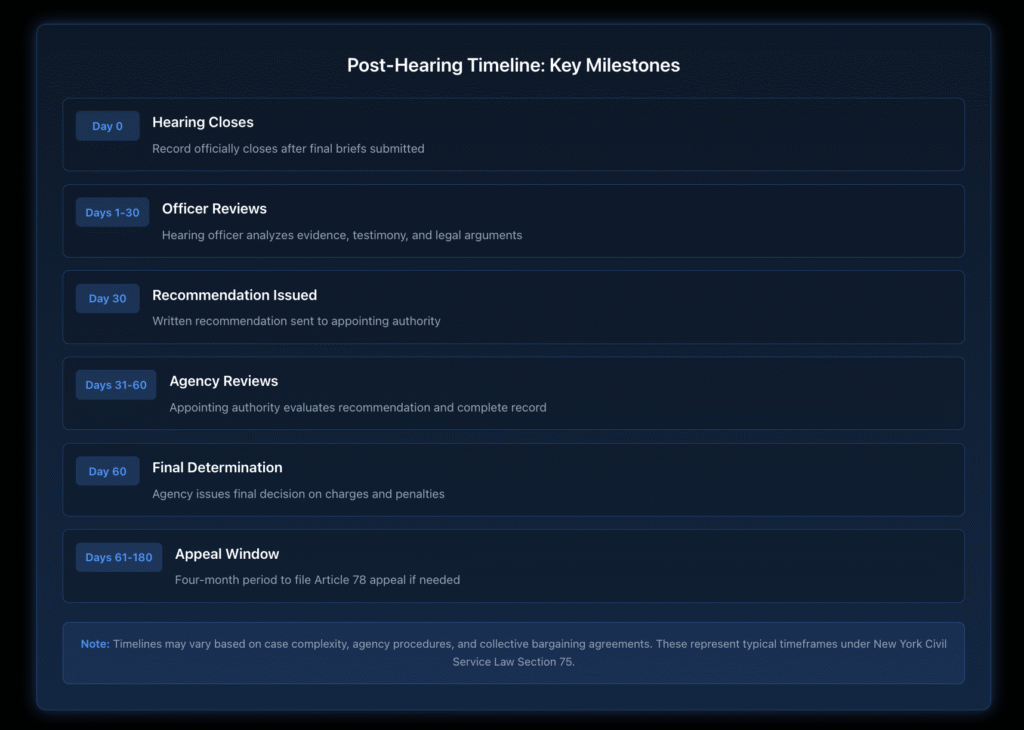

After your Section 75 hearing concludes, the process enters a critical phase where your case is decided. The hearing officer reviews all evidence and testimony, prepares a written recommendation, and submits it to your agency for a final determination. This post-hearing period typically lasts 30-60 days and involves multiple procedural steps that can significantly impact your career and livelihood. Understanding what happens next, the timelines involved, and your rights during this phase helps you navigate the process effectively and protects your interests as a New York civil service employee.

Key Takeaways

- Hearing officers must issue written recommendations within specific timeframes, typically 30 days after the hearing closes.

- Agency appointing authorities make final disciplinary determinations, which may differ from hearing officer recommendations.

- You have the right to receive copies of both the hearing officer’s recommendation and the agency’s final determination.

- Final agency decisions can be appealed through Article 78 proceedings in the New York State Supreme Court.

- The burden remains on the agency to prove the charges by substantial evidence throughout the post-hearing phase.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Does the Hearing Officer Do After the Hearing?

Once your Section 75 hearing concludes, the hearing officer begins the critical task of reviewing the complete record. This includes all testimony, documentary evidence, exhibits, and legal arguments presented by both sides. The officer analyzes whether the agency met its burden of proving the charges by substantial evidence.

The hearing officer evaluates witness credibility, considers conflicting testimony, and weighs the evidence according to established legal standards. Unlike courtroom trials, where judges often issue immediate rulings, Section 75 hearing officers take time to thoroughly review complex employment records, testimony transcripts, and legal precedents before making recommendations.

During this review period, the officer may request clarification on specific evidence or legal citations, though new evidence generally cannot be submitted after the hearing closes. The goal is to produce a comprehensive, legally sound recommendation that addresses each charge and specification individually.

How Long Do Hearing Officers Have to Issue Recommendations?

New York Civil Service Law § 75 establishes specific timeframes for hearing officer recommendations, though these periods can vary based on case complexity and hearing length. Generally, hearing officers must issue written recommendations within 30 days after the hearing record closes.

The “record closing” date is typically when the last brief is submitted, not necessarily when testimony concludes. If post-hearing briefs are allowed, parties usually have 15-30 days to submit written arguments after testimony ends. The hearing officer’s 30-day clock then starts from the brief submission deadline.

For particularly complex cases involving multiple charges, numerous witnesses, or extensive documentary evidence, hearing officers may request extensions. These extensions should be documented and communicated to both parties. However, unreasonable delays can become grounds for appeal if they prejudice your case or violate due process.

Some agencies have internal policies establishing shorter timeframes for recommendations. These internal deadlines don’t override statutory requirements but may provide additional protections. Your agency’s personnel manual or collective bargaining agreement might specify these enhanced procedural safeguards.

What Does a Hearing Officer’s Recommendation Include?

A proper hearing officer recommendation contains several essential components that form the foundation for the final agency decision. The document begins with a summary of the charges and specifications, outlining what the agency alleged you did wrong and what penalties they proposed.

The recommendation includes detailed findings of fact based on the evidence presented during the hearing. The hearing officer identifies which evidence was credible, which testimony was persuasive, and how conflicting evidence was resolved. These factual findings explain the reasoning behind the officer’s conclusions.

Next comes the application of law to facts. The hearing officer analyzes whether the proven facts constitute misconduct under applicable civil service law, agency regulations, or collective bargaining agreements. This legal analysis explains why certain conduct does or doesn’t support disciplinary charges.

The recommendation addresses each charge separately, determining whether the agency proved that specific allegation by substantial evidence. The hearing officer may find some charges proven while dismissing others, depending on the evidence presented.

Finally, if any charges are sustained, the recommendation includes a proposed penalty. The hearing officer considers factors like the severity of misconduct, your prior disciplinary record, length of service, and mitigating circumstances when recommending appropriate discipline. This penalty recommendation may align with or differ from what the agency originally proposed.

Who Makes the Final Decision After the Hearing?

The hearing officer’s recommendation is advisory, not binding. Under Section 75, the final determination rests with your agency’s appointing authority—typically the agency head, commissioner, or their designee. This represents a critical distinction between Section 75 proceedings and court cases where judges make final rulings.

The appointing authority reviews the hearing officer’s recommendation, the complete hearing record, and all evidence before making a final determination. While agencies must give substantial weight to hearing officer findings and recommendations, they retain ultimate decision-making authority over disciplinary matters.

This structure recognizes agencies’ legitimate interest in maintaining workplace discipline while providing employees with neutral hearing procedures. The appointing authority brings institutional knowledge about agency operations, workplace norms, and the broader context of the alleged misconduct.

Can the Agency Reject a Hearing Officer’s Recommendation?

Yes, appointing authorities can reject or modify hearing officer recommendations, but doing so requires careful legal justification. When an agency disagrees with its hearing officer’s findings or recommended penalty, it must provide a reasoned explanation supported by the record.

Courts reviewing agency decisions scrutinize situations where appointing authorities reject hearing officer recommendations, particularly when the hearing officer found charges unproven. If a hearing officer determines the agency failed to prove misconduct by substantial evidence, an appointing authority faces a heavy burden to justify imposing discipline anyway.

More commonly, agencies modify recommended penalties rather than completely rejecting findings. An appointing authority might accept the hearing officer’s factual findings but increase or decrease the proposed penalty based on agency needs, prior similar cases, or other legitimate factors not fully considered during the hearing.

When agencies deviate from hearing officer recommendations, they must document their reasoning. This documentation becomes important if you appeal the final determination—courts examine whether the agency’s divergence from the recommendation was arbitrary, capricious, or unsupported by substantial evidence.

How Long Does the Agency Have to Make a Final Decision?

Unlike the hearing officer recommendation timeframe, the New York Civil Service Law doesn’t establish a specific deadline for appointing authorities to issue final determinations. However, unreasonable delays may violate due process and create grounds for legal challenges.

Most agencies issue final determinations within 30-60 days after receiving the hearing officer’s recommendation. This timeframe allows for a thorough review while avoiding prejudicial delays. Some agencies establish internal policies specifying determination deadlines, which provide additional procedural protections.

During particularly busy periods or with complex cases, determination timelines may extend longer. However, delays exceeding several months without explanation raise serious concerns about procedural fairness and can prejudice your ability to secure new employment or plan your future.

If your case involves suspension without pay pending the hearing outcome, unreasonable delays in reaching final determinations compound the financial hardship. Extended periods without income while awaiting decisions may support claims for back pay if you ultimately prevail.

You can request status updates if the determination process extends beyond reasonable timeframes. Documenting these delays becomes important if you later need to demonstrate prejudice in an appeal.

What Rights Do You Have During the Post-Hearing Period?

Throughout the post-hearing phase, you maintain important procedural rights that protect your interests and ensure fairness. You’re entitled to receive a complete copy of the hearing officer’s recommendation once it’s issued. Some agencies provide this automatically, while others require formal requests.

You have the right to review the complete hearing record, including all exhibits, testimony transcripts, and submitted briefs. This access allows you to identify any errors or omissions that might affect the final determination or support an appeal.

You can submit written responses to the hearing officer’s recommendation before the appointing authority makes a final decision. While not always required, many agencies accept these post-recommendation submissions as part of their review process. These responses let you address any concerns about the recommendation or present additional context.

Your right to legal representation continues through the post-hearing period. Your attorney can monitor the process, submit responses, communicate with agency officials regarding delays, and prepare appeal documents if necessary.

You’re entitled to timely notification of the final agency determination. This notice must include the agency’s decision on each charge, the imposed penalty, if any, and information about your appeal rights. The determination should explain the reasoning behind the decision, particularly if it diverges from the hearing officer’s recommendation.

Can You Submit Additional Evidence After the Hearing?

Generally, the hearing record closes when testimony and evidence submission conclude. The hearing officer and agency must base their decisions on evidence presented during the hearing, not new materials submitted afterward.

However, limited exceptions exist for newly discovered evidence that couldn’t have been obtained through reasonable diligence before the hearing closed. This might include evidence that only became available after testimony concluded or information you didn’t know existed despite reasonable efforts to locate it.

If you discover significant new evidence after your hearing, you should immediately notify the hearing officer and opposing counsel. The officer must determine whether the evidence is truly “newly discovered” or could have been presented earlier with proper diligence.

Requests to reopen the record face strict scrutiny. You must demonstrate that the evidence is material to your case outcome, wasn’t available despite reasonable efforts before the hearing closed, and isn’t merely cumulative of evidence already presented.

Courts generally uphold hearing officers’ decisions to exclude evidence offered after record closure, recognizing the need for finality in administrative proceedings. Strategic considerations favor presenting the strongest possible case during the hearing rather than hoping to supplement it afterward.

What Penalties Can the Agency Impose?

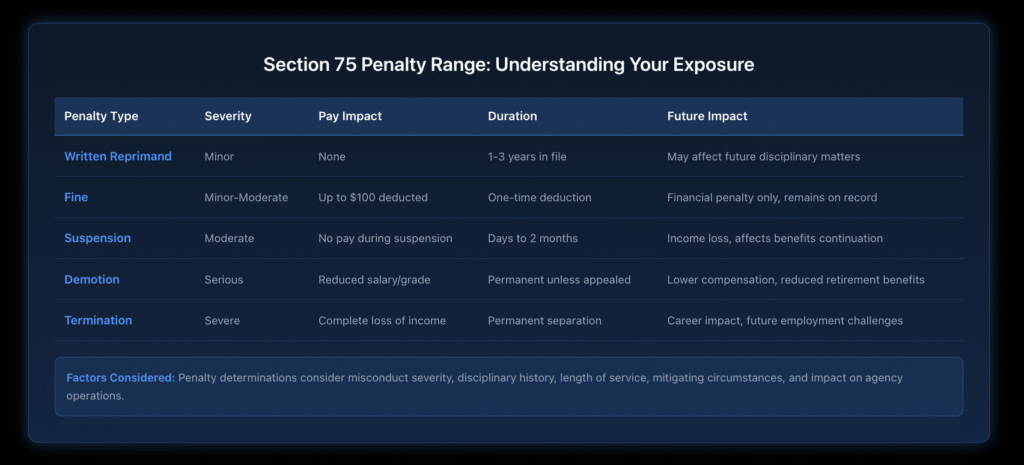

Section 75 allows agencies to impose various penalties ranging from minor reprimands to termination, depending on the severity of proven misconduct and relevant circumstances. Understanding the penalty range helps you evaluate outcomes and make informed decisions about potential appeals.

Minor penalties include written reprimands or formal warnings placed in your personnel file. While these don’t affect your pay or employment status immediately, they create a disciplinary record that can impact future matters. Reprimands typically remain in files for 1-3 years unless the collective bargaining agreement specifies different timeframes.

Suspensions without pay represent more serious discipline. These can range from several days to several months, depending on the offense severity. Extended suspensions significantly impact your income and may affect benefits continuation. During suspension periods, you generally cannot perform any work duties or access agency facilities.

Fines represent monetary penalties deducted from your salary over specified periods. While less common than suspensions, fines allow agencies to impose financial consequences without removing you from your position. However, fines must be reasonable and proportionate to the proven misconduct.

Demotion involves reducing your rank, grade, or salary level. This penalty affects not just current compensation but also future earning potential and retirement benefits. Demotions are typically reserved for serious misconduct that doesn’t warrant termination but requires significant consequences.

Termination represents the most severe penalty—complete separation from civil service employment. When agencies terminate employees under Section 75, it’s “for cause” rather than a layoff, which can significantly impact future employment prospects. Termination decisions receive heightened scrutiny on appeal, given their severe consequences.

What Factors Influence Penalty Determinations?

Hearing officers and appointing authorities consider multiple factors when determining appropriate discipline. The nature and severity of the proven misconduct stand as the primary consideration. Conduct endangering public safety, violating public trust, or involving criminal behavior typically warrants more serious penalties.

Your disciplinary history plays a significant role. First-time offenders generally receive more lenient treatment than employees with prior violations. However, progressive discipline principles require that penalties escalate for repeated similar misconduct. A clean record over many years of service serves as a strong mitigating factor.

Length of service with the agency affects penalty determinations. Long-tenured employees with previously good records often receive more consideration than newer employees. Years of satisfactory service demonstrate value to the agency and suggest the misconduct may be an aberration rather than a pattern.

The impact of misconduct on agency operations matters. Conduct disrupting essential services, damaging the agency’s reputation, or creating liability risks justifies more serious discipline. Conversely, minor infractions with minimal operational impact may warrant lesser penalties.

Mitigating circumstances deserve consideration in penalty decisions. Personal crises, medical conditions, or extraordinary stressors don’t excuse misconduct but may explain it and support more lenient treatment. Evidence of remorse, acceptance of responsibility, or steps taken to address underlying issues can also influence penalties.

How Do You Appeal an Unfavorable Determination?

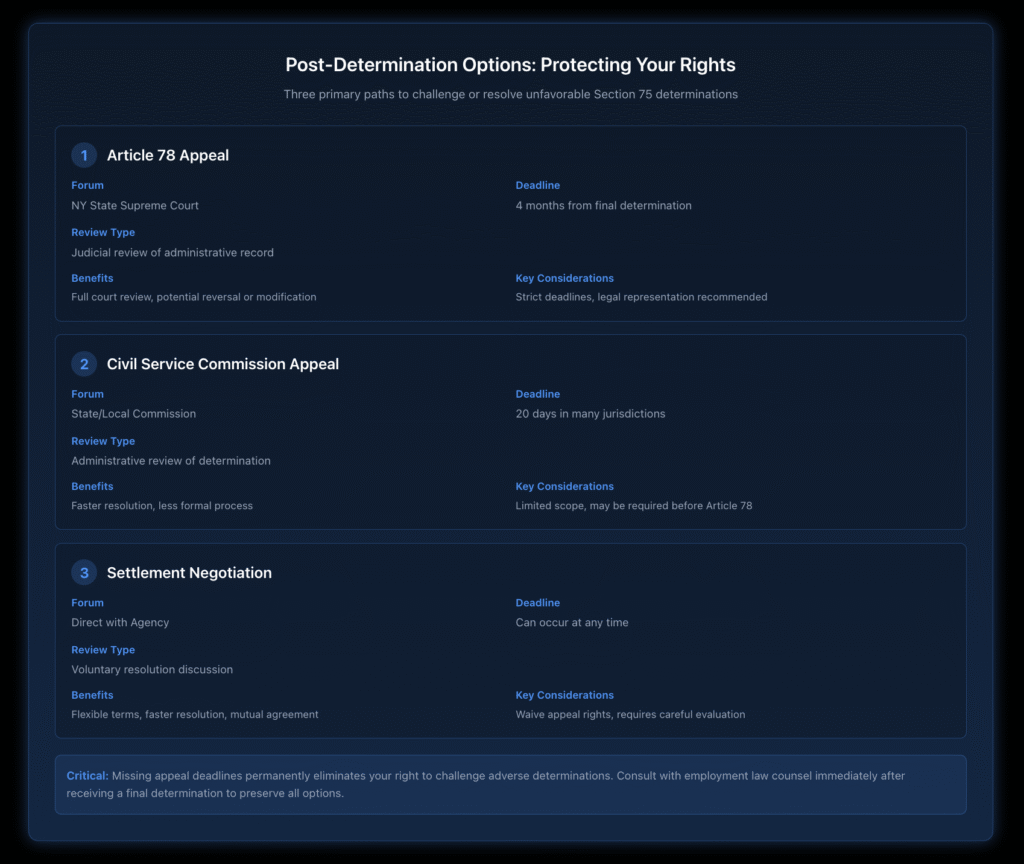

If the final agency determination sustains charges and imposes discipline you believe is unjustified or excessive, you have the right to appeal through Article 78 proceedings in the New York State Supreme Court. This provides judicial review of the agency’s decision and hearing process.

Article 78 appeals must be filed within four months of the final determination becoming final. This strict deadline requires careful attention—missing it generally means losing your appeal rights. The four-month period typically begins when you receive official notice of the final determination, not when the hearing officer issues their recommendation.

Article 78 proceedings don’t involve new testimony or evidence presentation. Instead, courts review the existing administrative record to determine whether the agency’s decision was affected by errors of law, was arbitrary and capricious, or lacked substantial evidence to support. Courts give agencies significant deference but will overturn decisions lacking a proper legal foundation.

Successful appeals may result in annulment of the determination, modification of the penalty, or remand for additional proceedings. Courts can direct agencies to reconsider decisions, conduct new hearings, or reinstate employees with back pay and damages. However, courts cannot simply substitute their judgment for the agency’s on factual matters where reasonable minds could differ.

The appeals process requires navigating complex procedural requirements, including proper notice to all parties, preparation of detailed records, and compliance with specific filing requirements. Working with experienced legal counsel significantly improves your chances of successful appeals.

What Grounds Exist for Appealing Section 75 Determinations?

Several legal grounds support Article 78 appeals of Section 75 determinations. Lack of substantial evidence represents the most common basis—arguing the agency failed to prove charges by credible evidence that a reasonable person would accept as adequate support.

Procedural errors during the hearing process can warrant reversal. This includes violations of due process, improper exclusion of relevant evidence, bias by the hearing officer, or failure to follow required procedural safeguards. However, not every procedural irregularity justifies reversal—the error must have prejudiced your case outcome.

Arbitrary and capricious decision-making provides grounds for appeal. This applies when penalties are grossly disproportionate to proven misconduct, the agency ignored relevant mitigating factors, or the determination lacked a rational basis. Courts examine whether the decision could be supported by any reasonable interpretation of the evidence.

Errors of law support appeals when agencies misapply statutes, regulations, or collective bargaining agreement provisions. This includes imposing discipline for conduct not actually prohibited, applying incorrect legal standards, or violating your contractual rights.

Violations of the hearing officer’s recommendation require explanation. While agencies can reject recommendations, doing so without adequate justification based on the record may be arbitrary. Courts scrutinize these situations to ensure agencies don’t circumvent the hearing process.

What Happens to Your Employment During Appeals?

Your employment status during the appeal process depends on the penalty imposed and whether you seek a stay of the determination. If the agency imposed termination, you would typically be separated from employment unless you obtain a court-ordered stay preventing implementation of the penalty during appeal proceedings.

For penalties less severe than termination—suspensions, demotions, or fines—implementation usually proceeds during appeals. However, if you successfully appeal, you’re entitled to be “made whole” through remedies like back pay for improper suspensions or restoration of prior rank and salary after improper demotions.

Seeking a stay of the determination requires filing a motion with the court hearing your Article 78 petition. Courts consider factors including the likelihood of success on appeal merits, irreparable harm if the penalty is implemented, the balance of hardships between parties, and public interest considerations.

Obtaining stays of termination decisions is particularly challenging. Courts recognize agencies’ legitimate interests in removing employees found to have committed serious misconduct. You must demonstrate a strong likelihood of appellate success and significant irreparable harm to secure stays of terminations.

Even when terminations proceed during appeals, successful challenges result in reinstatement with back pay and restoration of benefits. The delay during the appeal process doesn’t eliminate your right to make-whole remedies if you ultimately prevail.

How Long Do Article 78 Appeals Take?

Article 78 proceedings typically take 6-18 months from filing to resolution, though complex cases may take longer. Initial motion practice and responses usually occur within the first 2-4 months after filing. Courts then review the administrative record and legal arguments before issuing decisions.

The timeline depends partly on whether the agency moves to dismiss your petition before reaching the merits. These preliminary motions can add several months to the process. If your petition survives dismissal motions, the court proceeds to review the administrative record and parties’ substantive arguments.

Some courts hear oral argument before deciding Article 78 petitions, while others decide based solely on written submissions. Oral argument adds time but provides valuable opportunities to address judicial concerns directly and clarify complex legal issues.

If you prevail in the trial court, the agency may appeal to the Appellate Division, extending the process another 12-18 months. Further appeals to the Court of Appeals are possible but less common, typically involving novel legal questions affecting numerous employees.

Throughout the appeal process, maintaining detailed records of lost wages, benefits, and other damages helps ensure proper calculation of remedies if you ultimately succeed. This documentation becomes crucial for securing appropriate make-whole relief after lengthy legal battles.

Can You Negotiate Settlements After Determinations?

Even after hearing officer recommendations or final agency determinations, settlement negotiations remain possible and often advantageous for both parties. Settlement discussions can occur at any point during the post-hearing period, even after filing appeals.

Settlements allow you to negotiate terms that might not be available through the formal process. These could include resignation in lieu of termination, reduced penalties, neutral references, extended health coverage, or favorable separation payment arrangements. Settlements eliminate appeal uncertainty and provide faster resolution than litigation.

Agencies have practical reasons to settle post-hearing. Lengthy appeals are expensive, time-consuming, and create organizational uncertainty. Settlements allow agencies to achieve workforce management goals while avoiding continued legal costs and potential reversals on appeal.

However, settlement negotiations require careful evaluation. Once you sign a settlement agreement, you typically waive appeal rights and any claims related to the disciplinary matter. Understanding what you’re giving up and ensuring the settlement terms adequately protect your interests is essential before agreeing to resolve your case.

Settlement agreements should address several key issues, including your employment status, any monetary payments, reference information the agency will provide, treatment of your personnel file, healthcare continuation, and confidentiality provisions. Having experienced legal counsel review proposed settlements protects your interests and ensures you don’t inadvertently waive valuable rights.

What Leverage Do You Have in Post-Determination Settlements?

Your settlement leverage depends on several factors, including the strength of potential appeal grounds, the penalty imposed, and practical considerations affecting both parties. Strong evidence that the agency lacked substantial proof or violated procedural requirements significantly enhances your negotiating position.

When penalties appear grossly disproportionate to proven misconduct or hearing officers recommended dismissal of charges but agencies imposed discipline anyway, you possess increased leverage. Courts scrutinize these situations carefully, making agencies more receptive to reasonable settlement terms.

Your employment history and length of service create leverage. Long-tenured employees with clean prior records who face termination for relatively minor first offenses present strong equitable arguments that can influence settlement discussions.

The agency’s litigation risk and cost considerations factor into settlement calculations. Complex cases with uncertain appellate outcomes, potential for prolonged litigation, and significant attorney fee exposure make settlements attractive to agencies seeking to avoid continued legal costs.

Your willingness to move forward also affects leverage. If you’re primarily concerned about financial recovery and employment references rather than reinstatement, this flexibility creates settlement opportunities. Agencies often prefer negotiated departures to lengthy battles over reinstatement.

What Records Should You Maintain?

Throughout the post-hearing period and any subsequent appeals, maintaining comprehensive records protects your interests and supports potential remedies. Keep copies of all documents related to your hearing, including the hearing officer’s recommendation, the agency’s final determination, and any correspondence regarding the proceedings.

Document all communications with the agency during this period. Save emails, letters, and notes from phone conversations regarding the determination, implementation of penalties, or settlement discussions. These communications may become relevant if disputes arise about what was said or agreed upon.

Track your financial losses resulting from imposed penalties. For suspensions, document lost wages, including regular pay, overtime, shift differentials, and any other compensation you would have received. For demotions, calculate the difference between your former and new salary rates, including the impact on benefits and pension contributions.

Maintain records of your job search efforts if you face termination. Document applications submitted, interviews conducted, and employment offers received or rejected. This information becomes crucial for calculating front pay damages and demonstrating mitigation efforts if you appeal successfully.

Preserve evidence of emotional or health impacts from the disciplinary process. Medical records, counseling documentation, and personal journals describing the situation’s effects on your well-being can support claims for emotional distress damages in certain circumstances.

These comprehensive records serve multiple purposes—supporting appeals, calculating remedies, negotiating settlements, and demonstrating the full impact of improper discipline on your career and life.

What Should You Do If the Process Seems Unfair?

If you believe the post-hearing process involves procedural irregularities, bias, or other fairness concerns, document these issues immediately. Note specific instances of concern, including dates, individuals involved, and the nature of the problem. This documentation becomes crucial for potential appeals.

Bring concerns to the attention of appropriate individuals, starting with the hearing officer, if issues arise during their review period. For concerns about the agency’s final determination process, notify the appointing authority’s office in writing. Creating written records of your complaints protects your appeal rights.

Consider whether the irregularities rise to the level of due process violations. Not every disagreement with procedures or outcomes constitutes a legal violation, but serious fairness concerns—like bias, denial of procedural rights, or improper consideration of factors outside the record—can support appeals.

Consult with experienced employment law attorneys to evaluate whether observed irregularities provide valid appeal grounds. Attorneys familiar with Section 75 proceedings can assess whether specific concerns justify legal challenges or represent normal variations in administrative processes.

Continue following all procedural requirements even while raising concerns. Don’t miss deadlines or fail to respond to agency communications because you believe the process is unfair. Maintaining compliance with procedural obligations preserves your rights while you address fairness concerns through proper channels.

What Additional Protections Exist for New York Employees?

Beyond Section 75 protections, New York civil service employees have access to multiple legal remedies if they believe they’ve experienced discrimination or retaliation. The New York State Division of Human Rights enforces the state Human Rights Law, which prohibits employment discrimination based on protected characteristics.

You can file complaints with the U.S. Equal Employment Opportunity Commission if you believe federal anti-discrimination laws were violated. The EEOC investigates charges of discrimination based on race, color, religion, sex, national origin, age, disability, or genetic information.

New York City employees have additional protections under the NYC Human Rights Law, which provides broader protections than federal or state law. The NYC Commission on Human Rights handles complaints of discrimination, harassment, and retaliation in employment.

The New York State Civil Service Commission also provides oversight for civil service matters and can review certain disciplinary decisions. For state employees, the New York City Civil Service Commission serves a similar function at the local level.

These administrative remedies can proceed simultaneously with or after Section 75 proceedings, depending on the circumstances and timing of your claims. Working with employment law counsel helps you navigate multiple potential remedies and determine the best strategy for protecting your rights.

Protect Your Career After Section 75 Hearings

The post-hearing phase of Section 75 proceedings represents a critical period where your career and livelihood hang in the balance. Understanding the process, timeline, and your rights during this phase helps you make informed decisions and take appropriate action to protect your interests.

Whether you’re awaiting a hearing officer’s recommendation, evaluating a final agency determination, or considering an appeal, having experienced legal counsel significantly improves your outcomes. The attorneys at Nisar Law Group have extensive experience representing New York civil service employees throughout Section 75 proceedings, including post-hearing matters and appeals.

Don’t navigate this complex process alone. Contact Nisar Law Group today for a consultation about your Section 75 case and learn how we can help protect your civil service career and secure the best possible outcome in your disciplinary matter.

Frequently Asked Questions About Post-Hearing Procedures

After the final Section 75 hearing concludes, the hearing officer reviews all evidence and testimony to prepare a written recommendation. This recommendation addresses each charge individually, determines whether the agency proved misconduct by substantial evidence, and proposes appropriate penalties if charges are sustained. The hearing officer typically issues this recommendation within 30 days after the hearing record closes. Once the recommendation is complete, it goes to the agency’s appointing authority, who makes the final determination on whether to impose discipline and what penalties to implement.

Section 75 penalties range from minor written reprimands to termination, depending on the severity of proven misconduct. Common penalties include written warnings, suspensions without pay (ranging from days to months), monetary fines deducted from salary, demotions in rank or grade, and termination from civil service employment. The specific penalty depends on factors including the nature of the misconduct, your disciplinary history, length of service, mitigating circumstances, and the impact on agency operations. Hearing officers recommend penalties, but agency appointing authorities make final determinations about what discipline to impose.

Section 75 of the New York Civil Service Law provides civil service employees with important procedural protections before discipline can be imposed. Your rights include written notice of specific charges against you, adequate time to prepare a defense, a hearing before a neutral hearing officer, representation by an attorney or union representative, the opportunity to present evidence and witnesses, cross-examination of witnesses testifying against you, and a written determination explaining the basis for any discipline imposed. You also have the right to appeal adverse determinations through Article 78 proceedings in the New York State Supreme Court within four months of the final decision.

When Section 75 cases reach court, it’s typically through Article 78 proceedings in New York State Supreme Court after an agency imposes discipline following a hearing. These court proceedings don’t involve new testimony or evidence—instead, judges review the administrative hearing record to determine whether the agency’s determination was affected by errors of law, lacked substantial evidence, or was arbitrary and capricious. Courts give agencies significant deference on factual findings and credibility determinations but will overturn decisions lacking a proper legal foundation or adequate evidence support. Successful appeals may result in annulment of discipline, penalty reduction, or remand for additional proceedings.

The next stage after a Section 75 hearing involves the hearing officer preparing a written recommendation that analyzes the evidence, makes findings of fact, and recommends whether charges should be sustained and what penalties are appropriate. This recommendation goes to the agency’s appointing authority, who reviews it along with the complete hearing record before making a final determination. The appointing authority can accept, reject, or modify the hearing officer’s recommendation, though rejections require careful justification. Once the final determination is issued, you receive written notice of the decision and information about your appeal rights. If you disagree with the outcome, you can file an Article 78 appeal in court within four months.

For the agency to prevail in Section 75 proceedings, it must prove each charge by substantial evidence—credible evidence that a reasonable person would accept as adequate support for the allegations. This typically includes documentary evidence like emails, performance evaluations, attendance records, or policy documents, along with witness testimony from supervisors, coworkers, or others with direct knowledge of the alleged misconduct. The agency must present enough evidence to establish not just that violations occurred, but that you were responsible for them. As the charged employee, you can present your own evidence, including testimony, documents, character witnesses, and evidence challenging the agency’s proof or providing alternative explanations for events. The hearing officer weighs all evidence from both sides when making recommendations.

Section 75 establishes a formal disciplinary process for New York civil service employees with permanent status. When an agency seeks to impose discipline, it must provide written charges specifying the alleged misconduct. You then have the right to a hearing before a neutral hearing officer, where both sides present evidence and witnesses. The hearing operates similarly to a trial but with more relaxed evidentiary rules. After the hearing, the officer prepares a written recommendation analyzing whether charges were proven by substantial evidence and proposing appropriate penalties. The agency’s appointing authority reviews this recommendation and the complete record before making a final determination about what discipline, if any, to impose. You can appeal unfavorable determinations through Article 78 court proceedings, which provide judicial review of the agency’s decision for legal errors, lack of evidence, or arbitrary decision-making.

Winning a Section 75 case requires challenging the agency’s evidence while presenting your own strong defense. Success depends on demonstrating the agency failed to prove charges by substantial evidence—meaning their proof was insufficient, lacked credibility, or didn’t establish your responsibility for alleged misconduct. Effective strategies include presenting contradictory evidence that undermines the agency’s case, challenging witness credibility through cross-examination, providing legitimate explanations for questioned conduct, and showing procedural violations that prejudiced your case. Documentation supporting your position, credible witness testimony on your behalf, and evidence of your positive work history strengthen your defense. Working with experienced legal counsel helps identify weaknesses in the agency’s case and develop persuasive legal arguments. Even if some charges are sustained, you can argue for reduced penalties by presenting mitigating factors like your length of service, clean prior record, and steps taken to address concerns.