Yes, you can settle a Section 75 disciplinary case at any stage of the proceedings. Settlement negotiations allow civil service employees and their employers to resolve disciplinary charges through mutual agreement rather than proceeding to a formal hearing. These settlements can occur from the moment you receive disciplinary charges through the appeal stages, and they often provide more flexible resolutions than what a hearing officer might impose. Understanding your options for settlement—and when settling makes strategic sense—can significantly impact your career, finances, and future employment prospects.

Key Takeaways

- Settlement negotiations can happen at any point during Section 75 proceedings, from initial charge receipt through appeal stages.

- Settlements offer creative solutions not available through formal hearings, including modified penalties, confidential resolutions, and career preservation strategies.

- Early settlements often achieve better terms before agencies invest significant resources in prosecution.

- You can reject settlement offers and proceed to a hearing to contest the charges.

- Settlement agreements typically require you to waive certain appeal rights and sometimes future employment claims.

- Legal representation helps ensure settlement terms protect your interests and avoid unfavorable long-term consequences.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Are Section 75 Settlement Agreements?

Settlement agreements in Section 75 proceedings are written contracts between civil service employees and their employers that resolve disciplinary charges without proceeding to a formal hearing. These agreements typically outline what penalty the employee will accept, what rights they may be waiving, and any other terms that both parties find acceptable.

Unlike hearing determinations that follow strict legal frameworks, settlement agreements can be tailored to your specific situation. The agency might agree to reduce a termination to a suspension, convert unpaid leave to paid leave, or allow you to resign rather than face termination on your record. You might agree to counseling, training, or performance improvement plans that wouldn’t be available as hearing outcomes.

The flexibility of settlements makes them valuable tools for both employees and agencies. You gain certainty about the outcome and avoid the stress and uncertainty of contested proceedings. The agency avoids the time and cost of prosecuting charges through a full hearing, which can involve multiple witnesses, extensive documentation, and legal representation.

When Can Settlement Discussions Begin?

Settlement negotiations can start the moment you receive notice of disciplinary charges. Many employees begin exploring settlement options immediately to determine whether they can achieve acceptable terms without the risks and costs of a hearing.

Some of the most favorable settlements happen early in the process. Before agencies invest significant resources in preparing for a hearing, they’re often more willing to accept reduced penalties or alternative resolutions. Once an agency has committed substantial time and money to prosecution, it becomes more invested in achieving a hearing outcome.

Settlement discussions can also occur during the hearing itself. As evidence is presented, both sides gain clearer pictures of their cases’ strengths and weaknesses. A settlement reached mid-hearing might reflect these revealed dynamics—an agency seeing weak evidence might offer better terms, while an employee facing damaging testimony might accept harsher penalties than initially proposed.

Even after an adverse hearing decision, settlement remains possible. You might negotiate with the agency before filing an appeal, agreeing to accept a modified penalty in exchange for withdrawing your appeal rights. Some agencies prefer negotiated resolutions even after prevailing at a hearing, recognizing that appeals can overturn or modify hearing officer recommendations.

Why Would You Consider Settling Rather Than Going to a Hearing?

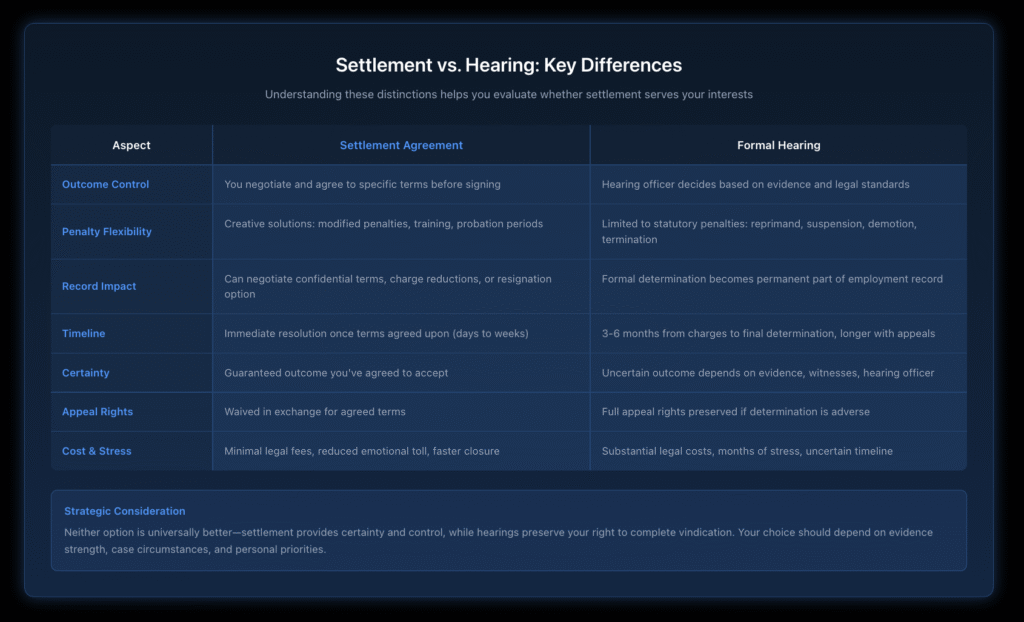

Several strategic considerations make settlement attractive even when you believe you could prevail at a hearing. Understanding these factors helps you evaluate whether settlement serves your interests better than contested proceedings.

What Are the Benefits of Settling Early?

Early settlements often yield more favorable terms than you’d achieve through a hearing. Before agencies invest substantial resources in prosecution, they’re more motivated to resolve cases efficiently. You might secure a lesser penalty, avoid certain charges altogether, or negotiate terms that protect your career prospects.

Settlement provides certainty that hearings cannot offer. Even with strong evidence supporting your position, hearings involve unpredictable elements—witness credibility, hearing officer interpretation, procedural issues, and agency discretion in imposing penalties. Settlement eliminates these uncertainties, giving you control over the outcome.

The emotional and practical toll of contested proceedings shouldn’t be underestimated. Hearings demand significant time commitment, generate substantial stress, and can drag on for months. Settlement allows you to move forward with your career and life rather than remaining in professional limbo while proceedings unfold.

How Does Settlement Impact Your Personnel Record?

One of the settlement’s most valuable aspects is controlling how discipline appears on your employment record. Through negotiation, you might:

Reduce charges from misconduct to lesser categories that look less serious to future employers. Convert termination to resignation, allowing you to claim you left voluntarily rather than being fired. Negotiate confidential settlements where specific details aren’t disclosed beyond your immediate employer. Structure agreements to avoid public hearings where misconduct allegations become part of the public record.

Your personnel record follows you throughout your civil service career and can impact future employment opportunities. Settlement agreements that minimize negative record entries protect your long-term career prospects more effectively than hearing determinations that become permanent parts of your employment history.

When Might Settlement Not Be in Your Best Interest?

Settlement isn’t always the right choice. If you’re innocent of the charges and have strong evidence supporting your position, proceeding to a hearing might vindicate you completely. A hearing determination finding you not guilty clears your record entirely, whereas a settlement typically requires accepting some penalty or admission.

When agencies propose settlement terms you find unacceptable—particularly if they demand termination or lengthy unpaid suspensions—proceeding to a hearing might achieve better outcomes. Hearing officers can impose lesser penalties than agencies propose, and appeals can further reduce excessive punishments.

If the disciplinary charges relate to conduct you absolutely did not commit, and false accusations could damage your professional reputation long-term, clearing your name through a hearing might outweigh the settlement’s certainty and convenience. The vindication of a not-guilty determination has value that a settlement cannot provide.

What Should Be Included in a Settlement Agreement?

Comprehensive settlement agreements address multiple elements beyond the immediate penalty. Understanding what should be included protects you from unforeseen consequences and ensures the agreement truly resolves all issues.

What Penalties and Discipline Terms Need Clarification?

The settlement must clearly specify what disciplinary action you’re accepting. This includes whether you’re receiving a reprimand, suspension, demotion, or termination. For suspensions, the agreement should state whether the time is paid or unpaid, and the exact dates of the suspension period.

If the settlement involves multiple charges, specify which charges you’re pleading guilty to or accepting responsibility for, and which charges the agency is withdrawing. This distinction matters for your employment record and potential future proceedings.

The agreement should address what happens to your salary and benefits during any suspension period. Can you use accrued leave to cover unpaid suspension time? Will you continue accruing seniority and benefits during suspension? These details significantly impact the settlement’s financial consequences.

What Rights Are You Waiving?

Most settlement agreements require you to waive your right to a Section 75 hearing and any subsequent appeals. The agreement should clearly state which appeal rights you’re surrendering—appeals to the Civil Service Commission, Article 78 proceedings, or other administrative remedies.

Some settlements include broader waivers releasing the agency from any employment-related claims arising from the disciplinary action or underlying conduct. These releases might bar you from filing discrimination complaints, pursuing wrongful termination claims, or asserting other legal remedies. You need to understand exactly what future legal actions you’re foreclosing by signing the agreement.

If you’re accepting termination as part of a settlement, the agreement typically includes provisions about your eligibility for rehire, whether you can apply for other civil service positions, and how the agency will respond to reference checks from future employers.

How Does Settlement Affect Your Future Employment?

Settlement agreements often address confidentiality provisions that limit what information the agency can disclose about the disciplinary action. You might negotiate that the agency will only confirm dates of employment and job title, without discussing the reasons for your departure.

If you’re settling a case that involves professional licenses or certifications, the agreement should clarify the agency’s obligations regarding reporting to licensing boards. Some misconduct must be reported by law, but settlement negotiations might address how the agency characterizes the conduct in those required reports.

For employees remaining with the agency post-settlement, the agreement should specify any ongoing obligations like counseling, training, performance improvement plans, or probationary periods. Understanding these continuing requirements helps you comply with settlement terms and avoid future disciplinary action.

How Do You Negotiate an Effective Settlement?

Effective settlement negotiation requires understanding your leverage, the agency’s interests, and the realistic range of possible outcomes. A strategic approach to negotiations can significantly improve the terms you ultimately accept.

What Leverage Do You Have in Settlement Discussions?

Your leverage in settlement negotiations derives from several sources. If the evidence supporting the charges is weak or problematic, the agency faces risks of an unfavorable hearing determination. You can use these evidentiary weaknesses to negotiate better settlement terms.

Procedural defects in how the agency conducted its investigation or brought charges create additional leverage. If notice requirements weren’t properly met, if timelines weren’t followed, or if your rights were violated during the investigative process, these issues strengthen your negotiating position.

The agency’s resource constraints and institutional interests also create leverage. Hearings consume substantial staff time, require legal representation, involve witness preparation, and tie up agency resources. Your willingness to resolve the matter quickly might be valuable enough that the agency accepts more favorable terms.

What Information Do You Need Before Accepting Settlement Terms?

Before agreeing to any settlement, you need complete information about the charges, the evidence the agency possesses, and the potential penalties you might face at a hearing. This requires reviewing all relevant documents, understanding witness statements, and assessing the strength of the agency’s case.

You should also understand the full range of potential hearing outcomes. What’s the best result you could achieve at a hearing? What’s the worst? How do proposed settlement terms compare to these potential outcomes? Without this context, you cannot meaningfully evaluate whether a settlement serves your interests.

Consider consulting with legal counsel before accepting settlement terms. An experienced employment attorney can identify problematic provisions, suggest alternative terms, explain long-term consequences, and ensure the agreement protects your interests. The cost of legal advice is typically far less than the potential cost of accepting unfavorable settlement terms.

Can You Modify or Reject Proposed Settlement Terms?

Settlement negotiations are just that—negotiations. You can propose modifications to any settlement terms the agency offers. If the proposed penalty seems excessive, suggest alternatives. If certain provisions seem problematic, propose different language.

The agency isn’t obligated to accept your proposed modifications, but negotiation often yields middle-ground solutions acceptable to both parties. The agency might reduce a suspension from 30 days to 20 days unpaid, or convert some unpaid time to paid suspension. You might agree to counseling or training that addresses agency concerns without accepting harsher penalties.

If you cannot reach acceptable settlement terms, you maintain your right to proceed to a hearing. Rejecting the settlement and proceeding to a hearing remains your option until you sign an agreement. Once signed, settlement agreements become binding contracts that courts will enforce.

What Legal Protections Apply to Settlement Agreements?

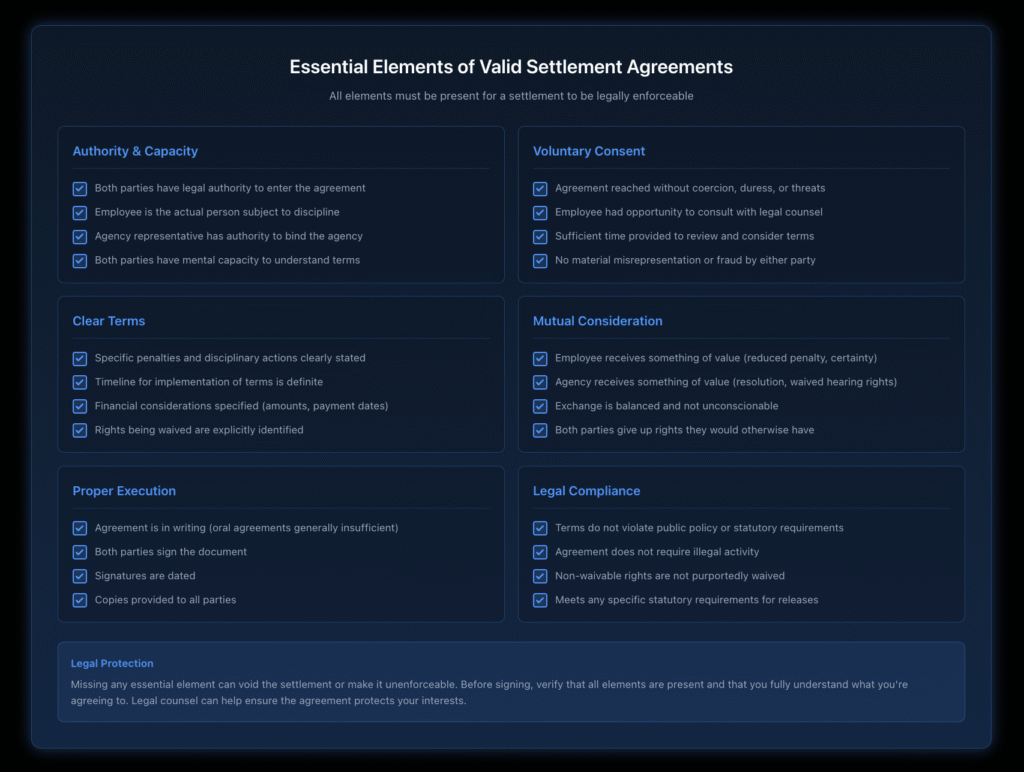

Settlement agreements in Section 75 proceedings operate as contracts between you and your employer, subject to contract law principles and specific statutory protections. Understanding these legal frameworks helps ensure your settlement is valid and enforceable.

What Makes a Section 75 Settlement Legally Binding?

For a settlement agreement to be legally enforceable, it must meet basic contract requirements: offer, acceptance, and consideration. The agency offers specific settlement terms; you accept those terms, and both parties provide consideration—you agree to accept discipline and waive hearing rights, while the agency agrees to resolve charges without further proceedings.

The agreement must be voluntary, meaning you cannot be coerced or misled into accepting settlement terms. If you can later prove you were pressured into settling through threats, false information, or denial of legal representation, courts might void the agreement.

Both parties must have the authority to enter the settlement. You must be the actual employee subject to discipline, and the agency representative must have authority to bind the agency to settlement terms. Agreements signed by individuals lacking proper authority may not be enforceable.

Can Settlement Agreements Be Challenged or Voided?

Once signed, settlement agreements are generally binding and difficult to overturn. However, certain circumstances might allow you to challenge or void an agreement.

If you can demonstrate that the settlement was based on fraud, duress, or material misrepresentation, courts might void the agreement. For example, if the agency misrepresented the evidence it possessed or made false promises about future treatment, you might have grounds to challenge the settlement.

Mutual mistake of fact can also void agreements. If both parties entered the settlement based on a fundamental misunderstanding of critical facts, the agreement might be voidable. However, this doctrine applies narrowly—general mistakes about how the settlement will work out aren’t sufficient.

Settlements that violate public policy or statutory rights might be unenforceable. If a settlement requires you to engage in illegal activity, waive non-waivable statutory rights, or accept terms that violate public policy, courts might refuse to enforce those provisions or void the entire agreement.

What Happens If Someone Violates the Settlement Terms?

If either party violates the settlement agreement terms, the other party can seek enforcement through the courts. The party claiming breach must prove that a settlement existed, that specific terms were violated, and that they suffered damages from the breach.

For employees who violate settlement terms—perhaps by failing to complete required training, returning to work before a suspension period ends, or engaging in prohibited conduct during a probationary period—the agency might reinstate original disciplinary charges or impose additional penalties specified in the agreement.

When agencies violate settlement terms—by failing to restore you to employment as promised, improperly disclosing confidential settlement information, or imposing harsher penalties than agreed—you can seek legal remedies, including specific performance (forcing the agency to comply with the agreement) or damages for breach of contract.

How Does Settlement Interact with Other Legal Rights?

Settlement agreements in Section 75 proceedings can impact various other legal rights and remedies you might have. Understanding these interactions helps you evaluate the full consequences of settling.

Can You Still File Discrimination or Retaliation Claims After Settling?

Whether settlement agreements bar discrimination or retaliation claims depends on the specific language in the agreement. If the settlement includes a broad release of all employment-related claims, you might be waiving rights to file EEOC complaints, state discrimination charges, or civil rights lawsuits.

However, releases of discrimination claims must meet specific legal requirements to be enforceable. They must be knowing and voluntary, which typically requires that you receive adequate consideration for the waiver and have the opportunity to consult with legal counsel before signing.

Some settlements specifically preserve your right to file discrimination or retaliation claims while resolving the disciplinary charges. Carefully review any release language to understand what claims you’re waiving. If you believe discrimination or retaliation motivated the disciplinary charges, you might negotiate to preserve these claims while settling the Section 75 matter.

How Does Settlement Affect Your Right to Appeal?

Settlement agreements typically require you to waive all appeal rights, including appeals to the Civil Service Commission and Article 78 judicial review proceedings. Once you sign the settlement and waive these rights, you generally cannot change your mind and appeal the disciplinary action.

This waiver is precisely why settlement offers certainty—by agreeing to specific penalties and waiving appeals, both parties know the matter is conclusively resolved. The agency cannot appeal to seek harsher penalties, and you cannot appeal seeking lesser punishment or exoneration.

Before waiving appeal rights, consider whether the evidence and circumstances of your case make an appeal likely to succeed. If significant procedural errors occurred, if the evidence is weak, or if the proposed penalty seems grossly disproportionate, preserving appeal rights by proceeding to a hearing might serve you better than settling.

What About Unemployment Benefits and Other Consequences?

Settlement agreements can impact your eligibility for unemployment benefits. If you settle by accepting termination rather than fighting the charges, you might face unemployment benefit denials on the grounds that you were fired for misconduct. The specific settlement terms and how they characterize your departure matter significantly.

Professional licensing consequences also require consideration. Some licenses require disclosure of disciplinary actions or employment terminations. Settlement agreements that frame your departure in less damaging ways might minimize licensing issues, while settlements involving misconduct admissions could trigger mandatory license reporting requirements.

For employees with pension rights, settlement terms can impact retirement benefits. Some settlements might allow you to retire rather than face termination, preserving full pension benefits. Others might result in benefit reductions if they involve misconduct findings that trigger pension forfeiture provisions.

Ready to Navigate Your Section 75 Settlement?

If you’re facing Section 75 disciplinary charges and considering settlement options, Nisar Law Group can help you evaluate whether a settlement serves your interests and negotiate terms that protect your career and future. Our employment law attorneys have extensive experience representing civil service employees throughout New York in disciplinary proceedings and settlement negotiations. Contact us today for a consultation to discuss your case and explore your options.

Frequently Asked Questions About Section 75 Settlements

Yes, Section 75 settlement agreements are legally enforceable contracts between you and your employer that courts will uphold according to their terms. Once both parties sign, it becomes a binding contract that must meet basic requirements, including offer, acceptance, consideration, and voluntary consent—you cannot be coerced or misled into accepting terms. Courts treat these agreements seriously and rarely allow parties to escape their obligations after signing, which gives settlement its value by providing certainty that the matter is conclusively resolved. However, agreements obtained through fraud, duress, or material misrepresentation might be voidable, as can settlements that violate public policy or statutory rights.

A settlement agreement becomes legally binding when several key elements are present: both parties must have legal authority to enter the agreement, there must be a mutual exchange of consideration (both parties give up something of value), your acceptance must be knowing and voluntary (not forced or deceived), the agreement must be properly executed in writing with signatures, and the terms must be sufficiently clear that both parties understand their obligations. Vague or ambiguous agreements that don’t clearly specify penalties, timelines, or obligations might not be fully enforceable.

Several circumstances can invalidate a settlement agreement, including fraud or material misrepresentation by either party (such as the agency falsely claiming it has strong witness testimony), duress or coercion that prevents voluntary consent, mutual mistake of fundamental fact that goes to the heart of what both parties thought they were agreeing to, requirements for illegal activity or violation of clearly established public policy, and lack of authority by the person who signed to bind their party. Additionally, settlements that purport to waive non-waivable statutory rights may be void or unenforceable.

When either party breaches settlement agreement terms, the other party can seek legal remedies through the courts by proving that a valid settlement existed, specific terms were violated, and they suffered harm from the breach. If you violate terms—such as failing to complete required training or returning to work before suspension ends—the agency might reinstate original disciplinary charges, impose additional penalties specified in the agreement, or pursue contract damages. When agencies violate terms—by failing to restore you to employment as promised, improperly disclosing confidential information, or imposing harsher penalties than agreed—you can seek remedies including specific performance (court order forcing compliance), damages for financial losses caused by the breach, or in some cases, rescission of the entire agreement allowing you to proceed as if settlement never occurred.

Generally, settlement agreements are very difficult to challenge or overturn once signed because courts strongly favor upholding them in the interest of resolving disputes through negotiation rather than litigation. You might successfully challenge a settlement if you can prove fraud, duress, or material misrepresentation that induced you to sign, though simply regretting the settlement or realizing you could have gotten better terms isn’t sufficient. You might also challenge agreements that violate public policy, require illegal conduct, or purport to waive rights that cannot legally be waived, or if you discover after signing that the agreement is based on a fundamental mistake of fact. The best approach is thoroughly evaluating settlement terms before signing and consulting with legal counsel to understand what you’re agreeing to, as once you sign, your options to challenge the agreement are limited.

Settlement agreements can be voided under specific limited circumstances including fraud (intentional misrepresentation of material facts that induced the other party to agree), duress or coercion that prevents voluntary consent through wrongful conduct by the other party, mutual mistake of material fact when both parties were mistaken about fundamental facts forming the basis of the settlement, unconscionability where settlement terms are so one-sided and unfair that they shock the conscience (though courts apply this sparingly), requirements for illegal activity or violations of clearly established public policy, attempts to waive non-waivable statutory rights, and lack of authority by the person signing to bind their party. Simply feeling pressured by the situation or discovering better terms were available isn’t sufficient—the circumstances must involve wrongful conduct or fundamental legal defects that undermine the agreement’s validity.

The timing of settlement payments depends entirely on the specific terms negotiated in your agreement, which should clearly specify when the agency will make any financial payments, whether they’re lump sum or periodic, and the exact amounts. For settlements involving back pay, compensation for unpaid suspension time, or other financial consideration from the agency, payment timelines might range from immediately upon signing to 30, 60, or 90 days afterward, as government agencies often require specific processing time to prepare checks, secure necessary approvals, and handle accounting requirements. If your settlement doesn’t specify payment timing, general contract principles require payment within a “reasonable time” based on the circumstances, but if payment is significantly delayed beyond standard agency processing times, you might have grounds to claim breach of the settlement agreement—so always ensure that settlement agreements include specific, concrete payment deadlines and specify the exact amounts you’ll receive rather than vague language about “prompt payment” or “reasonable time.”

Several risks accompany Section 75 settlement agreements that require careful consideration: you’re typically waiving your right to a hearing and all appeals including the possibility of complete exoneration, settlement terms become part of your permanent employment record affecting future opportunities even if you negotiated reduced charges, broad release language might waive legal claims you don’t fully appreciate you’re giving up (particularly discrimination or retaliation claims if those motivated the charges), settlement agreements are difficult to challenge or void after signing even if you discover misrepresented evidence or better available terms, and settlement terms might include ongoing obligations like counseling or probationary periods that create continued vulnerability to future discipline if requirements aren’t met perfectly. These risks make it essential to thoroughly understand all terms, consult with legal counsel, and carefully weigh settlement against the alternative of proceeding to a hearing where you might achieve complete vindication.