You’ve witnessed serious misconduct at work—fraud, discrimination, safety violations, or other illegal activities. While speaking up feels like the right thing to do, you’re concerned about the personal and financial risks. Here’s something that might change your perspective: multiple federal programs offer substantial financial rewards for whistleblowers who report violations, with some awards reaching millions of dollars.

These reward programs aren’t just token gestures. They’re designed to incentivize reporting of serious violations that might otherwise go undetected, and they can provide significant financial compensation for the risks whistleblowers take.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

Understanding the Major Whistleblower Reward Programs

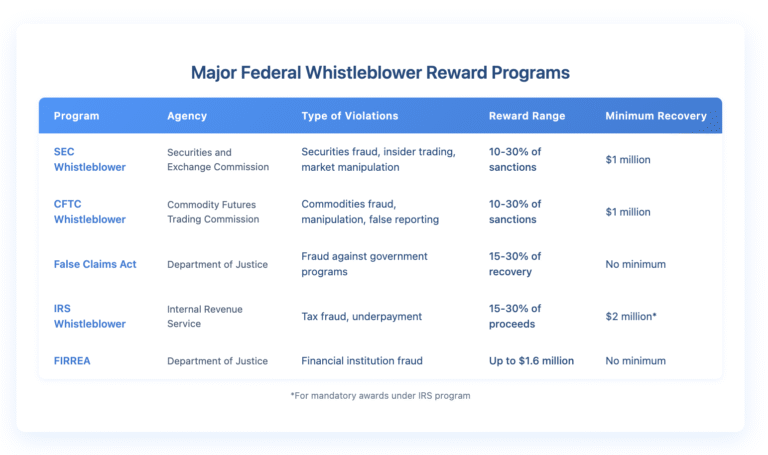

The federal government operates several distinct whistleblower reward programs, each targeting different types of violations. Understanding which program applies to your situation is the first step toward potentially qualifying for a reward.

The SEC Whistleblower Program has awarded over $1.6 billion to whistleblowers since its inception in 2011, with the largest single award exceeding $279 million in May 2023. These aren’t isolated success stories—the SEC issues awards regularly to qualifying whistleblowers.

How Whistleblower Rewards Actually Work

Let’s break down the mechanics of how these reward programs operate, because understanding the process helps you position yourself for maximum potential recovery.

The Percentage-Based Model

Most whistleblower programs use a percentage-based reward structure. When the government successfully recovers money based on your information, you receive a percentage of that recovery. The actual percentage depends on several factors:

The significance of your information plays a crucial role. Original information that triggers a new investigation typically qualifies for higher percentages than information that merely assists an ongoing investigation. Your level of cooperation throughout the investigation also matters—whistleblowers who provide extensive assistance and ongoing cooperation generally receive awards at the higher end of the range.

Timing and Payment Process

Whistleblower rewards aren’t immediate. The typical timeline looks something like this:

The investigation period varies significantly based on the complexity of the case. Securities fraud investigations might take 2-3 years, while straightforward tax cases could conclude within a year.

Qualifying for Whistleblower Rewards: Essential Requirements

Not every report of wrongdoing qualifies for a financial reward. Each program has specific eligibility requirements you must meet.

Original Information Requirement

Your information must be “original”—meaning it comes from your independent knowledge or analysis and isn’t already known to the government. This doesn’t mean you need to be the only person who knows about the violation, but you must be among the first to report it to the appropriate agency.

Original information typically includes:

- First-hand observations of illegal conduct

- Analysis of publicly available data that reveals hidden violations

- Information from company insiders about concealed wrongdoing

- Documentation of systematic fraud or discrimination patterns

Voluntary Submission

You must report the information voluntarily, before the government requests it from you. If you’re already under subpoena or investigation for the conduct, you generally can’t qualify for a reward by providing information about it.

This voluntary requirement has important implications for timing. If you suspect your company is about to be investigated, reporting the violations before any government contact maximizes your reward potential.

The False Claims Act: A Powerful Tool for Reporting Government Fraud

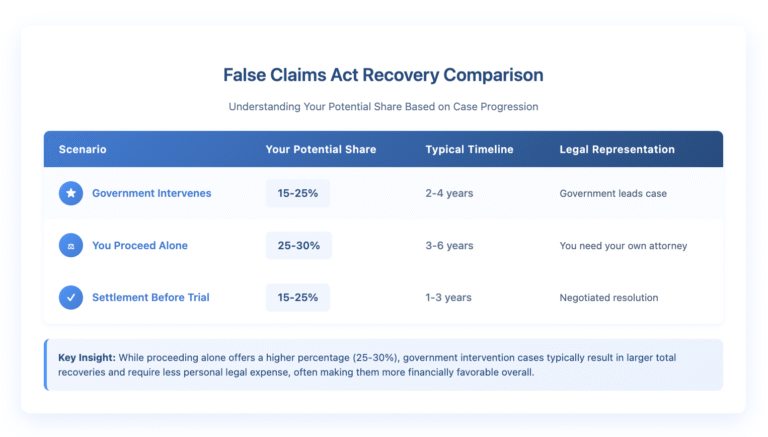

The False Claims Act (FCA) deserves special attention because it offers unique advantages for whistleblowers reporting fraud against government programs. Unlike other whistleblower programs, the FCA allows you to file a lawsuit on behalf of the government.

How Qui Tam Lawsuits Work

Under the FCA, you file a sealed lawsuit in federal court detailing the fraud. The government then investigates and decides whether to intervene in your case. If the government intervenes and recovers money, you receive 15-25% of the recovery. If the government declines to intervene but you proceed successfully on your own, your share increases to 25-30%.

The FCA is particularly relevant for reporting Medicare fraud, defense contractor fraud, education grant fraud, and other schemes targeting federal programs. In fiscal year 2023, the government recovered over $2.68 billion through FCA cases, with whistleblowers receiving $350 million in rewards.

Maximizing Your Whistleblower Reward Potential

Getting the maximum possible reward requires strategic planning and careful execution. Here’s how to position yourself for the best outcome.

Document Everything Meticulously

Strong documentation dramatically increases both your credibility and your reward percentage. Create a comprehensive record that includes:

Dates, times, and locations of relevant events. Names of individuals involved in the wrongdoing. Copies of relevant documents (obtained legally). Email communications showing knowledge or intent. Financial records demonstrating the violation’s scope.

Remember to only collect documents you have legal access to. Taking documents you’re not authorized to access could create legal problems that overshadow any potential reward.

Provide Specific, Detailed Information

Vague allegations rarely lead to successful investigations or rewards. Your report should answer fundamental questions: What specific laws or regulations were violated? Who participated in or knew about the violations? When did the violations occur? Where did they take place? How was the scheme carried out? Why do you believe it was intentional?

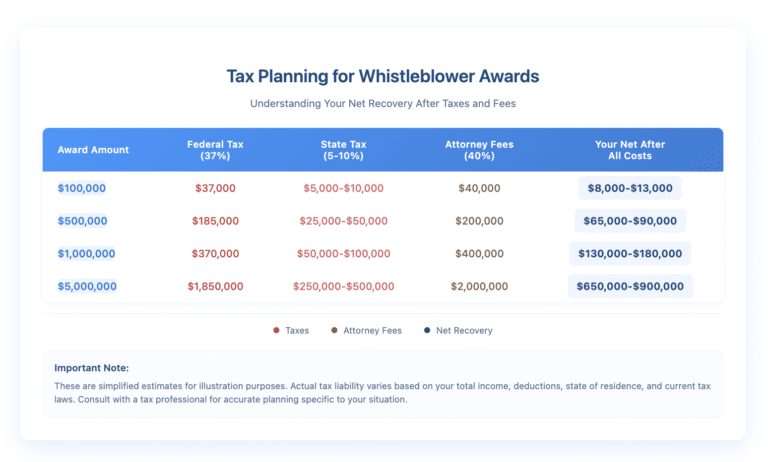

Understanding Tax Implications of Whistleblower Awards

Many whistleblowers are surprised to learn that reward payments are taxable income. Planning for these tax obligations is essential.

Federal Tax Treatment

The IRS treats whistleblower awards as ordinary income, subject to your regular income tax rate. For large awards, this could mean a tax rate of up to 37% for federal taxes alone. Additionally, if you hired an attorney on contingency, you might owe taxes on the entire award amount, not just your portion after attorney fees.

Note: These are simplified estimates. Actual tax liability varies based on your total income, deductions, and state of residence.

Some states don’t tax whistleblower awards, while others apply their full income tax rates. Consulting with a tax professional before receiving your award helps you plan appropriately and potentially minimize your tax burden through legal strategies.

Common Misconceptions About Whistleblower Rewards

Let’s address some frequent misunderstandings that might prevent you from pursuing legitimate rewards.

“I Need Smoking Gun Evidence”

You don’t need absolute proof of wrongdoing to qualify for a reward. Agencies understand that whistleblowers rarely have access to every piece of evidence. What matters is providing credible information that helps the agency investigate and prove violations.

“Small Violations Don’t Qualify”

While some programs have minimum recovery thresholds, many successful whistleblower cases involve systematic small violations that add up to significant recoveries. A pattern of discrimination affecting multiple employees or repeated safety violations can lead to substantial penalties and corresponding rewards.

“I’ll Be Blacklisted from My Industry”

Many whistleblower programs allow anonymous reporting through an attorney, protecting your identity during the investigation. The SEC and CFTC programs have robust confidentiality protections, and revealing a whistleblower’s identity without authorization is illegal.

Workplace Discrimination and Whistleblower Rewards

While discrimination cases don’t always involve the massive dollar amounts seen in financial fraud cases, several scenarios can trigger whistleblower rewards.

Government contractors who systematically discriminate in hiring or promotion violate federal contracting requirements, potentially triggering False Claims Act liability. Companies that lie about their diversity programs or equal opportunity compliance to obtain government contracts commit fraud that can lead to FCA recovery and whistleblower rewards.

Additionally, publicly traded companies that make false statements about their diversity initiatives or hide widespread discrimination problems might face SEC enforcement for misleading investors, potentially qualifying whistleblowers for SEC program rewards.

The Role of Legal Representation in Maximizing Rewards

While you can file whistleblower reports without an attorney, experienced legal representation significantly increases your chances of qualifying for and maximizing rewards.

Attorneys experienced in whistleblower cases understand how to present information effectively to government agencies. They know which details agencies prioritize and how to structure your submission for maximum impact. They can also help you avoid common pitfalls that might disqualify you from rewards or reduce your percentage.

For False Claims Act cases, having an attorney is practically essential. The procedural requirements are complex, and proceeding incorrectly could bar your claim entirely. Your attorney can also negotiate with the government about your reward percentage and advocate for the higher end of the range based on your contribution.

International Whistleblowing and U.S. Reward Programs

You don’t need to be a U.S. citizen or even work in the United States to qualify for many whistleblower reward programs. The SEC and CFTC programs explicitly cover international whistleblowers reporting violations that affect U.S. markets.

If you work for a foreign subsidiary of a U.S. company or a foreign company listed on U.S. exchanges, violations you observe might qualify for rewards. The key is whether the violation has a sufficient connection to U.S. markets or involves U.S. government programs.

When Whistleblower Rewards Aren't Available

It’s important to understand when reward programs don’t apply. Internal company policies violated without breaking federal law typically don’t qualify for rewards. State and local government fraud (unless federal funds are involved) usually falls outside federal whistleblower programs. Personal employment disputes without broader illegal conduct won’t trigger rewards.

However, even when formal reward programs don’t apply, other protections and remedies might be available. Anti-retaliation provisions protect whistleblowers regardless of reward eligibility, and state whistleblower laws might provide different benefits.

Taking Action: Your Next Steps

If you’ve witnessed serious wrongdoing at work, here’s your roadmap for potentially qualifying for whistleblower rewards:

First, identify which reward program applies to your situation. Securities fraud goes to the SEC, tax fraud to the IRS, and government contractor fraud typically falls under the False Claims Act.

Second, gather and organize your documentation. Create a detailed timeline of events, collect relevant documents you have legal access to, and identify potential witnesses or corroborating evidence.

Third, consider consulting with an experienced whistleblower attorney before filing your report. Many attorneys offer confidential consultations to evaluate your case’s reward potential.

Fourth, file your report with the appropriate agency following their specific procedures. Each program has particular forms and requirements that must be followed precisely.

Finally, maintain confidentiality about your report. Publicizing your allegations before the government investigates could disqualify you from rewards or compromise the investigation.

Protecting Your Rights and Maximizing Your Recovery

Whistleblowing takes courage, but federal reward programs recognize and compensate that courage financially. With potential rewards ranging from thousands to millions of dollars, understanding these programs could transform your decision to report wrongdoing from a risky sacrifice into a financially rewarding stand for justice.

Remember that timing matters in whistleblower cases. The first to report typically receives the reward, and delays could mean missing your opportunity entirely. Additionally, statutes of limitations apply to many types of violations, potentially barring both government enforcement and your reward eligibility if you wait too long.

If you’re considering blowing the whistle on workplace violations, discrimination, or fraud, don’t navigate this complex process alone. The experienced attorneys at Nisar Law Group can evaluate your case, help you understand your reward potential, and guide you through the reporting process while protecting your rights. Contact us today for a confidential consultation about your whistleblower matter and learn how we can help you maximize your potential recovery while fighting workplace injustice.