A standard severance package typically includes one to two weeks of pay per year of service, continuation of health benefits for a limited period (usually 3-6 months), payout of accrued vacation time, and a general release of claims against your employer. Most agreements also contain confidentiality provisions, non-disparagement clauses, and sometimes non-compete restrictions. While employers aren’t legally required to offer severance in most situations, understanding these baseline components helps you evaluate whether your offer meets industry standards and identify areas for potential negotiation.

What Are the Key Takeaways About Severance Packages?

- Severance pay typically ranges from 1-2 weeks per year of employment, though executives and long-tenured employees often receive more

- Health insurance continuation through COBRA is standard, with employers sometimes subsidizing premiums for 3-6 months

- You’ll likely be asked to sign a release waiving your right to sue for most employment-related claims

- Non-compete and non-solicitation clauses are common but negotiable in scope and duration

- Severance agreements must provide specific review periods under federal law – 21 days for individuals, 45 days for group terminations

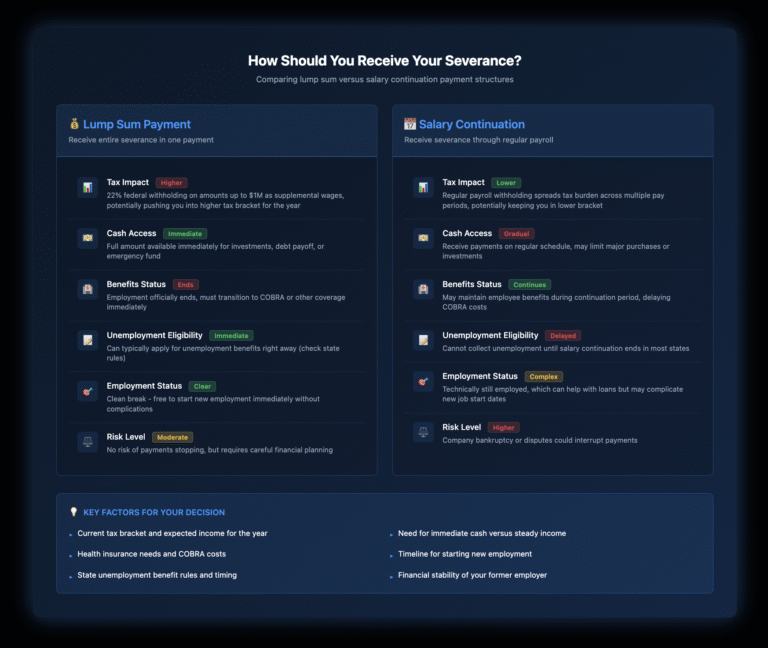

- Payment structure varies between lump sum and salary continuation, each with different tax implications

- Additional benefits like outplacement services, reference letters, and equipment retention are increasingly standard

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Financial Compensation Should You Expect in a Severance Package?

The cornerstone of any severance agreement is monetary compensation. For non-executive employees, the informal standard is one to two weeks of base salary for each year of service. If you’ve worked somewhere for five years, expecting five to ten weeks of severance pay falls within normal parameters.

Several factors influence where you’ll land within this range. Companies in financial services, technology, and consulting often lean toward the higher end, while retail and hospitality sectors typically offer less generous packages. Your role level matters too – managers and directors frequently receive better multipliers than individual contributors.

Beyond base severance pay, look for these additional financial components. Accrued but unused paid time off should be included – in New York, employers must pay out earned vacation time regardless of company policy. Many packages also include a pro-rated bonus if you’re leaving partway through a bonus period, especially if you’ve already substantially completed the performance year.

How Do Benefits Typically Continue After Employment Ends?

Health insurance continuation represents the second most valuable component of most severance packages. Under COBRA, you’re entitled to continue your group health coverage for up to 18 months, but you’ll typically pay the full premium plus a 2% administrative fee. The key negotiation point is how long your employer will subsidize these premiums.

Standard packages often include three to six months of employer-paid COBRA premiums. This subsidy can be worth thousands of dollars monthly, especially for family coverage. Some employers structure this as a lump sum you can use for COBRA or alternative coverage, providing more flexibility if you find less expensive insurance elsewhere.

Other benefits may continue temporarily. Life insurance and disability coverage sometimes extend through the severance period if you’re receiving salary continuation rather than a lump sum. Stock options typically have a limited exercise window after termination – usually 90 days – though some companies extend this period as part of severance negotiations.

What Legal Rights Are You Waiving in a Standard Release?

Nearly every severance agreement includes a general release of claims – a legal document where you agree not to sue your employer for various employment-related issues. This release typically covers discrimination claims under federal, state, and local laws, wage and hour violations, wrongful termination claims, and breach of contract allegations.

The release can’t waive certain rights. You’ll always retain the right to file a charge with the EEOC or participate in government investigations. Claims for unemployment benefits, workers’ compensation, and vested retirement benefits also can’t be waived. Future claims – those arising after you sign the agreement – remain preserved.

Federal law provides specific protections if you’re over 40. The Older Workers Benefit Protection Act requires employers to give you at least 21 days to consider the agreement (45 days for group terminations) and seven days to revoke after signing. The agreement must also reference the Age Discrimination in Employment Act specifically and advise you to consult an attorney.

What Restrictive Covenants Commonly Appear in Severance Agreements?

Non-compete clauses restrict your ability to work for competitors or start a competing business. While their enforceability varies by state, New York courts will enforce reasonable non-competes that protect legitimate business interests. Standard non-compete periods range from six months to two years, with one year being most common.

Geographic scope matters for enforceability. A nationwide non-compete for a regional sales manager likely won’t hold up, but a restriction covering your actual sales territory might. The definition of “competition” should be specific – vague language about “similar businesses” creates enforceability problems and negotiation opportunities.

Non-solicitation provisions prevent you from recruiting former colleagues or pursuing former clients. These restrictions typically last 12 to 24 months and are generally more enforceable than non-competes. Client non-solicitation clauses should clearly define which clients are covered – ideally, only those you personally serviced during a specific timeframe.

Confidentiality obligations require protecting your former employer’s trade secrets and proprietary information. While trade secret protection exists independently under law, severance agreements often define confidential information broadly. Watch for overreaching definitions that could restrict your ability to use general knowledge and skills in future positions.

How Are Severance Payments Structured and Taxed?

Severance pay can be distributed as a lump sum or through salary continuation. Lump sum payments provide immediate access to funds and a clean break, but result in higher tax withholding due to supplemental wage rules. The IRS requires 22% federal withholding on supplemental payments up to $1 million, though your actual tax liability depends on your total annual income.

Salary continuation maintains your regular payroll and benefits through the severance period. This approach spreads the tax impact and may help if you’re concerned about qualifying for loans or leases that require employment verification. However, it also means remaining technically employed, which could affect your ability to claim unemployment benefits.

Some portions of your severance might be allocated to non-wage items. Payments for releasing claims or accepting non-compete restrictions may be classified differently from wages, potentially reducing employment tax obligations. Outplacement services and certain other benefits may be provided tax-free up to specific limits.

What Additional Benefits Should You Look for in a Severance Package?

Outplacement services help with job searching through resume assistance, interview coaching, and sometimes office space or administrative support. Quality outplacement programs typically last three to six months and can be worth several thousand dollars. Even if you don’t think you’ll use these services, they’re a standard offering worth including.

A neutral reference agreement specifies what your employer will say about your departure. Standard language confirms your position, dates of employment, and that you’re eligible for rehire. Some agreements designate a specific person to handle reference calls and provide a written statement you can share with prospective employers.

Equipment retention allows you to keep your company laptop, phone, or other devices. While employers often want equipment returned, negotiating to purchase these items at depreciated value or receiving them as part of your package can be convenient, especially if they contain personal data or if you’ve grown accustomed to specific tools.

When Should You Sign a Severance Agreement?

Never sign immediately when presented with a severance agreement. Even if the terms seem generous, you’re entitled to review time – at a minimum, the 21 or 45 days required for employees over 40. Use this time to understand every provision and identify negotiation opportunities.

Consider the agreement’s interaction with unemployment benefits. In New York, severance pay may delay or reduce unemployment benefits depending on how it’s structured. Dismissal pay that’s not contingent on signing a release doesn’t affect benefits, but additional consideration for signing might.

What Makes a Severance Package Better Than Standard?

Enhanced packages often include extended severance pay multipliers, longer benefit continuation periods, accelerated vesting of equity compensation, and modification or elimination of restrictive covenants. Executives and employees with potential legal claims often negotiate packages well above standard terms.

Garden leave provisions pay you to not work during your non-compete period, effectively doubling your compensation for that time. Clawback waivers protect previous bonuses or commissions from recoupment. Indemnification provisions ensure continued legal protection for work performed during employment.

What Are Your Next Steps When Presented with a Severance Agreement?

Start by comparing your offer against industry standards for your role, tenure, and circumstances. Document any factors that might justify enhanced severance – strong performance history, unique circumstances around departure, or potential legal claims all create leverage for negotiation.

Review every provision carefully, not just compensation. Restrictive covenants that seem reasonable at first glance might significantly impact your career options. Consider both immediate needs and long-term implications before accepting any agreement.

Most importantly, remember that severance agreements are negotiable. Employers expect some back-and-forth, especially for professional and executive-level employees. Even seemingly standard packages often have room for improvement in payment terms, benefit continuation, or restrictive covenant modifications.

Consulting with an experienced employment attorney helps you understand whether your severance package meets industry standards and identify opportunities for improvement. At Nisar Law Group, we review severance agreements to ensure you’re receiving fair terms and help negotiate enhancements that protect your future career options. Contact us for a confidential consultation to discuss your severance package and understand your rights during this transition.

Frequently Asked Questions About Severance Terms

Most employers offer one to two weeks of severance pay for each year you’ve worked at the company. If you’ve been there five years, expect five to ten weeks of pay as a starting point. Executives and long-tenured employees often receive more generous multipliers—sometimes up to a month per year of service. Remember, these are just typical ranges. Your specific circumstances, industry standards, and negotiation can significantly impact the final amount.

There’s no legal requirement for severance pay in most situations—it’s purely at the employer’s discretion unless you have an employment contract or union agreement stating otherwise. However, informal industry standards have developed over time. The baseline of one to two weeks per year of service has become common practice, though financial services and tech companies often exceed this, while retail and hospitality typically offer less. What matters is understanding your industry’s norms to evaluate whether your offer is fair.

The traditional rule of thumb is one week of severance pay per year of employment, though many companies now offer two weeks per year as standard. For employees over 40, factor in additional time: you’re legally entitled to at least 21 days to review the agreement (45 days for group layoffs) plus seven days to revoke after signing. Don’t rush your decision based on arbitrary deadlines—take the time you’re entitled to for proper review.

Yes, severance packages are almost always negotiable, especially for professional and executive-level positions. Employers expect some back-and-forth and often leave room in their initial offer for negotiation. Beyond base pay, you can negotiate health insurance continuation, non-compete modifications, reference letters, outplacement services, and payment structure. Your leverage increases if you have a strong performance history, unique circumstances around your departure, or potential legal claims. Even a modest improvement through negotiation can mean thousands of additional dollars.

This depends entirely on how your severance is structured and what your agreement says. With lump sum payments, you’re typically free to start new employment immediately since you’re no longer on payroll. With salary continuation, you might technically remain an employee during the severance period, which could restrict outside employment. Some agreements explicitly prohibit working for competitors during severance, especially if you’re being paid not to compete. Always review restrictive covenants carefully—they might limit your employment options even after severance ends.

Both payment methods have trade-offs. A lump sum gives you immediate access to funds and a clean break, allowing you to start new employment right away and potentially collect unemployment sooner. However, it triggers higher tax withholding (22% federal on supplemental wages) and might push you into a higher tax bracket. Salary continuation spreads the tax impact, might preserve benefits longer, and provides a steady income, but delays unemployment eligibility and could complicate starting a new job. Consider your financial needs, job prospects, and tax situation when deciding.

It depends on the reason for termination. Companies typically offer severance for layoffs, restructuring, or position eliminations—situations where the job loss isn’t your fault. Termination for cause (misconduct, policy violations, poor performance) usually disqualifies you from severance, though “cause” must be clearly defined and documented. Even performance-based terminations sometimes result in severance offers if the employer wants to avoid potential disputes. If you’re offered severance after being fired, carefully review what rights you’re waiving—the company might be concerned about potential legal claims.

Never accept the first offer immediately. Use your review period to assess whether the package meets industry standards and your needs. Compare the financial terms, benefits continuation, and restrictive covenants against typical packages for your role and tenure. Consider the impact on unemployment benefits and future employment. Most importantly, understand exactly what claims you’re releasing. If the package seems light or includes overly restrictive terms, negotiate for improvements. Consulting with an employment attorney helps ensure you’re not leaving money on the table or accepting unfair restrictions on your career.