If you’ve discovered securities fraud or commodities violations at your workplace, you’re probably wondering: Should I report this? What protections exist? Here’s what you need to know: the SEC and CFTC offer some of the most robust whistleblower programs in federal law, providing both substantial financial rewards and strong anti-retaliation protections for employees who speak up about violations.

Unlike general employment whistleblower protections, these programs actively incentivize reporting through significant monetary awards while shielding you from workplace backlash. Understanding how these programs work can help you make an informed decision about reporting violations while protecting your career and financial future.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

Understanding SEC and CFTC Whistleblower Programs

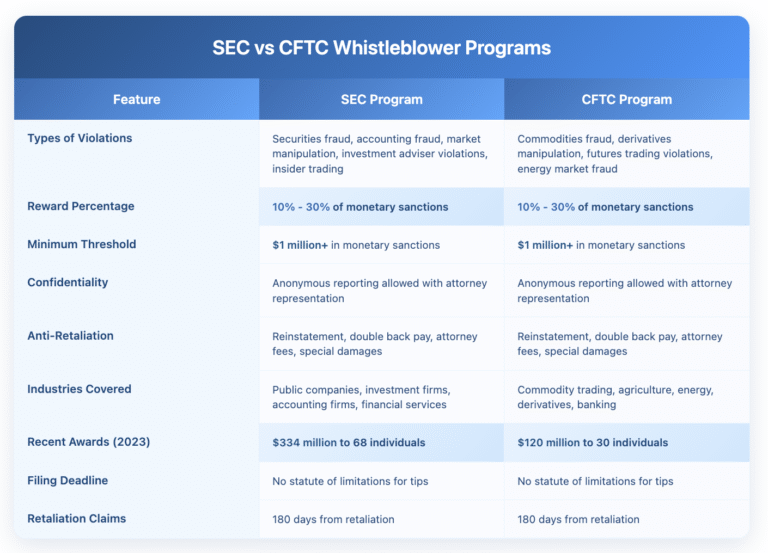

The Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) operate parallel whistleblower programs designed to uncover financial fraud and market manipulation. Both programs were strengthened significantly under the Dodd-Frank Act in 2010, creating powerful incentives for employees to report violations.

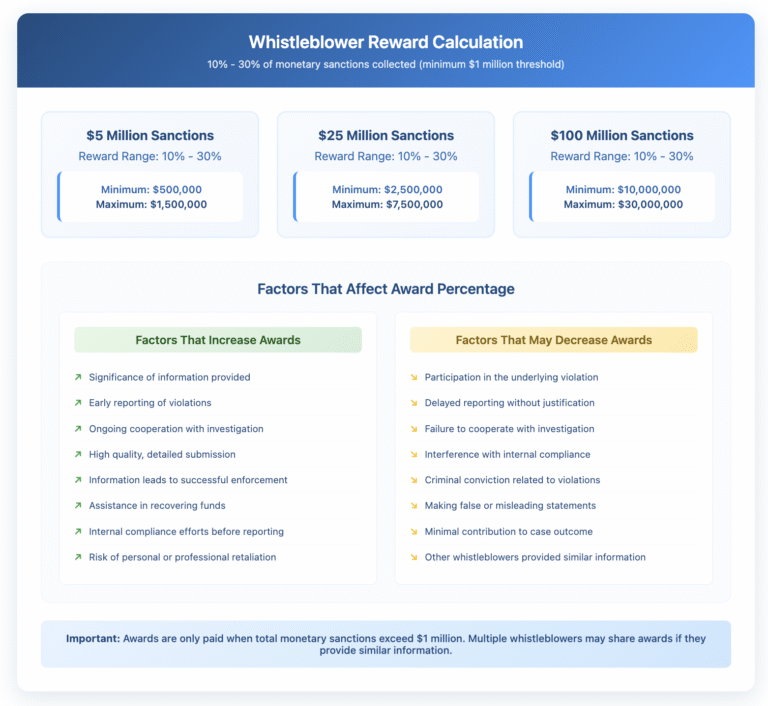

These programs differ from traditional anti-retaliation provisions in a crucial way: they don’t just protect you from punishment—they pay you for speaking up. When successful enforcement actions result from your tip, you can receive between 10% and 30% of the monetary sanctions collected.

Types of Violations That Qualify for Rewards

Both programs cover a wide range of financial misconduct that employees might observe in their workplaces. Understanding what qualifies helps you recognize when you might have a viable whistleblower claim.

SEC Whistleblower Program Coverage

The SEC program covers violations of federal securities laws, which often occur in various workplace contexts. Common violations include securities fraud, accounting fraud, market manipulation, and investment adviser violations.

You might observe these violations if you work for publicly traded companies, investment firms, accounting firms, or financial service providers. The violations don’t need to occur on U.S. exchanges—the SEC’s jurisdiction extends to conduct that has a connection to U.S. markets.

CFTC Whistleblower Program Coverage

The CFTC program focuses on violations of the Commodity Exchange Act, including commodities fraud, manipulation of derivatives markets, and violations of CFTC regulations. These violations often occur in agricultural commodities, energy markets, and financial derivatives trading.

Employees at commodity trading firms, agricultural companies with hedging operations, energy companies, and banks involved in derivatives trading frequently encounter potential CFTC violations.

Reward Structure and Financial Incentives

Both programs offer substantial financial incentives, but the structure and requirements differ slightly between the SEC and CFTC.

SEC Reward Framework

The SEC pays awards when monetary sanctions exceed $1 million. The award percentage ranges from 10% to 30% of the total monetary sanctions, with the exact percentage determined by factors including the significance of your information and your cooperation with the investigation.

Recent SEC awards have been substantial. In 2023, the SEC paid over $334 million to 68 individuals, demonstrating the program’s continued effectiveness and generosity to qualified whistleblowers.

CFTC Reward Structure

The CFTC follows a similar structure, paying awards between 10% and 30% of monetary sanctions exceeding $1 million. The CFTC considers factors like the significance of information provided, the degree of assistance offered, and whether you participated in or attempted to impede the investigation.

Anti-Retaliation Protections for Financial Whistleblowers

Both the SEC and CFTC programs include robust workplace retaliation protections that go beyond general employment law safeguards. These protections recognize that financial fraud whistleblowing often involves high-stakes situations where employers might aggressively retaliate.

Scope of Protected Activity

You’re protected from retaliation for reporting potential violations to the SEC or CFTC, assisting in investigations, or making disclosures required by securities or commodities laws. The protection covers both formal whistleblower submissions and internal reporting that relates to potential violations.

The anti-retaliation provisions protect against termination or demotion, but also cover subtle forms of retaliation like reduced responsibilities, negative performance reviews, or harassment or hostile work environment creation.

Remedies for Retaliation

If you face retaliation for protected whistleblowing activity, both programs provide comprehensive remedies. You can receive reinstatement, double back pay with interest, and compensation for litigation costs, including reasonable attorneys’ fees.

The programs also allow for special damages, including compensation for reputation damage and other consequential losses resulting from retaliation. This broader remedy structure often provides more comprehensive relief than traditional employment law claims.

The Confidential Reporting Process

Both the SEC and CFTC allow anonymous reporting, which can help protect you from immediate workplace retaliation while your allegations are investigated.

Filing Your Initial Report

You can submit tips online, by mail, or by fax to either agency. The submission should include as much detail as possible about the alleged violations, including specific facts, timeframes, and documentation if available.

While you can report anonymously, you must be represented by an attorney to be eligible for a whistleblower award. This requirement ensures proper legal guidance while maintaining your confidentiality during the investigation process.

Investigation and Follow-Up

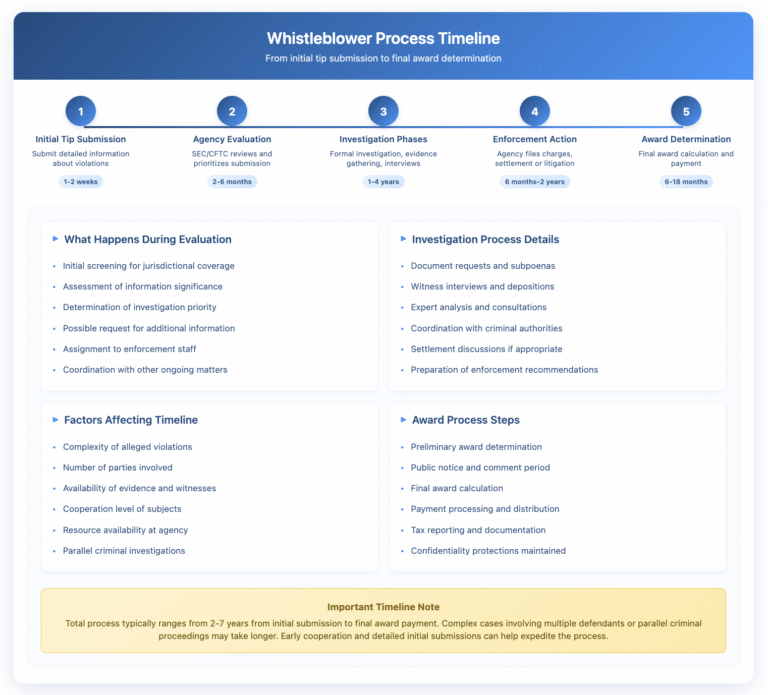

After submitting your tip, the agencies will evaluate the information and may contact you for additional details. Throughout this process, your identity remains confidential unless you consent to disclosure or a court orders it.

The investigation timeline varies significantly based on the complexity of the alleged violations. Some cases resolve within months, while complex fraud schemes may take years to fully investigate and prosecute.

Recent Legal Developments and Precedents

The SEC and CFTC whistleblower programs continue evolving through agency guidance and court decisions that affect how these protections work in practice.

Digital Asset Enforcement Expansion

In 2023, the SEC issued its first whistleblower award related to digital asset violations, signaling expanded enforcement in cryptocurrency and blockchain technologies. This development is particularly relevant for employees at fintech companies, cryptocurrency exchanges, and traditional financial firms entering the digital asset space.

The case involved an employee who reported unregistered securities offerings related to digital tokens. The award demonstrates that the SEC’s whistleblower program applies fully to emerging financial technologies, creating new opportunities for employees in this rapidly growing sector.

Enhanced Protection for Internal Reporting

Recent court decisions have strengthened protections for employees who report violations internally before contacting regulators. In Berman v. Neo@Ogilvy LLC (2022), the Second Circuit clarified that internal reporting of securities violations can qualify for anti-retaliation protection even without formal SEC involvement.

This development is significant because it protects employees who follow company compliance procedures before escalating to regulators. You don’t need to bypass internal channels to receive anti-retaliation protection, provided your internal reporting relates to potential securities or commodities violations.

Strategic Considerations for Potential Whistleblowers

Deciding whether to report violations involves weighing multiple factors beyond just the legal protections available. Understanding these considerations helps you make an informed decision about how and when to proceed.

Timing Your Report

The “first to file” principle means that only the first whistleblower to report specific violations typically receives an award. If you’re aware of potential violations, delaying your report could cost you the opportunity to participate in the program.

However, you should gather sufficient information to make your report credible and detailed. Vague allegations without supporting facts are less likely to result in successful enforcement actions or substantial awards.

Documentation and Evidence Preservation

Document what you know about potential violations, but be careful to only preserve information you’re legally authorized to access. Taking confidential documents or accessing systems beyond your authorization can undermine your whistleblower protection and create legal liability.

Focus on documenting patterns of conduct, policy violations, and publicly observable behaviors rather than accessing restricted information. Your insider knowledge about how the violations work is often more valuable than specific documents.

Career and Industry Considerations

Consider how reporting might affect your long-term career prospects within your industry. While anti-retaliation laws provide strong protections, practical considerations about future employment opportunities deserve attention in your decision-making process.

Some successful whistleblowers have used their awards to transition to new careers or industries, while others have remained in their fields with enhanced reputations for integrity. The impact varies significantly based on individual circumstances and industry dynamics.

Maximizing Your Protection and Potential Award

Several strategies can help strengthen both your legal protections and potential award if you decide to report violations.

Working with Experienced Counsel

Both programs require attorney representation for award eligibility, making the choice of counsel crucial to your success. Look for attorneys with specific experience in SEC or CFTC whistleblower cases, not just general employment law experience.

Experienced whistleblower attorneys understand how to present information to maximize both enforcement likelihood and award potential. They also know how to coordinate with agency staff and navigate the complex procedural requirements that affect award eligibility.

Coordinating with Employment Law Protections

SEC and CFTC whistleblower protections can work alongside traditional employment law remedies. If you face workplace retaliation, you might have claims under both whistleblower anti-retaliation provisions and general protected activities laws.

This coordination can provide multiple avenues for legal relief and compensation, potentially resulting in more comprehensive remedies than relying on a single legal theory.

Common Mistakes That Reduce Success

Understanding potential pitfalls helps you avoid problems that could undermine your whistleblower protection or award eligibility.

Inadequate Initial Submissions

Vague or incomplete initial submissions reduce the likelihood of successful enforcement actions. While you don’t need every piece of evidence before reporting, your submission should include sufficient detail for investigators to understand and evaluate the alleged violations.

Take time to organize your information clearly and provide context that helps investigators understand the significance of the violations you’re reporting.

Delay in Reporting Retaliation

If you face retaliation after making a whistleblower report, you must typically file anti-retaliation claims within specific timeframes. For SEC whistleblower retaliation claims, you generally have 180 days from when the retaliation occurred.

Missing these deadlines can forfeit your right to seek remedies for retaliation, even if the underlying whistleblower report leads to successful enforcement and awards.

Next Steps: Protecting Your Rights and Interests

If you’ve identified potential securities or commodities violations in your workplace, taking the right steps now can protect both your legal rights and career interests.

Start by assessing whether the conduct you’ve observed falls within SEC or CFTC jurisdiction. Securities violations typically involve publicly traded companies, investment advisers, or securities transactions, while CFTC violations involve commodities, derivatives, or futures trading.

Document what you know about the violations while being careful to only preserve information you’re legally authorized to access. Your observations and knowledge about how violations work are often more valuable than specific confidential documents.

Consider consulting with attorneys experienced in SEC or CFTC whistleblower cases before making any reports. This consultation can help you understand your options, evaluate the strength of your potential case, and develop a strategy that maximizes both your protection and potential rewards.

The SEC and CFTC whistleblower programs provide powerful tools for employees who expose financial violations while protecting their careers and financial interests. However, these programs involve complex procedural requirements and strategic considerations that benefit from experienced legal guidance.

Take Action to Protect Your Rights

Discovering financial fraud or market violations puts you in a unique position to serve the public interest while potentially securing substantial financial rewards. The SEC and CFTC whistleblower programs provide robust protections and incentives, but success requires careful navigation of complex legal requirements.

If you’ve observed potential securities or commodities violations in your workplace, consulting with experienced whistleblower counsel can help you understand your options and develop the best strategy for your situation. The combination of anti-retaliation protections and financial incentives makes these programs powerful tools for addressing financial misconduct while protecting your career.

Contact Nisar Law Group today for a confidential consultation about your potential whistleblower case. Our experienced attorneys can help you evaluate the strength of your allegations, understand the filing process, and take the right steps to protect both your legal rights and financial interests while serving the broader public good.