When you’re considering reporting workplace wrongdoing, understanding your state’s specific whistleblower protections could mean the difference between comprehensive legal coverage and leaving yourself vulnerable to retaliation. While federal laws provide a foundation of protection, many states offer stronger safeguards, broader coverage, and better remedies for employees who speak up about violations.

Here’s what you need to know about navigating the complex landscape of state whistleblower laws and how they can provide superior protection compared to federal alternatives.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

Why State Laws Often Provide Better Protection

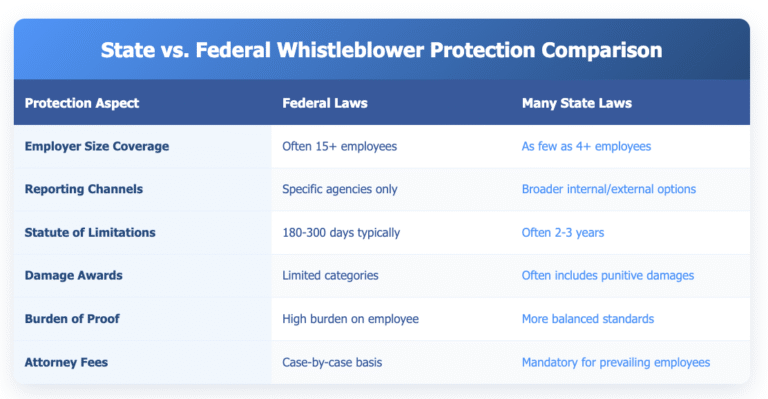

State whistleblower statutes frequently offer advantages that federal laws simply don’t match. Many states have eliminated procedural hurdles that can derail federal claims, extended coverage to smaller employers, and created more generous damage awards.

The key difference lies in how states approach the balance between encouraging reporting and protecting employers from frivolous claims. Most state laws tilt more heavily toward employee protection, recognizing that workplace retaliation is often subtle and difficult to prove under strict federal standards.

Understanding Coverage: Which Employees Are Protected

State whistleblower laws often cast a wider net than their federal counterparts. While federal statutes typically focus on specific industries or types of violations, state laws frequently provide blanket protection for reporting any legal violation or public safety concern.

Consider these coverage differences: Federal laws might protect you only if you work for a company with 15 or more employees and report specific regulatory violations. Your state law might protect any employee who reports violations of any law to any supervisor or government agency, regardless of company size.

This broader coverage becomes crucial if you work for a smaller employer or if the wrongdoing you’ve witnessed doesn’t fall neatly into federal regulatory categories. State protections often fill these gaps with comprehensive anti-retaliation provisions.

Key State Protections: A Regional Breakdown

Northeast Region Protections

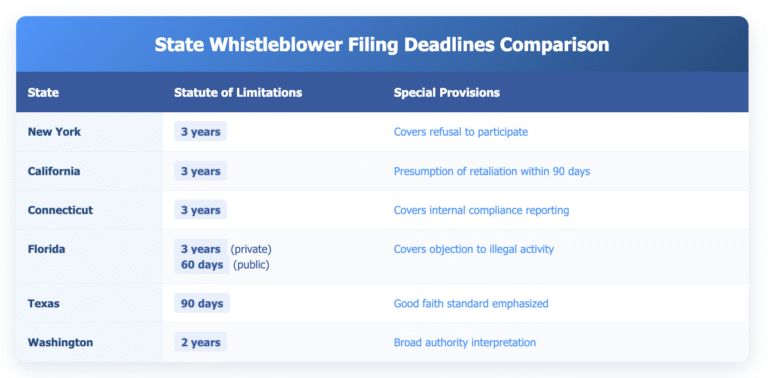

New York leads with some of the nation’s strongest whistleblower protections. The state’s Labor Law Section 740 protects employees who report violations of any law, rule, or regulation that creates substantial danger to public health or safety.

New York’s law covers all employers and provides a three-year statute of limitations—significantly longer than most federal alternatives. The law also explicitly protects employees who refuse to participate in illegal activities, not just those who report them.

Connecticut offers similar broad protection but adds unique coverage for employees who report human rights violations or ethics violations. The state also provides protection for employees who report violations to internal compliance programs, making it safer to use company reporting channels.

Western States Leading Innovation

California provides exceptionally comprehensive whistleblower protection through multiple statutes. The state’s Labor Code Section 1102.5 protects disclosure of information about violations of state or federal statutes or regulations to government agencies or to supervisors.

California’s law is particularly employee-friendly because it presumes retaliation if adverse action occurs within 90 days of a protected disclosure. This shifts the burden to employers to prove legitimate business reasons for any negative employment actions.

Washington recently strengthened its whistleblower protections by expanding coverage to include reports made to any person with authority to investigate or remedy the violation. This means employees can safely report to supervisors, compliance officers, or external agencies with equal protection.

Southern State Variations

Florida provides protection under the Whistleblower’s Act for public employees and the Private Sector Whistleblower Act for private employees. Florida’s approach is notable for specifically protecting employees who object to or refuse to participate in any activity that they reasonably believe violates a law.

Texas offers protection through the Texas Whistleblower Act for public employees and various industry-specific statutes for private sector workers. Texas law specifically protects good faith reports of violations of law to appropriate law enforcement authorities.

Practical Differences in Reporting Procedures

State laws often provide more flexibility in how and where you can report violations without losing legal protection. While federal laws typically require reporting to specific agencies through formal channels, state laws frequently recognize the reality of workplace hierarchies and internal reporting systems.

Many state statutes protect employees who report internally first, recognizing that most workers naturally turn to supervisors or HR departments before considering external agencies. This practical approach acknowledges that internal reporting can be effective while still providing legal protection if the employer retaliates instead of addressing the problem.

The timing requirements also tend to be more forgiving under state law. Where federal statutes might require reporting within specific timeframes or lose protection, state laws often focus on whether the employee had a reasonable belief that a violation occurred, regardless of exact timing.

Remedies and Damages: Where States Often Excel

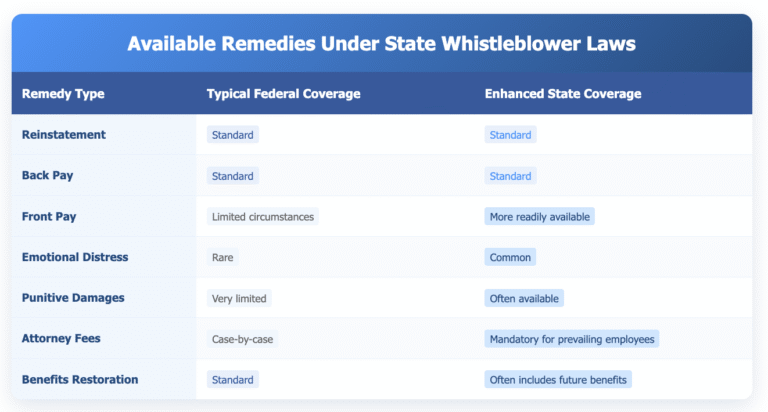

State whistleblower laws frequently provide more comprehensive remedy packages than federal alternatives. While federal statutes often limit damages to reinstatement and back pay, state laws commonly include additional categories that better reflect the real impact of retaliation.

Many states also provide for enhanced damages when employers engage in particularly egregious retaliation. This might include doubling damage awards or adding punitive damages designed to deter future violations.

The attorney fee provisions in state laws often make pursuing claims more feasible. While federal statutes may or may not provide fee-shifting, most comprehensive state whistleblower laws require employers to pay the prevailing employees’ attorney fees and costs.

Choosing Between State and Federal Protections

You don’t always have to choose between state and federal protections—many situations allow you to pursue claims under both. However, understanding the strategic advantages of each can help you make informed decisions about how to proceed.

Consider federal protections when the violation clearly falls within a specific regulatory scheme, when you need the resources of a federal agency investigation, or when federal remedies include unique provisions like whistleblower reward programs.

Choose state protections when you need broader coverage, longer filing deadlines, more comprehensive damages, or when the federal regulatory framework doesn’t clearly apply to your situation. State laws are often more straightforward and don’t require navigating complex federal bureaucracies.

Common Pitfalls and How to Avoid Them

One significant pitfall involves assuming that stronger state protections automatically apply to your situation. Employment law can involve complex jurisdictional questions, especially if you work remotely, travel for work, or if your employer operates in multiple states.

Another common mistake is failing to preserve both state and federal options by missing different filing deadlines. State and federal statutes often have different limitation periods, and missing one deadline might eliminate that avenue for protection even if the other remains available.

Document everything from the beginning, regardless of which legal avenue you ultimately choose. Both state and federal whistleblower claims rely heavily on your ability to demonstrate the connection between your protected activity and any subsequent retaliation.

Industry-Specific State Protections

Many states have developed specialized whistleblower protections for specific industries beyond general employment statutes. Healthcare workers often receive enhanced protections for reporting patient safety violations, while financial sector employees may have additional state-level protections for reporting securities violations or banking irregularities.

Environmental violations frequently trigger both state and federal protections, but state laws often provide broader coverage for environmental health concerns that might not meet strict federal regulatory definitions.

Educational institutions may be subject to state-specific whistleblower protections that go beyond federal Title IX or other educational regulations, particularly regarding financial aid fraud or academic integrity violations.

Navigating Multi-State Employment Situations

Remote work and multi-state business operations create complex questions about which state’s whistleblower laws apply to your situation. Generally, you may be protected by the laws of the state where the violation occurred, where you work, where your employer is headquartered, or where you experienced retaliation.

This complexity can actually work in your favor by providing multiple potential sources of legal protection. However, it also requires careful analysis to ensure you’re maximizing your protections while meeting all applicable procedural requirements.

Some states have specific provisions addressing multi-jurisdictional employment, while others rely on general conflict-of-laws principles. Understanding these nuances early can prevent strategic mistakes that might limit your options later.

Taking Action: Your Next Steps

If you’re considering reporting workplace violations, start by researching both your state’s specific whistleblower protections and any applicable federal statutes. Document the violations you’ve observed and any adverse treatment you’ve experienced, but don’t assume you have to choose immediately between different legal frameworks.

Consider consulting with an employment attorney who understands both state and federal whistleblower protections before making your report. This consultation can help you understand which laws provide the strongest protection for your specific situation and ensure you preserve all available legal options.

Remember that whistleblower protections are only as strong as your ability to prove retaliation occurred. Start documenting everything now—the violations you’ve observed, your reporting activities, and any changes in how you’re treated at work.

The landscape of whistleblower protection continues to evolve, with many states strengthening their laws in response to high-profile retaliation cases. Understanding your rights under state law isn’t just about legal technicalities—it’s about ensuring you have the strongest possible protection when you make the courageous decision to speak up about wrongdoing.

If you’re facing a whistleblower situation or believe you’ve experienced retaliation for reporting violations, contact Nisar Law Group for a confidential consultation. Our experienced employment attorneys can help you understand which state and federal protections apply to your situation and develop a strategy that maximizes your legal safeguards while achieving your goals of stopping workplace wrongdoing.