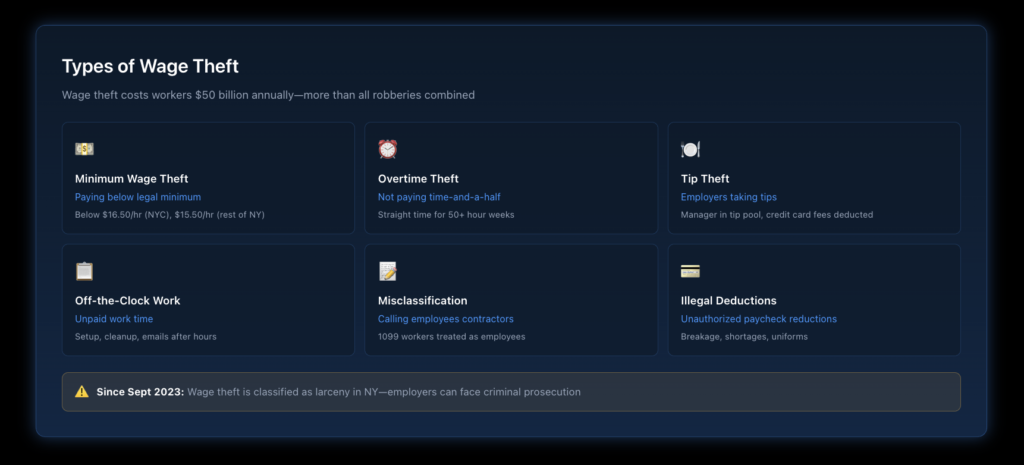

Wage theft is when your employer fails to pay you what you’re legally owed. It includes unpaid overtime, minimum wage violations, tip theft, illegal deductions, and off-the-clock work. Wage theft costs American workers an estimated $50 billion annually—more than all robberies, burglaries, and auto thefts combined. Since September 2023, wage theft has been classified as larceny under New York Penal Law, meaning employers can face criminal prosecution.

Key Takeaways

- Wage theft includes any failure to pay wages you’re legally entitled to receive.

- Common forms include unpaid overtime, minimum wage violations, tip theft, illegal deductions, and off-the-clock work.

- Wage theft is now classified as larceny in New York—a crime.

- Workers can recover unpaid wages plus 100% liquidated damages under NY law.

- You have six years to file a wage theft claim in New York.

- Your employer cannot retaliate against you for reporting wage theft.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Forms Does Wage Theft Take?

What Is Minimum Wage Theft?

Paying less than New York’s legal minimum wage is wage theft. As of 2025, the minimum is $16.50/hour in NYC, Long Island, and Westchester, and $15.50/hour elsewhere in New York. Even small shortfalls add up over time.

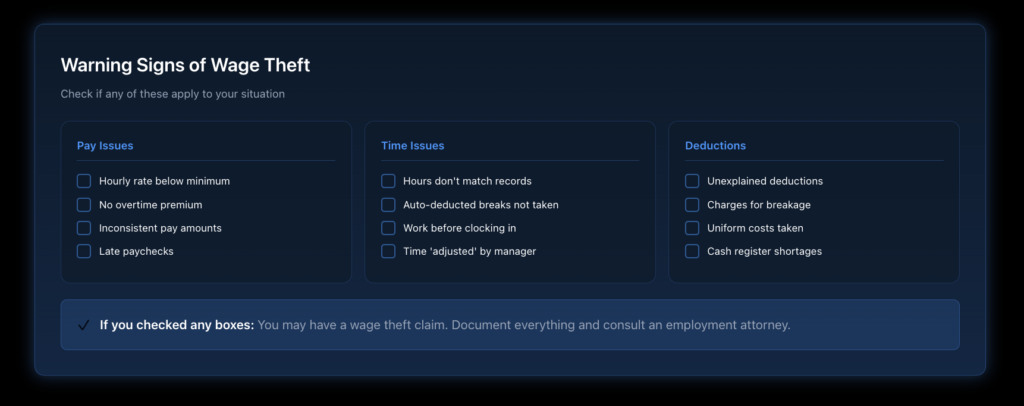

Warning signs:

- Your hourly rate is below minimum wage

- Deductions push your effective rate below the minimum

- You’re paid a flat amount that works out to less than minimum wage for hours worked

- Your employer calls you an “intern” when you’re doing regular work

Learn more about minimum wage rights in New York.

What Is Overtime Theft?

Not paying time-and-a-half for hours over 40 per week is one of the most common forms of wage theft. Under both federal and New York law, most workers are entitled to overtime pay.

Warning signs:

- You work over 40 hours but receive your regular rate for all hours

- Your employer says you’re “exempt” from overtime when you don’t meet the exemption requirements

- You’re paid a salary with no overtime, regardless of hours

- Your employer averages your hours across pay periods to avoid overtime

See our guide on what to do if you’re not getting overtime pay.

What Is Tip Theft?

When employers illegally take, keep, or redirect tips that belong to workers, that’s tip theft. Tips are the property of the employee who earns them.

Warning signs:

- Your employer takes a portion of your tips

- Credit card processing fees are deducted from tips

- Managers or owners participate in tip pools

- Your employer keeps “service charges” without giving them to the staff

- You’re not receiving the tip credit makeup when tips fall short

Read about tip theft laws in New York.

What Are Illegal Deductions?

Employers cannot make deductions from your pay for certain business expenses, especially if deductions bring you below minimum wage.

Warning signs:

- Deductions for cash register shortages

- Deductions for breakage or damaged merchandise

- Deductions for customer walkouts

- Deductions for uniforms (in many cases)

- Deductions for tools required for work

What Is Off-the-Clock Work?

Requiring work without pay is wage theft. All the time you spend working must be compensated.

Warning signs:

- Required to arrive early but not clock in until the shift starts

- Staying late to finish tasks after clocking out

- Working through unpaid meal breaks

- Answering work calls or emails off the clock

- Performing setup or cleanup outside recorded hours

What Is Time Record Manipulation?

Falsifying time records to reduce hours paid is wage theft.

Warning signs:

- Time clock rounds down but never up

- Manager “adjusts” your time after you clock out

- Hours mysteriously disappear from your pay stub

- Automatic deduction for breaks you didn’t take

- Time shaved from the beginning or end of shifts

What Is Misclassification?

Calling employees “independent contractors” to avoid paying minimum wage, overtime, or benefits is illegal when it doesn’t reflect the true working relationship.

Warning signs:

- You’re called a “1099 worker,” but you work set schedules

- Your employer controls how you do your work

- You use company equipment and resources

- You work primarily for one company

- You don’t have your own business

See our guide on independent contractor misclassification.

Which Industries Have the Most Wage Theft?

Where Is Wage Theft Most Common?

Wage theft happens in every industry, but it’s most prevalent in:

Industry | Common Violations |

Restaurants & Food Service | Tip theft, unpaid overtime, off-the-clock work |

Construction | Misclassification, cash payments, and unpaid travel time |

Retail | Illegal deductions, off-the-clock work, and minimum wage |

Home Care | Flat daily rates, no overtime, unpaid live-in hours |

Janitorial/Cleaning | Minimum wage violations, off-the-clock setup |

Warehouses & Delivery | Misclassification, unpaid loading time |

Nail Salons | Below-minimum wages, tip retention |

Who Is Most Vulnerable?

Workers most at risk for wage theft include:

- Immigrant workers (who may fear retaliation or deportation threats)

- Low-wage workers

- Workers are paid in cash

- Workers without union representation

- Workers in small businesses with limited oversight

- Workers with limited English proficiency

What Legal Protections Exist in New York?

What Laws Prohibit Wage Theft?

Federal Fair Labor Standards Act (FLSA): Establishes minimum wage, overtime, and recordkeeping requirements.

New York Labor Law: Provides stronger protections with higher penalties and longer time limits.

Wage Theft Prevention Act (WTPA): Requires employers to provide written wage notices and detailed pay stubs.

New York Penal Law (since Sept 2023): Classifies wage theft as larceny, enabling criminal prosecution.

What Are the Penalties for Employers?

Employers who commit wage theft face:

- Civil liability: Back wages plus liquidated damages up to 100%

- Interest: From when wages were due

- Attorney’s fees: Employer pays if worker wins

- Civil penalties: Per-employee fines for violations

- Criminal penalties: Since wage theft is now larceny, potential criminal prosecution, including possible felony charges for large amounts

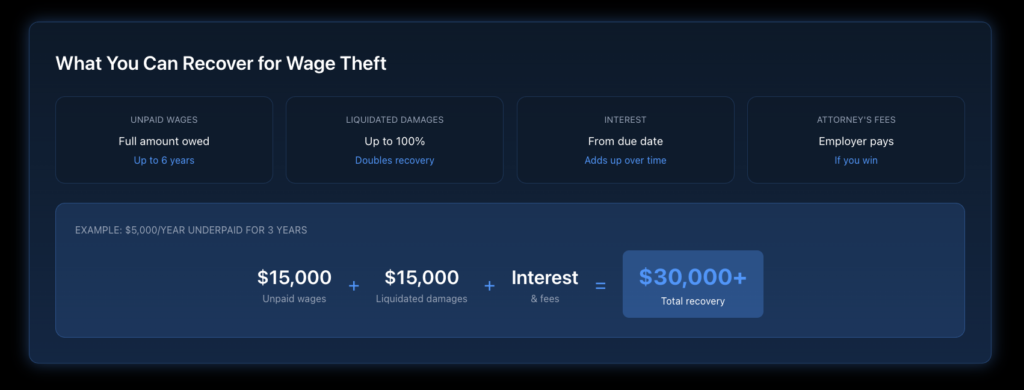

What Can You Recover for Wage Theft?

What Damages Are Available?

Under New York Labor Law:

Recovery Type | Amount |

Unpaid wages | Full amount owed for up to 6 years |

Liquidated damages | Up to 100% of unpaid wages |

Interest | From when wages were due |

Attorney’s fees | Employer pays if you win |

This means you can potentially recover more than double what you were originally owed.

What Should You Do If You Suspect Wage Theft?

How Do You Document Wage Theft?

Build your case by keeping records:

- Track hours: Keep a personal log of all hours worked

- Save pay stubs: Keep copies of every pay stub

- Document deductions: Note any amounts taken from your pay

- Save communications: Keep texts, emails, or messages about pay

- Note witnesses: Coworkers experiencing the same issues

What Are Your Reporting Options?

You can:

- File with the NYS Department of Labor: Free investigation, the state can order the employer to pay

- File a lawsuit: Work with an employment attorney for potentially higher recovery

- Join a collective action: If multiple workers are affected

- Report for criminal investigation: Contact the district attorney for serious cases

See our detailed guide on how to report wage theft in New York.

What Protections Against Retaliation Exist?

It’s illegal for employers to retaliate against workers who report wage theft. Protected activities include:

- Filing a complaint

- Participating in an investigation

- Testifying in proceedings

- Discussing wages with coworkers

If your employer retaliates, you have a separate legal claim. See our guide on retaliation protections.

Ready to Take Action?

If your employer is stealing your wages, you have powerful legal tools to fight back. Nisar Law Group helps workers throughout New York City, Long Island, Westchester, and across New York State recover stolen wages and hold employers accountable. We handle wage theft cases on a contingency basis—you pay nothing unless we recover money for you. Contact us today for a free consultation.

Frequently Asked Questions About Wage Theft in New York

Compare what you’re paid to what you should legally receive. Check if your hourly rate meets minimum wage, if you receive overtime for hours over 40, if all your hours are recorded, and if deductions are legitimate. If there’s a gap between what you’re owed and what you receive, you may be experiencing wage theft.

Yes. How you’re paid doesn’t affect your wage rights. Whether you receive a paycheck, direct deposit, or cash, your employer must pay minimum wage and overtime. Cash payment is often a red flag for wage theft—document your hours and amounts carefully.

No—retaliation is illegal. If your employer fires you, cuts your hours, or takes other adverse action because you reported wage theft, you have a separate retaliation claim with additional damages. Don’t let fear of retaliation stop you from asserting your rights.

It varies. DOL complaints typically take several months to over a year. Lawsuits can take months to years, depending on complexity and whether the case settles. Many cases resolve through settlement before trial.

You can file with the DOL without a lawyer. However, an attorney can help maximize your recovery, navigate complex issues, and provide representation if needed. Most wage theft attorneys work on contingency—you pay nothing unless you win.