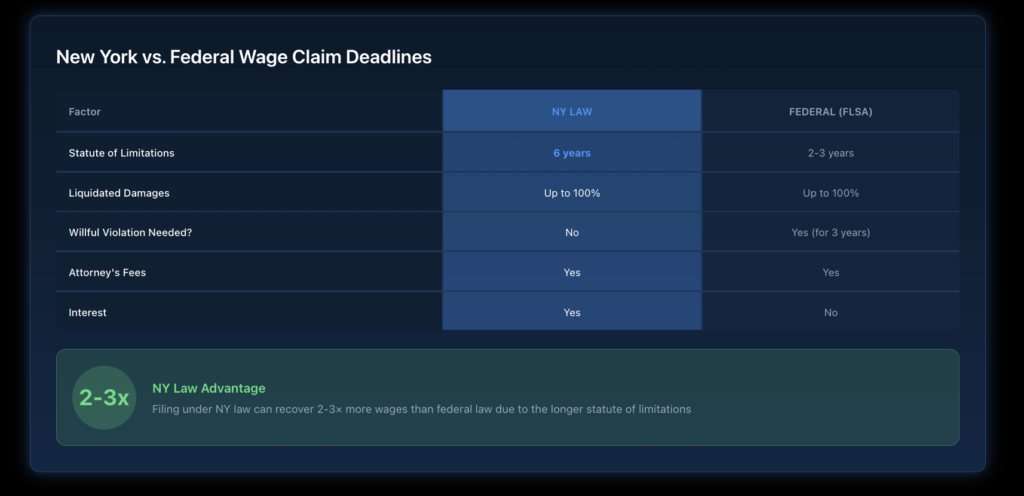

Under New York law, you have six years to file a claim for unpaid wages—one of the longest time limits in the country. This applies to minimum wage violations, unpaid overtime, tip theft, and other wage claims. Federal law provides only two to three years, making New York’s state law significantly more favorable for workers. But don’t wait—the sooner you file, the more you can recover.

Key Takeaways

- New York statute of limitations for wage claims: 6 years.

- Federal statute of limitations (FLSA): 2 years (3 years if willful).

- You can only recover wages going back as far as the statute of limitations allows.

- Acting sooner preserves more evidence and maximizes potential recovery.

- The clock starts when wages are due, not when you discover the violation.

- Filing stops the clock—wages continue accruing until you file.

- Some claims have shorter deadlines, so don’t assume you have 6 years for everything.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Are the Statute of Limitations for Wage Claims?

How Long Does New York Law Allow?

Under the New York Labor Law, you have six years from when wages were due to file a claim. This applies to:

- Minimum wage violations

- Unpaid overtime

- Tip theft

- Illegal deductions

- Unpaid wage supplements (vacation, commissions, bonuses)

- Late payment of wages

This six-year window is generous compared to most states and federal law.

How Long Does Federal Law Allow?

Under the Fair Labor Standards Act (FLSA):

- 2 years for non-willful violations

- 3 years for willful violations (employer knew or showed reckless disregard for the law)

Because New York’s deadline is longer, most wage claims in New York are filed under state law.

When Does the Clock Start?

The statute of limitations begins when each payment was due, not when you discovered the violation. Each pay period creates a separate claim with its own deadline.

Example: If you were underpaid every week for five years, each week’s underpayment has its own deadline. A claim filed today would recover underpayments from the last six years, but underpayments from seven years ago would be too old.

Why Does Filing Sooner Mean Recovering More?

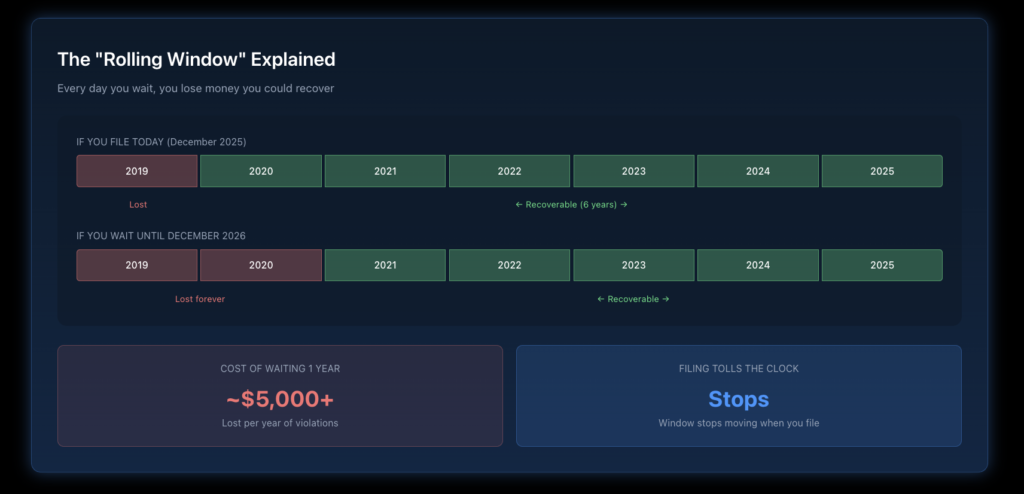

How Does the “Rolling” Deadline Work?

The statute of limitations is a rolling window. You can only recover wages going back six years from when you file. Every week you wait, you lose the ability to recover the oldest week of underpayment.

Example calculation:

Scenario | Years of Underpayment | Recovery if Filed Now | Recovery is Filed in 2 Years |

Ongoing violation since 2018 | 7 years | 6 years (2019-2025) | 6 years (2021-2027) |

Total owed per year: $5,000 | – | $30,000 | $30,000 |

Lost by waiting | – | $5,000 (2018) | $15,000 (2018-2020) |

Filing now protects more of your claim.

What Evidence Gets Lost Over Time?

Beyond the legal deadline, practical concerns favor filing sooner:

- Pay records: Employers must keep records for 6 years, but some don’t comply

- Witnesses: Coworkers may leave the company or forget details

- Your own records: Memories fade; documents get lost

- Employer solvency: Companies can go out of business or become judgment-proof

The stronger your evidence, the stronger your case.

Are There Shorter Deadlines for Some Claims?

What Claims Have Different Time Limits?

Some wage-related claims have shorter deadlines:

Claim Type | Deadline |

NYS DOL wage complaint | 6 years for most claims |

FLSA federal claim | 2-3 years |

Discrimination-based wage claim (EEOC) | 300 days (NY) |

Union grievance | Often 30-90 days per contract |

ERISA benefits claims | Varies |

If your wage issue involves discrimination, don’t assume you have six years—discrimination claims have much shorter deadlines.

What About Retaliation Claims?

If your employer retaliates against you for asserting wage rights, you may have a retaliation claim. The deadline depends on the specific law:

- State whistleblower claims: Varies by statute

- Title VII retaliation: 300 days to file with EEOC

- FLSA retaliation: 2-3 years

See our guide on retaliation protections for more information.

What Happens When You File a Wage Claim?

Does Filing Stop the Clock?

Yes. Once you file a claim (whether with the DOL or in court), the statute of limitations stops running for that claim. This is called “tolling.”

What Are the Steps After Filing?

If you file with NYS DOL:

- DOL acknowledges your complaint

- Investigator assigned

- Employer contacted for records and response

- Investigation conducted

- Determination issued

- To pay if violations are found

If you file a lawsuit:

- Complaint filed in court

- Employer served

- Discovery (exchanging evidence)

- Motion practice or settlement negotiations

- Trial if no settlement

See our full guide on how to report wage theft in New York.

What Can You Recover Within the Statute of Limitations?

What Damages Are Available?

Under New York Labor Law:

Recovery Type | Amount |

Unpaid wages | Full amount within a 6-year window |

Liquidated damages | Up to 100% of unpaid wages |

Interest | From when each payment was due |

Attorney’s fees | Employer pays if you win |

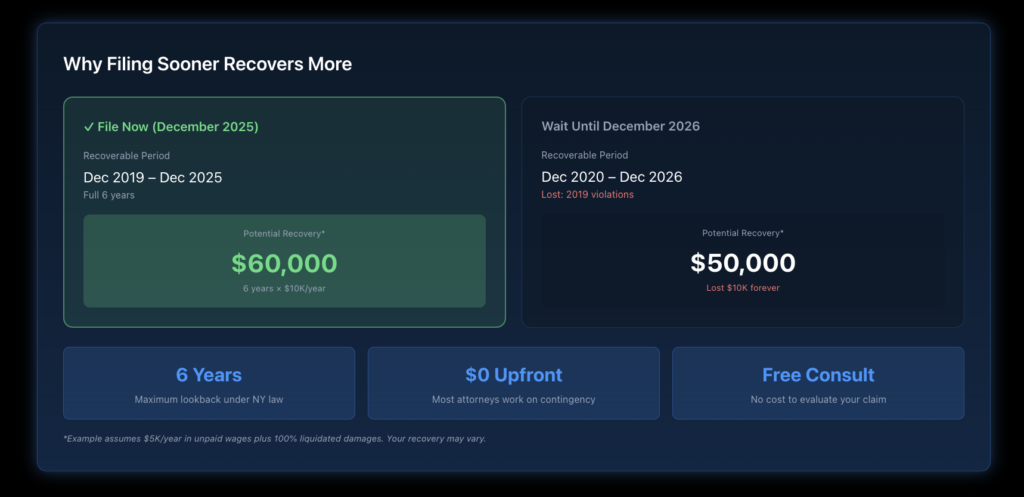

Example: Full vs. Partial Recovery

Worker underpaid $100/week in overtime since 2017 (8 years):

- Total owed: $100 × 52 weeks × 8 years = $41,600

- Recoverable if filed now (6 years): $31,200

- Plus liquidated damages: $31,200

- Total potential recovery: $62,400+

If they wait two more years:

- Recoverable (6 years): Still $31,200

- But the 2017-2019 underpayments are lost forever

What Should You Do Now?

How Do You Protect Your Claim?

Even if you’re not ready to file immediately:

Start documenting:

- Keep your own time records going forward

- Save all pay stubs

- Note any conversations about pay or hours

- Keep copies of schedules and policies

Calculate your potential claim:

- How long have you been underpaid?

- How much per week/month?

- What’s the total?

Consult an attorney:

- Most wage attorneys offer free consultations

- They can calculate your claim value

- They can advise on timing

When Is It Too Late to File?

Under New York law, you’re too late if:

- More than 6 years have passed since the wage was due, AND

- You haven’t filed a complaint or lawsuit

If you’re close to the deadline, act immediately. Even informal complaints to the DOL can preserve your rights.

Ready to Take Action?

Don’t let the statute of limitations reduce what you can recover. If your employer owes you wages, every week you wait is a week you may not be able to recover. Nisar Law Group helps workers throughout New York City, Long Island, Westchester, and across New York State file wage claims and recover what they’re owed. Contact us today for a free consultation.

Frequently Asked Questions About Wage Claim Deadlines in New York

No. The statute of limitations starts when each wage payment was due, not when you realized you were underpaid. This is why it’s important to act once you suspect a violation—you can’t wait and then claim you didn’t know.

For ongoing violations, each new underpayment has its own deadline. You can still file a claim for underpayments within the last six years, even if older violations are time-barred. Filing stops the clock and preserves your claim going forward.

In limited circumstances, yes. If the employer actively concealed the violation through fraud, the deadline might be “tolled” (paused) until you could reasonably discover it. But this is difficult to prove—don’t rely on it.

You can still file a wage claim after leaving the job. The deadline runs from when wages were due, not from your last day of employment. Former employees file wage claims all the time.

Both are valid options. DOL complaints are free and can be effective. Attorneys often achieve higher recoveries and faster resolutions, and work on contingency (you pay nothing unless you win). For significant claims, consulting an attorney makes sense.