If your employer is taking your tips, requiring illegal tip pools, deducting credit card fees from tips, or failing to make up the difference when tips don’t reach minimum wage, they’re breaking the law. Tips are your property under New York law—your employer cannot touch them except in very limited circumstances. Here’s what you need to know to protect your earnings.

Key Takeaways

- Tips are your property—employers cannot keep any portion.

- Managers and owners cannot participate in tip pools.

- Employers cannot deduct credit card processing fees from tips.

- If tips + cash wage don’t equal minimum wage, your employer must pay the difference.

- “Service charges” are not automatically tips—know the difference.

- You can recover stolen tips plus liquidated damages up to 100% and attorney’s fees.

- The statute of limitations is six years under New York law.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Is Tip Theft?

What Practices Constitute Tip Theft?

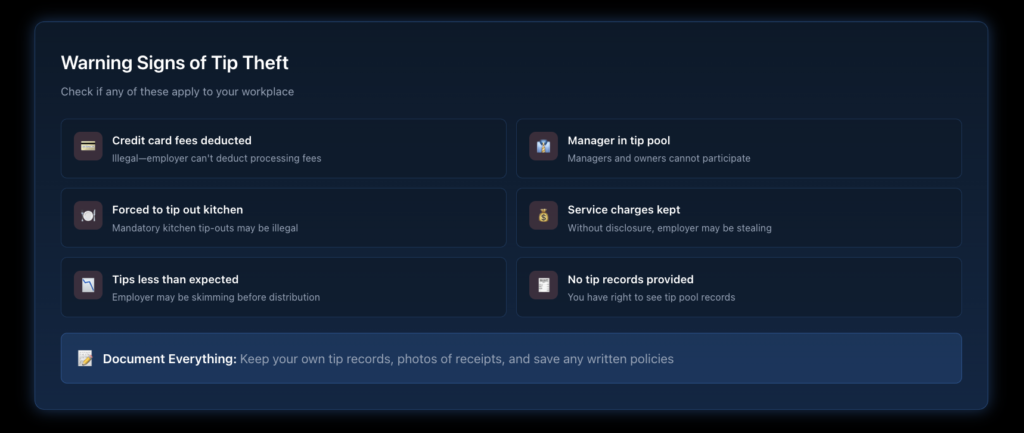

Tip theft occurs when your employer illegally takes, keeps, or redirects tips that belong to you. Common forms include:

Direct tip theft:

- Employer keeps a percentage of tips

- The owner or manager takes tips from the pool

- Tips collected but not distributed to employees

Illegal deductions:

- Credit card processing fees are deducted from credit card tips

- “House fees” taken from tips

- Deductions for walkouts or breakage taken from tips

Tip credit violations:

- Not paying the required cash wage

- Not making up the shortfall when tips don’t reach minimum wage

- Taking a larger tip credit than allowed

Illegal tip pooling:

- Requiring tips to be shared with management

- Including non-tipped employees who shouldn’t be in the pool

- Keeping the pool money rather than distributing it

Who Can Be Affected by Tip Theft?

Any tipped worker can be a victim, including:

- Restaurant servers and bartenders

- Food delivery workers

- Hotel housekeepers and bellhops

- Salon workers (hair stylists, nail technicians)

- Valets

- Tour guides

- Casino workers

How Does the Tip Credit Work in New York?

What Is the Tip Credit?

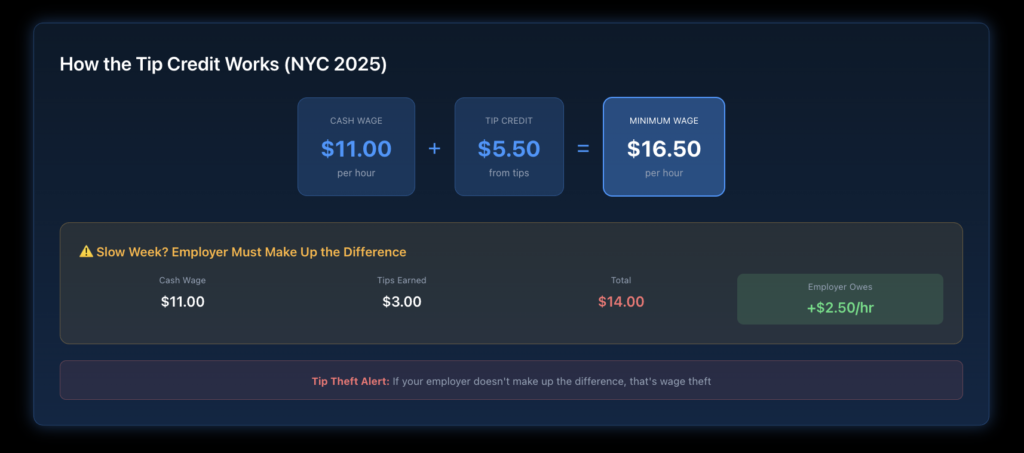

The tip credit allows employers to pay tipped workers a lower “cash wage” if tips bring total earnings to at least minimum wage. For 2025 in NYC, Long Island, and Westchester:

Worker Type | Cash Wage | Tip Credit | Minimum Required Total |

Food Service Workers | $11.00/hr | $5.50/hr | $16.50/hr |

Service Workers | $13.75/hr | $2.75/hr | $16.50/hr |

What Happens When Tips Don’t Reach Minimum Wage?

Your employer must make up the difference. If your tips plus cash wage don’t equal at least $16.50/hour (in the NYC area), your employer is required to pay the shortfall. This “tip credit makeup” is often not paid, which is wage theft.

Example: A server in Manhattan earns $11/hour cash wage. In a slow week, her tips average only $3/hour. Total: $14/hour. The employer must pay an additional $2.50/hour to bring her to the $16.50 minimum.

What Requirements Must Employers Meet to Use the Tip Credit?

To legally take a tip credit, employers must:

- Inform employees about the tip credit before they start

- Allow employees to keep all tips (except for valid tip pooling)

- Pay at least the minimum cash wage for the worker type

- Make up any shortfall to reach the full minimum wage

Failure to meet these requirements means the employer cannot use the tip credit and must pay full minimum wage, plus allow employees to keep all tips.

What Are the Rules for Tip Pools in New York?

What Makes a Tip Pool Legal?

Tip pooling is legal in New York, but only under specific conditions:

Who CAN be in a tip pool:

- Servers

- Bartenders

- Bussers

- Food runners

- Hosts (in some cases)

- Other employees who “customarily and regularly receive tips.”

Who CANNOT be in a tip pool:

- Owners

- Managers with supervisory authority

- Employees who don’t regularly receive tips (traditionally back-of-house, though rules are evolving)

Can Kitchen Staff Be Included in Tip Pools?

The rules around tipping kitchen staff have evolved. Generally, mandatory tip sharing with traditionally non-tipped employees like cooks and dishwashers has been restricted. However, employers can pass along voluntary direct tips to kitchen staff. The rules are complex—if you’re required to share tips with kitchen staff, consult an attorney about whether it’s legal.

What About Service Charges?

Service charges added to bills (like “automatic gratuity” on large parties) are not automatically tips. Unless the employer clearly and prominently communicates that the charge goes entirely to employees as a tip, they can keep it.

What to look for:

- Does the menu or bill state the service charge is “distributed to employees” or is it a “gratuity”?

- Is the language clear and prominent?

- Ask your employer in writing how service charges are distributed

If unclear, the service charge may not be a tip—and your employer may be legally keeping it (even if it seems unfair).

What Deductions Are Illegal from Tips?

Can Employers Deduct Credit Card Fees?

No. Under New York law, employers cannot deduct credit card processing fees from tips. If a customer tips $20 on a credit card, you must receive the full $20—even if the employer pays a 3% processing fee.

This is a common violation. Check your pay carefully if you receive credit card tips.

Can Employers Deduct for Walkouts or Breakage?

No. Employers cannot deduct from tips (or wages) for:

- Customer walkouts

- Cash register shortages

- Broken dishes or equipment

- Mistakes on orders

These are business costs the employer must absorb.

What Should You Do If Your Tips Are Being Stolen?

How Do You Document Tip Theft?

Gather evidence of the violation:

- Track your tips: Record daily tip amounts from credit cards and cash

- Save pay stubs: Compare reported tips to what you actually received

- Document policies: Keep copies of any written tip policies

- Note practices: Document how tips are collected and distributed

- Save communications: Keep texts, emails, or messages about tips

What Are Your Recovery Options?

You can pursue stolen tips through:

- NYS Department of Labor: File a complaint for investigation

- Lawsuit: Work with an employment attorney to sue for stolen tips plus damages

- Collective action: If multiple workers are affected, join together

Learn more in our guide on how to report wage theft in New York.

What Can You Recover for Tip Theft?

What Damages Are Available?

Under New York Labor Law:

Recovery Type | Amount |

Stolen tips | Full amount for up to 6 years |

Tip credit violations | The difference between what you earned and the minimum wage |

Liquidated damages | Up to 100% of unpaid amounts |

Interest | From when tips were due |

Attorney’s fees | Employer pays if you win |

Example Recovery

A server whose employer kept 10% of credit card tips:

- Average weekly credit card tips: $500

- Amount stolen: $50/week

- Annual theft: $2,600

- Three years: $7,800

- Liquidated damages: $7,800

- Potential recovery: $15,600+ (plus interest and attorney’s fees)

Ready to Take Action?

If your employer is stealing your tips, you have legal options. Nisar Law Group helps tipped workers throughout New York City, Long Island, Westchester, and across New York State recover stolen tips and hold employers accountable. We understand the unique issues facing restaurant workers, salon employees, and other tipped workers. Contact us today for a free consultation.

Frequently Asked Questions About Tip Theft in New York

No. Managers and owners cannot participate in tip pools or receive any portion of employee tips. If your employer requires you to share tips with anyone who has supervisory authority, that’s illegal tip theft.

Tips are voluntary payments from customers directly to you. Service charges are mandatory charges added to bills by the employer. Unless the employer clearly states that service charges go to employees as gratuities, they may keep them. Ask about your employer’s policy in writing.

They can pay a lower cash wage, but your total earnings (cash wage + tips) must equal at least minimum wage. If tips fall short in any pay period, your employer must pay the difference. This “tip credit makeup” is frequently violated.

Yes. How you’re paid doesn’t affect your tip rights. Document your tips and hours carefully. Even without perfect records, you can estimate based on reasonable recollection.

No—retaliation is illegal. If your employer fires you, cuts your hours, or takes other adverse action for asserting your tip rights, you have a separate retaliation claim with additional damages.