If you work in a New York City restaurant—as a server, cook, busser, dishwasher, bartender, or any other position—you have specific wage rights that many employers violate. Restaurant workers are among the most frequently underpaid workers in the city, facing tip theft, unpaid overtime, illegal deductions, and minimum wage violations. Here’s what the law requires and what to do if your employer isn’t complying.

Key Takeaways

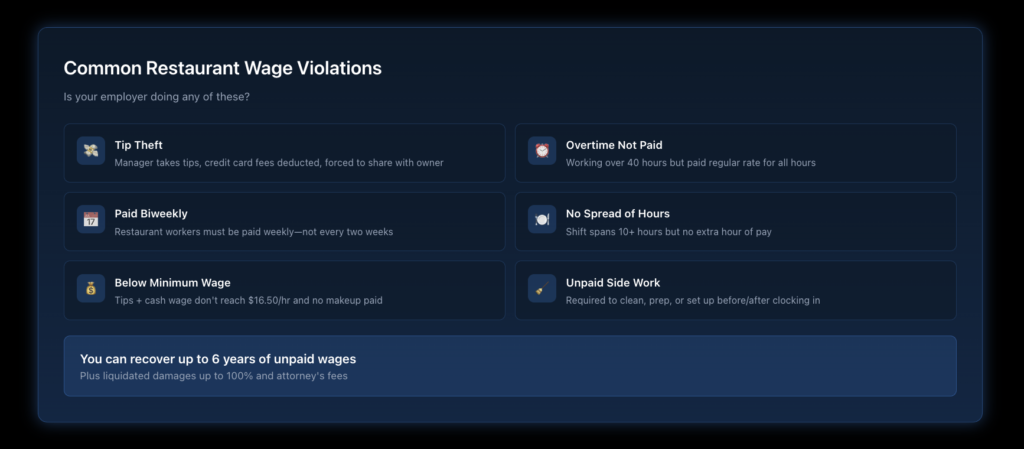

- NYC restaurant workers must earn at least $16.50/hour (including tips for tipped employees).

- Tipped workers have specific cash wage minimums: $11.00/hour for food service workers.

- Employers cannot take any portion of your tips (with limited exceptions for valid tip pools).

- Working over 40 hours requires time-and-a-half overtime pay.

- Spread of hours pay is required when your shift spans more than 10 hours.

- Restaurant employers must pay you weekly under New York law.

- You have six years to file a claim for wage violations.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Is the Minimum Wage for NYC Restaurant Workers?

What Are the Basic Rates?

As of January 1, 2025, all NYC workers must earn at least $16.50 per hour. For tipped restaurant workers, employers can pay a lower “cash wage” if tips bring the total to $16.50 or more:

Food Service Workers (servers, bartenders, etc.):

- Cash wage: $11.00/hour

- Tip credit: $5.50/hour

- Total must equal: $16.50/hour minimum

Service Workers (other tipped positions):

- Cash wage: $13.75/hour

- Tip credit: $2.75/hour

- Total must equal: $16.50/hour minimum

What Happens If Tips Don’t Reach Minimum Wage?

Your employer must make up the difference. If your tips plus cash wage don’t equal at least $16.50/hour for any workweek, your employer is required to pay the shortfall. This is called the “tip credit makeup,” and many restaurants illegally fail to pay it.

What About Kitchen Staff and Back-of-House?

Non-tipped workers—cooks, prep cooks, dishwashers, porters—must be paid at least $16.50/hour directly. They cannot be paid a lower “tipped” rate and must receive straight minimum wage or higher.

What Are the Rules for Tips in NYC?

Can Your Employer Take Your Tips?

No. Tips are the property of the employee. Your employer cannot:

- Keep any portion of your tips

- Require you to share tips with managers or owners

- Make deductions from tips for credit card processing fees

- Use tips to pay for walkouts, breakage, or shortages

Violations of these rules constitute tip theft.

What About Tip Pools?

Tip pooling is legal in New York, but only among employees who “customarily and regularly receive tips.” This typically includes servers, bartenders, bussers, and food runners. Employers, managers, and supervisors cannot participate in tip pools. Kitchen staff traditionally cannot participate unless a specific tip-sharing arrangement is disclosed.

What Are “Service Charges”?

Service charges added to bills (like “gratuity” on large parties) are not automatically tips. Unless the restaurant clearly communicates that the charge goes entirely to employees, they may keep it. Ask your employer about their policy and review your pay stubs.

How Does Overtime Work for Restaurant Workers?

When Are You Owed Overtime?

You’re entitled to 1.5 times your regular rate for every hour over 40 in a workweek. For example:

- Regular rate: $16.50/hour

- Overtime rate: $24.75/hour

This applies to all restaurant positions—servers, cooks, dishwashers, managers (unless truly exempt).

How Is Overtime Calculated for Tipped Employees?

For tipped workers, overtime is calculated on your full minimum wage rate, not just your cash wage:

- Regular rate: $16.50/hour (cash wage + tip credit)

- Overtime rate: $24.75/hour (1.5 × $16.50)

- Cash overtime wage: $19.25/hour ($24.75 minus $5.50 tip credit)

Many restaurants miscalculate this, paying overtime based only on the cash wage.

Are Restaurant Managers Exempt from Overtime?

It depends on their actual duties. Having the title “manager” doesn’t automatically exempt someone. To be exempt, a manager must:

- Be paid at least $1,237.50/week salary

- Have the primary duty of managing the restaurant or a department

- Regularly supervise at least two employees

- Have authority to hire or fire (or significant input on those decisions)

Many “managers” spend most of their time doing non-managerial work (cooking, serving, cashiering) and are entitled to overtime. This is a common misclassification issue.

What Is the Spread of Hours Pay?

What Does “Spread of Hours” Mean?

New York requires an extra hour of pay when your workday spans more than 10 hours. This applies even if you have breaks during that time.

Example: You work 11 AM to 10 PM with a 2-hour break. Even though you only worked 9 hours, your day spans 11 hours. You’re owed one extra hour at minimum wage ($16.50).

Why Do Restaurants Violate This?

Split shifts are common in restaurants—lunch and dinner service with a break in between. Many employers don’t realize or don’t comply with the spread of hours requirements. If your shift spans more than 10 hours, check that you’re receiving this extra pay.

What Other Wage Rules Apply to Restaurant Workers?

When Must You Be Paid?

New York law requires that restaurant workers be paid weekly. Biweekly or semi-monthly pay is not permitted for restaurant employees. If your employer pays you less frequently, that’s a violation.

What About Uniform Costs?

If you’re required to wear a uniform, your employer generally cannot deduct uniform costs from your pay if it would bring you below minimum wage. For workers earning minimum wage, the employer must provide and maintain uniforms.

Can Your Employer Deduct for Walkouts or Breakage?

No. Employers cannot deduct money from your wages for:

- Customer walkouts (dine and dash)

- Cash register shortages

- Broken dishes or equipment

- Mistakes on orders

These are costs of doing business that employers cannot pass on to employees.

What Should You Do If Your Rights Are Violated?

How Can You Document Violations?

Start keeping records now:

- Track your hours: Note when you start, take breaks, and end each day

- Keep pay stubs: Photograph or save every pay stub

- Note tip amounts: Record your daily tips

- Save schedules: Keep copies of posted schedules

- Document policies: If there are written policies about tips or pay, keep copies

What Are Your Options for Recovery?

You have several paths to recover unpaid wages:

- File with NYS DOL: Free complaint process, state investigates

- File a lawsuit: Work with an employment attorney for potentially higher recovery

- Join a collective action: If your employer underpays multiple workers

Our guide on how to report wage theft in New York explains each option in detail.

What Can You Recover?

Under New York law, you can recover:

- All unpaid wages for up to 6 years

- Liquidated damages up to 100% of the unpaid wages

- Interest from when wages were due

- Attorney’s fees (employer pays if you win)

What If You’re Undocumented?

Your immigration status does not affect your wage rights. The Department of Labor investigates complaints regardless of documentation. Employers who threaten to report workers to immigration for asserting wage rights face additional penalties.

Ready to Take Action?

If your restaurant employer is violating your wage rights, you don’t have to accept it. Nisar Law Group helps restaurant workers throughout New York City recover unpaid wages, tips, and overtime. We understand the unique wage issues facing restaurant workers and fight to hold employers accountable. Contact us today for a free consultation.

Frequently Asked Questions About Restaurant Worker Wage Rights in NYC

Under current New York law, mandatory tip sharing with non-customarily tipped employees (like kitchen staff) is generally prohibited unless very specific conditions are met. If your employer requires you to share tips with cooks or management, this may be illegal tip theft. The rules around tip pools are complicated—consult an attorney if you’re unsure.

Flat daily or weekly rates are legal, but your employer must still ensure you receive at least minimum wage for all hours worked, plus overtime for hours over 40. If your flat rate divided by hours worked falls below minimum wage, your employer is violating the law.

No. All time spent working must be compensated. If you’re required to clean, set up, or perform any work before clocking in or after clocking out, you must be paid for that time. If this time pushes you over 40 hours, you’re owed overtime.

Tips are voluntary payments from customers directly to employees. Service charges are mandatory charges added to bills. Unless the restaurant clearly communicates that 100% of service charges go to employees, they may not be. Ask your employer about their policy in writing.

No. Under New York law, employers cannot deduct credit card processing fees from tips. The full tip amount charged to the credit card must be paid to you. This is a common violation in restaurants.