If you work more than 40 hours a week and don’t receive overtime pay in New York, your employer is likely violating the law. You’re entitled to 1.5 times your regular hourly rate for every hour over 40, and you can recover up to six years of unpaid overtime plus additional penalties. New York’s wage laws are among the strongest in the country—here’s how to use them.

Key Takeaways

- Overtime pay in New York is 1.5 times your regular rate for hours over 40 per week.

- Most workers are entitled to overtime—being “salaried” doesn’t automatically exempt you.

- Employers use various illegal tactics to avoid paying overtime, including misclassification and time manipulation.

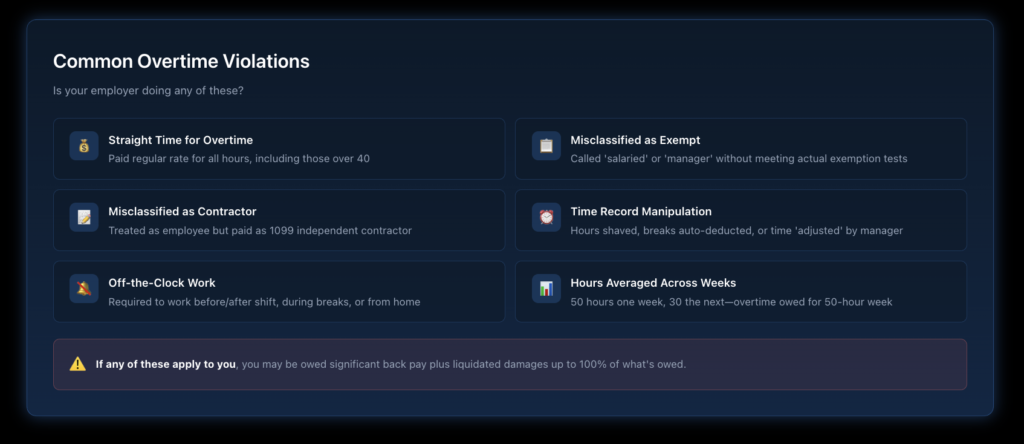

- Under New York law, you can recover six years of unpaid overtime plus liquidated damages (up to 100% extra).

- Your employer cannot retaliate against you for asserting overtime rights.

- You don’t need perfect records—employers are required to keep accurate time records.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

How Does Overtime Work in New York?

What Is the Overtime Rate?

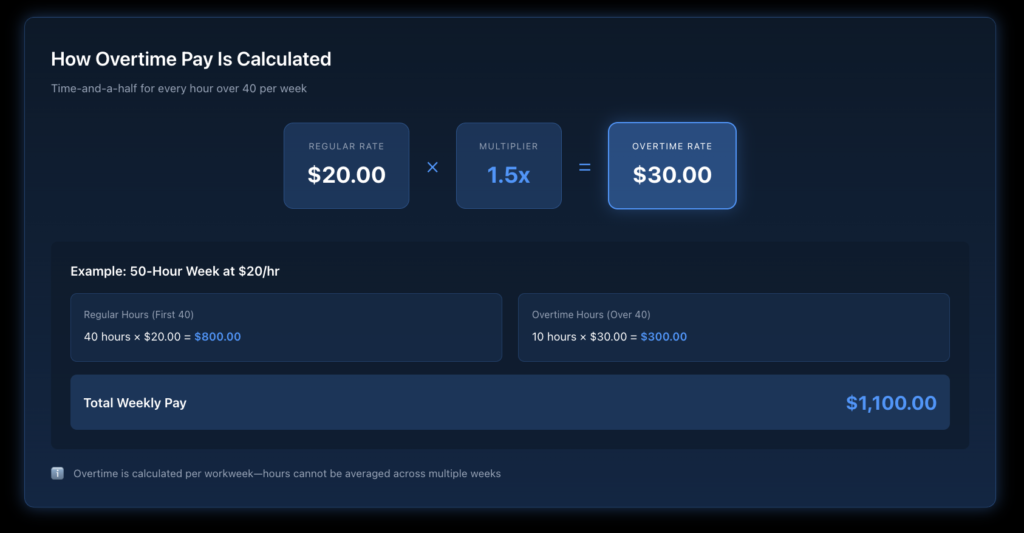

For every hour you work beyond 40 in a workweek, your employer must pay you at least time-and-a-half. If your regular rate is $20 per hour, your overtime rate is $30 per hour.

How Is a “Workweek” Defined?

A workweek is any fixed period of seven consecutive 24-hour days (168 hours total). Your employer can start the workweek on any day, but once established, they can’t change it to avoid paying overtime.

Critical point: Overtime is calculated weekly, not by pay period. If you work 50 hours one week and 30 the next, you’re owed 10 hours of overtime for the first week—even if the two-week average is 40 hours.

What Counts as “Hours Worked”?

All time spent performing job duties or under your employer’s control counts toward the 40-hour threshold:

- Preparation and cleanup time

- Required meetings or training

- Time putting on safety equipment or uniforms

- Waiting time while on duty

- Travel between job sites during the workday

- Work performed from home or off-site

If these activities push you over 40 hours, you’re entitled to overtime for that time.

Why Might Your Employer Not Be Paying Overtime?

Are You Being Paid “Straight Time” for Overtime Hours?

The most straightforward violation: your employer pays your regular rate for all hours, including overtime. If you worked 50 hours at $20/hour and received $1,000 instead of $1,100, you’re owed that extra $100 (plus penalties).

Is Your Employer Claiming You’re “Exempt”?

Many employers incorrectly classify workers as exempt from overtime. Being paid a salary doesn’t make you exempt. To be truly exempt, you must meet specific requirements:

Salary test (2025 rates for NYC/Long Island/Westchester):

- Executive and administrative exemptions: $1,237.50 per week ($64,350/year)

Duties test: You must also perform specific types of work:

- Executive: Manage a department, supervise 2+ employees, have hiring/firing authority

- Administrative: Office work directly related to management, exercises independent judgment

- Professional: Work requiring advanced knowledge from prolonged education

If you don’t meet BOTH tests, you’re not exempt—regardless of your job title or how you’re paid.

Has Your Employer Misclassified You as an Independent Contractor?

Some employers classify workers as independent contractors to avoid overtime obligations. But if your employer controls your schedule, provides your tools, and directs how you do your work, you’re likely an employee entitled to overtime.

Is Your Employer Manipulating Time Records?

Watch for these violations:

- Time systems that round down (but not up)

- Automatic deduction of meal breaks you didn’t actually take

- Managers “adjusting” your time after you clock out

- Being required to clock out, then continue working

- Time shaved from the beginning or end of shifts

Falsifying time records is wage theft under New York law.

Are You Being Required to Work “Off the Clock”?

Common off-the-clock violations include:

- Answering work emails or calls after hours

- Required to arrive early but not clock in until the shift starts

- Performing setup/cleanup before or after recorded hours

- Training time not recorded

- Work during unpaid meal breaks

All work time must be paid. If off-the-clock work pushes you over 40 hours, you’re owed overtime.

What Can You Recover for Unpaid Overtime?

What Does New York Law Allow?

New York Labor Law provides strong remedies:

- Unpaid overtime wages: All overtime owed for up to six years

- Liquidated damages: Up to 100% of unpaid wages (doubling your recovery)

- Interest: From when overtime was due

- Attorney’s fees: Your employer pays your legal costs if you win

How Much Could Your Claim Be Worth?

Here’s an example calculation:

Scenario: Working 50 hours/week at $25/hour, paid straight time instead of overtime

- Overtime owed per week: 10 hours × $12.50 (half-time premium) = $125

- Annual overtime owed: $125 × 52 weeks = $6,500

- Three-year claim: $19,500 in unpaid overtime

- Plus liquidated damages: $19,500

- Potential recovery: $39,000+ (plus interest and attorney’s fees)

For workers who’ve been underpaid for several years or owe significant overtime hours, claims can be substantial.

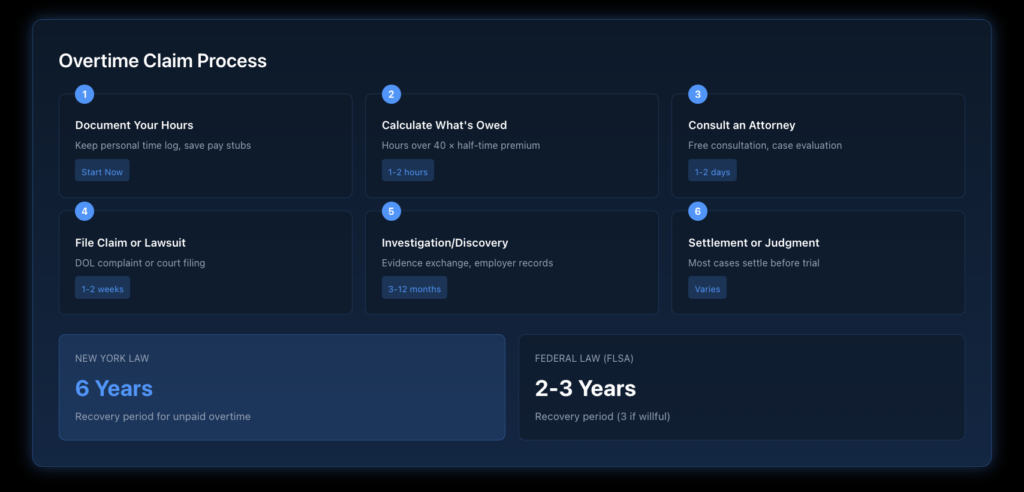

How Does Federal Law Compare?

Federal law (FLSA) also provides overtime protections, but with shorter time limits:

Factor | New York Law | Federal Law (FLSA) |

Recovery period | 6 years | 2-3 years |

Liquidated damages | Up to 100% | Up to 100% |

Attorney’s fees | Yes | Yes |

Because New York law is often more favorable, most claims are filed under state law. Your attorney can determine which law provides the best outcome.

How Do You File an Unpaid Overtime Claim?

What Are Your Options?

You have several paths to recover unpaid overtime:

- File with the New York State Department of Labor

- Free to file

- State investigates the complaint

- Can result in an order requiring the employer to pay

- File with the US Department of Labor (Wage and Hour Division)

- For federal FLSA violations

- Useful when the employer has locations in multiple states

- File a lawsuit

- Work with an overtime violation attorney

- Often results in higher recovery

- More control over the process

- Join or start a collective action

- If multiple workers are affected, you can join together

- Increases pressure on the employer to settle

Our guide on how to report wage theft in New York explains each option in detail.

What’s the Deadline to File?

Under New York law, you have six years to file an overtime claim. You can recover unpaid overtime going back six years from when you file. The sooner you act, the more you can recover.

See our complete guide on wage claim deadlines in New York.

What Should You Do Right Now?

How Can You Build Your Case?

Start documenting immediately:

- Keep your own time records: Use a notes app, calendar, or spreadsheet to track daily hours

- Save pay stubs: Photograph or keep copies of every pay stub

- Document communications: Save texts, emails, or messages about hours, overtime, or pay

- Note policies: Keep copies of any written policies about overtime or scheduling

- Identify witnesses: Coworkers experiencing similar violations can support your claim

What If You Don’t Have Records?

You can still file a claim. Employers are legally required to maintain accurate time and pay records. If they fail to do so, courts allow workers to estimate their hours based on reasonable recollection. The burden then shifts to the employer to disprove your estimates.

What If Your Employer Retaliates?

It’s illegal for your employer to retaliate against you for asserting overtime rights. Protected activities include:

- Asking about overtime pay

- Complaining to your employer about unpaid overtime

- Filing a complaint with the DOL

- Participating in an overtime lawsuit

- Discussing overtime issues with coworkers

If your employer fires you, cuts hours, or takes other adverse action, you may have a separate retaliation claim.

Ready to Take Action?

If you’ve been working over 40 hours without proper overtime pay, you have legal options. Nisar Law Group helps workers throughout New York recover unpaid overtime and hold employers accountable. We handle overtime cases on a contingency basis—you pay nothing unless we recover money for you. Contact us today for a free consultation.

Frequently Asked Questions About Unpaid Overtime in New York

Your employer can require you to work overtime, but they cannot refuse to pay for it. If you’re a non-exempt employee and you work over 40 hours, you must be paid time-and-a-half for those hours, regardless of whether the overtime was authorized or scheduled. Your employer can discipline you for unauthorized overtime, but they still must pay for it.

That agreement is not enforceable. You cannot waive your right to overtime under New York or federal law. Even if you signed a contract agreeing to a flat salary with no overtime, that agreement is void. You’re still entitled to overtime pay for hours over 40.

No. Being salaried doesn’t automatically exempt you from overtime. You must also meet specific salary thresholds AND perform certain types of exempt duties. Many salaried workers are entitled to overtime but don’t realize it because their employers have misclassified them.

All hours worked for the same employer are combined for overtime purposes. If you work 30 hours at one location and 20 hours at another location for the same company, you’ve worked 50 hours and are owed 10 hours of overtime. Employers cannot split hours across different positions or locations to avoid overtime.

Yes. How you’re paid doesn’t affect your overtime rights. Whether you receive a paycheck, direct deposit, or cash, your employer must pay overtime for hours over 40. Cash payment is often a red flag for wage violations—document your hours carefully.