If your employer calls you an “independent contractor” or pays you as a “1099 worker” but controls your schedule, tells you how to do your work, and treats you like an employee, you may be misclassified. Misclassification is illegal and costs you overtime pay, minimum wage protections, unemployment benefits, workers’ compensation, and employer-paid taxes. New York has aggressive enforcement against misclassification—here’s how to tell if you’re affected and what you can do.

Key Takeaways

- What you’re called doesn’t matter—your actual working relationship determines employee status.

- Receiving a 1099 form or being paid in cash doesn’t make you a legitimate contractor.

- Misclassified workers miss out on overtime, minimum wage protections, benefits, and tax contributions.

- New York uses a strict “ABC test” to determine worker status.

- You can recover unpaid overtime, minimum wage differences, and additional damages.

- The statute of limitations is six years under New York law.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Is Worker Misclassification?

How Does Misclassification Happen?

Misclassification occurs when an employer treats a worker as an independent contractor when the legal reality shows they’re an employee. Employers do this to avoid:

- Paying overtime (time-and-a-half for hours over 40)

- Paying minimum wage

- Providing workers’ compensation insurance

- Paying unemployment insurance

- Contributing to Social Security and Medicare

- Providing benefits like health insurance

For workers, misclassification means losing these protections and shouldering the full burden of self-employment taxes.

What Industries Have the Most Misclassification?

Misclassification is common in:

Industry | Common Scenarios |

Construction | Laborers, carpenters, and electricians are called “subcontractors.” |

Transportation | Delivery drivers, truckers |

Home Care | Home health aides, companions |

Cleaning/Janitorial | Cleaners are paid as contractors |

Tech/Gig Economy | App-based workers |

Restaurants | Kitchen staff, prep workers |

How Do You Determine Employee vs. Independent Contractor Status?

What Is the ABC Test?

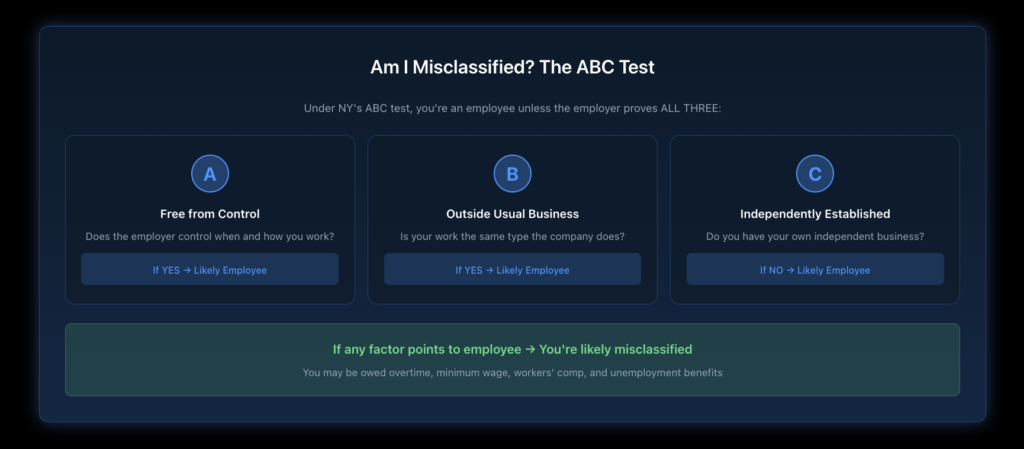

New York uses the “ABC test” for unemployment insurance purposes. Under this test, a worker is an employee unless the employer proves ALL THREE:

- Free from control: The worker is free from control and direction in performing the work, both under contract and in fact.

- Outside usual business: The work is performed outside the usual course of the employer’s business OR outside all of the employer’s places of business.

- Customarily engaged: The worker is customarily engaged in an independently established trade, occupation, profession, or business of the same nature as the work performed.

Failing ANY ONE of these factors means you’re likely an employee.

What Factors Indicate Employee Status?

You’re more likely to be an employee if:

- Your employer sets your schedule

- Your employer tells you how to do the work (not just what to accomplish)

- You use your employer’s equipment and materials

- You work at locations the employer specifies

- You’re paid by the hour, day, or week (not by project completion)

- You work primarily or exclusively for one company

- You can’t hire others to do your work

- You’re integrated into the company’s business operations

- You don’t have your own business license or business entity

- You don’t advertise services to the public

What Factors Indicate Independent Contractor Status?

Genuine independent contractors typically:

- Control when and how they complete work

- Provide their own tools and equipment

- Work for multiple clients

- Have their own business entity (LLC, corporation)

- Advertise services to the public

- Can profit or lose money based on their business decisions

- Set their own rates

- Are paid by the project, not by time

- Can hire employees or subcontract work

- Have specialized skills not central to the hiring company’s business

What Are You Losing If You're Misclassified?

What Benefits Do Employees Get That Contractors Don’t?

Misclassified workers miss out on significant protections:

Wage protections:

- Minimum wage coverage

- Overtime pay (1.5x for hours over 40)

- Weekly pay requirements for certain jobs

- Protection from illegal deductions

Benefits and insurance:

- Workers’ compensation if injured on the job

- Unemployment insurance if laid off

- Potential employer-provided health insurance

- Employer’s half of Social Security/Medicare taxes

Legal protections:

- Anti-retaliation protections

- Whistleblower protections

- Protection from discrimination

How Much Does Misclassification Cost Workers?

The costs add up quickly:

- Overtime: If you work 50 hours/week at $20/hour, you’re losing $100/week in overtime (over $5,000/year)

- Taxes: You pay an extra 7.65% in self-employment taxes that employers should cover

- Workers’ comp: No coverage if injured on the job

- Unemployment: No benefits if work ends

What Should You Do If You're Misclassified?

How Do You Build Your Case?

Gather evidence of your working relationship:

- Schedule documents: Keep copies of the schedules your employer sets

- Instructions: Save any written instructions about how to do the work

- Equipment records: Note whether you use company or personal equipment

- Payment records: Keep all pay stubs, checks, or 1099 forms

- Communications: Save emails, texts, and messages showing employer control

- Time records: Keep your own log of hours worked

What Are Your Options for Recovery?

You can pursue claims for:

- Unpaid overtime: If you worked over 40 hours without overtime pay

- Minimum wage violations: If your effective rate fell below the minimum wage

- Unpaid benefits: Through various state agencies

File with:

- NYS Department of Labor: For wage violations and unemployment issues

- IRS: Form SS-8 to request a determination of worker status

- Employment attorney: For lawsuits seeking back pay and damages

Learn more in our guide on how to report wage theft in New York.

What Can You Recover for Misclassification?

What Damages Are Available?

If you were misclassified and denied proper wages:

Recovery Type | Amount |

Unpaid overtime | Full amount for up to 6 years |

Minimum wage shortfalls | Full amount for up to 6 years |

Liquidated damages | Up to 100% of unpaid wages |

Interest | From when wages were due |

Attorney’s fees | Employer pays if you win |

Example Recovery Calculation

A misclassified construction worker earning $25/hour, working 50 hours/week:

- Weekly overtime owed: 10 hours × $12.50 (half-time premium) = $125

- Annual overtime: $125 × 52 = $6,500

- Three years: $19,500

- Liquidated damages: $19,500

- Potential recovery: $39,000+ (plus interest and attorney’s fees)

What Protections Exist Against Retaliation?

Can Your Employer Retaliate?

No. It’s illegal to retaliate against workers who:

- Question their classification

- File complaints about misclassification

- Report wage violations

- Participate in investigations

If your employer fires you, cuts your work, or takes other adverse action for asserting your rights, you have a separate retaliation claim. See our guide on retaliation protections.

What If I Signed a Contract Saying I’m an Independent Contractor?

What the contract says doesn’t control your legal status. Courts look at the reality of your working relationship, not what you agreed to on paper. An employer can’t avoid employee obligations by having you sign a contractor agreement if the actual relationship shows employee status.

Ready to Take Action?

If you’re being treated like an employee but classified as an independent contractor, you may be entitled to significant back pay and damages. Nisar Law Group helps workers throughout New York City, Long Island, Westchester, and across New York State challenge misclassification and recover what they’re owed. Contact us today for a free consultation.

Frequently Asked Questions About Worker Misclassification in NY

No. The form your employer uses doesn’t determine your legal status. Many employers give 1099 forms to workers who should legally be employees. What matters is the reality of your working relationship—how much control your employer has, whether you have your own business, and other factors in the ABC test.

Yes. Your status is determined separately for each working relationship. You might legitimately be a contractor for one company (where you control your work) and an employee for another (where the employer controls your schedule and methods).

No. Having an LLC doesn’t automatically make you a contractor. Courts look at the substance of your relationship, not its form. If you formed an LLC at your employer’s request but are still controlled like an employee, you may still be misclassified.

It’s illegal for employers to retaliate against workers who question their classification. However, if you’re concerned, you can consult with an attorney before raising the issue with your employer. Filing with the DOL or IRS doesn’t require notifying your employer first.

For wage claims (overtime, minimum wage), New York has a six-year statute of limitations. For other claims, deadlines vary. Acting sooner preserves more evidence and maximizes potential recovery.