New York’s minimum wage increased on January 1, 2025. If you work in New York City, Long Island, or Westchester County, the minimum wage is now $16.50 per hour. For the rest of New York State, it’s $15.50 per hour. These rates apply to most workers regardless of immigration status, and your employer faces serious penalties for paying less.

Key Takeaways

- NYC, Long Island, and Westchester minimum wage: $16.50/hour (effective January 1, 2025).

- Rest of New York State minimum wage: $15.50/hour (effective January 1, 2025).

- Tipped workers have different (lower) cash wage minimums, but must earn at least the full minimum wage with tips included.

- Employers violating minimum wage laws must pay back wages plus penalties up to 100% of what’s owed.

- You have six years to file a claim for unpaid minimum wages.

- Immigration status does not affect your right to minimum wage.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Are the 2025 Minimum Wage Rates Across New York?

How Much Is Minimum Wage in New York City?

The minimum wage in all five NYC boroughs (Manhattan, Brooklyn, Queens, the Bronx, and Staten Island) is $16.50 per hour as of January 1, 2025. This applies to all employers, regardless of size—New York eliminated the distinction between large and small employers.

How Much Is Minimum Wage on Long Island and in Westchester?

Nassau County, Suffolk County, and Westchester County share the same $16.50 per hour minimum wage as New York City. These areas have had unified rates since 2022.

How Much Is Minimum Wage in the Rest of New York State?

All other counties in New York—including Albany, Buffalo, Rochester, Syracuse, and everywhere else outside the NYC metro area—have a minimum wage of $15.50 per hour.

When Will Minimum Wage Increase Again?

Another $0.50 increase is scheduled for January 1, 2026:

Region | 2025 Rate | 2026 Rate |

NYC, Long Island, Westchester | $16.50 | $17.00 |

Rest of New York | $15.50 | $16.00 |

Starting in 2027, minimum wage will be indexed to inflation using the Consumer Price Index.

What Are the Minimum Wage Rules for Tipped Workers?

What Is the Cash Wage for Tipped Employees?

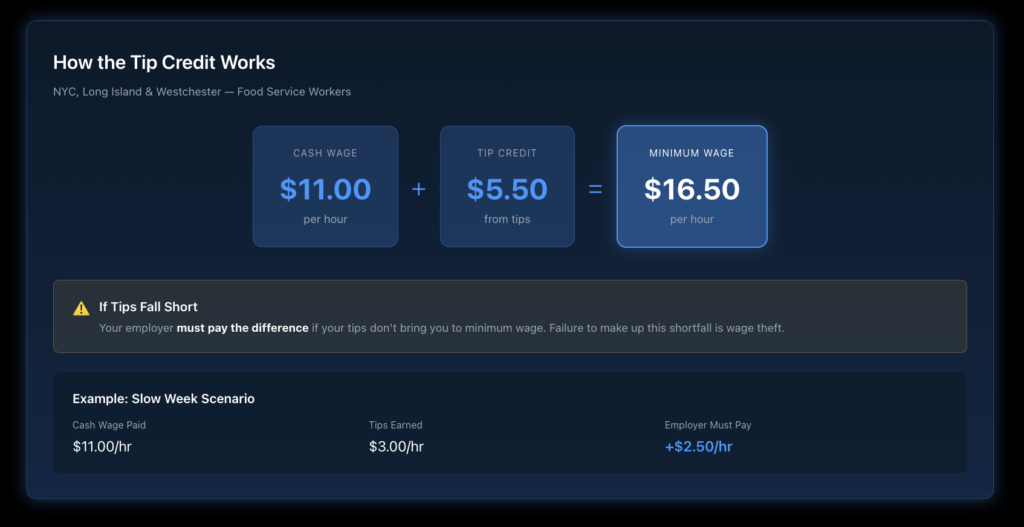

New York allows employers to pay tipped workers a lower “cash wage” if tips bring total earnings to at least the full minimum wage. For 2025, the cash wage minimums are:

NYC, Long Island, Westchester:

- Service workers: $13.75/hour cash wage (tip credit of $2.75)

- Food service workers: $11.00/hour cash wage (tip credit of $5.50)

Rest of New York:

- Service workers: $12.90/hour cash wage (tip credit of $2.60)

- Food service workers: $10.35/hour cash wage (tip credit of $5.15)

What Happens If Tips Don’t Bring You to Minimum Wage?

Your employer must make up the difference. If your cash wage plus tips for any pay period falls below the full minimum wage rate, your employer is required to pay the shortfall. Many employers fail to do this, which is illegal.

If you’re a restaurant worker experiencing tip theft or tip credit violations, you have legal options.

Who Is Covered by New York Minimum Wage Laws?

Which Workers Are Protected?

Nearly everyone working in New York is entitled to a minimum wage:

- Full-time employees

- Part-time employees

- Temporary workers

- Seasonal workers

- Day laborers

- Undocumented workers

- Workers are paid in cash

The New York State Department of Labor enforces these protections regardless of how you’re paid or your immigration status.

Are There Any Workers Exempt from Minimum Wage?

A small number of workers are exempt:

- Some agricultural workers (though many farm workers now have minimum wage rights)

- Certain employees of religious or nonprofit organizations performing religious duties

- Outside salespeople who primarily work away from the employer’s premises

- Executive, administrative, and professional employees meeting specific salary and duties tests

If you’re unsure whether you qualify for an exemption, an employment attorney can evaluate your situation.

Does Minimum Wage Apply to Independent Contractors?

No, true independent contractors aren’t covered by minimum wage laws. However, many workers are misclassified as independent contractors when they should legally be employees. If your employer controls when, where, and how you work, you may actually be an employee entitled to minimum wage protection.

What Should You Do If You're Paid Below Minimum Wage?

How Can You Tell If You’re Being Underpaid?

Check your pay stub against these calculations:

- Identify your region (NYC/LI/Westchester vs. rest of NY)

- Multiply your hourly rate by hours worked

- Compared to what you should earn at minimum wage

- For tipped workers: add tips to cash wage and verify total meets minimum wage

Watch for these red flags:

- Flat daily or weekly pay that doesn’t account for actual hours

- Deductions that bring your effective rate below minimum wage

- Being paid “off the books” at a lower rate

- Training time is paid at a lower rate (or not paid at all)

What Documentation Should You Keep?

Start collecting evidence now:

- Pay stubs (photograph them if your employer doesn’t provide copies)

- Personal log of hours worked each day

- Any written agreements about pay

- Text messages or emails discussing wages

- Names of coworkers experiencing similar issues

What Are Your Options for Recovering Unpaid Wages?

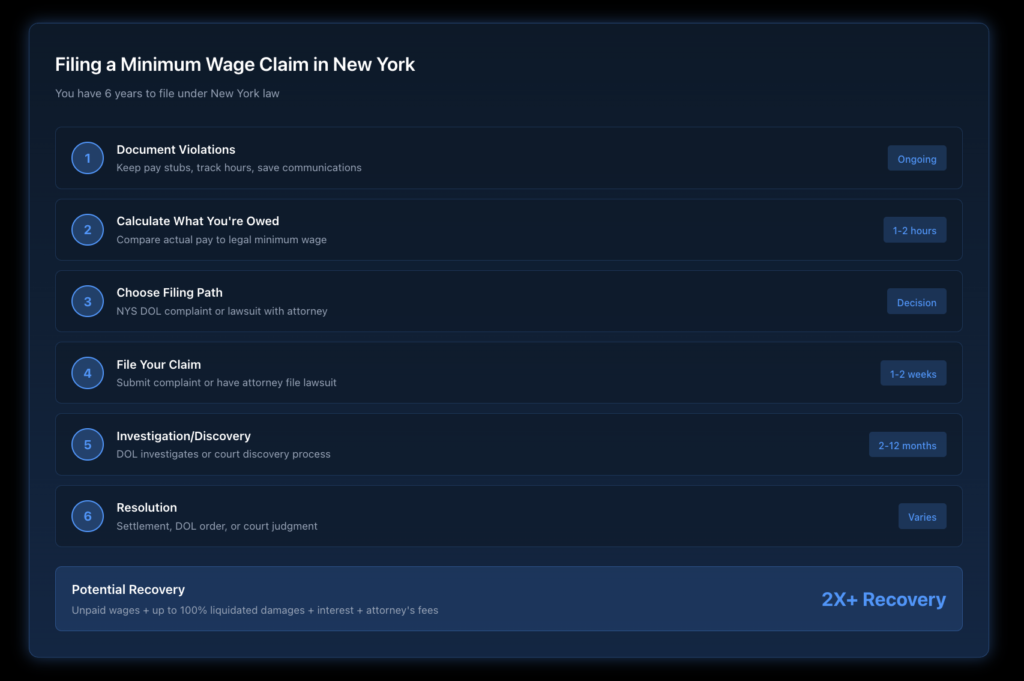

You have several paths to recover what you’re owed:

- File a complaint with the NYS Department of Labor: Free process, the state investigates

- File a lawsuit: Work with an attorney to sue for unpaid wages plus damages

- Join a class action: If multiple workers are underpaid, collective action may be appropriate

Learn more in our guide on how to report wage theft in New York.

What Penalties Do Employers Face for Minimum Wage Violations?

What Can You Recover?

Under New York Labor Law, workers can recover:

- All unpaid wages: Every dollar below the minimum wage you should have received

- Liquidated damages: Up to 100% of unpaid wages (essentially doubling your recovery)

- Interest: Calculated from when wages were due

- Attorney’s fees: Your employer pays your legal costs if you win

What Criminal Penalties Exist?

Since September 2023, wage theft has been classified as larceny under New York Penal Law. Employers who willfully refuse to pay minimum wage can face criminal prosecution, including potential felony charges for larger amounts.

How Long Do You Have to File a Minimum Wage Claim?

What Is the Statute of Limitations?

New York has a six-year statute of limitations for wage claims. This means:

- You have six years from when wages were due to file a claim

- You can recover unpaid wages going back six years from your filing date

- The sooner you file, the more you can potentially recover

For complete details, see our guide on wage claim deadlines in New York.

Does Immigration Status Affect Your Right to File?

No. Federal and New York labor laws protect all workers regardless of immigration status. The Department of Labor investigates wage complaints without asking about documentation. Employers who threaten to report workers to immigration for asserting wage rights face additional penalties.

Ready to Take Action?

If your employer is paying you less than New York’s minimum wage, you don’t have to accept it. Nisar Law Group helps workers throughout New York City, Long Island, Westchester, and across New York State recover unpaid wages and hold employers accountable. Contact us today for a free consultation to discuss your situation and learn what your claim may be worth.

Frequently Asked Questions About Minimum Wage in New York

Yes. How you’re paid doesn’t affect your minimum wage rights. Whether you receive a paycheck, direct deposit, or cash, your employer must pay at least minimum wage for all hours worked. Paying cash is often a red flag that an employer may be violating wage laws, so document your hours carefully.

Generally no. New York law prohibits deductions that bring your pay below minimum wage. Employers cannot deduct for cash register shortages, breakage, customer theft, or similar issues if it reduces your wages below the minimum. Any authorized deductions must be voluntary and in writing.

New York does not have a separate youth minimum wage—workers under 18 are entitled to the same minimum wage as adults. However, there are restrictions on hours and types of work for minors. Some student learner programs may have different rates in limited circumstances.

You don’t need perfect records. Employers are required by law to keep accurate time records. If they don’t, courts allow workers to estimate hours based on reasonable recollection. The burden then shifts to the employer to disprove your estimates.

That agreement is not enforceable. You cannot waive your right to minimum wage under New York or federal law. Any contract, agreement, or verbal understanding to accept less than minimum wage is void and unenforceable.

Retaliation for asserting wage rights is illegal. If your employer fires you, cuts your hours, or takes other adverse action because you complained about wages, you may have an additional legal claim for retaliation.