If your employer is stealing your wages—whether through unpaid overtime, minimum wage violations, illegal deductions, or tip theft—New York gives you multiple options to fight back. You can file a complaint with the state Department of Labor, file a federal complaint, sue your employer, or join a class action. Each path has different advantages depending on your situation.

Key Takeaways

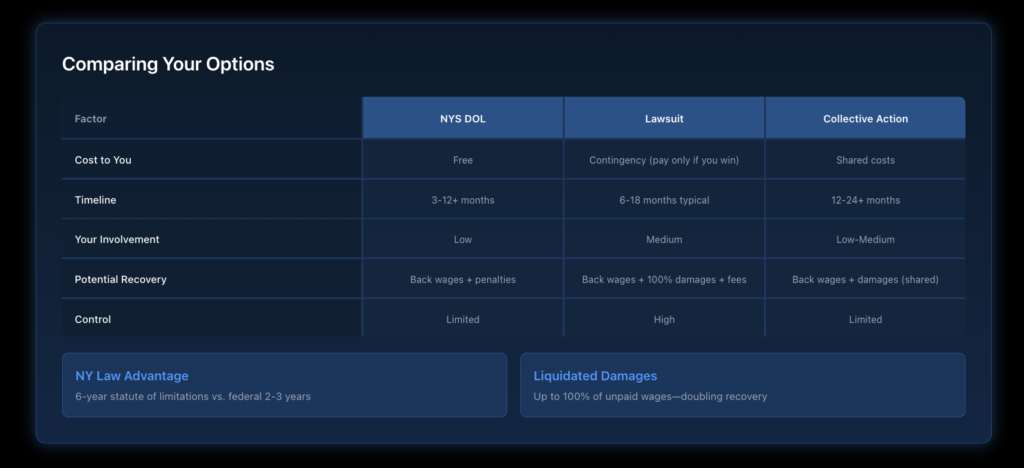

- You have three main options: file with NYS DOL, file a lawsuit, or join a collective action.

- The NYS Department of Labor investigates complaints for free and can order employers to pay.

- Filing a lawsuit often results in higher recovery and faster resolution.

- You can recover unpaid wages plus liquidated damages up to 100% of what you’re owed.

- New York’s six-year statute of limitations is longer than federal law’s two to three years.

- Retaliation for reporting wage theft is illegal and can result in additional damages.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Qualifies as Wage Theft in New York?

What Types of Violations Count as Wage Theft?

Wage theft includes any situation where your employer fails to pay what you’re legally owed:

- Minimum wage violations: Paying below New York’s minimum wage

- Overtime violations: Not paying time-and-a-half for hours over 40

- Tip theft: Employers keeping tips, illegal tip pooling, or failing to make up tip credit shortfalls

- Off-the-clock work: Requiring work without pay

- Illegal deductions: Unauthorized deductions that reduce pay below legal minimums

- Misclassification: Calling employees “independent contractors” to avoid wage laws

- Time record manipulation: Shaving hours, auto-deducting breaks not taken

- Late or missing paychecks: Not paying on time or at all

Since September 2023, theft has been classified as larceny under New York Penal Law, meaning employers can face criminal prosecution.

How Do You Know If You’re a Victim?

Ask yourself these questions:

- Are you earning less than $16.50/hour (NYC area) or $15.50/hour (rest of NY)?

- Do you work over 40 hours without getting time-and-a-half?

- Are deductions taken from the pay that you didn’t authorize?

- Do you have to work before clocking in or after clocking out?

- Does your time record not match your actual hours?

If you answered yes to any of these, you may be experiencing wage theft.

What Are Your Options for Reporting Wage Theft?

Option 1: How Do You File a Complaint with the NYS Department of Labor?

The New York State Department of Labor accepts wage theft complaints and investigates them at no cost to you.

How to file:

- Gather your information: Pay stubs, time records, and employer contact information

- Complete the complaint form: Available online (Form LS 223 for most claims)

- Submit the form: Online, by mail, or in person at a DOL office

- DOL investigates: The agency contacts your employer and reviews records

- DOL issues findings: If violations are found, DOL orders the employer to pay

Pros of DOL filing:

- Free—no attorney fees

- The state does the investigation work

- Can result in the employer paying back wages plus penalties

- Can refer criminal cases to district attorneys

Cons of DOL filing:

- It can take several months to resolve

- Limited control over the process

- Recovery may be lower than through litigation

- DOL has limited resources for complex cases

Option 2: How Do You File a Lawsuit?

Working with an employment attorney to file a lawsuit often results in higher recovery and faster resolution.

How the process works:

- Consult with an attorney: Most wage theft attorneys offer free consultations

- Attorney evaluates your case: Reviews evidence, calculates potential recovery

- Demand letter: The Attorney may send a demand letter to your employer

- File a lawsuit: If the employer doesn’t settle, file in court

- Discovery: Both sides exchange evidence

- Settlement or trial: Most cases settle before trial

Pros of filing a lawsuit:

- Higher potential recovery

- More control over timing and strategy

- Contingency fee (you pay nothing unless you win)

- Stronger pressure on the employer to settle

- Can pursue claims DOL might not prioritize

Cons of filing a lawsuit:

- It may take longer if the employer fights

- More involved process

- Attorney takes percentage of recovery (typically 33%)

Option 3: What Is a Collective or Class Action?

If your employer is underpaying multiple workers, a collective action allows employees to join together.

How it works:

- One or more workers file on behalf of similarly affected employees

- Other workers can “opt in” to join the lawsuit

- Increases pressure on the employer

- Shares legal costs across the group

- Often results in larger overall settlements

This is common in cases involving company-wide policies like misclassification or systematic overtime violations.

What Steps Should You Take Before Filing?

What Documentation Should You Gather?

Strong documentation strengthens your claim:

- Pay stubs: Every pay stub you have access to

- Time records: Your own notes of hours worked, if available

- Employment documents: Offer letters, contracts, employee handbooks

- Communications: Emails, texts, or messages about pay or hours

- Bank records: Direct deposits showing amounts paid

- Witness information: Names of coworkers who experienced similar violations

What If You Don’t Have Records?

You can still file a claim. Employers are legally required to maintain accurate wage and hour records. If they failed to do so, courts allow workers to estimate their hours based on reasonable recollection. The burden shifts to the employer to disprove your estimates.

Should You Talk to Your Employer First?

This is optional. Some workers prefer to raise concerns internally first. Others worry about retaliation and go directly to filing a complaint or consulting an attorney. There’s no legal requirement to complain to your employer before filing, but documenting that you raised concerns can strengthen a retaliation claim if your employer retaliates.

What Can You Recover for Wage Theft?

What Damages Does New York Law Provide?

Under New York Labor Law, you can recover:

Damage Type | Amount |

Unpaid wages | Full amount owed for up to 6 years |

Liquidated damages | Up to 100% of unpaid wages |

Interest | From when wages were due |

Attorney’s fees | Employer pays if you win |

How Does This Compare to Federal Law?

Factor | New York | Federal (FLSA) |

Recovery period | 6 years | 2-3 years |

Liquidated damages | Up to 100% | Up to 100% |

Attorney’s fees | Yes | Yes |

New York’s longer statute of limitations means you can potentially recover more.

What Happens After You File?

What Is the NYS DOL Process?

After you file with the Department of Labor:

- Acknowledgment: DOL confirms receipt of your complaint

- Assignment: A compliance officer is assigned to investigate

- Employer contact: DOL contacts your employer for records and response

- Investigation: DOL reviews evidence from both sides

- Determination: DOL issues findings

- In order to comply, if violations are found, DOL orders the employer to pay

- Collection: If the employer doesn’t pay, DOL can pursue collection actions

If the employer refuses to pay, DOL can now pursue additional enforcement measures, including liens, asset seizure, and stop-work orders.

What Protections Do You Have Against Retaliation?

It’s illegal for your employer to retaliate against you for:

- Filing a wage complaint

- Participating in an investigation

- Testifying in a wage theft case

- Discussing wages with coworkers

- Complaining about wage violations internally

Retaliation includes firing, demotion, hour reduction, discipline, or threatening to report immigration status. If your employer retaliates, you have a separate legal claim with additional damages. Learn more about retaliation protections.

How Long Do You Have to File?

What Are the Deadlines?

- New York State claims: 6 years from when wages were due

- Federal FLSA claims: 2 years (3 years for willful violations)

Because New York’s deadline is longer, most claims are filed under state law. However, acting sooner preserves more evidence and allows you to recover more back wages.

For complete details, see our guide on wage claim deadlines in New York.

Ready to Take Action?

If your employer is stealing your wages, you have powerful legal tools to fight back. Nisar Law Group helps workers throughout New York City, Long Island, Westchester, and across New York State recover unpaid wages and hold employers accountable. We handle wage theft cases on a contingency basis—you pay nothing unless we recover money for you. Contact us today for a free consultation.

Frequently Asked Questions About Reporting Wage Theft in New York

Filing a DOL complaint is not anonymous—your employer will know a complaint was filed. However, an attorney may be able to send an initial demand letter without immediately identifying you. If you’re concerned about retaliation, know that retaliation is illegal and creates a separate legal claim with additional damages.

You may still be able to recover wages. Individual owners or managers can sometimes be held personally liable for wage violations. If the business were sold, the new owner may have liability. An attorney can help identify potential sources of recovery.

DOL investigations typically take several months to over a year, depending on complexity and caseload. Lawsuits can also take months to years, though many settle before trial. Complex cases or class actions generally take longer.

You can file a DOL complaint without an attorney. However, an attorney can help you understand your rights, calculate what you’re owed, navigate the process, and maximize your recovery. Most wage theft attorneys work on contingency, so there’s no upfront cost.

Yes. Immigration status does not affect your right to file a wage claim. The Department of Labor investigates complaints regardless of documentation. It’s illegal for employers to threaten to report workers to immigration for asserting wage rights—that’s itself a violation that can result in additional penalties.