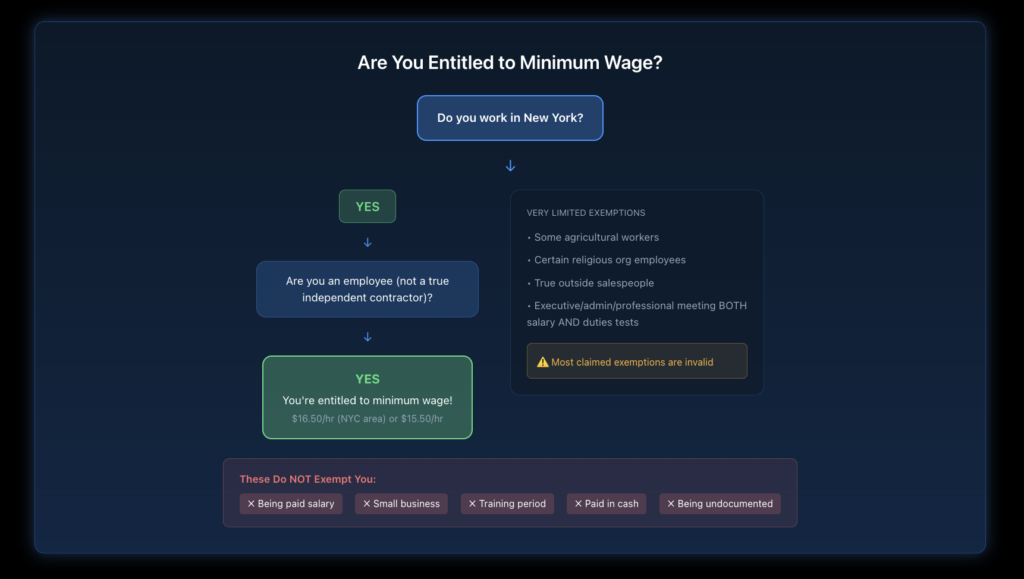

In almost all cases, no. If you’re working in New York and your employer is paying you less than the legal minimum wage, they’re breaking the law. There are very few legitimate exceptions, and employers often claim exemptions that don’t actually apply. If you’re being paid less than $16.50/hour in NYC, Long Island, or Westchester—or $15.50/hour elsewhere in New York—you likely have a wage claim.

Key Takeaways

- Most workers in New York must be paid at least minimum wage ($16.50 in the NYC area, $15.50 elsewhere).

- Very few workers are legally exempt—most claimed exemptions are invalid.

- Tipped workers must still earn at least minimum wage when tips are included.

- Immigration status does not affect your right to minimum wage.

- Agreements to work for less than minimum wage are not enforceable.

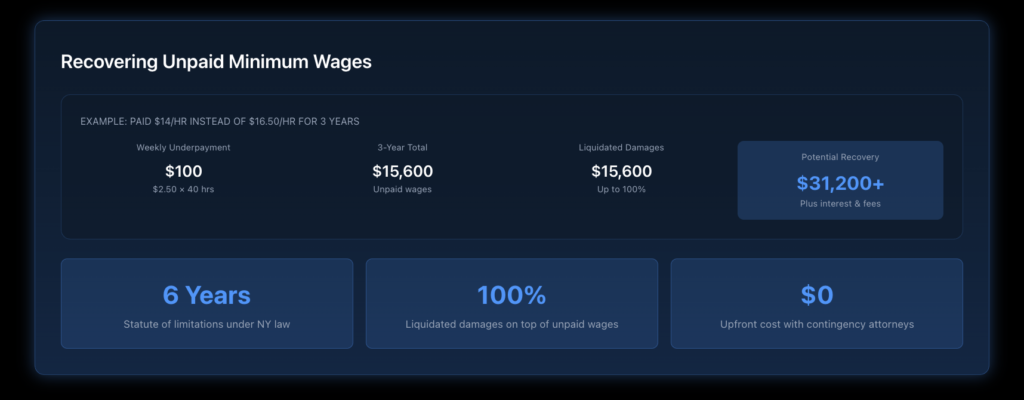

- You can recover up to six years of underpaid wages plus 100% liquidated damages.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Are the Current Minimum Wage Rates in New York?

What Must Employers Pay?

As of January 1, 2025:

Location | Minimum Wage |

New York City (all boroughs) | $16.50/hour |

Long Island (Nassau & Suffolk) | $16.50/hour |

Westchester County | $16.50/hour |

Rest of New York State | $15.50/hour |

These are the minimums—employers can and often do pay more, but they cannot pay less.

What About Tipped Workers?

Employers can pay tipped workers a lower “cash wage” only if tips bring total earnings to at least minimum wage. If tips fall short, the employer must make up the difference. Learn more about tip rules in New York.

When Can Employers Legally Pay Less Than Minimum Wage?

What Are the Actual Exemptions?

Very few workers are exempt from minimum wage requirements:

Legitimate exemptions:

- Some agricultural workers (though recent changes expanded coverage)

- Certain employees of religious organizations performing religious duties

- Outside salespeople who work primarily away from the employer’s premises

- Executive, administrative, and professional employees meeting strict salary AND duties tests

Not legitimate exemptions:

- Being called a “manager” without meeting actual exemption tests

- Being paid a salary (salary alone doesn’t create an exemption)

- Working for a small business (size doesn’t matter)

- Being new to the job or in “training.”

- Being paid in cash

- Being an intern (most interns must be paid)

- Being undocumented

Why Do Employers Claim Invalid Exemptions?

Common tactics employers use to illegally pay below minimum wage:

“Training” pay: Some employers pay reduced rates during training periods. Unless you’re in a very specific vocational program, you must receive minimum wage from day one.

“Independent contractor” classification: Employers may call you an independent contractor to avoid wage laws. If they control your schedule, provide equipment, and direct your work, you’re likely an employee entitled to minimum wage. See our guide on misclassification.

Salary arrangements: Being paid a salary doesn’t mean you’re exempt. Salaried workers who don’t meet strict exemption tests must still earn at least minimum wage for all hours worked.

Small business claims: New York’s minimum wage applies to all employers regardless of size. There’s no small business exemption.

What Makes You Fall Below Minimum Wage?

How Do You Calculate Your Effective Hourly Rate?

To determine if you’re being paid minimum wage:

- Add up your total pay for the week (before deductions)

- Add up your total hours worked (including any unpaid time you were required to work)

- Divide pay by hours

If the result is less than the applicable minimum wage, you’re being underpaid.

What Practices Can Push You Below Minimum Wage?

Illegal deductions: Employers cannot make deductions that reduce pay below minimum wage. Deductions for uniforms, tools, breakage, or shortages that bring you below minimum wage are illegal.

Off-the-clock work: Time spent working before clocking in, after clocking out, or during unpaid breaks counts as work time. If you’re required to do tasks off the clock, add that time to your hours.

Unpaid setup and cleanup: Preparation and cleanup time is work time. If you arrive early to set up or stay late to clean, you must be paid.

Flat shift pay: Some employers pay a flat amount per shift regardless of hours. If that amount divided by hours falls below minimum wage, it’s a violation.

Improper rounding: Time systems that round hours down can push you below minimum wage. Rounding must be neutral over time—consistent rounding down is illegal.

What Should You Do If You're Paid Below Minimum Wage?

How Do You Document the Violation?

Start building evidence now:

- Keep your own time records: Track when you actually work each day

- Save pay stubs: Keep copies of every pay stub (photograph them if needed)

- Note deductions: Document any amounts taken from your pay

- Record policies: Keep copies of any written policies about pay or deductions

- Identify coworkers: Others experiencing the same violations can support your claim

What Are Your Options for Recovery?

You have several paths to recover underpaid wages:

- File a complaint with NYS DOL: The Department of Labor investigates complaints for free and can order your employer to pay. File at dol.ny.gov.

- File a lawsuit: Work with an employment attorney to sue for unpaid wages plus damages. Often results in higher recovery.

- Join a collective action: If multiple workers are underpaid, a group lawsuit increases pressure on the employer.

See our complete guide on how to report wage theft in New York.

How Long Do You Have to File?

New York has a six-year statute of limitations for wage claims. You can recover unpaid minimum wages going back six years from when you file. Don’t wait—the sooner you act, the more you can recover.

What Can You Recover for Minimum Wage Violations?

What Damages Are Available?

Under New York Labor Law:

Recovery Type | Amount |

Unpaid wages | Full amount owed for up to 6 years |

Liquidated damages | Up to 100% of unpaid wages |

Interest | Calculated from when wages were due |

Attorney’s fees | Employer pays if you win |

Example Calculation

If you were paid $14/hour when minimum wage was $16.50:

- Underpayment: $2.50/hour × 40 hours/week = $100/week

- Annual underpayment: $100 × 52 weeks = $5,200

- Three-year claim: $15,600

- Liquidated damages: $15,600

- Potential recovery: $31,200+ (plus interest and attorney’s fees)

What Protections Exist Against Retaliation?

Can Your Employer Retaliate for Asserting Your Rights?

No. It’s illegal for employers to retaliate against workers who:

- Ask about minimum wage

- Complain about being underpaid

- File a wage complaint

- Participate in a wage investigation

- Discuss wages with coworkers

Retaliation includes firing, demotion, hour cuts, discipline, or threats. If your employer retaliates, you have a separate retaliation claim with additional damages.

What If You’re Undocumented?

Your immigration status does not affect your right to minimum wage. The Department of Labor enforces wage laws regardless of documentation. Employers who threaten to report workers to immigration for asserting wage rights face additional penalties.

Ready to Take Action?

If your employer is paying you less than minimum wage, you have legal options to recover what you’re owed—plus significant additional damages. Nisar Law Group helps workers throughout New York City, Long Island, Westchester, and across New York State fight minimum wage violations. We handle these cases on a contingency basis—you pay nothing unless we win. Contact us today for a free consultation.

Frequently Asked Questions About Below-Minimum Wage Pay

That agreement is not enforceable. Under both New York and federal law, you cannot waive your right to minimum wage. Even if you signed a contract or verbally agreed to work for less, your employer must still pay minimum wage. The agreement doesn’t protect them.

No. There’s no “training wage” or “probation rate” exception in New York. You’re entitled to minimum wage from your first day of work, regardless of any probationary period. Employers cannot pay below minimum wage while you’re “learning the job.”

Your employer is violating the law. Divide your weekly salary by hours worked. If the result is below minimum wage, you’re being underpaid. You can recover the difference for up to six years.

Yes. Where you work doesn’t affect your minimum wage rights. Remote workers, work-from-home employees, and telecommuters are all entitled to minimum wage for all hours worked.

Most interns must be paid at least minimum wage. Unpaid internships are only legal in very limited circumstances—primarily when the intern is the primary beneficiary of the arrangement and receives training similar to an educational environment. Most “internships” at for-profit companies don’t qualify.