If you work construction in New York, you have strong wage protections—and they’re frequently violated. Construction workers must receive overtime pay at 1.5 times the regular rate for hours over 40 per week, must be paid weekly (not biweekly), and cannot be misclassified as independent contractors to avoid wage laws. Construction has one of the highest rates of wage theft in New York. Here’s what you need to know to protect yourself.

Key Takeaways

- Construction workers are entitled to time-and-a-half for hours over 40 per week.

- New York requires weekly pay for construction workers—biweekly is illegal.

- Being paid in cash or as a “1099 contractor” doesn’t eliminate overtime rights.

- Misclassification as an independent contractor is common and often illegal.

- Public works projects require prevailing wage rates.

- You can recover six years of unpaid overtime plus 100% liquidated damages.

- Travel time between job sites during the workday must be paid.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

How Does Overtime Work for Construction Workers?

What Is the Overtime Rate?

For every hour over 40 in a workweek, you must be paid 1.5 times your regular hourly rate:

- Regular rate: $30/hour

- Overtime rate: $45/hour

This applies whether you’re a laborer, carpenter, electrician, plumber, roofer, or any other construction position.

Is There Daily Overtime in New York?

No. New York calculates overtime weekly, not daily. Working 12 hours in one day doesn’t trigger overtime unless your weekly total exceeds 40 hours. However, some union contracts provide daily overtime—check your collective bargaining agreement if applicable.

What Counts as Hours Worked?

All the time you’re required to be on the job or under your employer’s control counts toward the 40-hour threshold:

- Time on the job site

- Travel between job sites during the workday

- Mandatory meetings or training

- Time getting or returning equipment

- Waiting time when required to stay on site

- Putting on and removing required safety gear

Travel from home to the first job site and from the last job site to home is generally not compensated, but travel between sites during the day is.

Why Is Wage Theft So Common in Construction?

What Tactics Do Employers Use?

Construction has among the highest wage theft rates in New York. Common violations include:

Cash payments below legal wages: Paying in cash often comes with below-minimum or below-overtime rates.

“1099” misclassification: Calling workers independent contractors to avoid paying overtime, workers’ comp, and payroll taxes.

Not paying for all hours: Excluding travel time, waiting time, or requiring work before/after recorded hours.

Day rate or project rate schemes: Paying flat amounts that don’t account for overtime hours.

Biweekly or monthly pay: New York law requires weekly pay for construction workers.

No pay at all: Some contractors simply don’t pay workers, especially near the end of projects.

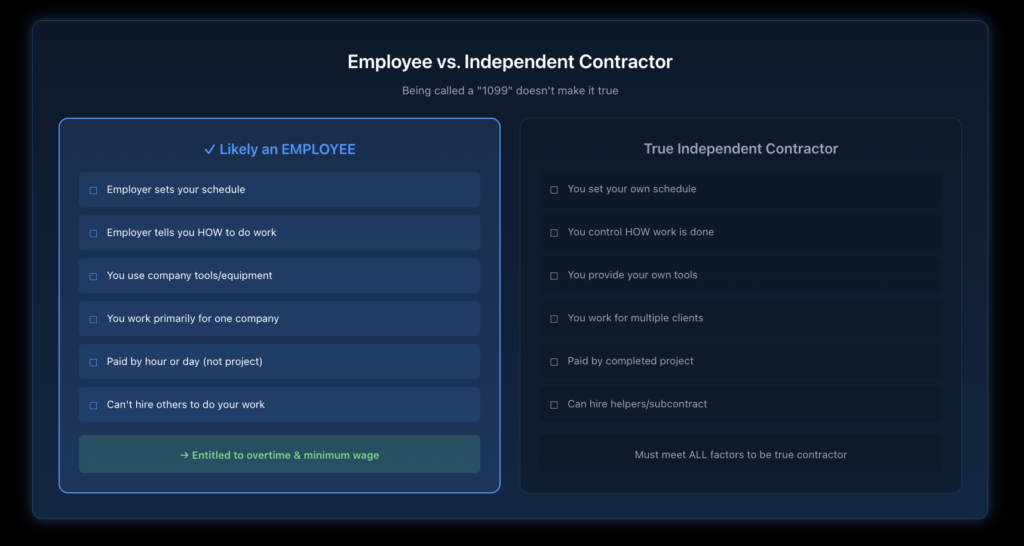

How Does Misclassification Work?

Many construction employers call workers “independent contractors” or “1099 workers” when they’re actually employees. This is often illegal.

You’re likely an employee (not an independent contractor) if:

- The employer controls when and where you work

- The employer provides tools and equipment

- You work for one employer primarily

- You’re told how to do the work, not just what to accomplish

- You’re paid by the hour or day, not by completed project

Being paid in cash or receiving a 1099 form doesn’t make you a legitimate independent contractor. What matters is the reality of your working relationship. See our detailed guide on misclassification.

What Is the Weekly Pay Requirement for Construction?

Must Construction Workers Be Paid Weekly?

Yes. Under New York Labor Law Section 191, construction workers must be paid on a weekly basis. This means you should receive your paycheck within seven days of completing the work.

Employers who pay construction workers biweekly, semi-monthly, or monthly are violating the law. You can recover damages for frequency violations in addition to any unpaid wage claims.

What If You’re Paid Biweekly?

If your construction employer pays you every two weeks, they’re breaking the law. Recent court decisions have confirmed that workers can sue for pay frequency violations even if they received their full wages; the violation is in the timing.

What Are Prevailing Wage Requirements?

What Is Prevailing Wage?

For construction work on public projects (government buildings, schools, highways, etc.), contractors must pay “prevailing wage” rates set by the New York State Department of Labor. These rates are often significantly higher than minimum wage and vary by trade and region.

Who Is Covered?

Prevailing wage applies to:

- Public building construction and renovation

- Highway and bridge projects

- Public utility work

- Projects funded by government agencies

If you’re working on a public project and being paid below the prevailing wage, you have a claim for the difference.

How Do You Find Prevailing Wage Rates?

The NYS Department of Labor publishes prevailing wage schedules by county and trade. Compare your pay rate to the schedule for your location and craft.

What Should Construction Workers Do to Protect Their Rights?

How Do You Document Your Hours?

Don’t rely only on your employer’s records. Keep your own documentation:

- Daily log: Record your start time, end time, and breaks each day

- Job sites: Note which sites you worked at and travel between them

- Photos: Take photos of time sheets before turning them in

- Pay stubs: Keep copies of all pay stubs (or photograph them)

- Communications: Save texts or messages about hours or pay

What Are Your Options for Recovery?

If your employer isn’t paying properly, you can:

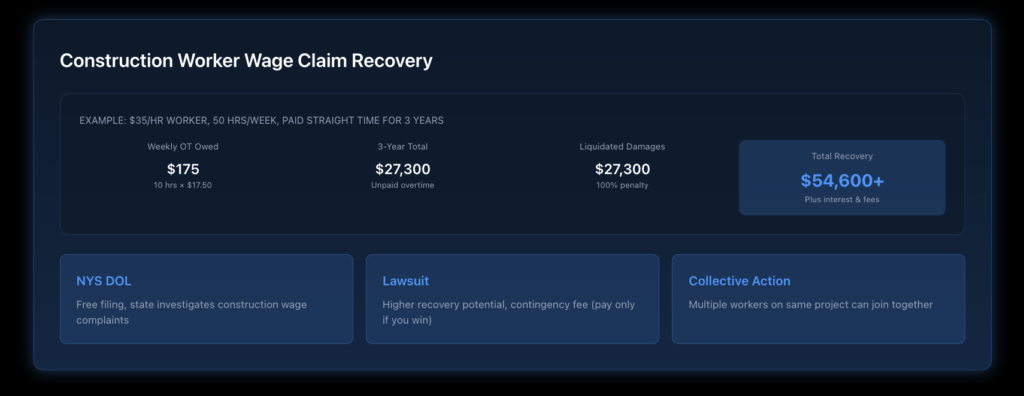

- File with NYS DOL: The Department of Labor investigates construction wage complaints. This is free.

- File a lawsuit: Work with an employment attorney to sue for unpaid wages plus damages.

- File with the federal DOL: For FLSA overtime violations.

- Join a collective action: If multiple workers on a project are underpaid, collective action increases leverage.

See our guide on how to report wage theft for detailed steps.

What Can Construction Workers Recover?

What Damages Are Available?

Under New York law:

Recovery Type | Amount |

Unpaid overtime wages | Full amount for up to 6 years |

Unpaid minimum wages | Full amount for up to 6 years |

Weekly pay violation damages | Potential statutory damages |

Liquidated damages | Up to 100% of unpaid wages |

Interest | From when wages were due |

Attorney’s fees | Employer pays if you win |

Example Recovery

A construction worker earning $35/hour who works 50 hours/week but is paid only straight time:

- Weekly overtime owed: 10 hours × $17.50 (half-time premium) = $175

- Annual overtime owed: $175 × 52 = $9,100

- Three years: $27,300

- Liquidated damages: $27,300

- Potential recovery: $54,600+ (plus interest and attorney’s fees)

What Protections Exist Against Retaliation?

Can Your Employer Retaliate?

No. It’s illegal to retaliate against workers who assert wage rights. Retaliation includes:

- Firing or laying off

- Reducing hours or assignments

- Blacklisting from future work

- Threatening immigration consequences

- Harassment or hostile treatment

If you experience retaliation, you have a separate legal claim. See our guide on retaliation protections.

What If You’re Undocumented?

Immigration status does not affect your wage rights. New York wage laws protect all workers regardless of documentation. Employers who threaten to report workers to immigration face additional penalties.

Ready to Take Action?

If your construction employer is cheating you on wages, overtime, or proper pay frequency, you have powerful legal remedies. Nisar Law Group helps construction workers throughout New York recover unpaid wages and hold employers accountable. We understand the tactics construction employers use and know how to fight back. Contact us today for a free consultation.

Frequently Asked Questions About Construction Worker Overtime in NY

No. Day rates are legal, but you still must receive overtime for hours over 40. Your employer must track hours and pay 1.5 times your effective hourly rate for overtime. If you work 10-hour days five days a week on a $300/day rate, you’re owed overtime for 10 hours.

Both the staffing agency and the company where you work may be responsible for wage violations. If you’re not receiving overtime or weekly pay, both entities can potentially be held liable.

Travel between job sites during the workday must be paid and counts toward overtime. Travel from home to the first site and from the last site to home generally doesn’t count, unless the employer requires you to report to a central location first.

Your direct employer—the subcontractor—is responsible for your wages. However, the general contractor may also have liability for wage violations on the project, especially on public works. This creates additional potential for recovery.

Potentially. Individual owners, officers, or managers can sometimes be held personally liable for wage violations. If the business were sold, the new owner may have liability. An attorney can help identify sources of recovery.