If you’ve discovered your employer is defrauding the government, you’re facing a critical decision. Should you report it? What protections exist? Here’s what you need to know: the False Claims Act doesn’t just protect whistleblowers who expose government fraud—it rewards them with potentially substantial financial compensation.

Unlike many whistleblower laws that only prevent retaliation, the False Claims Act actively incentivizes employees to come forward by offering them a percentage of whatever the government recovers. This creates one of the most powerful legal frameworks for exposing fraud while protecting your career and financial future.

Disclaimer: This article provides general information for informational purposes only and should not be considered a substitute for legal advice. It is essential to consult with an experienced employment lawyer at our law firm to discuss the specific facts of your case and understand your legal rights and options. This information does not create an attorney-client relationship.

What Is a Qui Tam Action?

A qui tam action is a lawsuit filed by a private individual (called a “relator”) on behalf of the federal government under the False Claims Act. The term “qui tam” comes from the Latin phrase meaning “he who sues for the king as well as for himself.”

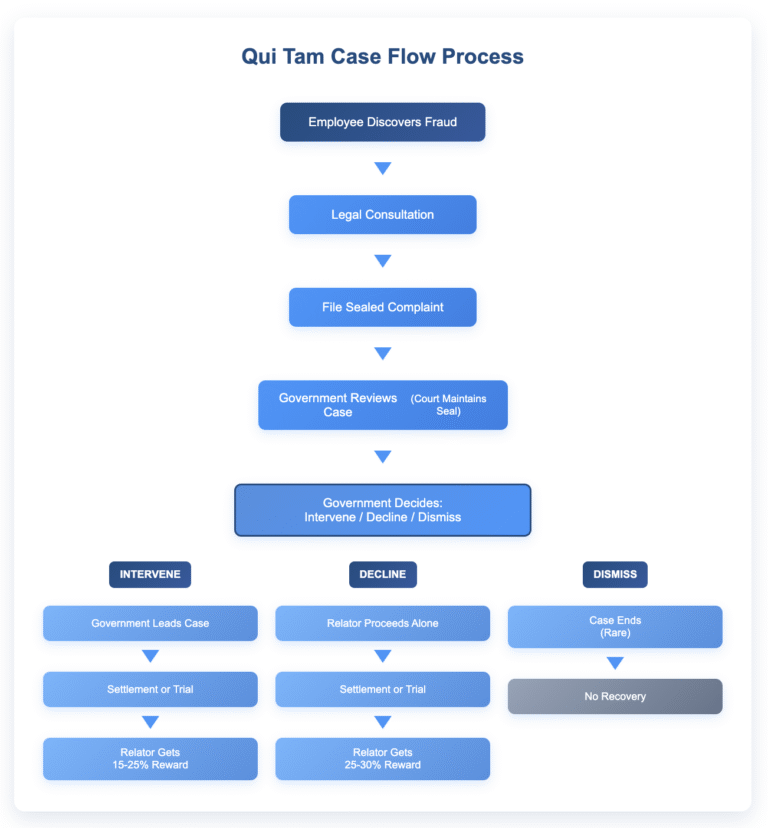

Here’s how it works: when you discover your employer is submitting false claims to government programs, you can file a sealed lawsuit in federal court. The government then investigates your allegations and decides whether to join your case or let you proceed alone.

The most common qui tam cases involve healthcare fraud, defense contractor fraud, and education fraud—all areas where employers receive significant government funding and may be tempted to cut corners or misrepresent their compliance.

The False Claims Act: Powerful Protection for Whistleblowers

The False Claims Act serves two crucial functions: it recovers taxpayer money stolen through fraud, and it protects employees who expose that fraud. Understanding both aspects helps you see why this law is so effective.

Financial Penalties That Get Attention

When the government proves False Claims Act violations, the penalties are severe enough to change corporate behavior. Violators face:

- Treble damages: Three times the amount of money the government lost

- Civil penalties: $11,803 to $23,607 per false claim (as of 2023)

- Legal costs: Payment of the government’s attorneys’ fees and investigation expenses

These penalties add up quickly. A healthcare company submitting 1,000 false claims could face over $23 million in penalties alone, before counting the treble damages.

Types of Fraud Covered

The False Claims Act covers any scheme to defraud the federal government, but certain patterns appear frequently in workplace settings:

Healthcare Fraud:

- Billing for services never provided

- Upcoding procedures to increase reimbursement

- Unnecessary medical procedures or tests

- Kickbacks for patient referrals

Defense Contractor Fraud:

- Charging for defective products

- Falsifying test results or compliance certificates

- Labor charging fraud (billing for work not performed)

- Substituting inferior materials

Education Fraud:

- Falsifying student eligibility for federal aid

- Misrepresenting job placement rates

- Billing for educational services not provided

- Enrollment manipulation

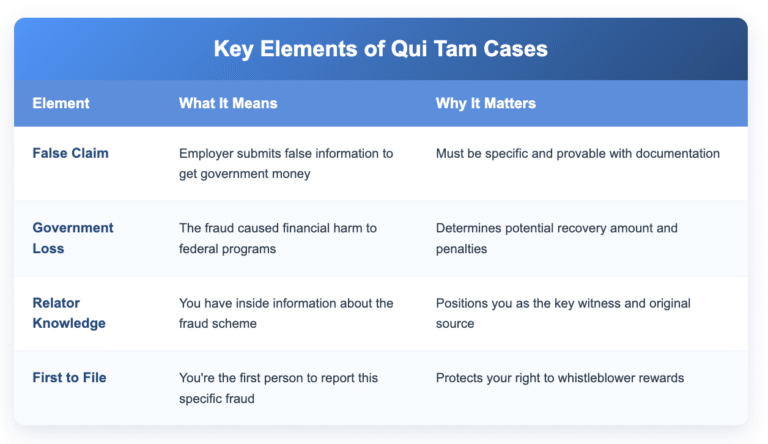

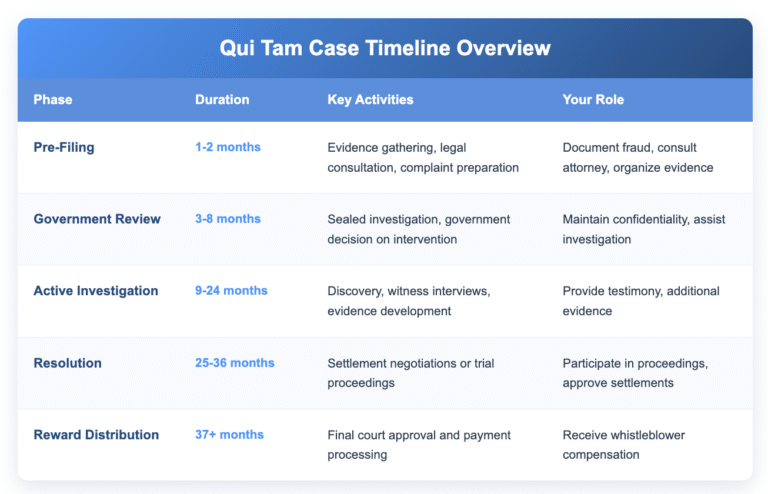

The Qui Tam Process: Step-by-Step Timeline

Understanding the qui tam process helps you prepare for what can be a lengthy but potentially rewarding legal journey.

Qui Tam Case Flow Diagram

Phase 1: Pre-Filing Investigation (1-2 Months)

Before filing your qui tam action, you’ll need to gather sufficient evidence to support your allegations. This doesn’t mean you need every document—the government will conduct its own investigation—but you need enough information to file a credible complaint.

Critical evidence includes:

- Documents showing false claims submitted to the government

- Communications revealing knowledge of the fraud

- Policies or procedures that facilitate the fraudulent activity

- Financial records showing improper billing or charging

Remember, you can only use information you accessed legally through your job. Don’t take documents you weren’t authorized to have or hack into systems to gather evidence.

Phase 2: Filing and Government Review (3-8 Months)

When you file a qui tam complaint, it remains under court seal while the government investigates. During this period:

- The complaint stays confidential: Your employer doesn’t know about the lawsuit

- You continue working normally: The seal protects you from immediate retaliation

- The government investigates: Federal agencies review your allegations and evidence

- You may be interviewed: Government attorneys and investigators will want to speak with you

The government has 60 days to decide whether to intervene (join your case), but this period is routinely extended. Most government decisions take 6-18 months.

Phase 3: Government Decision Point

The government faces three options after investigating your allegations:

Option 1: Intervention: The government joins your case and takes the lead on prosecution. This significantly increases your chances of success and typically results in larger settlements.

Option 2: Declination: The government chooses not to join but allows you to proceed with your own attorneys. You’ll have more control but face greater challenges proving the case.

Option 3: Dismissal: The government asks the court to dismiss your case, usually because the allegations lack merit or sufficient evidence.

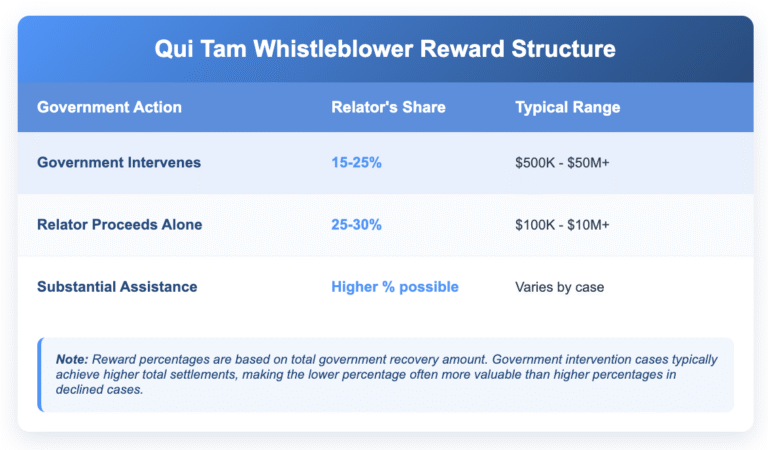

Reward Structure for Successful Cases

The False Claims Act provides substantial financial incentives for whistleblowers, but the amount depends on several factors.

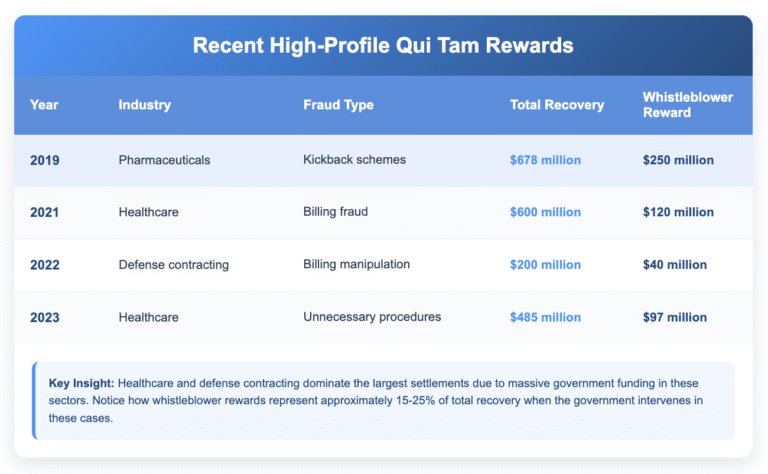

Recent High-Profile Rewards

Understanding actual qui tam rewards helps illustrate the law’s potential impact:

These cases demonstrate both the substantial rewards possible and the types of fraud that generate the largest recoveries. Notice how healthcare and defense contracting dominate the largest settlements—these industries receive massive government funding, creating both opportunity for fraud and substantial recovery potential.

Workplace Protections for Qui Tam Whistleblowers

The False Claims Act includes robust anti-retaliation provisions that protect employees who file qui tam actions or assist in False Claims Act investigations.

What Actions Are Protected

You’re protected from retaliation for:

- Filing a qui tam complaint

- Investigating potential False Claims Act violations

- Assisting government investigations of fraud

- Refusing to participate in fraudulent activities

- Reporting fraud internally before filing qui tam actions

Types of Retaliation Prohibited

Employers cannot retaliate through:

- Termination or demotion

- Harassment or hostile work environment

- Reduction in pay, hours, or responsibilities

- Negative performance reviews

- Exclusion from meetings or decision-making

- Any other adverse employment action

Remedies for Retaliation

If you face retaliation for qui tam activities, the False Claims Act provides comprehensive remedies:

Financial Compensation:

- Two times back pay with interest

- Compensation for lost benefits

- Front pay if reinstatement isn’t appropriate

- Attorneys’ fees and costs

Equitable Relief:

- Reinstatement to your position

- Restoration of seniority and benefits

- Injunctions preventing further retaliation

Common Qui Tam Mistakes That Reduce Success

Even strong fraud cases can fail due to procedural errors or strategic mistakes. Understanding these common pitfalls helps you avoid problems that could derail your case or reduce your potential reward.

Waiting Too Long to File

The first-to-file rule creates a race among potential whistleblowers. If someone else files first based on substantially the same fraud, your case gets dismissed even if you have better evidence.

This rule particularly affects large companies where multiple employees might discover the same fraud. The employee who acts quickly secures the right to pursue the case and receive rewards.

Insufficient Evidence at Filing

While you don’t need every piece of evidence to file, your complaint must include enough specific allegations to survive a motion to dismiss. Vague allegations about “improper billing practices” won’t support a qui tam case.

Successful complaints typically include:

- Specific examples of false claims with dates and amounts

- Clear explanation of why the claims are false

- Evidence showing the defendant’s knowledge of falsity

- Calculation of approximate damages to the government

Public Disclosure Problems

Public disclosure can kill an otherwise strong qui tam case. If fraudulent information becomes public through news reports, audit findings, or other legal proceedings before you file, you may lose the right to bring a qui tam action unless you’re the original source.

This creates tension between internal reporting (which might trigger public investigations) and preserving qui tam rights. Timing becomes critical when deciding whether to report internally or file qui tam actions first.

Inadequate Legal Representation

Qui tam cases require specialized expertise that general employment attorneys may not possess. False Claims Act cases involve unique procedures, government relationships, and complex fraud analysis that demand specific experience.

Successful qui tam representation requires attorneys who understand:

- Federal court procedures and discovery rules

- Government investigation processes and priorities

- False Claims Act jurisprudence and recent developments

- Effective negotiation with Department of Justice attorneys

- Complex damages calculation in fraud cases

Financial Considerations Beyond Rewards

While whistleblower rewards receive the most attention, qui tam cases involve other financial considerations that affect your decision-making.

Litigation Costs and Funding

Qui tam cases can be expensive to litigate, particularly if the government declines to intervene. Costs may include:

- Expert witness fees for fraud analysis

- Document review and production costs

- Deposition and trial preparation expenses

- Investigation and fact development costs

Many qui tam attorneys work on contingency fee arrangements, advancing these costs in exchange for a percentage of any recovery. This makes qui tam cases accessible to employees regardless of financial resources.

Tax Implications of Qui Tam Rewards

Whistleblower rewards are generally taxable as ordinary income, which can create significant tax obligations. Large rewards may push you into higher tax brackets, making tax planning important.

Consider consulting with tax professionals about:

- Estimated tax payment requirements

- Potential for installment payment elections

- Retirement account contribution strategies

- State tax implications in addition to federal taxes

Employment and Career Impact

Successful qui tam cases can provide financial security that allows career transitions, but they may also affect your employment prospects in your current industry.

Some considerations include:

- Potential difficulty finding new employment in the same industry

- Need for career transition planning during lengthy qui tam proceedings

- Possible benefits of delayed public disclosure during job searching

- Long-term reputation management in professional networks

Maximizing Your Qui Tam Case Value

Several strategies can help strengthen your case and maximize potential rewards, though each approach requires careful consideration of your specific circumstances.

Building Strong Government Relationships

Cases where the government intervenes typically achieve higher settlement values and have better success rates. Building productive relationships with government investigators and attorneys can encourage intervention.

This involves:

- Providing comprehensive, organized evidence

- Being available and responsive during the investigation

- Helping the government understand the technical aspects of the fraud

- Connecting investigators with other knowledgeable witnesses

Strategic Case Development

Effective qui tam cases often involve expanding the scope of fraud beyond initial discoveries. As the government investigates, new fraud patterns may emerge that increase the case value.

Working with experienced counsel helps identify these opportunities while avoiding overreach that could undermine your credibility.

Timing Settlement Discussions

Qui tam cases can settle at various stages, from early in the government investigation through trial. Understanding the advantages and disadvantages of settlement timing helps optimize your outcome.

Early settlements often provide:

- Faster resolution and payment

- Lower litigation risks and costs

- Preserved relationships with government agencies

- Reduced public attention

Later settlements may offer:

- Higher settlement amounts due to developed evidence

- Greater negotiating leverage

- More comprehensive resolution of related issues

Beyond Financial Rewards: The Public Impact

While financial incentives motivate many qui tam cases, understanding the broader impact helps put your decision in perspective.

Government Recovery Statistics

Since 1986, qui tam cases have recovered more than $78 billion for the federal government. This represents money returned to taxpayers and available for legitimate government programs.

Your individual case contributes to this larger enforcement effort that:

- Deters future fraud through visible consequences

- Recovers money for underfunded government programs

- Demonstrates that fraud will be discovered and prosecuted

- Encourages other employees to report wrongdoing

Compliance and Deterrence Effects

Successful qui tam cases often force companies to implement stronger compliance programs, preventing future fraud beyond just recovering past losses.

These improvements may include:

- Enhanced billing review procedures

- Improved employee training on fraud prevention

- Stronger internal reporting systems

- Independent compliance monitoring

Your case can create lasting change that protects the integrity of government programs and prevents future fraud by your employer and competitors who observe the consequences.

The “First to File” Rule

The False Claims Act includes a “first to file” provision that bars qui tam actions based on substantially the same allegations as a previously filed case. This creates urgency around filing if you know about fraud that others might also report.

The first-to-file rule means:

- Only the first person to file gets whistleblower protection

- Later-filed cases on the same fraud are typically dismissed

- You can’t wait indefinitely to decide whether to file

Public Disclosure Bar Challenges

The False Claims Act includes a “public disclosure bar” that can complicate cases where fraudulent information becomes public before filing. This provision aims to ensure qui tam relators provide new information rather than simply repackaging publicly available data.

You may face public disclosure challenges if fraudulent information appears in:

- News media reports

- Government audit reports

- Legislative hearings or reports

- Other legal proceedings

However, if you’re an “original source” with direct, independent knowledge of the fraud, you may still proceed even after public disclosure.

Quality of Evidence Considerations

Strong qui tam cases typically involve:

- Specific false claims: Exact invoices, bills, or reimbursement requests

- Pattern evidence: Documentation showing systematic rather than isolated fraud

- Financial impact: Clear evidence of government monetary loss

- Intent evidence: Communications showing knowledge of falsity

The strongest cases combine insider knowledge with documentation that would be difficult for the government to obtain through other investigation methods.

Industry-Specific Qui Tam Opportunities

Understanding how False Claims Act violations typically occur in different industries helps identify potential cases and prepare stronger evidence.

Healthcare Industry Patterns

Healthcare generates the largest number of qui tam cases because of extensive government funding through Medicare, Medicaid, and other programs.

Common violations include:

- Billing fraud: Charging for services not provided or medically unnecessary procedures

- Kickback schemes: Improper payments for patient referrals

- Quality of care issues: Providing substandard care while billing at standard rates

- Compliance violations: Failing to meet required standards while certifying compliance

Government Contracting Fraud

Defense contractors and other companies serving government agencies create significant qui tam opportunities.

Typical violations involve:

- Product substitution: Delivering inferior products while billing for specified quality

- Testing fraud: Falsifying compliance or performance test results

- Labor charging: Billing for senior personnel while using junior staff

- Cost allocation: Improperly shifting costs between contracts

Education Sector Violations

Educational institutions receiving federal funding face qui tam exposure for various compliance failures.

Common issues include:

- Student aid fraud: Falsifying student eligibility or enrollment information

- Research misconduct: Misrepresenting research results or noncompliance in federally funded studies

- Outcome misrepresentation: Falsifying job placement or graduation rates for federal programs

Filing Requirements and Procedural Considerations

Successfully filing a qui tam action requires careful attention to procedural requirements that can make or break your case.

Documentation Requirements

Your initial complaint must include:

- Specific allegations: Detailed description of the fraudulent scheme

- False claims identification: Examples of actual false submissions to the government

- Legal basis: Citations to relevant False Claims Act provisions

- Supporting evidence: Documents and information supporting your allegations

The complaint doesn’t need to include every piece of evidence—the government will conduct its own investigation—but it must provide enough detail for the court and government to understand the fraud allegations.

Disclosure Statement Requirements

Along with your complaint, you must file a disclosure statement providing the government with all evidence in your possession. This includes:

- All relevant documents

- Contact information for witnesses

- Description of any other legal proceedings related to the fraud

- Information about any public disclosures of the fraud

Statute of Limitations

Qui tam actions must be filed within the later of:

- Six years from the False Claims Act violation, or

- Three years from when the government knew or should have known about the violation (with a 10-year maximum)

This extended timeline recognizes that fraud often isn’t discovered immediately, but it still creates urgency around filing once you become aware of violations.

Working with Experienced Qui Tam Counsel

Qui tam cases involve complex federal procedures and substantial resources. Most successful cases require attorneys with specific False Claims Act experience who can:

- Evaluate the strength of your potential case

- Help gather evidence legally and strategically

- Navigate the government investigation process

- Negotiate with government attorneys about intervention

- Litigate complex fraud cases if the government declines

- Maximize your potential reward through effective case development

The investment in experienced counsel often pays for itself through higher settlement amounts and more efficient case resolution.

Recent Developments Affecting Qui Tam Actions

The False Claims Act continues evolving through court decisions and government enforcement priorities that affect whistleblower cases.

COVID-19 Fraud Enforcement

The pandemic created new fraud opportunities that generated significant qui tam activity. Government programs like the Paycheck Protection Program (PPP) and increased healthcare funding led to various fraud schemes.

Recent enforcement priorities include:

- PPP loan fraud and misrepresentation

- COVID-related healthcare billing fraud

- False compliance certifications for pandemic-related programs

Cybersecurity and Data Protection

Emerging qui tam theories involve cybersecurity failures where government contractors falsely certify compliance with security requirements while exposing sensitive government data.

These cases represent a growing area of False Claims Act enforcement as cybersecurity becomes increasingly critical to government operations.

Taking Action: Your Next Steps

If you believe your employer is defrauding the government, time matters. The first-to-file rule means delay could cost you the opportunity to pursue a qui tam action and receive whistleblower rewards.

Immediate steps to consider:

- Document what you know: Preserve evidence of fraudulent activities you’ve observed

- Avoid illegal evidence gathering: Only use information you’re authorized to access

- Consult with qui tam counsel: Get a professional evaluation of your potential case

- Understand the timeline: False Claims Act cases often take years to resolve

- Consider your risk tolerance: Evaluate both the potential rewards and challenges

Questions to ask yourself:

- Do I have specific evidence of false claims submitted to the government?

- Is this fraud ongoing or likely to continue?

- Am I the first person likely to report this fraud?

- Do I have enough evidence to support a credible complaint?

The False Claims Act provides both powerful protection and substantial financial incentives for employees who expose government fraud. However, qui tam cases require careful preparation and experienced legal guidance to navigate successfully.

Protect Your Rights and Maximize Your Impact

Exposing government fraud takes courage, but you don’t have to face the process alone. The False Claims Act provides both legal protection and financial rewards for whistleblowers who help recover taxpayer money stolen through fraud.

If you’ve discovered potential government fraud in your workplace, consulting with an experienced qui tam attorney can help you understand your options and protect your rights. The complexity of False Claims Act procedures and the substantial money at stake make professional legal guidance essential for maximizing both your protection and potential reward.

Contact Nisar Law Group today for a confidential consultation about your potential qui tam case. We can help you evaluate the strength of your allegations, understand the filing process, and take the right steps to protect both your career and the public interest.