Is Your Employer Refusing to Pay You Overtime in New York?

If you work more than 40 hours in a week and don’t receive overtime pay, your employer is likely breaking the law. Under New York and federal law, most employees must be paid 1.5 times their regular hourly rate for every hour worked over 40 in a workweek.

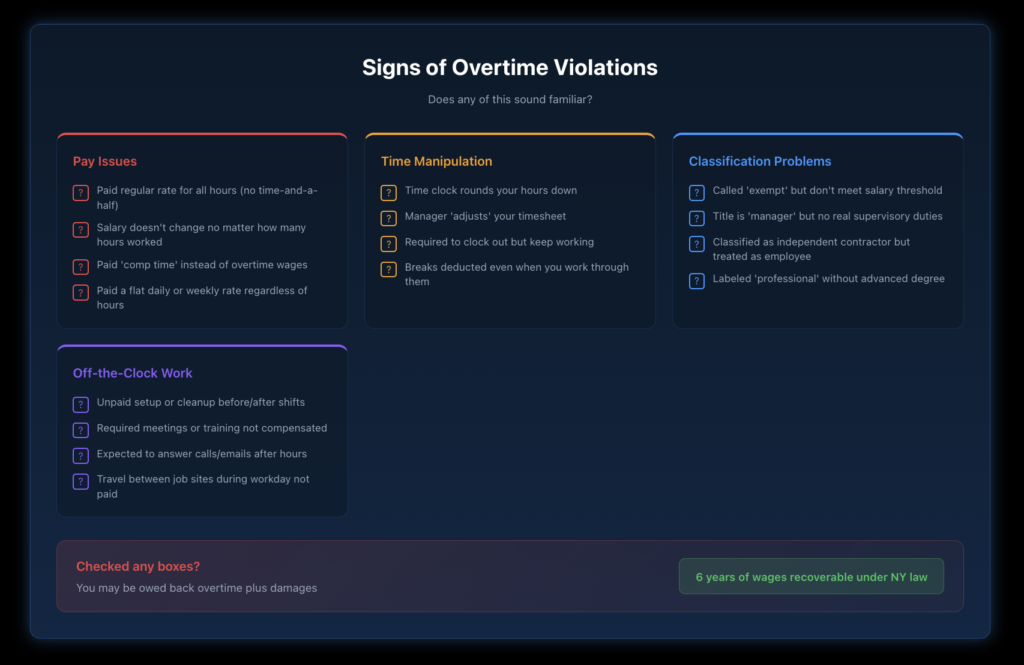

Unpaid overtime is one of the most common forms of wage theft in New York. Employers use various tactics to avoid paying overtime—from misclassifying workers as “exempt” to manipulating time records. These practices are illegal, and workers can recover significant damages.

Contact us today for a confidential consultation about your whistleblower case.

How Does Overtime Pay Work in New York?

What Is the Overtime Rate?

For every hour you work over 40 in a single workweek, your employer must pay you at least 1.5 times your regular rate of pay. If your regular rate is $20/hour, your overtime rate is $30/hour.

How Is the Workweek Defined?

A workweek is any fixed period of 168 hours (seven consecutive 24-hour periods). Your employer can set the workweek to start on any day, but they can’t change it to avoid paying overtime.

Important: Overtime is calculated per workweek, not per pay period. If you work 50 hours one week and 30 hours the next, you’re owed 10 hours of overtime for the first week—even if the two-week total averages to 40 hours.

Does Working Multiple Jobs for the Same Employer Count?

Yes. If you work multiple positions or locations for the same employer, all hours are combined for overtime purposes. Some employers try to split hours across different “entities” to avoid this—that’s illegal.

What Are Common Overtime Violations in New York?

Are You Being Paid “Straight Time” for Overtime Hours?

Some employers pay a regular hourly rate for all hours worked, including overtime. This “straight time for overtime” is one of the most straightforward violations. If you worked 50 hours and only received your regular rate for all 50 hours, you’re owed the extra half-time for those 10 overtime hours.

Is Your Employer Misclassifying You as Exempt?

Employers often claim workers are “exempt” from overtime when they’re not. Common misclassification targets include:

- Assistant managers who spend most of their time doing non-managerial work

- Employees are paid a salary, but do not meet the actual exemption requirements

- Workers with impressive job titles but limited actual authority

- Technical workers are misclassified as “professionals.”

To be truly exempt, you must meet specific salary AND duties tests. A job title alone doesn’t determine exemption.

Are You Classified as an Independent Contractor but Treated Like an Employee?

If your employer controls when, where, and how you work, you’re likely an employee—regardless of what your contract says. Misclassifying workers as independent contractors to avoid overtime is illegal.

Is Your Employer Manipulating Your Time Records?

Watch for these red flags:

- The time clock automatically rounds hours down

- Manager “adjusts” your time after you clock out

- Required to clock out but keep working

- Breaks are deducted even when you worked through them

- Time system shaves minutes from each shift

Falsifying timesheets is considered wage theft under New York law.

Are You Required to Work “Off the Clock”?

All work time must be compensated, including:

- Setting up or cleaning up before/after shifts

- Mandatory meetings or training

- Putting on the required safety equipment

- Waiting for assignments while on premises

- Work-related travel during the workday

- Answering work emails or calls after hours

If these activities push you over 40 hours, you’re entitled to overtime.

If you believe an AI system was used to discriminate against you, discipline you, or terminate your employment, contact us. You may have significant legal claims even when the decision came from an algorithm.

Which Workers Are Entitled to Overtime in New York?

Who Is Covered?

Most workers in New York are entitled to overtime pay. You’re generally covered if you:

- Are paid hourly

- Are paid a salary below the exemption threshold

- Don’t meet the strict duties test for exemption

- Work for a private employer

Who Is Exempt from Overtime?

Certain workers are exempt from overtime requirements if they meet BOTH a salary threshold AND specific duties tests:

Exemption | 2025 Salary Threshold (NYC/LI/Westchester) | Key Duties Requirement |

Executive | $1,237.50/week ($64,350/year) | Manage department, supervise 2+ employees, hiring authority |

Administrative | $1,237.50/week ($64,350/year) | Office work directly related to management, exercise discretion |

Professional | Varies (often federal threshold) | Work requiring advanced knowledge and education |

Meeting the salary threshold isn’t enough. If you’re paid $70,000 but spend most of your time doing non-exempt work, you may still be entitled to overtime.

What About Specific Industries?

Some industries have special rules:

Restaurant Workers: Generally entitled to overtime. Tips don’t affect overtime eligibility. See our guide on restaurant worker wage rights in NYC.

Construction Workers: Almost always entitled to overtime. New York also requires weekly pay for construction workers. Our guide on construction worker overtime in New York covers the details.

Home Care Workers: Recent changes expanded overtime protections. Live-in domestic workers now have clearer overtime rights.

Contact us at (212) 600-9534 to schedule a confidential consultation.

What Can You Recover for Unpaid Overtime?

What Damages Are Available Under Federal Law (FLSA)?

Under the Fair Labor Standards Act:

- Unpaid overtime wages: Back wages for all overtime owed

- Liquidated damages: An additional amount equal to unpaid wages (doubling your recovery)

- Attorney’s fees: Your employer pays your legal costs if you win

You can recover up to 2 years of back wages (3 years if the violation was willful).

What Damages Are Available Under New York Law?

New York’s Labor Law often provides better recovery:

- Unpaid overtime wages: All overtime owed

- Liquidated damages: 100% of unpaid wages

- Interest: From when wages were due

- Attorney’s fees and costs

You can recover up to 6 years of back wages under New York law—significantly longer than federal law.

Example Recovery Calculation

If you worked 10 hours of overtime per week at $20/hour but were paid straight time:

- Lost overtime premium: $10/hour × 10 hours × 52 weeks × 3 years = $15,600

- Liquidated damages: $15,600

- Total potential recovery: $31,200+ (plus interest and attorney’s fees)

How Do You File an Overtime Claim?

What Are Your Filing Options?

You can pursue unpaid overtime through several paths:

- File with the NYS Department of Labor: The DOL investigates and can order payment. This is free but may take time.

- File with the US Department of Labor: For FLSA violations. Useful when multiple states are involved.

- File a lawsuit: Work with an employment attorney to sue in court. Often results in higher recoveries and faster resolution.

- Join a collective action: If your employer owes overtime to multiple workers, you may join or start a collective action.

Our guide on how to report wage theft in New York walks through each option.

What’s the Deadline to File?

Under New York law, you have six years to file an overtime claim. Under federal law (FLSA), you have 2 years (or 3 years for willful violations). Because New York law is more favorable, most claims are filed under state law.

See our complete guide on wage claim deadlines in New York.

What Should You Do If You're Not Getting Overtime Pay?

How Can You Protect Your Rights?

Start building your case now:

- Keep your own time records: Use a notes app, spreadsheet, or calendar to track hours daily

- Save pay stubs: Photograph or keep copies of every pay stub

- Document communications: Save texts, emails, or messages about hours and pay

- Note policies: If there’s a written policy about overtime, keep a copy

- Identify witnesses: Coworkers experiencing the same violations can support your claim

What If Your Employer Retaliates?

New York law protects workers who complain about wage violations. If your employer fires you, cuts your hours, or takes other adverse action because you raised overtime concerns, you have a separate retaliation claim.

Contact us today for a confidential consultation about your whistleblower case.

Why Work With Nisar Law on Your Overtime Case?

Nisar Law Group has deep experience with New York wage and hour cases. We understand the tactics employers use to avoid paying overtime, and we know how to fight back. Our employment attorneys have recovered significant damages for workers throughout New York City, Long Island, Westchester, and across the state.

We handle overtime cases on a contingency basis—you pay nothing unless we win.

Ready to Get the Overtime You Earned?

If you’ve worked over 40 hours without proper overtime pay, contact Nisar Law Group for a free consultation. We’ll review your pay records, calculate what you may be owed, and explain your options.

Call us or fill out our online form to get started.

Types of AI Discrimination Cases We Handle?

Why We're the Right Choice

- Experienced Federal Employment Attorneys

- Personalized Service and Client-Focused Approach

- Proven Track Record of Success

- Nationwide Representation for Federal Employees

- In-depth Knowledge of Federal Agency Procedures

Frequently Asked Questions About Overtime Pay Violations

Overtime is calculated per workweek. For every hour you work over 40 in a single workweek, you must be paid at least 1.5 times your regular hourly rate. Overtime cannot be averaged across multiple weeks—if you work 50 hours one week, you’re owed 10 hours of overtime for that week, regardless of other weeks.

Yes, many salaried employees are entitled to overtime. Being paid a salary doesn’t automatically exempt you. You must also earn above the salary threshold and meet specific duties requirements for executive, administrative, or professional exemptions. If you don’t meet both tests, you’re entitled to overtime regardless of how you’re paid.

Your employer’s classification doesn’t determine your actual status under the law. Many workers are misclassified as exempt when they don’t meet the legal requirements. If you spend most of your time doing non-exempt work or don’t have real supervisory or decision-making authority, you may be misclassified and entitled to overtime.

Under New York law, you can recover all unpaid overtime wages for up to six years, plus liquidated damages equal to 100% of unpaid wages, plus interest and attorney’s fees. This can result in recovering more than double what you were originally owed, and your employer pays your legal costs if you win.

No. While documentation helps, employers are legally required to keep accurate time records. If they don’t, courts allow workers to estimate their hours based on reasonable recollection. The burden shifts to the employer to disprove your estimates if they failed to keep proper records.