Are You Being Paid Less Than New York's Minimum Wage?

If your employer is paying you below New York’s legal minimum wage, you have the right to recover every dollar you’re owed—plus potential penalties and damages. New York has some of the strongest wage protections in the country, and employers who violate these laws face serious consequences.

As of January 1, 2025, the minimum wage in New York City, Long Island, and Westchester is $16.50 per hour. For the rest of New York State, it’s $15.50 per hour. If you’re earning less than these amounts, your employer is breaking the law.

Contact us today for a confidential consultation about your whistleblower case.

What Are Common Minimum Wage Violations in New York?

Does Your Employer Pay You Below the Legal Rate?

The most obvious violation is simply paying less than the required minimum wage. This happens more often than you’d think—especially in cash-based industries, among immigrant workers, and in businesses that assume employees won’t know their rights.

Are Illegal Deductions Reducing Your Pay Below Minimum Wage?

Some employers make deductions from paychecks that push your effective hourly rate below minimum wage. In New York, employers cannot deduct for:

- Cash register shortages

- Breakage or equipment damage

- Customer walkouts

- Uniforms (in most cases)

- Tools or supplies required for work

If deductions are dropping your pay below minimum wage, that’s illegal.

Is Your Employer Misclassifying You to Avoid Minimum Wage?

A common tactic is classifying workers as independent contractors when they’re actually employees. Independent contractors aren’t covered by minimum wage laws. But if you work set hours, use company equipment, and have your work controlled by your employer, you’re likely an employee entitled to minimum wage protection.

Are You a Tipped Worker Being Underpaid?

New York allows employers to pay tipped workers a lower cash wage if tips bring the total to minimum wage. But many employers violate tip theft laws by taking illegal tip credits or failing to make up the difference when tips fall short.

For 2025, the minimum cash wage for service workers in NYC, Long Island, and Westchester is $13.75 per hour.

If you believe an AI system was used to discriminate against you, discipline you, or terminate your employment, contact us. You may have significant legal claims even when the decision came from an algorithm.

Who Is Covered by New York Minimum Wage Laws?

Which Workers Are Protected?

Nearly all workers in New York are entitled to a minimum wage, including:

- Full-time and part-time employees

- Temporary and seasonal workers

- Undocumented workers (immigration status does not affect wage rights)

- Day laborers

- Most tipped employees

Your immigration status has no bearing on your right to minimum wage. The New York State Department of Labor enforces wage laws regardless of documentation.

Which Workers Are Exempt?

A small number of workers are exempt from minimum wage requirements:

- Some agricultural workers

- Certain employees of religious or charitable organizations

- Executive, administrative, and professional employees meeting specific criteria

- Outside salespeople

If you’re unsure whether you’re covered, an employment attorney can review your situation.

What Industries See the Most Minimum Wage Violations?

Certain industries have consistently higher rates of wage violations:

Industry | Common Violations |

Restaurants & Food Service | Tip theft, flat shift pay, and unpaid training |

Construction | Cash payments, misclassification, and unpaid travel time |

Retail | Illegal deductions, off-the-clock work |

Home Care | Flat daily rates, no overtime |

Nail Salons | Below-minimum cash wages, tip retention |

Domestic Work | Off-the-books payments, no records |

If you work in one of these industries, pay close attention to your paychecks and hours.

Contact us at (212) 600-9534 to schedule a confidential consultation.

What Can You Recover for Minimum Wage Violations?

What Damages Are Available?

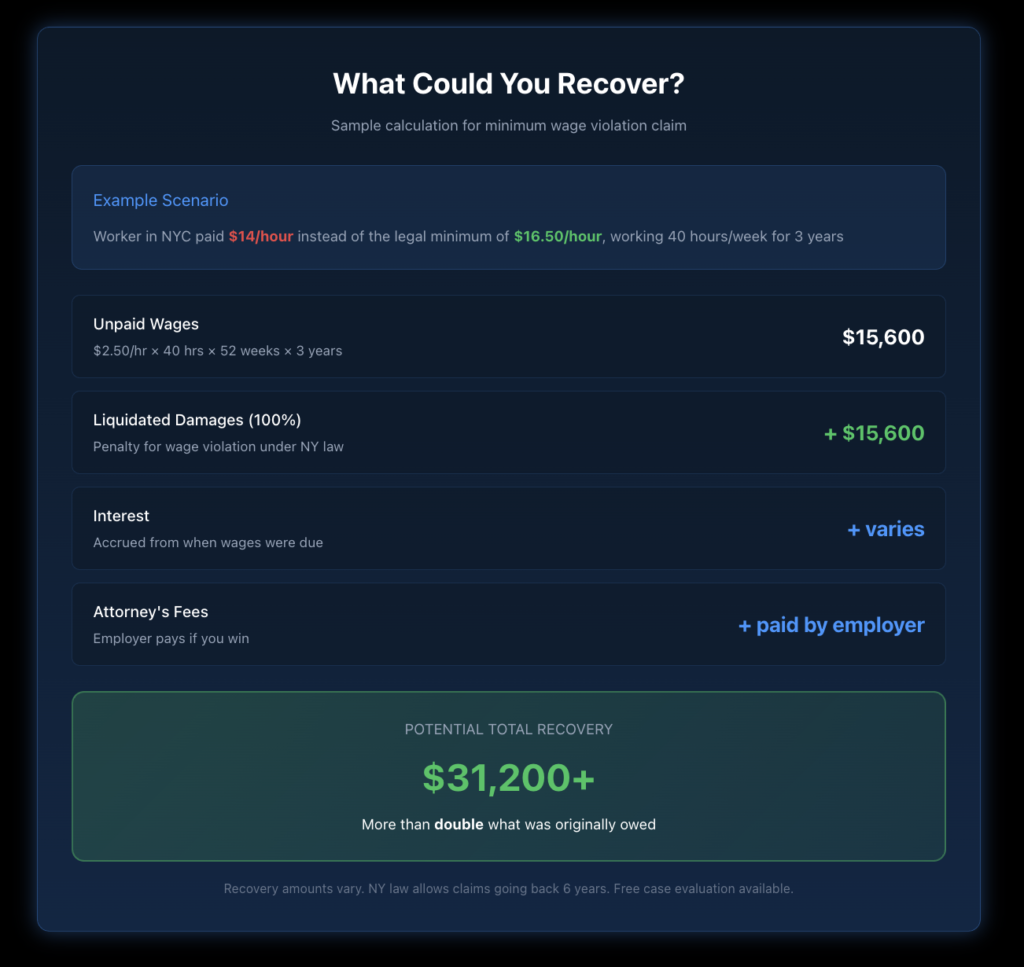

Under New York law, victims of minimum wage violations can recover:

- Unpaid wages: Every dollar you should have been paid

- Liquidated damages: Up to 100% of unpaid wages (essentially doubling your recovery)

- Interest: Calculated from when wages were due

- Attorney’s fees: Your employer pays your legal costs if you win

How Much Is My Claim Worth?

The value depends on how long the violation continued and how much you were underpaid. For example:

- Underpaid $1/hour × 40 hours/week × 52 weeks = $2,080 in unpaid wages

- Add 100% liquidated damages = $4,160 total

- Plus interest and attorney’s fees

Claims involving multiple years or multiple employees can be worth significantly more.

How Do You File a Minimum Wage Claim in New York?

What Are Your Options?

You have several paths to recover unpaid wages:

- File with the NYS Department of Labor: Submit a complaint online or by mail. The DOL investigates and can order your employer to pay.

- File a lawsuit: Work with an employment attorney to sue your employer in court. This often results in higher recoveries.

- Join a class action: If your employer is underpaying multiple workers, a collective action may be appropriate.

Learn more about the process in our guide on how to report wage theft in New York.

How Long Do You Have to File?

In New York, you have six years to file a claim for unpaid minimum wages. However, you can only recover wages going back six years from when you file. The sooner you act, the more you can recover.

See our detailed guide on wage claim deadlines in New York.

What Should You Do If Your Employer Isn't Paying Minimum Wage?

How Can You Build Your Case?

Start documenting immediately:

- Keep copies of pay stubs (photograph them if necessary)

- Track your hours independently using a personal log or app

- Save any written communications about pay

- Note the names of coworkers who may have experienced similar issues

- Don’t sign anything without understanding it first

What Happens If Your Employer Retaliates?

It’s illegal for your employer to retaliate against you for asserting your wage rights. Retaliation protections cover actions like:

- Firing or demoting you

- Reducing your hours

- Changing your job duties

- Threatening you

- Reporting you to the immigration authorities

If your employer retaliates, you may have an additional legal claim.

Contact us today for a confidential consultation about your whistleblower case.

Why Work With Nisar Law on Your Minimum Wage Case?

Nisar Law Group has extensive experience representing New York workers in wage and hour cases. Our employment attorneys understand the complexities of New York and federal wage laws, and we fight to ensure workers receive every dollar they’re owed.

We handle minimum wage cases on a contingency basis—you pay nothing unless we recover money for you.

Ready to Discuss Your Case?

If you believe your employer is paying you less than minimum wage, contact Nisar Law Group today for a free consultation. We’ll review your situation, explain your options, and help you understand what your claim may be worth.

Call us or fill out our online form to get started.

Types of AI Discrimination Cases We Handle?

Why We're the Right Choice

- Experienced Federal Employment Attorneys

- Personalized Service and Client-Focused Approach

- Proven Track Record of Success

- Nationwide Representation for Federal Employees

- In-depth Knowledge of Federal Agency Procedures

Frequently Asked Questions About Minimum Wage Violations

As of January 1, 2025, the minimum wage in New York City, Long Island, and Westchester is $16.50 per hour. For the rest of New York State, the minimum wage is $15.50 per hour. These rates apply to most workers, with some exceptions for tipped employees who may be paid a lower cash wage if tips bring their total to minimum wage.

Yes. Your immigration status does not affect your right to minimum wage under New York law. The New York State Department of Labor investigates wage complaints regardless of documentation status. Employers cannot use immigration status as a defense against wage violations, and threatening to report workers to immigration authorities is itself illegal.

You can recover all unpaid wages plus liquidated damages of up to 100% of the unpaid amount. You’re also entitled to interest and, if you hire an attorney and win, your employer pays your attorney’s fees. The total recovery depends on how long the violations continued and how much you were underpaid.

New York has a six-year statute of limitations for wage claims. This means you have six years to file, and you can recover wages going back six years from when you file. Acting sooner maximizes your potential recovery and preserves more evidence.

Retaliation is illegal. If your employer fires you, cuts your hours, demotes you, or takes any adverse action because you complained about wages, you may have an additional legal claim. Document any retaliatory actions immediately and contact an employment attorney.